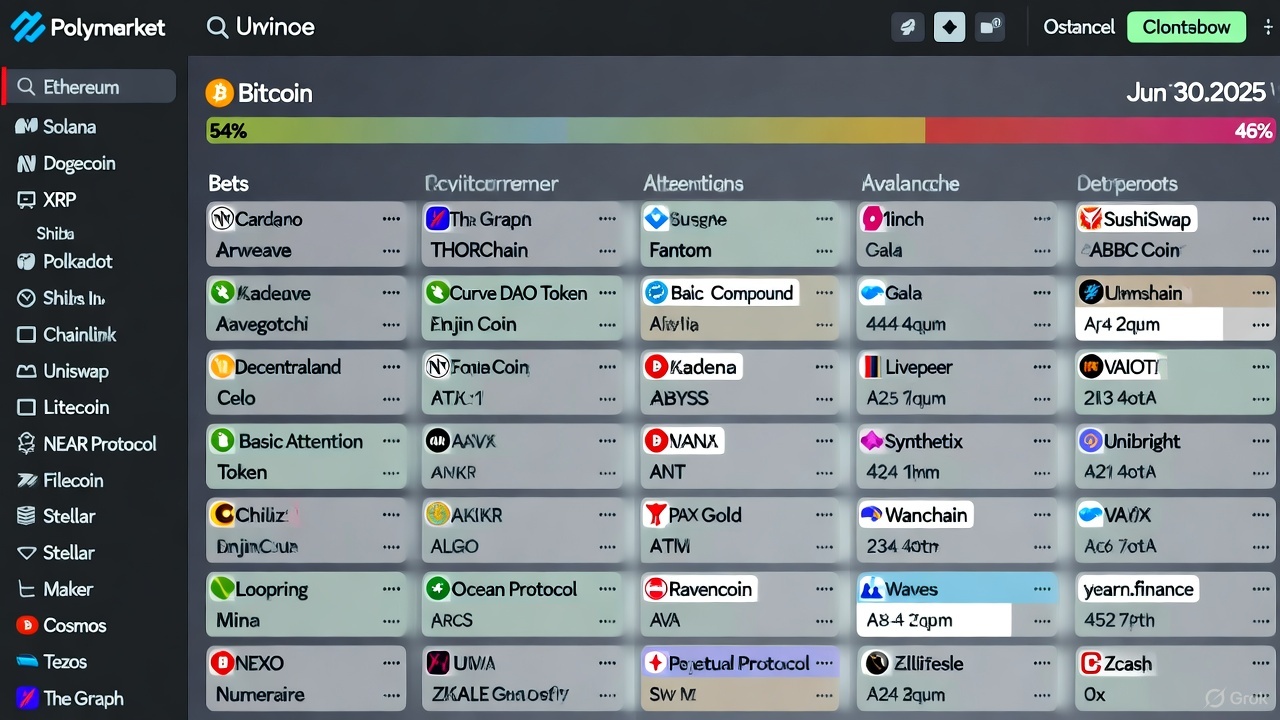

In a move that's sure to resonate with the cryptocurrency faithful, Polymarket, the blockchain-powered prediction market powerhouse, has rolled out support for direct Bitcoin (BTC) deposits. Announced via a succinct post on X, the update reads simply: "Bitcoin deposits. Now live." This expansion builds on the platform's existing compatibility with stablecoins like USDC and USDT, as well as altcoins such as ETH, across networks including Ethereum, Polygon, Base, Arbitrum, and Solana.

Previously limited to these fiat-pegged and alternative tokens, Polymarket's decision to integrate BTC marks a significant evolution. Users can now fund their accounts with the world's premier digital asset, streamlining participation in high-stakes wagers on everything from political outcomes and global conflicts to economic forecasts and sports events. Payouts remain in USDC, but the ability to deposit BTC directly eliminates the friction of conversions, potentially drawing in a wave of holders eager to speculate without leaving the crypto ecosystem.

Previously limited to these fiat-pegged and alternative tokens, Polymarket's decision to integrate BTC marks a significant evolution. Users can now fund their accounts with the world's premier digital asset, streamlining participation in high-stakes wagers on everything from political outcomes and global conflicts to economic forecasts and sports events. Payouts remain in USDC, but the ability to deposit BTC directly eliminates the friction of conversions, potentially drawing in a wave of holders eager to speculate without leaving the crypto ecosystem.

The timing couldn't be more auspicious. Bitcoin shattered its previous all-time high, surging past a record peak before stabilizing at a slightly lower level. The rally, fueled by robust inflows into spot Bitcoin ETFs and a weakening U.S. dollar amid tariff uncertainties, has injected fresh adrenaline into risk assets. Traders on Polymarket are riding the wave, with the platform's "What price will Bitcoin hit in October?" contract showing strong odds for a new peak, backed by significant betting volume.

Polymarket's overall momentum is equally impressive. The platform has amassed a staggering amount in trading volume year-to-date, with active traders showing substantial growth from the prior year. While a specific high-profile market likely spotlights its recent success, the broader ecosystem underscores Polymarket's dominance in decentralized forecasting. Features like Chainlink oracle integrations for real-time price feeds have further enhanced its appeal, enabling near-instant resolutions on complex contracts.

Yet, this Bitcoin boost arrives at a pivotal juncture for Polymarket, as it scrambles to reclaim ground lost to arch-rival Kalshi. In recent months, the federally regulated New York-based exchange leapfrogged Polymarket, capturing a majority of the global prediction market's volume compared to Polymarket's share.

Yet, this Bitcoin boost arrives at a pivotal juncture for Polymarket, as it scrambles to reclaim ground lost to arch-rival Kalshi. In recent months, the federally regulated New York-based exchange leapfrogged Polymarket, capturing a majority of the global prediction market's volume compared to Polymarket's share.

Kalshi's edge stems from its CFTC authorization, allowing seamless U.S. access and innovations like complex parlay bets on sports and earnings reports. By contrast, Polymarket - still navigating regulatory hurdles following a CFTC fine - has leaned into its crypto-native strengths but faced restrictions barring U.S. users.

Adding BTC deposits is Polymarket's latest chess move in this intensifying battle. It not only bolsters liquidity for its global users but also positions the platform to capitalize on Bitcoin's "debasement trade" narrative, where investors hedge against geopolitical risks and fiscal policies with hard assets like BTC and gold.

Adding BTC deposits is Polymarket's latest chess move in this intensifying battle. It not only bolsters liquidity for its global users but also positions the platform to capitalize on Bitcoin's "debasement trade" narrative, where investors hedge against geopolitical risks and fiscal policies with hard assets like BTC and gold.

Analysts see this as a bid to simplify onboarding for BTC holders flush with gains, potentially accelerating turnover in volatile markets like the ongoing U.S. government shutdown bets, where volumes have hit a notable level on contracts predicting resolutions.

The strategic layer runs deeper. Polymarket is reportedly closing a major funding round led by a prominent venture capital firm, eyeing a valuation that could soar amid surging investor hype. Whispers of a significant stake acquisition by a major exchange suggest even bigger institutional plays. Partnerships, such as embedding prediction data into a leading social media platform and AI technology, have already amplified visibility.

Also read:

Also read:

- Donald Trump Jr. and Kalshi: Place Your Bets, Gentlemen!

- Kling 2.5 Turbo Challenges Veo 3: A Quiet Release with SOTA Ambitions

- Perfect Storm: Deloitte Expands Anthropic Partnership to 470,000 Employees Amidst GPT-4o Blunder

- Zuckerberg Says It's Fine to Train AI on Your Data Because It Probably Has No Value Anyway

As prediction markets mature - from niche crypto experiments to mainstream tools blending DeFi with real-world intelligence - the BTC integration signals Polymarket's resolve. With Kalshi's regulated fortress looming, Polymarket's crypto agility could prove the differentiator, especially as Bitcoin's bull run tempts speculators back to the table. For now, the odds favor innovation over inertia: will BTC deposits tip the scales? The market, as always, will decide.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).