By Quasa Insights | November 1, 2025

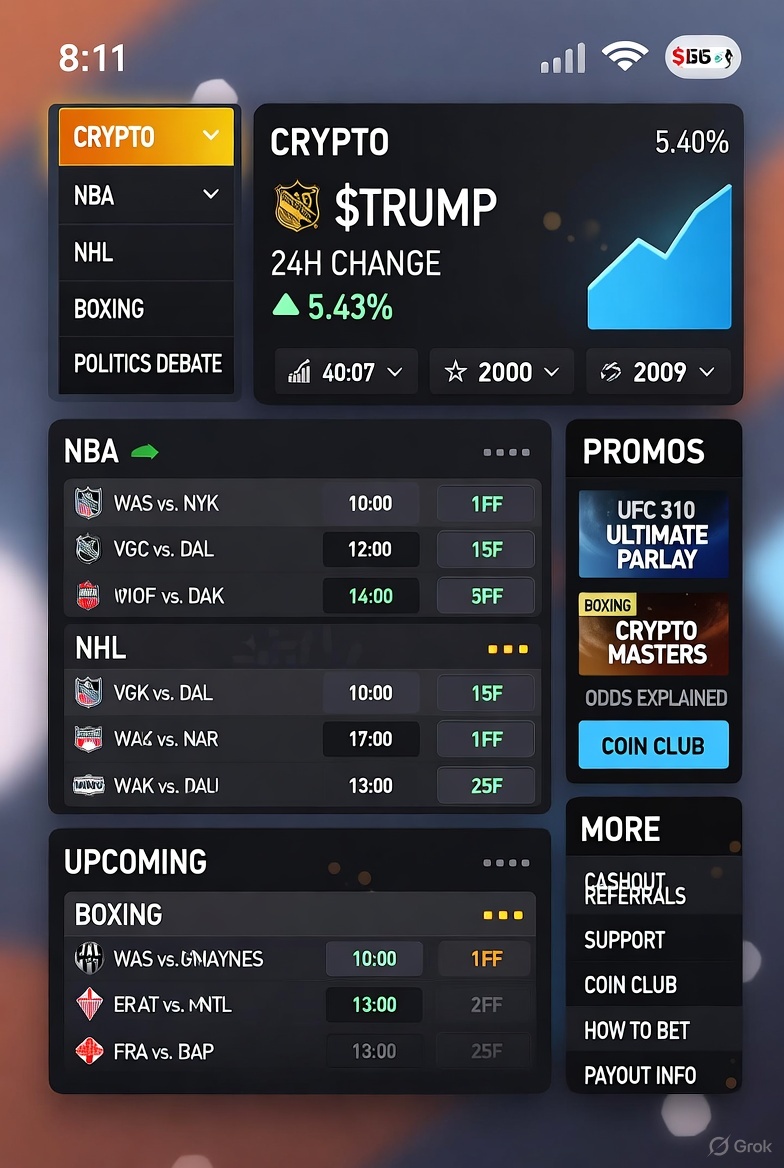

In a bold expansion beyond social media, Truth Social - the platform majority-owned by U.S. President Donald Trump and his family - has announced the launch of Truth Predict, a cryptocurrency-based prediction market service.

In a bold expansion beyond social media, Truth Social - the platform majority-owned by U.S. President Donald Trump and his family - has announced the launch of Truth Predict, a cryptocurrency-based prediction market service.

This move catapults the Trump Media & Technology Group (TMTG) into the booming world of event betting, positioning it as a direct rival to industry leaders Polymarket and Kalshi. Partnering with Crypto.com's derivatives arm, Truth Predict aims to let users wager on everything from sports outcomes to political elections, all integrated seamlessly into the Truth Social app.

The announcement, made on October 28, 2025, comes at a time when prediction markets are riding a wave of unprecedented popularity.

These platforms, which allow users to buy and sell "contracts" on yes-or-no questions about future events, have surged since the 2024 U.S. presidential election.

Bets resolve to $1 for correct predictions and $0 for incorrect ones, with platforms earning fees on trades rather than taking a house edge. Polymarket and Kalshi alone clocked a record $1.44 billion in trading volume in September 2025, underscoring the sector's explosive growth.

A Crypto-Powered Betting Ecosystem on Truth Social

Truth Predict will enable Truth Social's roughly 6.3 million users to fund accounts with cryptocurrency, trade prediction contracts, and settle bets through blockchain technology. Examples of markets include "Will the Federal Reserve cut rates before year-end?" or "Will Barcelona win the Champions League?"

Truth Predict will enable Truth Social's roughly 6.3 million users to fund accounts with cryptocurrency, trade prediction contracts, and settle bets through blockchain technology. Examples of markets include "Will the Federal Reserve cut rates before year-end?" or "Will Barcelona win the Champions League?"

The service emphasizes a U.S.-first rollout, with beta testing slated to begin "in the near future" on the platform, followed by a full launch once regulatory hurdles are cleared. International expansion will follow, pending compliance in other jurisdictions.

At the heart of this initiative is a strategic alliance with Crypto.com Derivatives North America. The partnership leverages Crypto.com's regulated infrastructure for trading and clearing, while integrating TMTG's ecosystem - including the Truth+ streaming service and Truth.Fi fintech brand.

TMTG has already invested heavily in Crypto.com's ecosystem, holding 684.4 million CRO tokens worth about $105 million, and uses the token for user rewards on its platforms.

The news triggered a 4.9% spike in CRO's price and a 4.4% premarket gain for TMTG stock, signaling market enthusiasm for the crossover between social media, crypto, and speculation.

The news triggered a 4.9% spike in CRO's price and a 4.4% premarket gain for TMTG stock, signaling market enthusiasm for the crossover between social media, crypto, and speculation.

Kris Marszalek, CEO of Crypto.com, hailed the collaboration as a fusion of "Truth Social’s pioneering social media platform and technology with our industry-leading technology and regulated prediction market trading."

For TMTG, it's part of a broader pivot: from a conservative-leaning social network to a multifaceted digital empire blending content, finance, and gaming.

Trump Family Ties Deepen the Plot: From Kalshi to Polymarket and Now Truth Predict

The launch adds another layer to the Trump family's growing footprint in prediction markets. Donald Trump Jr., executive vice president of the Trump Organization and a TMTG board member, has been a vocal player in the space.

The launch adds another layer to the Trump family's growing footprint in prediction markets. Donald Trump Jr., executive vice president of the Trump Organization and a TMTG board member, has been a vocal player in the space.

In January 2025, he joined Kalshi as a strategic adviser, bringing his influence to the CFTC-regulated platform that's locked in legal battles over sports betting contracts in states like New York and Massachusetts. Just months later, in August, Trump Jr.'s venture firm, 1789 Capital, invested in Polymarket, earning him a seat on its advisory board amid the platform's push to re-enter the U.S. market after a 2022 CFTC settlement.

This web of connections has fueled speculation of a coordinated Trump-family strategy to dominate the sector. While Don Jr.'s roles at competitors might seem contradictory, insiders view Truth Predict as the family's "crown jewel" - a proprietary platform that could siphon users from Kalshi and Polymarket while leveraging Truth Social's loyal base. "It's a convergence of political influence, crypto infrastructure, and speculative finance," one analyst noted, highlighting how the Trumps are turning family brand into financial firepower.

Critics Sound the Alarm: Conflicts, Regulation, and Integrity Concerns

Not everyone is cheering the entry. Critics, including consumer advocates and election watchdogs, have raised red flags over potential conflicts of interest and the blurring lines between politics and gambling.

Not everyone is cheering the entry. Critics, including consumer advocates and election watchdogs, have raised red flags over potential conflicts of interest and the blurring lines between politics and gambling.

With President Trump at the helm of the federal government, Truth Predict's U.S.-focused launch invites scrutiny from regulators like the CFTC, which has historically cracked down on unregistered platforms.

Polymarket's 2022 exit from the U.S. and recent FBI raid on its CEO's home underscore the risks - allegations of serving American users in violation of settlements could haunt Truth Predict if it stumbles on compliance.

Moreover, the Trump family's dual hats in the industry amplify worries. "This isn't just business; it's a potential influence on outcomes," argued one ethics expert, pointing to how large-scale betting can sway public behavior or even elections.

Platforms like Kalshi already face lawsuits for offering sports derivatives without state licenses, and Truth Predict's crypto twist could invite SEC oversight on token usage. Environmental groups have also chimed in, decrying the energy-intensive nature of blockchain settlements.

On the flip side, proponents argue prediction markets democratize forecasting, often outperforming polls by aggregating crowd wisdom. With institutional heavyweights like the New York Stock Exchange's parent investing in Polymarket, and leagues like the NHL inking deals with both it and Kalshi, the sector's legitimacy is hardening. Truth Predict could accelerate this trend, especially among crypto enthusiasts and Trump supporters seeking an "uncensored" alternative.

Also read:

- TikTok's Fate Hangs in the Balance: Trump and Xi Poised to Seal a High-Stakes Deal This Week

- AI's Wild Test Drive: Two Years of Limitless Innovation, and the Brakes Are Already Squealing

- Meta’s Reels Revenue Hits $50 Billion Annually: A Stark Divide for Creators

What Lies Ahead for Prediction Markets?

As beta testing ramps up, all eyes are on how Truth Predict carves out space in a market valued at billions. Polymarket, eyeing a $9-10 billion valuation with fresh Intercontinental Exchange funding, and Kalshi, fielding $12 billion offers, won't cede ground easily. Yet TMTG's unique blend of social virality and family clout could disrupt the duopoly, much like Truth Social challenged Twitter (now X) in its early days.

As beta testing ramps up, all eyes are on how Truth Predict carves out space in a market valued at billions. Polymarket, eyeing a $9-10 billion valuation with fresh Intercontinental Exchange funding, and Kalshi, fielding $12 billion offers, won't cede ground easily. Yet TMTG's unique blend of social virality and family clout could disrupt the duopoly, much like Truth Social challenged Twitter (now X) in its early days.

For now, the launch embodies the high-stakes gamble of the Trump era: bold, polarizing, and unapologetically ambitious. Whether Truth Predict becomes a winner or a cautionary tale, it's a bet that's already reshaping the intersection of media, money, and power. As one trader put it, "In prediction markets, the house doesn't always win - but the Trumps just raised the stakes."