Circle, the leading issuer of the USDC stablecoin, is making waves in the blockchain space with the announcement of its new Layer-1 (L1) blockchain, designed with a focus on stablecoin payments and financial applications.

Dubbed "Arc," this EVM-compatible blockchain will utilize USDC as its native gas token, marking a significant step toward integrating stablecoins into mainstream financial systems. The public testnet is slated for launch this fall, with a full rollout expected to follow.

Arc: A Stablecoin-Centric Blockchain

Arc is purpose-built to serve as an enterprise-grade foundation for stablecoin payments, foreign exchange, and capital markets applications. By leveraging USDC as the gas token, Circle aims to streamline transaction fees and enhance efficiency, particularly for cross-border payments and high-volume trading.

Arc is purpose-built to serve as an enterprise-grade foundation for stablecoin payments, foreign exchange, and capital markets applications. By leveraging USDC as the gas token, Circle aims to streamline transaction fees and enhance efficiency, particularly for cross-border payments and high-volume trading.

The blockchain promises sub-second settlement times, opt-in privacy features, and seamless interoperability with Circle’s existing platform and other partner blockchains.

This move positions Arc as a competitor to other stablecoin-focused networks while capitalizing on USDC’s growing dominance in the stablecoin market.

The decision to use USDC as the gas token is a strategic one, aligning with Circle’s mission to create a "full-stack platform for the internet financial system." This approach could reduce reliance on volatile cryptocurrencies like Ethereum’s ETH for transaction fees, offering a more predictable and stable payment model for users and businesses alike.

First Public Company Report Highlights Explosive Growth

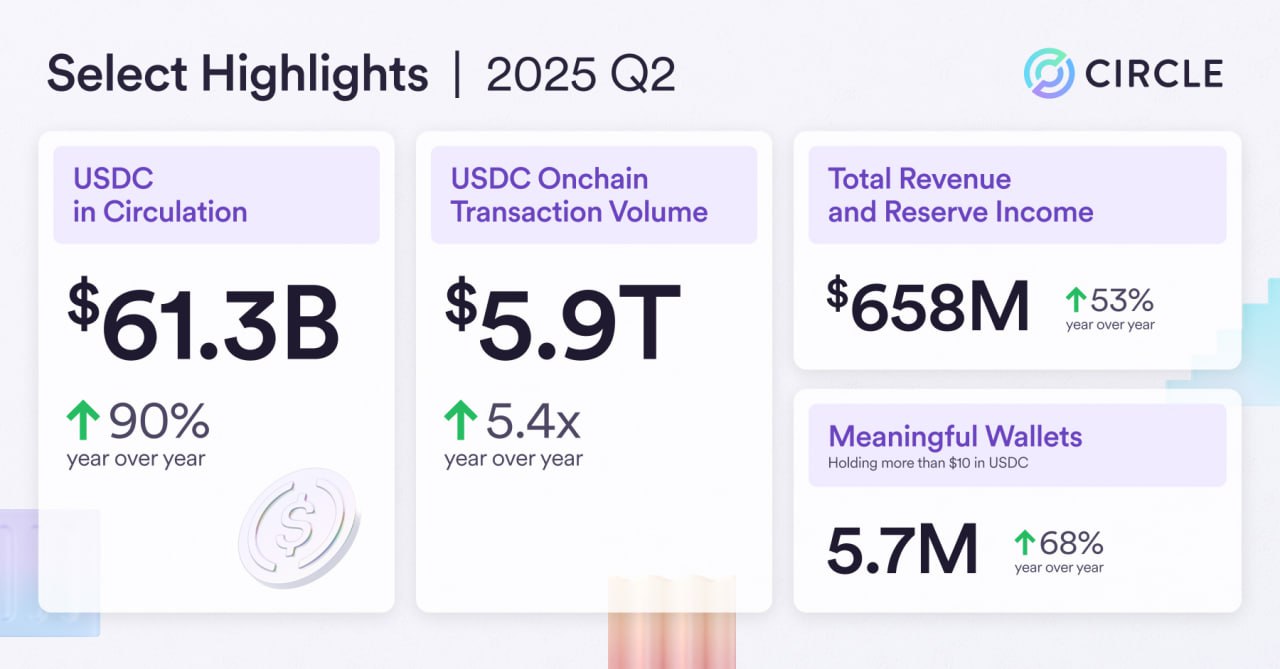

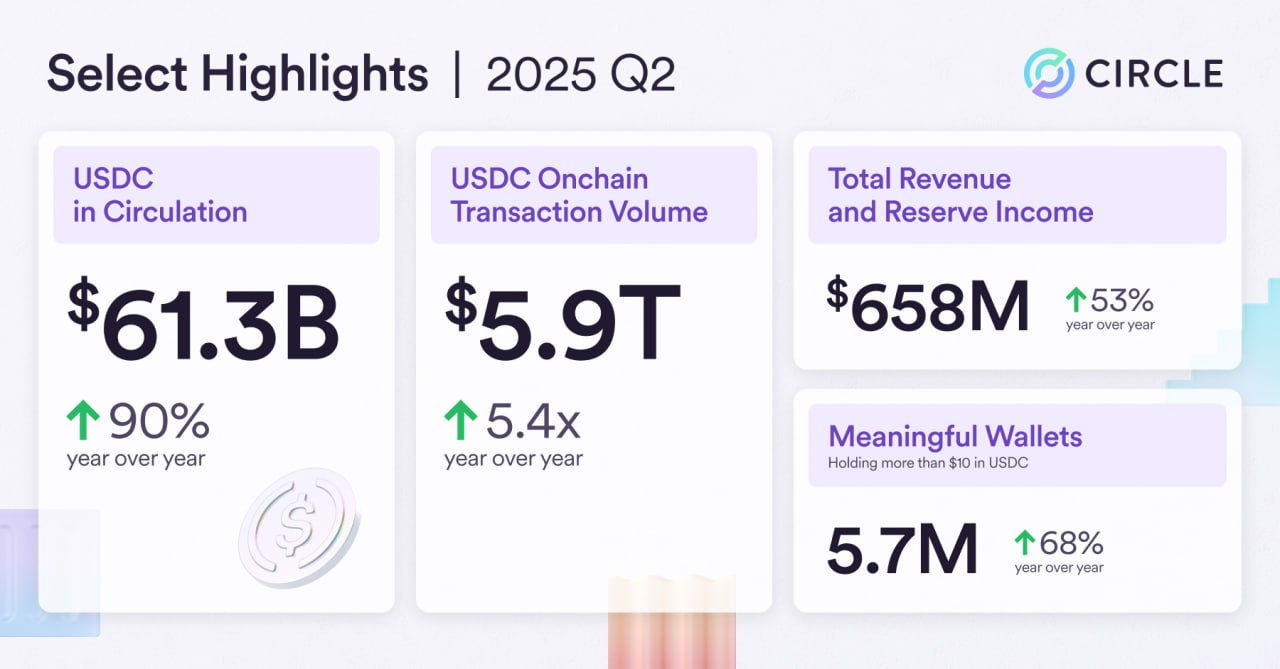

Alongside the Arc announcement, Circle released its first quarterly financial report as a publicly traded company, revealing impressive growth metrics for Q2 2025.

The report underscores USDC’s rising adoption and Circle’s strong position in the stablecoin sector:

The report underscores USDC’s rising adoption and Circle’s strong position in the stablecoin sector:

- 90% Annual USDC Issuance Growth: USDC’s circulation surged to $61.3 billion by the end of Q2, with an additional 6.4% increase to $65.2 billion by August 10, reflecting a 90% year-over-year rise. This growth highlights the increasing demand for a regulated, dollar-pegged stablecoin.

- 5.4x Transaction Volume Increase: The total transaction volume reached an astounding $5.9 trillion, a 5.4-fold increase from the previous year, demonstrating USDC’s expanding role in global finance.

- *53% Profit Surge: Circle reported a profit of $658 million, up 53% from the previous year, driven by higher transaction volumes and growing interest in its stablecoin services.

- 68% Rise in Holders: The number of USDC holders with a minimum balance of $10 climbed to 5.7 million, a 68% increase, signaling broader adoption among individuals and institutions.

These figures cement Circle’s leadership in the stablecoin market, with USDC now accounting for a significant share of the $250 billion stablecoin economy as of mid-2025.

Strategic Implications and Testnet Details

The launch of Arc aligns with the regulatory clarity provided by the GENIUS Act, passed in July 2025, which has spurred corporate adoption of stablecoins. Circle’s decision to develop an EVM-compatible blockchain ensures compatibility with existing decentralized applications (dApps) and smart contracts, potentially attracting developers from the Ethereum ecosystem.

The launch of Arc aligns with the regulatory clarity provided by the GENIUS Act, passed in July 2025, which has spurred corporate adoption of stablecoins. Circle’s decision to develop an EVM-compatible blockchain ensures compatibility with existing decentralized applications (dApps) and smart contracts, potentially attracting developers from the Ethereum ecosystem.

The testnet, scheduled for fall 2025, will allow users to experiment with Arc’s features, including USDC-based gas payments and privacy tools, with feedback shaping the mainnet launch.

This move also positions Circle to compete with other L1 blockchains like Solana and Avalanche, as well as stablecoin initiatives from competitors such as Tether. By controlling its own blockchain, Circle can optimize performance for USDC transactions, reduce costs, and enhance compliance with global financial regulations—a critical factor for enterprise adoption.

Also read:

- Sam Altman Addresses GPT-5 Launch Criticism: OpenAI Doubles Plus Subscription Limits

- "Weapons" Horror Film Scores Rare A- CinemaScore, Joining Elite Company

- China’s Economic Might vs. Its Stock Market: A Tale of Disparity and Opportunity

The Road Ahead

As Circle prepares for the Arc testnet, the company is poised to redefine how stablecoins are integrated into blockchain infrastructure. With USDC’s explosive growth and Arc’s innovative design, Circle is betting big on a future where stablecoins power the global economy.

As Circle prepares for the Arc testnet, the company is poised to redefine how stablecoins are integrated into blockchain infrastructure. With USDC’s explosive growth and Arc’s innovative design, Circle is betting big on a future where stablecoins power the global economy.

The fall 2025 testnet will be a key milestone, offering a glimpse into a new era of payments and financial services driven by Circle’s vision. Industry watchers will be keen to see how Arc performs and whether it can capture a significant share of the evolving blockchain landscape.

---

**Disclaimer**: This article is based on Circle’s announcements and financial reports as of August 12, 2025. Details about Arc’s testnet and mainnet rollout may evolve, and readers are encouraged to verify information independently before making financial decisions.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).