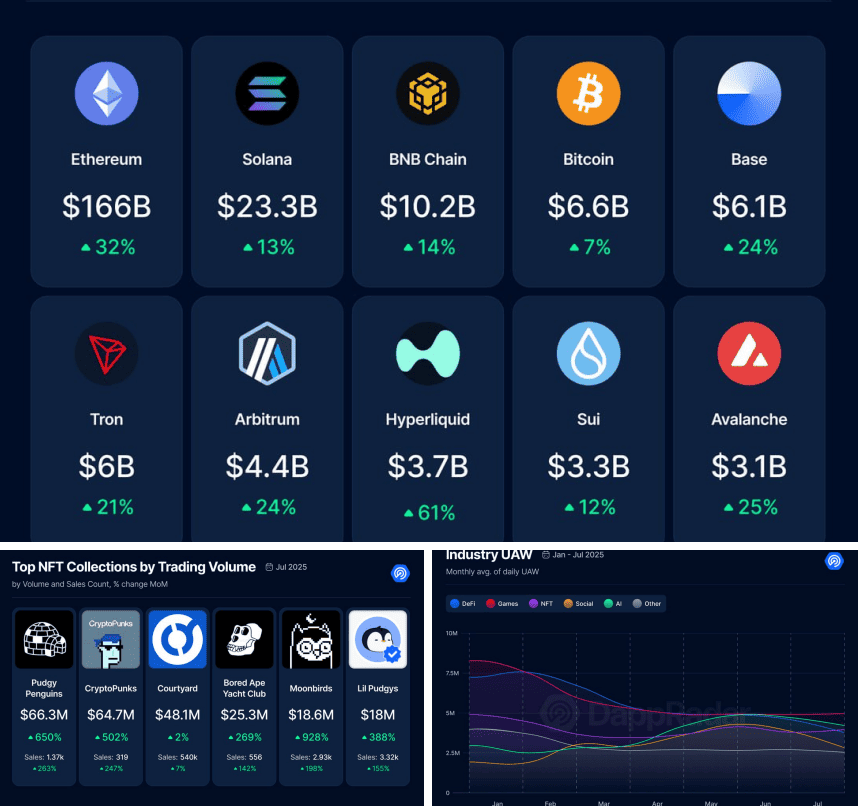

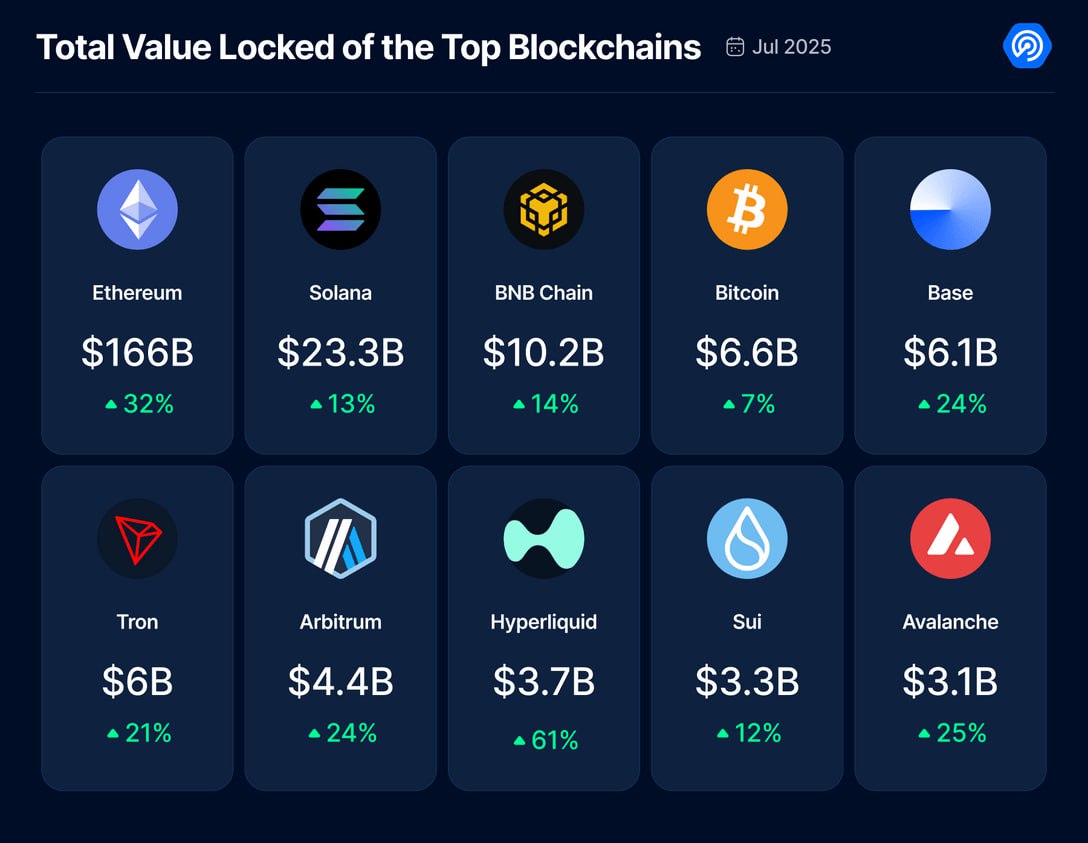

The decentralized finance (DeFi) sector has reached a new milestone, with the total value locked (TVL) in DeFi applications soaring to a record $270 billion, according to a recent DappRadar report.

The figure closed the month at $259 billion, reflecting a remarkable month-over-month increase of over 30%.

This surge is largely attributed to the real-world asset (RWA) segment, which saw its market capitalization jump by 220%. The number of wallets interacting with this asset class spiked dramatically, rising from approximately 1,600 to nearly 90,000 within a 30-day period, signaling a significant uptake in tokenized asset adoption.

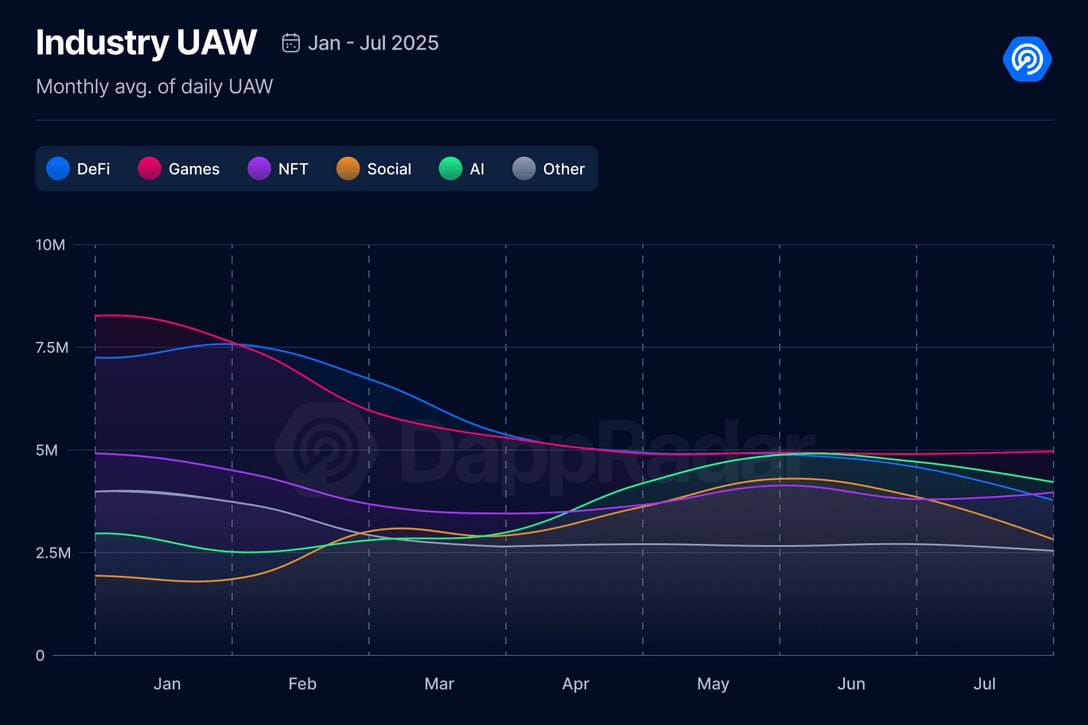

Interestingly, while DeFi liquidity climbed, the market for non-fungible tokens (NFTs) outpaced it in user activity. NFT trading volumes and average prices doubled, highlighting a renewed interest in digital collectibles. This shift underscores a broader diversification of engagement within the decentralized application (dApp) ecosystem.

Also read:

Also read:

- QUASA's Strategic Expansion in DeFi and Crypto Markets: 11 Crypto Exchanges

- Roblox Content on YouTube Surpasses One Trillion Views: YouTube Throws a Block Party with Top Influencers

- The Decline of the Marvel Cinematic Universe at the Box Office: Phase 5 Marks a Historic Low

However, the overall trend for decentralized applications reveals a traditional summer decline. The number of unique active wallets (UAW) dropped by 8%, settling at 22 million. This seasonal dip suggests a temporary cooling in user participation, despite the robust growth in specific sectors like RWA and NFTs.

The data paints a picture of a dynamic DeFi landscape, where innovation in tokenized assets and NFT markets drives growth, even as broader dApp activity faces periodic slowdowns.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).