Introduction

NFTs are tokens that have introduced a new way to verifiably prove ownership of virtually anything through the blockchain.

While a majority of the current NFTs come in the form of a JPEG or GIF, the sector is evolving such that the NFT itself becomes a means to an end. In other words, the ownership of a NFT can grant the owner the right and avenue to access data or a community directly.

NFTs reportedly recorded over $56M in sales in 2020 and over $927M in 1H2021 alone.

This marks a 5,404% growth year-over-year when compared to 1H 2020. While NFTs may sound foreign to many, the concept is fairly aged and rooted in the history of the crypto industry.

As always, we strongly urge you to do thorough research before jumping in.

Non-Fungible Tokens (NFTs) are more than just JPEGs or GIFs, they empower online communities and they are a technological breakthrough for content creators looking to build an economy with direct access to their consumers.

While art and music appear to be the initial use cases for NFTs, they represent so much more. Many are sold as part of a limited collection, which buyers then use as a form of digital identity and affiliation with a community. Those NFTs can serve as a fundraising mechanism for the community who issued them and in turn reward members who bring the greatest value or reinvest the funds in future activities.

Not only that, because an NFT is digitally scarce and verifiably authenticated on a blockchain, it can act as a passkey for exclusive content or an activity at the creator’s discretion. In addition, when the NFT is created via a smart contract, should the asset be continuously sold in the future, a portion of the proceeds can be returned to the creator in the form of a royalty.

Defining NFTs

Non-Fungible Tokens (NFTs) refer to digital assets that cannot be interchanged for another asset of the same type. Fungible assets can be substituted or exchanged for another asset of the same type, much like bitcoin (BTC), ether (ETH), and even fiat. They serve in place of what they are exchanged for; 1 bitcoin can be exchanged with another bitcoin, and both can be used in place of one another. Non-fungible assets, however, are unique and cannot be replaced.

An example would be a one-of-a-kind original oil painting by an artist, like the Mona Lisa hanging in the Louvre. Multiple replicas can be printed and oil paintings can be recreated based on the original, yet nothing will ever replace the original. Similarly, NFTs are one-of-a-kind, digital representations of information or data where a holder has proof of ownership. NFTs and their corresponding ownership are recorded on the blockchain, which establishes NFTs verifiable digital scarcity and the uniqueness of each asset.

Process

Marketplaces and infrastructure such as Nifty Gateway, SuperRare, Rarible, OpenSea all began to gain traction. Everything from game characters to event entrance tickets were traded as NFTs. Towards the end of 2020, the NFT marketplace started picking up steam in art and collectibles. By 1Q20, there were around 633K NFT sales, totaling a value of over $9M. By 4Q20, there were around 180K sales at a total value of over $20M. While the total number of sales dropped, NFTs were appreciating in value.

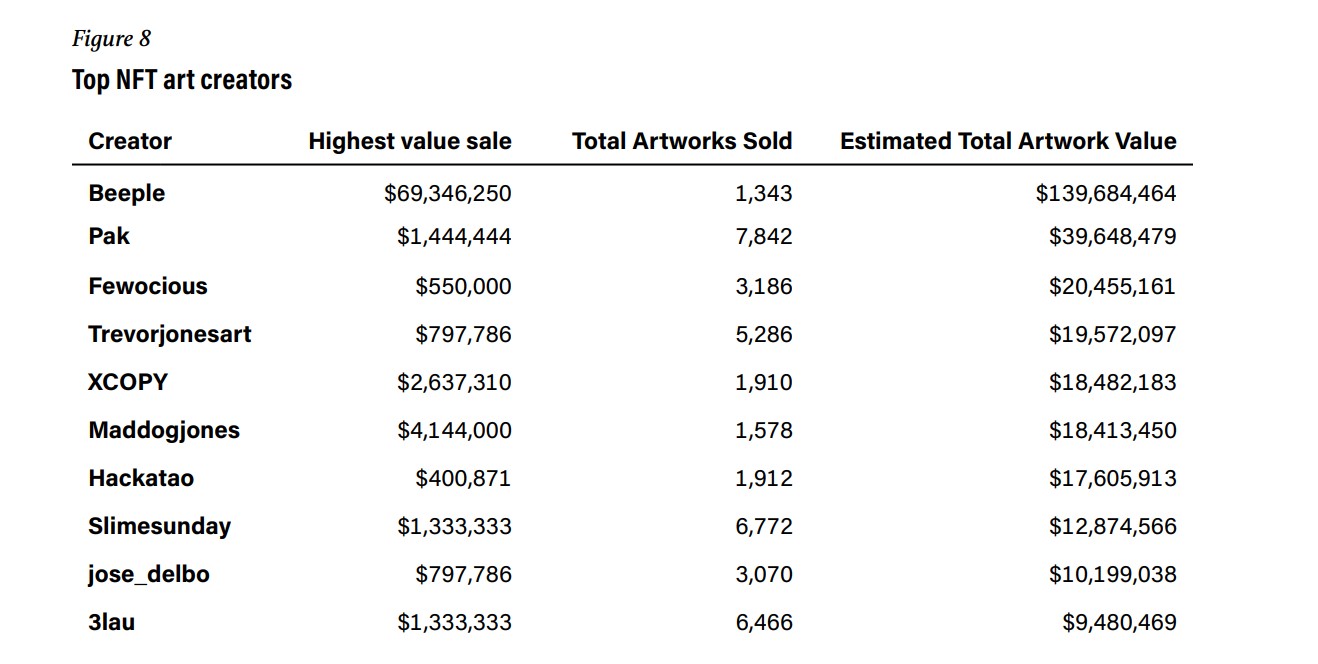

In March 2021, a famous NFT artist known as Beeple, auctioned off his artwork named Everydays—The First 5000 Days. The starting bid was $100 and quickly sold for an astonishing $69M. This is the most expensive NFT art sold to date, and the third-most expensive art among all living artists.

The new standard

In recent years, ERC-1155, also known as the Multi Token Standard, has become a popular standard for NFTs. This framework is designed to enable an infinite number of NFTs and fungible tokens in a single smart contract. This is an impressive leap from ERC-20 and ERC-721, both of which require a new smart contract deployed for each new class of tokens. With the right implementation, ERC-1155 significantly reduces gas fees when compared to ERC-721 tokens by allowing multiple tokens to be sent in one single transaction. This batching of transactions could offer significant savings in gas costs and shorten the time spent waiting for new blocks in recognizing single transfers.

A common explanation given for the difference between ERC-721 tokens and ERC-1155 is the analogy of a vending machine. While ERC-1155 can hold an infinite variety of items in one vending machine (smart contract), ERC-721 requires one vending machine (smart contract) for each item created.

While most of the current NFT market runs on the Ethereum blockchain, alternative layer 1 networks are competing for a greater share of the market. Solana and Cardano are among some of the networks that are competing with Ethereum-backed NFT marketplaces and expanding the NFT ecosystem.

For instance, the Solana Foundation, in partnership with music platform Audius and NFT market builder Metaplex, announced the launch of a $5M Creator Fund to boost Solana’s NFT ecosystem. The fund was created to spur innovation on the network from artists, musicians, NFT projects, and metaverse builders.

Similarly, Cardano is becoming a popular network on which to build a NFT marketplace. The Cardano network is scalable, interoperable, and enjoys relatively higher transaction speed with its Proof-of-Stake consensus mechanism. Projects such as Cardano Kidz, Spacebudz, Professor Cardano, LoveADA, and Somint are among some of the projects created on Cardano that are quickly gaining traction and interest from the broader NFT user community. As the number of NFT projects grows and the diversity of blockchains underlying NFT platforms expands, it’s possible there will be a shift from Ethereum onto various different blockchains that are optimized for NFT capabilities.

Value

At a glance, the value of NFTs may not be as clear, especially if the NFT has no immediate utility. For instance, art NFTs may seem to be nothing other than a digitized piece of art that can be exactly duplicated and owned. After all, if an individual buys the right to make legitimate copies of a digital art piece, what is then the value of the original digital art? While the value of a NFT may vary depending on the asset which the NFT represents, in the case of art or collectibles, we believe the value is derived from the status of originating ownership. While art pieces or visual collectibles may not have the most obvious or immediate physical utility, the ownership history or ownership status that is provable and immutable on a blockchain gives it value. In the long run, if art pieces trade hands and are passed on for generations, the latest owner will be able to prove the authenticity of the piece. This provable ownership can be applied not only to art pieces but also to goods that are protected with copyrights. Verifiable ownership is the main value driver for NFT collectors and users alike.

With NFTs, a blockchain can track every interaction or connection to ever occur on digital content.

While the recent wave of NFTs has taken off with NFT art and collectibles, the application is truly endless and has far reaching implications with the digitized world we live in today. This is particularly the case as younger generations interact moreso online than offline.

The notion of digital scarcity and digital identity is at the forefront of this generational shift, where people are learning to place value on digital identity and reputation more than ever before. This isn’t attributable solely to art or music becoming digitized, but even social interactions or personal thoughts jotted down on a blog or on Twitter. This is where the transformative power of NFTs and digital footprint takes hold at a macro level. With NFTs, a blockchain can track every interaction or connection to ever occur on digital content. This results in a direct connection between the creator of content with the user. This means that the intrinsic value of interaction is baked into the creation or content itself and individuals will begin to demand ownership of their digital content.

As it stands currently, platforms that connect creators to users have a monopoly on the content that is distributed. The users access a copy of the content, and the creators do not necessarily own the content themselves. Creators are no more than a renter of the content and users are granted permission to view the content in an app, which takes profit for the viewership. This leaves us with the realization—do creators actually own any of their digital content online? While the illusion of ownership makes it seem they do, the real answer is no.

Media platforms reap profits from their users and content creators are paid less for the quality of their content and more for the attention, and the duration of the attention it can garner. Media platforms make significant profit from creators by retaining the distribution channels to disseminate content to a wider audience. Under this hierarchy, creators are challenged to profit directly from their own creations. This is an example where NFTs can step in to create value. While current media outlets such as YouTube, Instagram, TikTok, and others have the ability to garner attention surrounding distributed content, there is a lack of claimed ownership or even scarcity.

Imagine a NFT that can grant access to a TikTok video or Instagram post. Access is controlled by the NFT owner and/or creator of the content.

Content creators will have the ability to generate direct revenue and the platforms acting as middlemen may cease to exist. Much like crypto, NFTs have the power to cut out third parties as value is programmed into the asset/content.

This leads us to the question - how would creators generate direct revenue? One way is through royalties. NFT royalties allow artists or content creators to receive a percentage of secondary sales. Each time a NFT is sold or changes hands, the smart contract will automatically trigger and execute royalty payments to the identified creator or author of the work.

While royalty systems can differ by platform, some marketplaces will allow the creator to choose the royalty percentage when minting the NFT. A 5%–10% cut of the sale is considered a standard payment. It should be noted that NFTs are not automatically royalty-yielding and terms must be clearly written into a smart contract should creators wish to receive a recurring cut of secondary sales. Creators also have the option of selling a percentage of the underlying copyrights to an NFT, which would grant the buyer a portion of the royalties earned. This is the unique and unprecedented proposition offered by NFTs, where artists and creators can maximize earnings on their creations.

While traditionally creators didn’t have a proper way to monetize their work post-initial sale, the NFT royalty system can generate perpetual returns especially with an increase in popularity of their work. While conceptually, NFTs are game-changing and valuable because of the decentralized and permanent provable ownership of a service or product, it’s important to note that under the current ecosystem, many NFTs may be more centralized than imagined.

Typically with NFTs, the token itself is stored on a blockchain (i.e., on-chain) but the corresponding content or art is stored off-chain due to the costs associated with storing large files on-chain. The artist or platform that mints the NFT gets to decide where the media and metadata related to the NFT is stored. If the artist chooses to store the media portion of the NFT on platforms or companies that maintain centralized servers, this could imply that buyers of a NFT run the risk of “losing” their NFT if these centralized platforms cease to exist and the token points to an off-chain dead link.

While storing data off-chain in a centralized manner can increase flexibility for artists or creators that need to update metadata constantly (e.g., for in-game NFTs), it also carries ramifications on the long-term viability of NFTs. After all, what’s the value of the rights tied to a digital art piece that you can no longer see? To combat the risks of losing NFT metadata, minters, creators, and collectors should all take an active role in protecting and hosting their NFT-related data.

As awareness of potential risks grows, platforms and projects are also seemingly taking an active stance and role in determining the responsibility tied to NFT- maintenance. Whether it’s familiarizing oneself with on-chain solutions that can truly make the NFT centralized by nature or utilizing services requiring ongoing data.

State of NFTs

The NFT market currently enjoys a wide array of participants, both users and platforms flourishing with new applications of NFTs as the industry matures. While the boom in early-2021 mostly came in the form of art collectibles, the industry now sees a diverse mix of NFT product sales.

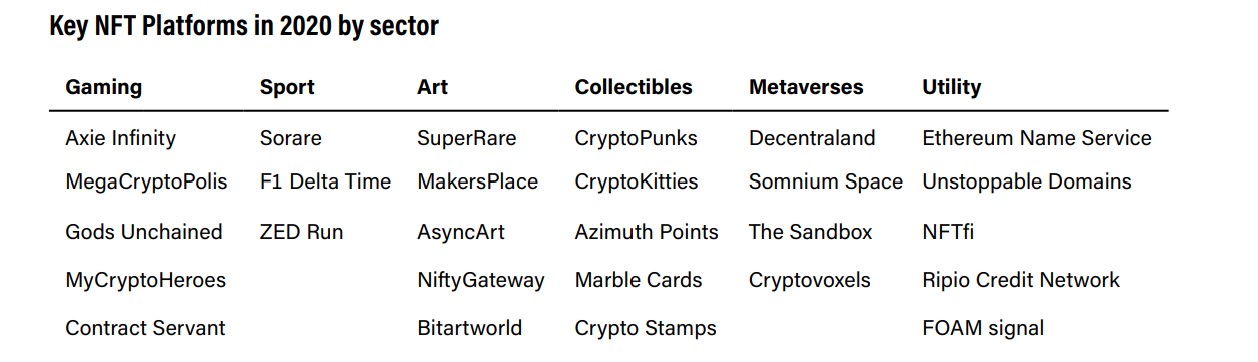

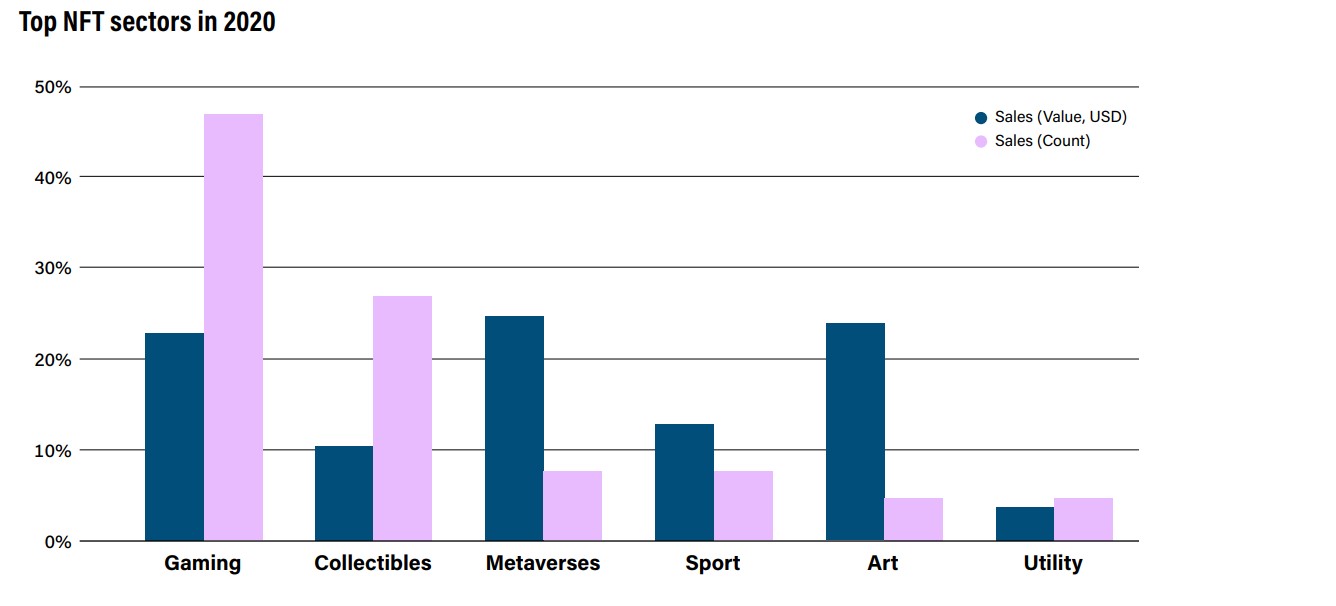

The current ecosystem is booming in a handful of sectors: gaming, sports, art, collectibles, metaverses, utility-driven NFTs, and more. Various NFT types exist within each sector. For instance in the art category, some NFTs take the form of video or static images. In collectibles, there may be generative NFTs or even dynamic NFTs. Sectors can also overlap, where an art NFT is purchased and displayed in a metaverse or game. Despite instances of overlap, each sector serves a unique purpose and market audience.

For example, NFTs in the domain of gaming generally represent in-game items. Purchasing a gaming NFT can offer ownership of in-game items with a range of benefits exclusively available to the players who own them. On the other hand, utility-driven NFTs, represent collectibles that carry real-life utility. Utility NFTs can be anything from an “access token” where NFT holders can tap into exclusive opportunities with creators and artists, to NFT-collateralized loans where NFT holders can put up their NFT as collateral for a loan. The applications are ever-expanding, and while there are countless players and sectors in the space today, below are some examples of key platforms by sector.

Looking to 2020, when sorted by sales count, the gaming sector came out on top with over 629K sales. In terms of sales value, the metaverse and art sector saw the highest value, with over $14M and $12M in sales, respectively. This suggests that higher value sales were made over fewer transactions for art and metaverses while the gaming industry saw more frequent sales at lower values. Trends across both metrics describe the growth in engagement and participation in NFT-related projects.

Beyond marketplaces and infrastructure platforms, wallets have also begun integrating NFT-related services in an attempt to make them more approachable for users. Wallets such as Metamask, Pillar, Alphawallet, and Argent are among those that have made it

easier to trade and securely keep track of purchased NFTs alongside cryptoassets. Some crypto wallets are specifically designed or optimized for NFTs and have features enabled to allow for easier organization of NFTs held.

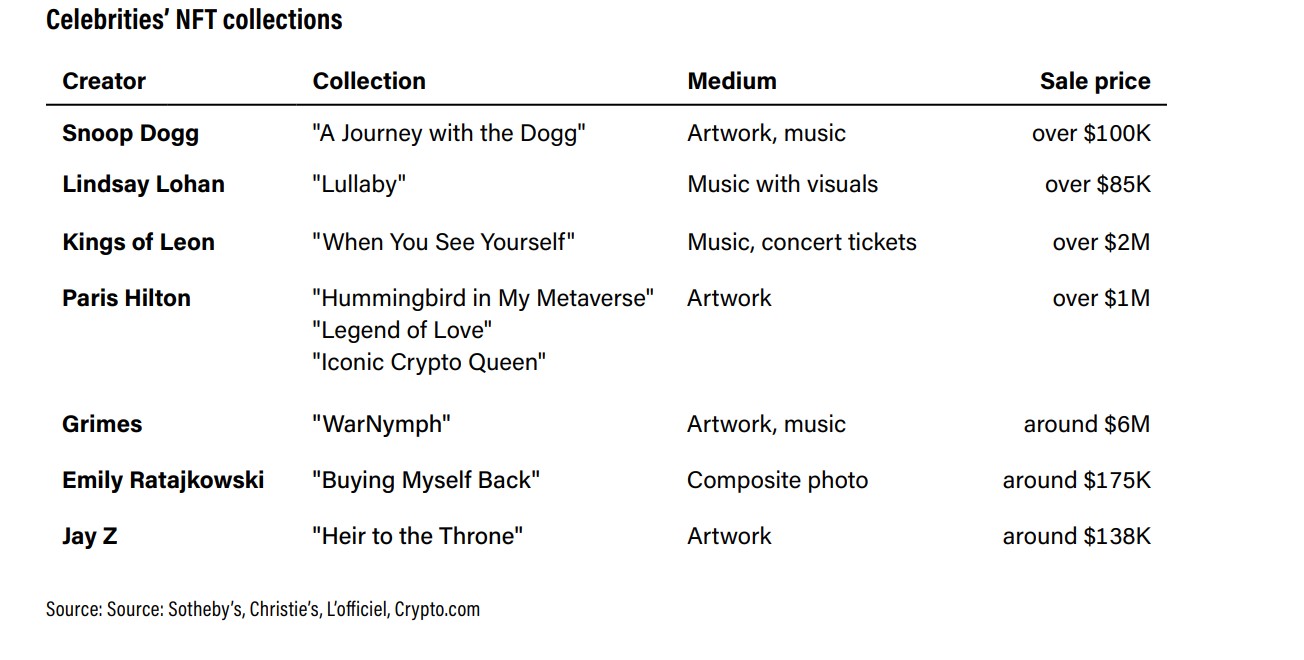

The NFT art frenzy of 2021 aided in the boom of NFT platforms and infrastructure as well as artists. Much like crypto transforming legacy financial markets, NFT art brought down barriers to the art world. Anyone with an art piece to offer can join NFT markets, which aren’t restricted to established artists. As a result, the industry saw a flurry of digital creators join the trade. At its height, as NFTs began expanding to other products such as collectibles, well-known celebrities also began creating and actively trading NFTs.

In the NFT art scene, a digital artist known as Beeple (Mike Winkelmann) rose to prominence and launched the NFT art scene forward with an art piece that sold for over $69M by the historical auction house Christie’s. This was the first time a NFT had bled into the traditional art world and the number of bids placed on Beeple’s artwork nearly crashed Christie’s website. Similarly riding the NFT wave were celebrities, who raced to mint their own NFT tokens. Everything from music albums and art to concert experiences were tokenized and sold.

NFTs quickly became an open yet lucrative trade, and artists and celebrities were seen opening up NFT marketplaces that made it easier for users to participate. Billionaire entrepreneur Mark Cuban launched an online digital art gallery, named Lazy, where users could easily display their digital art and collectibles and share their collections on social media platforms.

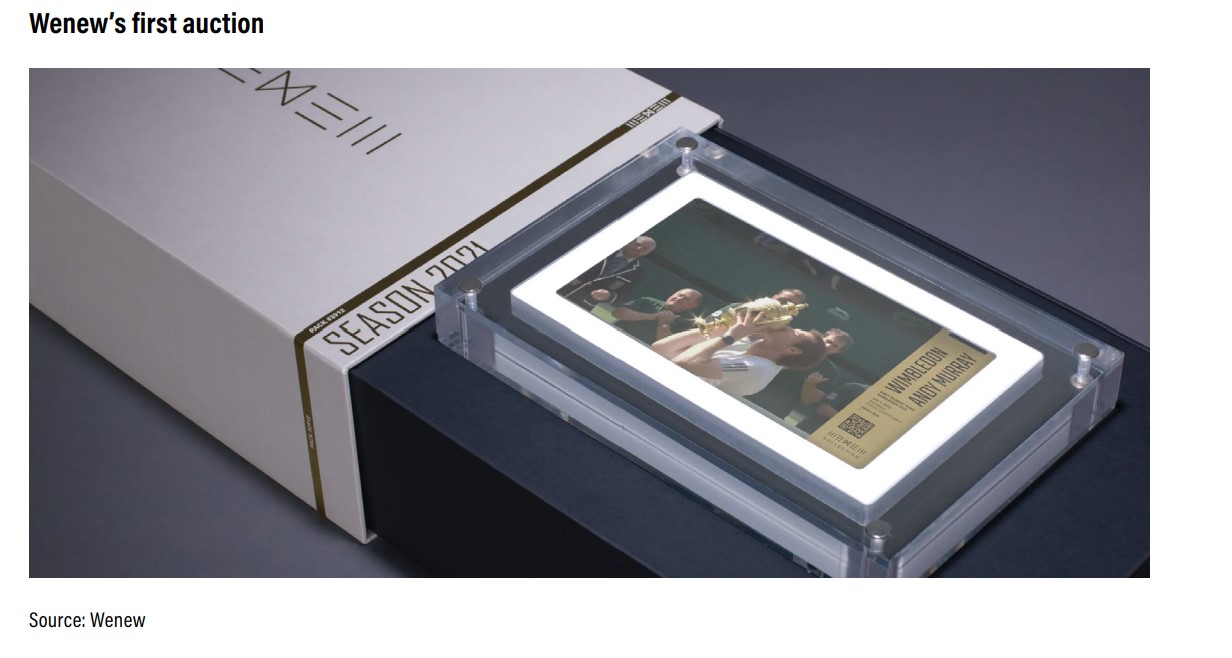

Digital artist Beeple launched a curated NFT platform, known as Wenew, that would auction off “historic and iconic moments across sports, politics, history, fashion, and more.”, Each collection is created in collaboration with the entity behind the moment or cultural milestone, like the first Wenew auction which featured British tennis player Andy Murray and his win at Wimbledon in 2013. By curating iconic moments in history into NFTs, Beeple wishes to create a sustainable NFT marketplace that would live through the market’s highs and lows.

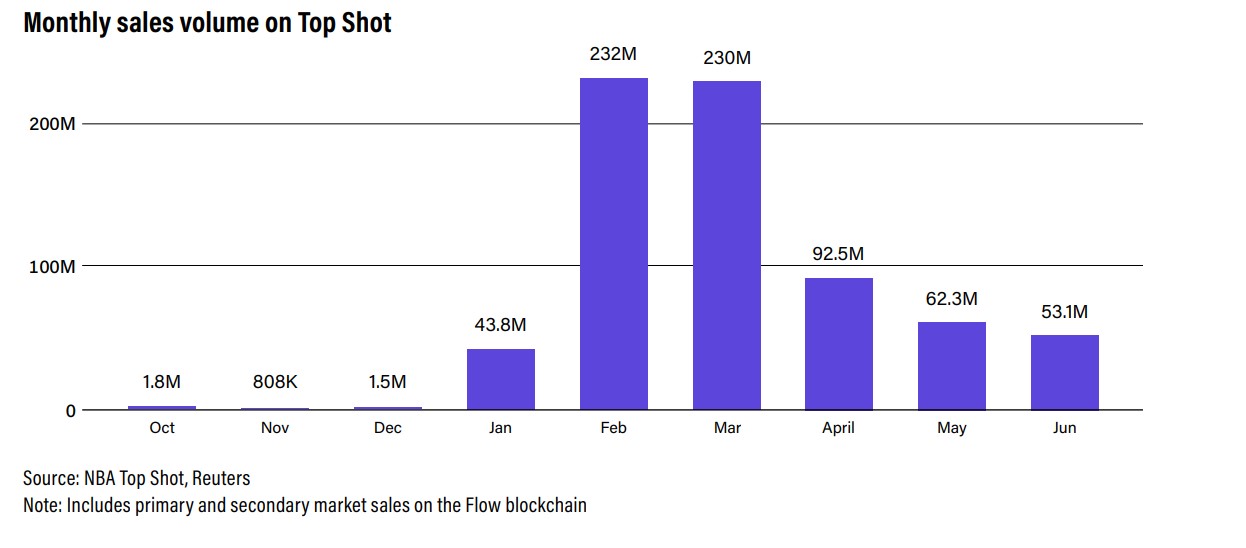

While some are worried that NFTs are a speculative bubble primed to burst, its application only continues to grow and expand. For instance, Twitter’s CEO sold his first tweet as a NFT for a whopping $2.9M and the blockchain company that launched CryptoKitties, known as Dapper Labs, launched another digital collectibles platform called Top Shot.

Top Shot was created to be a place where users can trade NBA collectibles.,The platform was backed by not only Dapper Labs, but also players such as Michael Jordan, Kevin Durant, Andre Iguodala, as well as investors such as Will Smith, Andreessen Horowitz, and The Chernin Group. While the NFT industry began with gaming, it certainly has expanded far beyond games and continues to push boundaries through the tokenization of products and experiences.

In 1Q2021, Top Shot saw a meteoric rise as sports fans brought back card collecting into the digital world. Users could collect video highlights that were officially licensed digital collectives, known as “moments.” This signified a new era of fandom where individuals could secure the most coveted plays of the season, with each moment produced in limited numbers. While Top Shot, along with art and other NFT collectibles, kick-started the NFT boom in early 2021, the quick moving industry soon saw a shift. Top Shot saw volumes shrink and buyers drop to 246K in June versus 403K in March 2021. The average price of a Top Shot “moment” peaked in February at $182 but slumped to $27 in June. As the industry began to expand past Top Shot, another collectible marketplace came to the fore, known as the Bored Ape Yacht Club.

The Bored Ape Yacht Club (BAYC) is a collectibles marketplace where a set of 10K unique digital “Bored Ape” NFTs have become a hit among collectors. A bored ape acts as a digital identity for the ape-holder and also grants membership access to the BAYC.

The highest priced ape sold on OpenSea as of September 2021 stands at 740ETH ($2.9M equivalent), a remarkable jump from the launch price (minting price) of around $220 in April 2021.

As NFTs started going mainstream, e-commerce companies also began embracing NFTs. eBay announced that it will allow the sales of NFTs on its platforms while Chinese online entertainment giant Tencent Music built its own NFT platform for the trade of music NFTs. The application of NFTs are expanding, especially in industries where the middlemen have a greater portion or share of profits. Take for instance the music industry, where the structure is set up to reward most of the profits of a music sale to the streaming platform or middlemen corporations. Artists themselves, are said to only receive around 12% of all profits from sales of music streamed.

NFTs can radically transform industries like this, where independent artists are empowered to make direct profit and not have to rely on streaming platforms or third-party services. However, NFTs have the power to not only transform currently existing, and perhaps inefficient, industries but also to introduce entirely new ones.

Transformative power of NFTs

NFTs can theoretically have an endless application. Anything from physical products to cultural experiences to historical moments can be captured into a token in the current static form and eventually a dynamic NFT. With verifiable ownership on the blockchain, participants can have universally recognized ownership of a purchase. This level of assurance and guarantee awarded to an owner of a NFT has the potential to make markets more transparent. In addition, given the expansion of marketplaces and UX improvements for NFT apps, the barrier to entry is becoming lower and more accessible to global participants.

The industry continues to break new ground and go mainstream, with platforms like Twitter pursuing NFT authentication support through badges that would mark users’ NFTs as authentic. Yet many still worry about the future of the NFT market. Is it a gold rush?

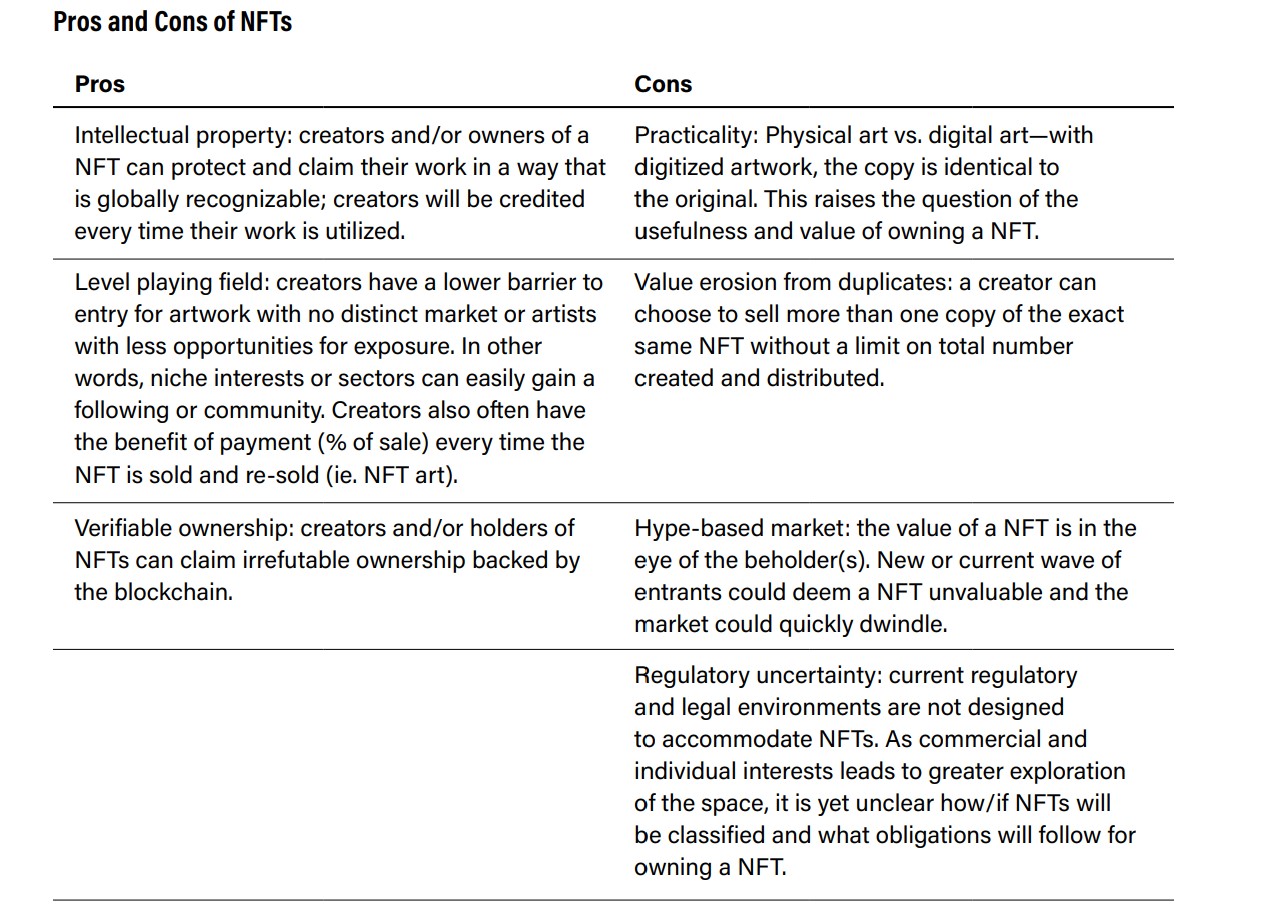

Or is it here to stay? We look at the pros and cons of NFTs as it stands today, to consolidate the perspectives of both skeptics and believers in the space.

NFTs brought digital scarcity to the fore and have the potential to revolutionize most industries, from art to finance. The recent growth in demand has translated into robust advancement and creative application of NFTs. Any creator can tokenize a service, product, content, or idea and sell or share it with the world in a way that suits them. The concept of ownership and scarcity is made verifiable and irrefutable by the blockchain.

However, as with any new innovation, NFTs are accompanied by uncertainty and regulation. The demand surrounding NFTs can as easily dwindle as it rose, especially as the value of an NFT is often subjective. NFTs being the new sector fueling a part of the crypto industry, global regulators have yet to define and classify NFTs from a legal perspective. We imagine that greater exploration, advancement, and application of NFTs in various industries will bring forth greater regulatory-side desire to tame the beast. However, while the NFT industry has a long way to go, whatever belief you hold towards NFTs it’s hard to ignore the potential and benefits the market can bring to creators and participants alike.

Owning NFTs

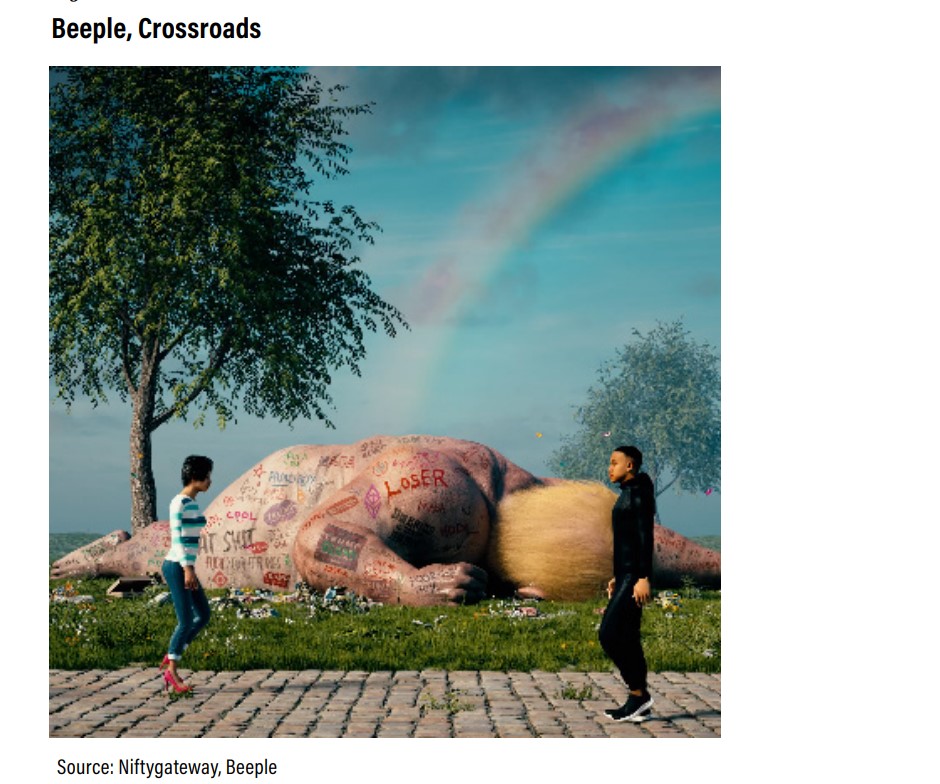

Currently, NFTs exist as a digital token that represents ownership of objects like art, music, in-game items and videos. Although almost everyone has heard of NFTs and associate the term with images of digital generated art, NFTs come in a number of different forms. First, NFTs can be tokenized video clips that are available for purchase through various NFT marketplaces. Though not always, the purchase can entitle the owner(s) to distribution rights in addition to owning the underlying token associated with the video clip in question. In February, a 10-second video clip entitled “Crossroads” by artist Beeple was sold for $6.6M on the Nifty Gateway platform.

In addition to video NFTs, music NFTs allow the token owner to have either full or partial rights to an mp3 file. Ownership can entitle the owner to streaming royalties so long as they own the NFT. Renowned electronic dance music (EDM) artist 3LAU recently

launched music marketplace Royal, allowing users to buy shares of songs through their marketplace to earn royalties as the music they’ve invested in is played. In October 2020, OpenSea began supporting the sale and mint of mp3 and mp4 audio files with DAOrecords as the platform’s first mp3 collection listed.

Other than digital art, video, and audio, NFTs can represent ownership of unique digital items within a video game that are tracked using the blockchain. In the blockchain-based game Axie Infinity, NFTs represent an actual character in the video game. By turning characters and in-game items into NFTs on a blockchain, users can more efficiently transact and trade their virtual goods, and ownership of said virtual items is easily tracked and provable. But most importantly, video game NFTs also open the door to interoperability across different games. That is, items and characters can be transferred across to other games that utilize the same blockchain. In the future, it may be possible that time and money spent earning or purchasing items in one game become transferable to a completely different game. In addition to Axie Infinity, up and coming games like Decentraland and Aurory are using NFTs to create new and innovative games where users are rewarded for playing and can have provable, tokenized ownership of their goods and characters within the game.

Where to Buy or Mint NFTs

While many have heard of NFTs and seem to know a thing or two about them, there remains confusion on how to make a purchase or where to begin.

Aside from participating in NFT mints, or the public sale of a NFT collection, others can turn to secondary marketplaces where NFTs are exchanged in auctions.

Because high-profile NFT collections are almost instantly sold out once available for mint, many turn to secondary marketplaces to buy these NFTs. Some prefer to browse NFT marketplaces to selectively shop around for their favorite NFTs instead of committing themselves to join a first mint. Purchases via a NFT marketplace also allow for potential purchasers to see statistics that can help them get a better sense of how popular the collection is and whether the collection has gained or lost value over time.

For instance, NFT marketplaces like OpenSea or rarity.tools allow users to track stats such as floor price (lowest price), 24-hour price change, 7-day price change, number of owners, number of assets, and trading volume.

Those who explore the world of NFTs by browsing through a catalog on the secondary market will either come across NFTs that are either part of a much larger collection or ecosystem, or represent a unique 1-of-1 piece.

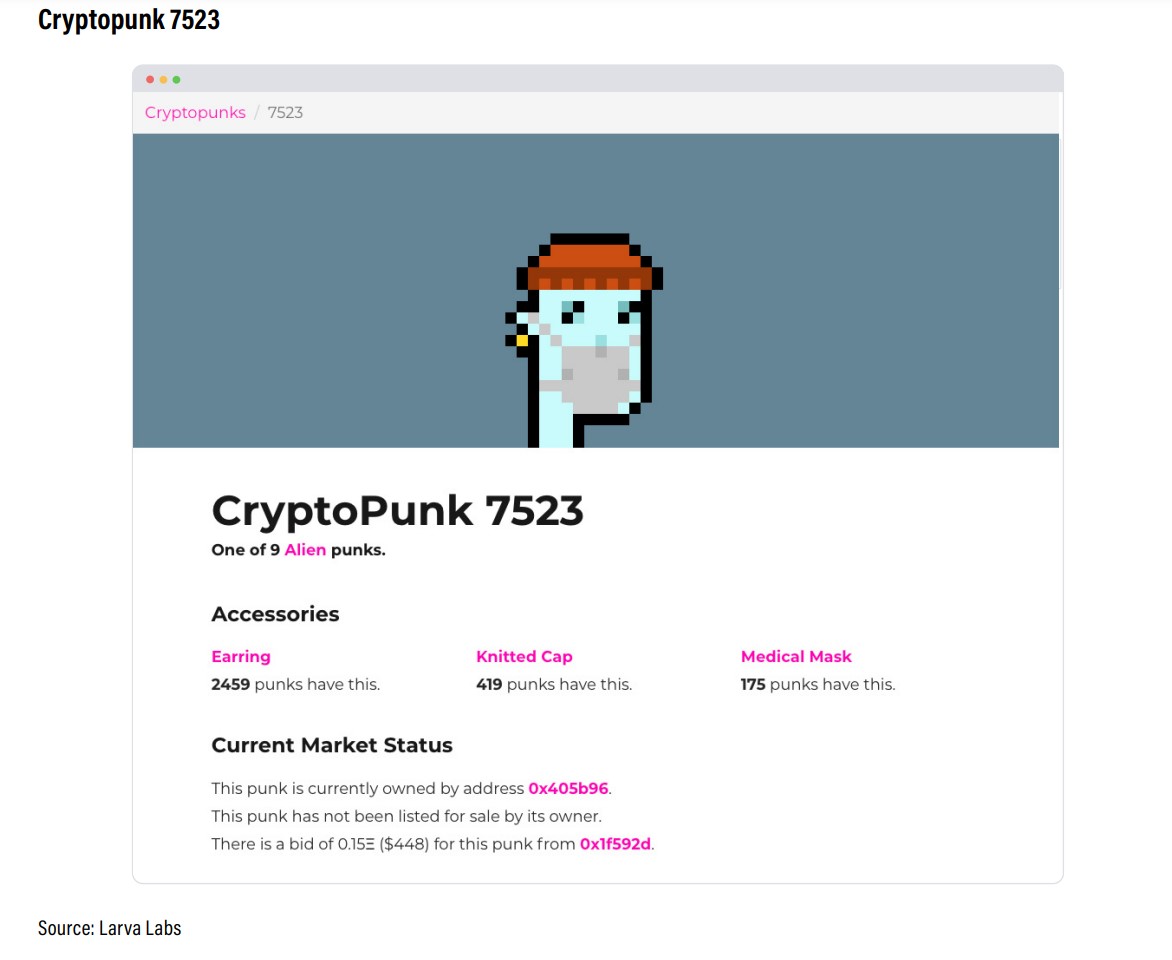

For example, Beeple’s “Crossroads” NFT is a unique political art piece that isn’t part of any one particular NFT collection and is created by Beeple himself. Meanwhile, the alien crypto punk dubbed “#7523”, which sold for nearly $12M, is one of 10,000 unique, digitally created avatars that were all released together.

In any event, these secondary marketplaces are ripe with all sorts of NFTs that appeal to individuals of different backgrounds and with varying tastes, as we list below.

Please note that we do not endorse any single platform or marketplace, as well as the act of buying, minting, or engaging with NFTs. The platforms listed below are for illustrative purposes, and we strongly urge individuals to carry out their own thorough research.

OpenSea (https://opensea.io)

An Ethereum-focused NFT marketplace where users can buy, sell, and trade image-based NFTs, music NFTs, video NFTs, audio NFTs, and ENS domains. NFTs listed on OpenSea are either Ethereum ERC-721 or ERC-1155 tokens, which can verify and track ownership of a particular digital and/or physical item.

OpenSea was founded in 2017 after its founders saw the explosive growth and potential of NFTs following the birth of CryptoKitties. As of September 2021, OpenSea has more than 300K users, 1M collections, 34M NFTs, and more than $4B in volume traded.

In 2Q2021, OpenSea raised $100 million in a Series B round led by Andreessen Horowitz at a $1.5B valuation.

Nifty Gateway (https://niftygateway.com/about)

Nifty Gateway is a NFT auction that was acquired by crypto exchange Gemini in November 2019. The platform facilitates NFT purchases for many of the most popular crypto games and applications, such as OpenSea, Gods Unchained, and CryptoKitties.

Nifty Gateway allows users to purchase NFTs with their credit card. In addition to teaming up with artists and brands to create limited edition NFTs, also known as Nifties, that are exclusively for sale on their platform, the platform aims to drop new, limited collections roughly every 3 weeks.

After the initial drop for a collection closes or sells out, users can purchase nifties from that collection in the marketplace.

According to their website, “Nifty Gateway lets you display your Nifties, as well as withdraw them to external wallets, or deposit Nifties from external wallets into your collection.”

Much like OpenSea, all NFTs listed on Nifty reside on the Ethereum blockchain.

Rarible (https://rarible.com/rari)

Rarible claims to be the first “community-owned NFT marketplace” and uses its RARI token, a governance token, to power its community-run platform model.

Like others, it is a NFT platform at its core where anyone can buy, sell, trade, and mint Ethereum-based NFTs.

Since its inception, Rarible has continued to place an increasingly greater emphasis on becoming a Decentralized Autonomous Organization (DAO) where users will make key decisions for the platform.

Mintable (https://mintable.app/)

Mintable is a NFT marketplace where users can create, buy, and sell ERC-721 NFTs, which also include game items, domain names, and templates.

Like its peers, Mintable allows users to manage their digital assets and browse other digital items that are listed on

their marketplace. But unlike other Ethereum NFT marketplaces, Mintable removes “gas” fees associated with minting NFTs by absorbing the cost.

Mintable’s “Sellers University” tool can help users get quickly up to speed on how to create, mint, and list their NFTs on their platform.

Solanart (https://solanart.io/)

Solanart is a NFT marketplace that allows users to buy and sell select Solana-based NFT collections. While users benefit from Solana’s fast and low-cost transactions, the platform currently only supports a limited number of preexisting art and video game NFT collections.

Per their website, “Solanart aims to help promote artists and creators by providing them with a trustless marketplace to share their art.“ On August 30, 2021, Solanart tweeted, “Almost two months ago, we launched Solanart, the first NFT marketplace on Solana. Today, we broke 1,000,000 SOL in volume, and as SOL breaks $100, that's over $100,000,000 traded on our platform.”

The most popular NFT collections listed on Solanart include Degen Ape Academy, Aurory, and SolPunks.

Singular (https://singular.rmrk.app/)

Singular is the first NFT marketplace on the Kusama blockchain and was created by RMRK, an advanced NFT protocol project that is focused on supporting innovative NFTs.

In June 2021, RMRK announced that it raised $6M to build the standard cross-chain NFT infrastructure for the Polkadot and Kusama ecosystem. Because of Kusama’s architecture, users only have to pay a few cents to mint a NFT.

Users can also mint upgradable NFTs, or where an NFT can owns another NFT (e.g., an in-game character owns an in-game item), and smart NFTs with multi-resource capability that enable them to be presented in more than one file format (a PDF, JPEG, MP3, etc.).

Because all mints on Singular can be teleported to any Substrate-based chain in the Kusama and Polkadot ecosystems, they’re also interoperable across various different networks on Kusama or Polkadot. Aside from minting, users can also buy and sell NFTs on the Singular platform.

Making A Purchase

Should you seek to participate in the initial public sale of a NFT collection, or what is also known as a “mint,” you will likely need to mint through the collection’s own website. For details on how, where, and when to mint, it's best to reference details on the collection’s website and/or join one of their social media/messaging platforms (Twitter, Telegram, Discord, etc.) to learn more.

On the other hand, if you have already found a NFT on a secondary marketplace that has piqued your interest, you will need to make the purchase from the website of the marketplace where it is listed. Regardless, you will be required to fund a digital wallet with the cryptocurrency that is native to the blockchain that the NFT exists on, be that ETH, SOL, or KSM.

Users who are looking to purchase Ethereum-based NFTs can fund a number of different wallets to make their purchase, though the most popular amongst users is MetaMask.

For Solana-based NFTs, purchases can typically be made using a Phantom wallet. With respect to Kusama and Polkadot-based NFTs, a Polkadot.js wallet can be funded. Much like any other kind of digital wallet, users should do their own research as to which wallet is best for them, follow best security practices, and be on the lookout for scams.

Interacting With Your NFT

After a NFT has been bought and paid for, the token will appear in the same wallet that was used to purchase the NFT. Depending on the legal rights that come with the purchase, there are a number of different things that can be done with the NFT besides it sitting in

your wallet or relisting it.

If the NFT in question represents ownership of a digital image, video, or audio, its owner may have distribution rights and can use the corresponding image, video, or audio file for commercial purposes.

However, because most NFTs do not include distribution rights, they can be brought to life in the physical world. Some may decide to print out their NFTon a poster board, clothing, or other physical goods. Not only that, digital picture frames

can also be purchased to have NFTs on display, much like a normal picture frame would display traditional art pieces.

Qonos is one of many purpose-built digital display picture frames for NFT art and collectibles. Per the company’s website, their display is “the world’s first custom digital frame for NFT art and collectibles.” Their displays include motion and proximity sensors, stereo output speakers and are customizable for images, GIFs, video, and full webpages.

To some, the idea of putting digital art on display instead of physical art is novel and met with skepticism. However, NFT art galleries are on the rise and are becoming a popular part of modern culture. In July, L.A. Art Show had its first NFT art display in partnership with NFT marketplace SuperRare and L.A.-based media and design firm StandardVision.58 Owners of the digital NFT may ultimately decide to bring their NFT to life so they can appreciate it both in the physical and digital world.

NFTs can also be experienced in the metaverse, or what is an immersive digital environment where people interact as avatars. If the NFT purchased is part of a video game or specific web application, it can then be used within that respective ecosystem.

But more often than not, NFTs in the form of images or videos are shared on social media platforms and are used as profile pictures and avatars. For instance, in August 2021, NBAsuperstar Stephen Curry purchased a Bored Ape Yacht Club NFT and promptly set it as his profile picture on Twitter.

NFTs can also be put on display as part of a digital collection. As noted earlier, Lazy.com is a digital art gallery founded by Mark Cuban, where anyone can create a Lazy landing page to display their NFTs on the Internet.

Unlike posting on social media or sharing directly with friends, Lazy offers its users a go-to centralized landing page where a user’s Ethereum NFT collection can be displayed on a single web page. Users can add, remove, and shift around NFTs on their Lazy page to their liking.

Similarly, the Nametag extension is a web browser extension tool that allows its users to view NFT collections of other Nametag users by simply visiting a Twitter profile page. Like Lazy, this allows easy access to NFT collections and allows for owners to share their NFTs with the rest of the world.

Alternatively, if putting NFTs on display through traditional social media platforms doesn’t spark an owner’s interest, they can also join NFT social media platform Showtime. The platform enables both creators and collectors to showcase their digital art for free, in addition to allowing users to follow creators and collectors, browse personalized news feeds, discover trending NFTs, and engage with artists directly.

In May 2021, the platform raised nearly $8M in a funding round that was led by crypto investment firm Paradigm and DJ 3LAU.

Conclusion

Society is moving towards a digital world where expressions, creativity, moments, and entertainment are becoming digitized and memorialized on blockchain platforms.

While NFTs started out as a niche sector, their evolution has caught the attention and introduced many new individuals to the world of blockchain and cryptocurrencies. We have seen impressive growth in the past few years and even the first half of this year alone, and it appears we have only scratched the surface.

In the current ecosystem, NFTs and the storage of their metadata may come with risks that affect their sustainability, but as awareness grows, we believe that NFTs will successfully expand beyond art, sports, music, and collectibles. It will transform the way creators offer their goods and services to buyers, or even simply in the way individuals interact with others on the Internet.

With the younger and more tech-savvy generation moving offline activities online, we believe NFTs will disrupt and transform the way we experience culture, trends, and interactions in our everyday lives.

Thank you!