In the shadowy intersection of cryptocurrency prediction markets and global politics, a single trader's prescient wager on Venezuelan President Nicolás Maduro's ouster has ignited a firestorm of insider trading allegations.

Just days before U.S. forces captured Maduro in a surprise operation announced by President Trump on January 3, 2026, an anonymous Polymarket account turned a $32,537 investment into over $436,000 in profits by betting that Maduro would be removed from power by January 31.

Just days before U.S. forces captured Maduro in a surprise operation announced by President Trump on January 3, 2026, an anonymous Polymarket account turned a $32,537 investment into over $436,000 in profits by betting that Maduro would be removed from power by January 31.

The account, created on December 27, 2025, placed bets when the market odds were as low as 6%, suggesting either extraordinary luck or access to privileged information.

Combined with two other suspiciously timed accounts, the total profit across these trades reached $630,484, according to blockchain analyst Lookonchain.

Combined with two other suspiciously timed accounts, the total profit across these trades reached $630,484, according to blockchain analyst Lookonchain.

The timing has fueled widespread speculation online, with users on platforms like X and Reddit labeling it "insider trading on Maduro." Epidemiologist Eric Feigl-Ding highlighted the mystery account's rapid accumulation of 'YES' positions at bargain prices, becoming the largest shareholder before the news broke.

This isn't the first time prediction markets like Polymarket have faced such scrutiny; experts note that while traditional finance prohibits insider trading, these decentralized platforms often view it as a "feature, not a bug," allowing real-world information to influence prices without regulatory oversight.

This isn't the first time prediction markets like Polymarket have faced such scrutiny; experts note that while traditional finance prohibits insider trading, these decentralized platforms often view it as a "feature, not a bug," allowing real-world information to influence prices without regulatory oversight.

However, the incident has prompted calls for reform, including a proposed "Public Integrity in Financial Prediction Markets Act of 2026" by Rep. Ritchie Torres, aiming to bar federal officials from exploiting nonpublic info on such platforms.

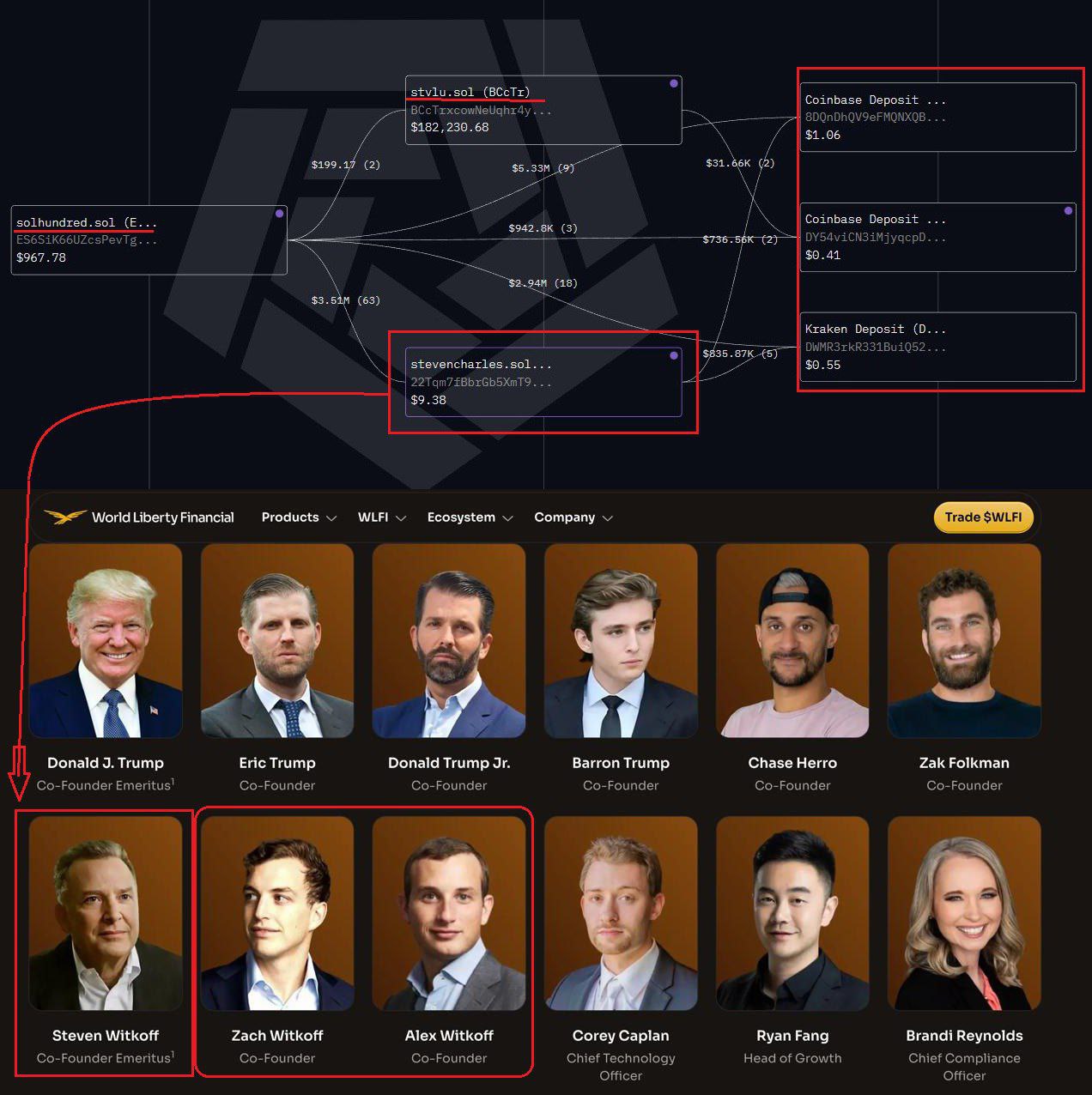

Adding intrigue, internet sleuths have drawn connections between the bet and Steven Charles Witkoff, President Trump's special envoy to the Middle East and a key negotiator with Russian President Vladimir Putin. Witkoff, a New York real estate magnate with no prior diplomatic experience, has been instrumental in high-stakes talks, including prisoner swaps with Russia and efforts to broker peace in Ukraine and Gaza.

He has publicly praised Putin as a "great guy" and "super smart," and in February 2025, he facilitated a deal releasing U.S. citizen Marc Fogel in exchange for Russian Alexander Vinnik. Witkoff's role extended to coaching Putin's aides on pitching Ukraine peace plans to Trump, as revealed in a leaked October 2025 call transcript.

He has publicly praised Putin as a "great guy" and "super smart," and in February 2025, he facilitated a deal releasing U.S. citizen Marc Fogel in exchange for Russian Alexander Vinnik. Witkoff's role extended to coaching Putin's aides on pitching Ukraine peace plans to Trump, as revealed in a leaked October 2025 call transcript.

Given the U.S. involvement in Maduro's capture — amid escalating tensions with Venezuela over oil and regime change — speculation abounds that Witkoff's international dealings might intersect with the bet's uncanny foresight.

Further complicating the narrative is Witkoff's involvement in World Liberty Financial (WLFI), a cryptocurrency venture co-founded by members of the Trump family, including Donald Trump Jr., Eric Trump, and Barron Trump, alongside Witkoff and his sons Zach and Alex.

Launched in 2024 as a decentralized finance (DeFi) platform, WLFI has propelled the Trump family's crypto holdings to over $5 billion, with Trump himself owning 15.75 billion WLFI tokens valued at $3.4 billion.

The firm, which includes Trump as "co-founder emeritus," has raised eyebrows for potential conflicts, as the family receives 75% of coin sale revenues and has benefited from policy shifts like the GENIUS Act for stablecoins. Critics, including House Democrats, have labeled it a "grift," pointing to international fundraising tours and deals yielding $500 million for the Trumps.

Separately, an ongoing investigation into a massive short position on Hyperliquid —a perpetual futures platform — has also pointed fingers at the WLFI circle. On October 10, 2025, a "Satoshi-era" Bitcoin whale opened over $1.1 billion in shorts on BTC and ETH, just minutes before Trump's announcement of 100% tariffs on Chinese imports triggered a market crash.

Separately, an ongoing investigation into a massive short position on Hyperliquid —a perpetual futures platform — has also pointed fingers at the WLFI circle. On October 10, 2025, a "Satoshi-era" Bitcoin whale opened over $1.1 billion in shorts on BTC and ETH, just minutes before Trump's announcement of 100% tariffs on Chinese imports triggered a market crash.

The trader netted an initial $27 million in unrealized profits, later ballooning to $160 million, amid the largest crypto liquidation event of 2025. On-chain investigator Eye has linked this to WLFI members, including Donald Trump Jr., suggesting possible leaks from White House insiders. The trader reloaded with another $392 million short, fueling further bearish pressure.

These incidents underscore the blurred lines between political power, diplomacy, and financial speculation in the Trump era. While Polymarket and Hyperliquid operate in unregulated gray areas, the potential for abuse — especially with ties to high-level envoys like Witkoff and ventures like WLFI — has amplified calls for oversight.

As one X user noted, "This is why Polymarket breaks news before traditional media," highlighting how incentives can reward leaks over transparency.

Whether these bets stem from insider knowledge or savvy analysis remains unproven, but they cast a long shadow over the integrity of prediction markets and the influence of Trump's inner circle.

Also read:

- Truth Social Enters the Prediction Market Arena with Truth Predict, Challenging Polymarket and Kalshi

- Thrills, Big Bets, and Billions: ICE's $2 Billion Gamble on Polymarket Signals a New Era for Prediction Markets

- Kalshi appoints Donald Trump Jr. as a strategic advisor to the prediction market company.

Thank you!