In a move that's equal parts audacious and affirming, Intercontinental Exchange (ICE) - the powerhouse behind the New York Stock Exchange (NYSE) - has thrown its weight behind the wild world of prediction markets. The company announced plans to invest up to $2 billion in Polymarket, valuing the crypto-fueled betting platform at a whopping $8 billion.

This isn't just a cash infusion; it's a resounding vote of confidence from one of Wall Street's steadiest hands in a sector that's long danced on the edge of gambling and genius.

This isn't just a cash infusion; it's a resounding vote of confidence from one of Wall Street's steadiest hands in a sector that's long danced on the edge of gambling and genius.

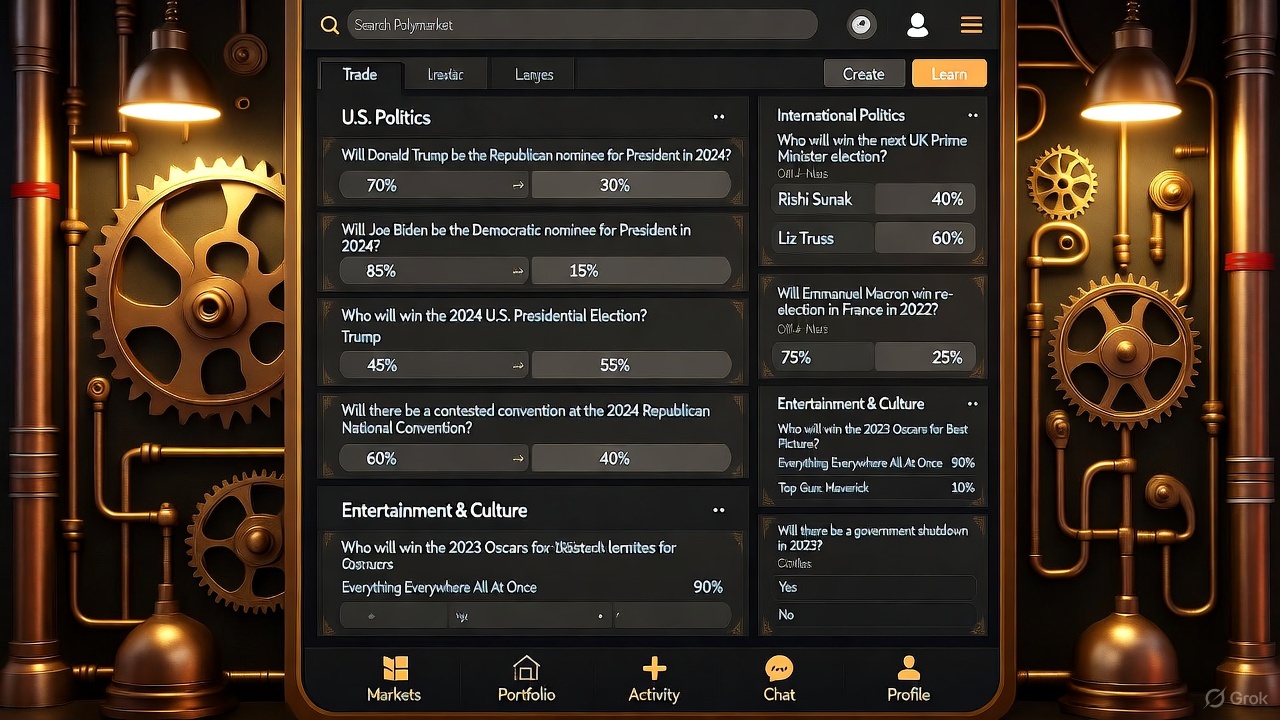

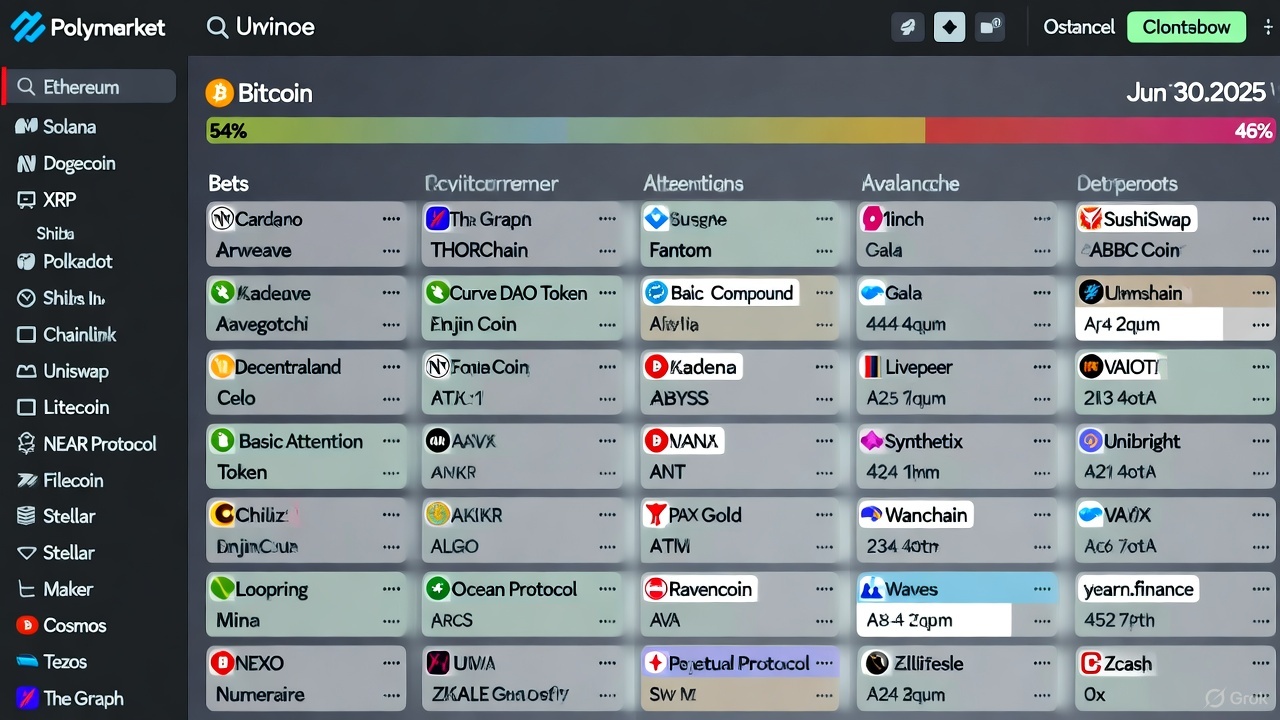

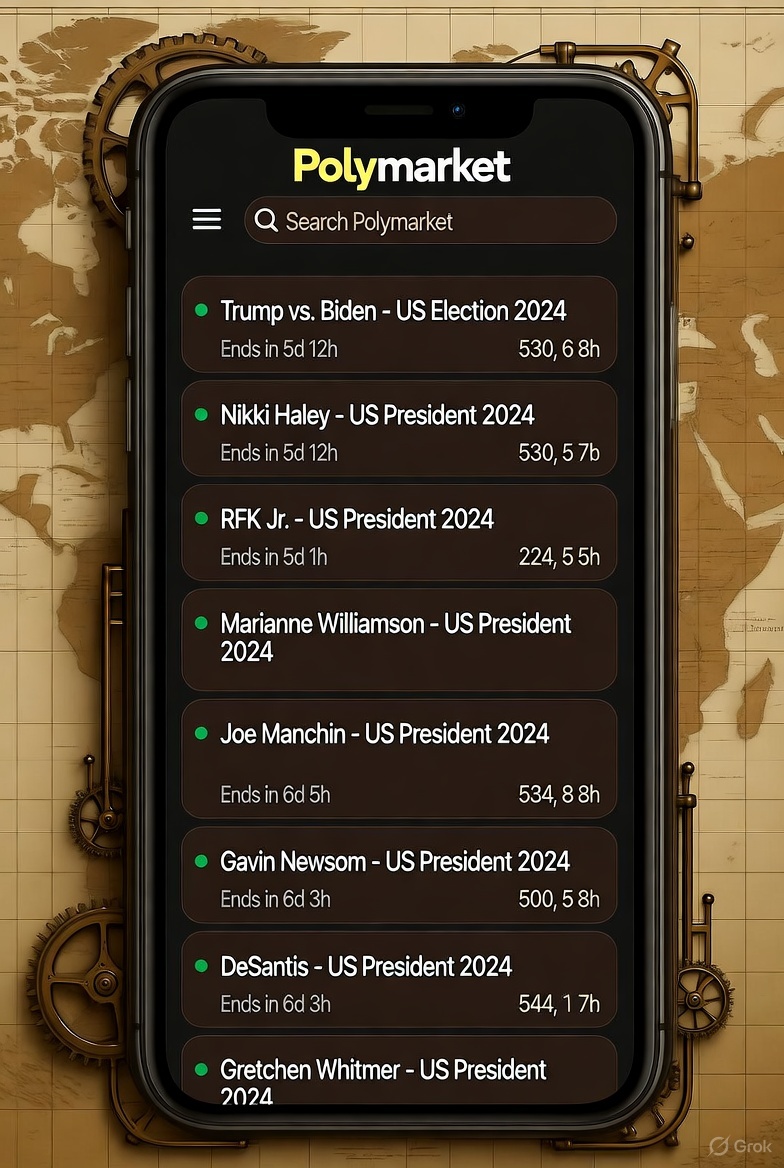

Founded in 2020 by Shayne Coplan, Polymarket lets users wager "yes" or "no" on just about anything: election outcomes, sports upsets, celebrity scandals, or even the next government shutdown. More than a thrill ride for punters, it's become a go-to oracle for real-time event probabilities, blending blockchain transparency with crowd-sourced foresight. Investors, from hedge funds to everyday traders, flock here for edges that traditional polls or bookies can't match - think dynamic odds on political horse races or cultural curveballs.

A Proven Prophet: Polymarket's Election Windfall

Polymarket's star turn came during the November 2024 U.S. presidential election, where trading volume exploded past $2 billion. The platform's odds famously nailed Donald Trump's victory when mainstream forecasts waffled, earning shoutouts from outlets like CNBC and The Wall Street Journal. That buzz propelled it into the mainstream, with daily volumes now hovering between $40 million and $80 million - even as post-election hype cools. Backed by heavyweights like Peter Thiel's Founders Fund, Polymarket isn't just surviving the crypto winter; it's thriving on the predictive power of the masses.

Polymarket's star turn came during the November 2024 U.S. presidential election, where trading volume exploded past $2 billion. The platform's odds famously nailed Donald Trump's victory when mainstream forecasts waffled, earning shoutouts from outlets like CNBC and The Wall Street Journal. That buzz propelled it into the mainstream, with daily volumes now hovering between $40 million and $80 million - even as post-election hype cools. Backed by heavyweights like Peter Thiel's Founders Fund, Polymarket isn't just surviving the crypto winter; it's thriving on the predictive power of the masses.

ICE's bet fits like a glove for the $90 billion behemoth. As part of the deal, ICE will distribute Polymarket's event data to institutional clients worldwide, turning crowd bets into premium sentiment indicators for everything from rates to geopolitics. "There are opportunities across markets which ICE together with Polymarket can uniquely serve," said ICE CEO Jeffrey Sprecher. It's a savvy pivot: Monetize the odds, not just the trades, and collaborate on tokenization plays that could redefine financial plumbing.

Rough Road to Respectability: From Ban to Boom

Polymarket's path to this payday has been anything but smooth. In 2022, it settled with the Commodity Futures Trading Commission (CFTC), paying a $1.4 million fine and banning U.S. users over unlicensed derivatives trading. Labeled an "unlicensed offshore gambling parlor" in some corners, it faced bans in multiple countries. Coplan even had his phone seized by the FBI right after Trump's 2024 win - a stark reminder of the regulatory tightrope.

Polymarket's path to this payday has been anything but smooth. In 2022, it settled with the Commodity Futures Trading Commission (CFTC), paying a $1.4 million fine and banning U.S. users over unlicensed derivatives trading. Labeled an "unlicensed offshore gambling parlor" in some corners, it faced bans in multiple countries. Coplan even had his phone seized by the FBI right after Trump's 2024 win - a stark reminder of the regulatory tightrope.

Enter the Trump administration's crypto-friendly thaw. By mid-July, Coplan triumphantly tweeted that CFTC and DOJ probes had wrapped up: "Justice has prevailed." The pivot accelerated in August when Donald Trump Jr. joined Polymarket's advisory board, with his firm 1789 Capital piling in as an investor. To seal its U.S. comeback, Polymarket snapped up QCEX - a CFTC-licensed exchange and clearinghouse - for $112 million, paving a compliant runway for relaunch. A CFTC no-action letter in September greenlit the return, though a government shutdown has snagged final filings.

ICE's involvement adds institutional gravitas, potentially shielding Polymarket from future flak. Shares of ICE ticked up over 1% on the news, underscoring market buy-in.

The Thrill of the Game: Prediction Markets vs. the Old Guard

This coup arrives as prediction markets explode in popularity, challenging everything from Vegas odds to Vegas itself. Rival Kalshi, fresh off a $2 billion valuation, shattered records with NFL-related contracts - proving fans crave probabilistic plays beyond straight bets.

This coup arrives as prediction markets explode in popularity, challenging everything from Vegas odds to Vegas itself. Rival Kalshi, fresh off a $2 billion valuation, shattered records with NFL-related contracts - proving fans crave probabilistic plays beyond straight bets.

But the honeymoon's not without drama: Gaming giants and state regulators howl that these platforms encroach on state-regulated sports wagering, blurring lines between info markets and outright gambling. "Prediction markets aren't sportsbooks," they argue, fearing a federal overreach on a trillion-dollar patchwork of state laws.

ICE, ever the trendsetter, has a track record of leaping into financial frontiers - from launching the NYSE to pioneering mortgage data. Sprecher's personal ties to the Trump orbit (he's married to Kelly Loeffler, Trump's SBA administrator and former senator) only sweeten the irony. It's a reminder: In finance, politics and profit often bet on the same horse.

Also read:

- Netflix's "Boot" Defies Pentagon Backlash: 9.4 Million Views in Week Two, Nearly Doubling Premiere Numbers

- Samantha the Afghan Hound: The Furry Fashion Icon Stealing Hearts and Millions of Likes

- Apple’s Name Game: The Curious Case of Sam Sung

Betting Big on the Future

Polymarket's $8 billion tag isn't hype - it's a marker of prediction markets' maturation. By fusing crypto's speed with Wall Street's muscle, ICE and Polymarket could mainstream event contracts, turning "what if" into tradable truth. For Coplan, it's validation after years in the regulatory crosshairs: "This partnership marks a major step in bringing prediction markets into the financial mainstream."

As volumes climb and competitors scramble, one thing's clear: The house always wins when the odds are this good. In a world of uncertainty, Polymarket isn't just a bet - it's the new bookmaker for reality itself.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).