New York, NY – In a long-awaited revelation for the crypto prediction market community, Polymarket's Chief Marketing Officer Matthew Modabber has officially confirmed the platform's plans to launch its native POLY token and distribute a portion through an airdrop to users.

However, the rollout won't happen immediately: Polymarket is prioritizing its high-stakes return to the U.S. market after a three-year regulatory hiatus.

However, the rollout won't happen immediately: Polymarket is prioritizing its high-stakes return to the U.S. market after a three-year regulatory hiatus.

Modabber's announcement came during an appearance on the Degenz Live podcast, where he addressed months of speculation surrounding the token. "There will be a token, there will be an airdrop," Modabber stated emphatically.

He emphasized the company's deliberate approach, noting that Polymarket could have rushed the launch but chose instead to focus on building something enduring. "We could have launched a token whenever we wanted, and it's just how thorough we want to be about it.

e want it to be a token with true utility, longevity, and to be around forever, right? That's what we expect from ourselves, and that's what I think everyone in the space expects from us."

This confirmation arrives at a pivotal moment for Polymarket, which has surged in popularity amid booming interest in event-based betting.

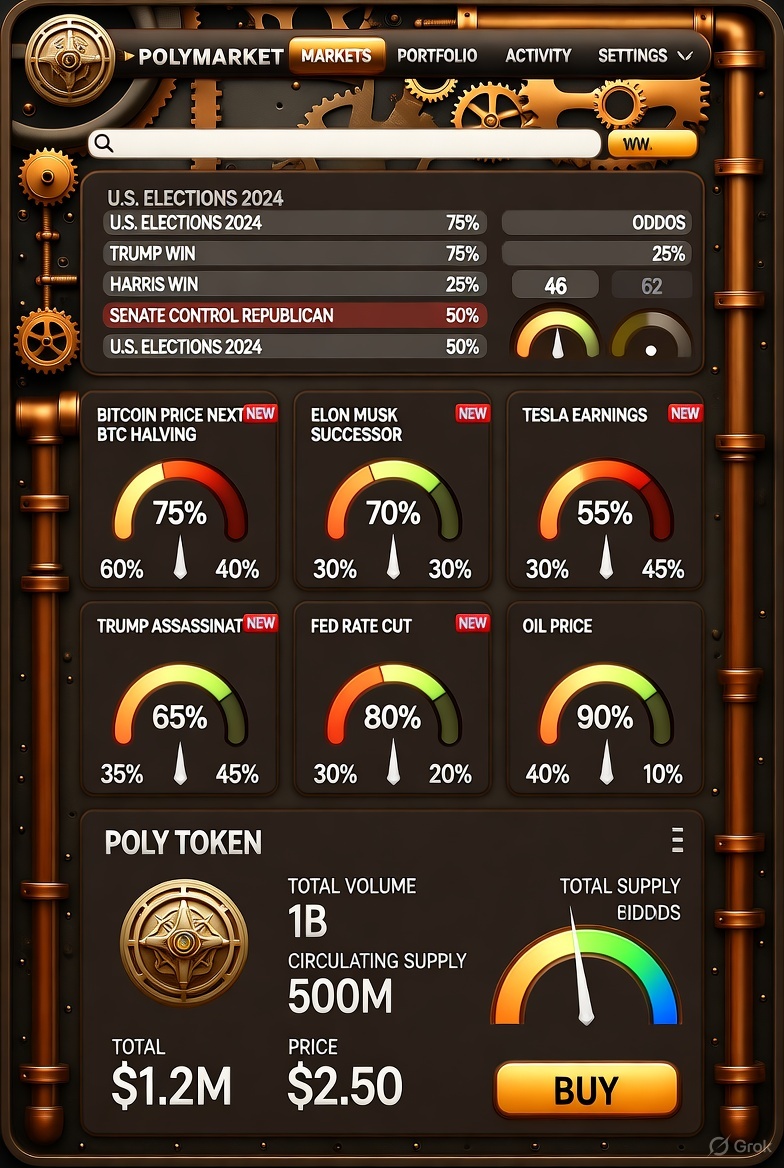

The platform now boasts over 1.35 million active traders and recently logged $1.4 billion in monthly trading volume, underscoring its position as a leader in decentralized prediction markets. Yet, the token's debut is tied directly to the company's U.S. relaunch, a strategic move that could unlock even greater growth.

A Triumphant Return to the U.S.

Polymarket's path back to America has been anything but smooth. In 2022, the U.S. Commodity Futures Trading Commission (CFTC) effectively banned the platform from serving American users, citing concerns over unregulated derivatives trading. This forced Polymarket to block U.S. IP addresses and pivot to international markets, where it thrived on events like the 2024 U.S. presidential election.

Polymarket's path back to America has been anything but smooth. In 2022, the U.S. Commodity Futures Trading Commission (CFTC) effectively banned the platform from serving American users, citing concerns over unregulated derivatives trading. This forced Polymarket to block U.S. IP addresses and pivot to international markets, where it thrived on events like the 2024 U.S. presidential election.

Fast-forward to July 2025: Polymarket acquired QCX, a CFTC-licensed derivatives exchange, for $112 million, paving the way for a compliant relaunch. In early September, founder and CEO Shayne Coplan announced that the platform had received a "green light" from regulators via a no-action letter to QCX, allowing Polymarket to resume operations stateside. This regulatory clearance marks a significant milestone, enabling the platform to tap into the world's largest economy and its deep pool of institutional and retail bettors.

"Why rush the token release when we need to prioritize the American application?" Modabber explained on the podcast. "After deploying activities in the U.S., we will focus on the coin to ensure everything is done properly." With the U.S. app rollout now underway, Polymarket is laser-focused on stability and compliance before shifting gears to tokenization. This sequencing reflects a maturing crypto industry, where regulatory hurdles are increasingly navigated rather than avoided.

The POLY Token: Utility Over Hype

The forthcoming POLY token is poised to integrate deeply into Polymarket's ecosystem, going beyond mere speculation. While details on exact utilities remain under wraps, Modabber hinted at features that could enhance governance, staking for liquidity provision, or rewards for accurate predictions - elements designed to foster long-term engagement.

The forthcoming POLY token is poised to integrate deeply into Polymarket's ecosystem, going beyond mere speculation. While details on exact utilities remain under wraps, Modabber hinted at features that could enhance governance, staking for liquidity provision, or rewards for accurate predictions - elements designed to foster long-term engagement.

The CMO drew inspiration from recent successes like Hyperliquid's token launch, praising its approach to creating sustainable value.

The airdrop, in particular, has ignited fervor among users. Speculation runs high that allocations will be based on trading volume or activity metrics, potentially creating a multi-tiered distribution to reward loyal participants without favoring whales disproportionately. "I think the distribution will be multi-tiered or based on a logarithmic curve," Modabber suggested, acknowledging the platform's power users who drive the bulk of liquidity. This could make the POLY drop one of the largest in crypto history, given Polymarket's user base and trading history.

Adding fuel to the fire, Polymarket is reportedly in talks for a funding round that could value the company at up to $15 billion, backed by heavyweights like Intercontinental Exchange (ICE), which recently committed $2 billion. Earlier reports from The Information even mentioned token warrants for investors in a July round, further signaling POLY's inevitability.

Also read:

Also read:

- Think Like a Whale: The Crypto Mindset for Unshakeable Success

- Investigation: The October 11 Crypto Crash - What Really Happened

- Chinese Woman Convicted in History’s Largest Cryptocurrency Fraud

Implications for Prediction Markets and Beyond

Polymarket's dual milestones - the U.S. relaunch and POLY token - signal a broader evolution in prediction markets. Once niche experiments in DeFi, these platforms are now blending crypto's borderless innovation with traditional finance's regulatory rigor. Rivals like Kalshi have posted even higher volumes ($2.9 billion last month), but Polymarket's crypto-native edge positions it uniquely for tokenized growth.

For users, the airdrop represents a tangible reward for years of "farming" points through trades on everything from elections to sports outcomes. But challenges loom: U.S. regulators still grapple with classifying prediction markets as derivatives or gambling, which could impact POLY's rollout.

For users, the airdrop represents a tangible reward for years of "farming" points through trades on everything from elections to sports outcomes. But challenges loom: U.S. regulators still grapple with classifying prediction markets as derivatives or gambling, which could impact POLY's rollout.

Meanwhile, airdrop hunters - sophisticated bots and multi-account schemers - are already adapting tactics to snag shares, prompting Polymarket to refine its eligibility criteria.

As Modabber put it, this isn't about a quick pump-and-dump; it's about building infrastructure that endures. With Wall Street's backing and regulatory doors cracking open, Polymarket's next chapter could redefine how we bet on the future - literally.

About the Author: This article synthesizes insights from recent podcast appearances, regulatory filings, and industry reports to chart Polymarket's trajectory in the prediction market space.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).