In a move that could reshape its economic model, the Hyper Foundation has proposed a validator vote to formally recognize 37 million HYPE tokens - valued at nearly $1 billion at current prices - as permanently burned. These tokens reside in the Assistance Fund, a smart contract address without a private key, making them inaccessible without a hard fork.

The initiative, detailed in a December 17, 2025, announcement, aims to enhance supply transparency and introduce deflationary pressure, with all future fee-based HYPE buybacks also destined for burning.

The initiative, detailed in a December 17, 2025, announcement, aims to enhance supply transparency and introduce deflationary pressure, with all future fee-based HYPE buybacks also destined for burning.

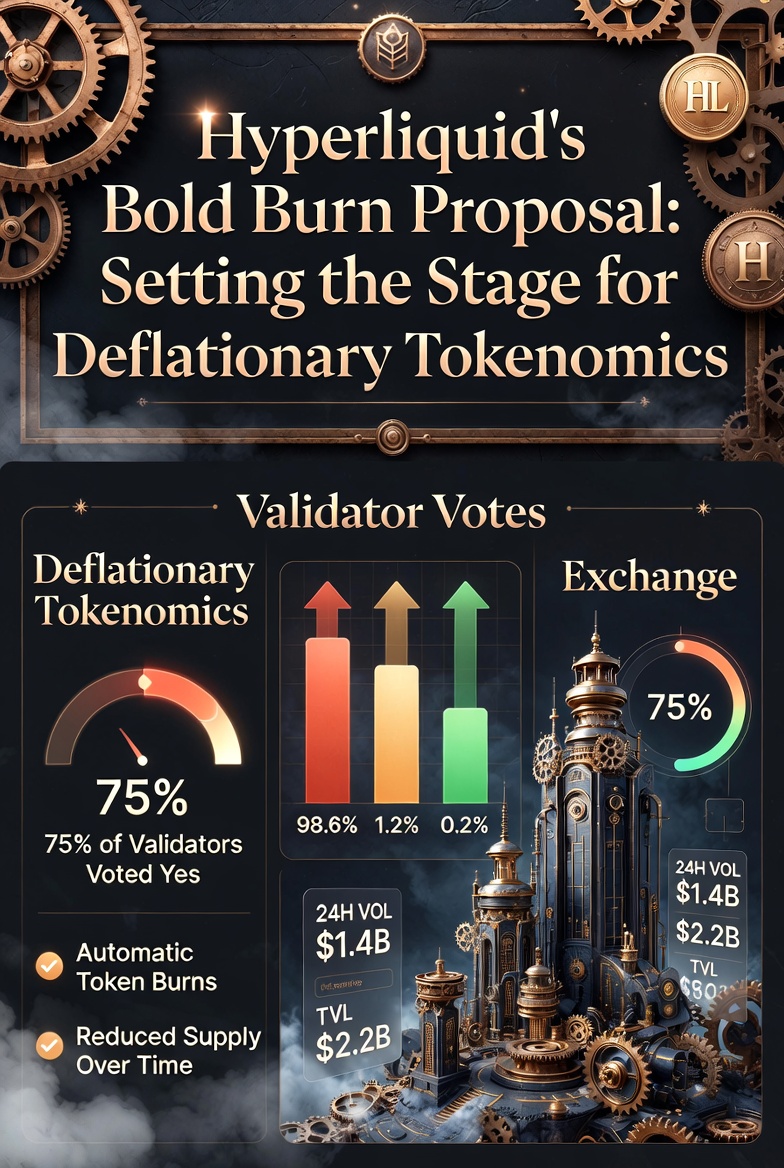

As validators and delegators weigh in ahead of the December 24 snapshot, early signals show strong support, potentially locking in an annual deflation rate of 12–15% - far outpacing competitors like BNB's roughly 4-5%.

This "social burn" bets on market trust: fewer tokens mean less dilution and upward price pressure as trading volumes grow on Hyperliquid, the leading decentralized perpetuals exchange.

The Proposal Details: A "Social Burn" for Irretrievable Tokens

The Assistance Fund automatically converts a portion of Hyperliquid's trading fees into HYPE, accumulating tokens in the system address 0xfefefefefefefefefefefefefefefefefefefefe—a "black hole" similar to Ethereum's zero address, with no controlling private key.

The Assistance Fund automatically converts a portion of Hyperliquid's trading fees into HYPE, accumulating tokens in the system address 0xfefefefefefefefefefefefefefefefefefefefe—a "black hole" similar to Ethereum's zero address, with no controlling private key.

By voting "Yes," validators commit to treating these 37 million HYPE (13% of circulating supply) as burned, establishing binding social consensus against any future protocol upgrade to access them. No on-chain transaction is needed; the vote simply formalizes their permanent removal from total and circulating supply metrics.

Validators signal intent on the governance forum by December 21 at 04:00 UTC, while users can delegate stakes by December 24 at 04:00 UTC for the stake-weighted tally. Community reactions, as seen in X replies, overwhelmingly favor the burn, with sentiments like "Burn it all" dominating discussions.

Deflationary Shift: 12–15% Annual Burn Rate and Comparisons

Post-approval, all HYPE repurchased via trading fees will be burned, creating a deflationary model estimated at 12–15% annually based on current volumes.

Post-approval, all HYPE repurchased via trading fees will be burned, creating a deflationary model estimated at 12–15% annually based on current volumes.

This is triple BNB's deflation rate, which relies on quarterly burns tied to Binance fees. Hyperliquid's L1-native mechanism ensures automated, transparent deflation, potentially boosting HYPE's scarcity amid the platform's $2.5 billion daily volume in perps.

At $27 per token (as of December 20, 2025), the 37 million HYPE represent about $999 million, underscoring the proposal's scale. This aligns with Hyperliquid's community-driven ethos, where validators (holding stakes) play a pivotal role in governance.

Potential Impacts: Boosting Trust and Price Dynamics

By committing to burns, Hyperliquid signals long-term confidence, reducing sell pressure from unlocked tokens and enhancing value accrual for holders. Critics argue it addresses dilution concerns ahead of potential unlocks, while proponents see it as a catalyst for price appreciation if volumes sustain. Unlike traditional burns requiring transactions, this "social" approach leverages consensus to achieve similar effects without gas costs.

By committing to burns, Hyperliquid signals long-term confidence, reducing sell pressure from unlocked tokens and enhancing value accrual for holders. Critics argue it addresses dilution concerns ahead of potential unlocks, while proponents see it as a catalyst for price appreciation if volumes sustain. Unlike traditional burns requiring transactions, this "social" approach leverages consensus to achieve similar effects without gas costs.

If passed, it could set a precedent for other DeFi projects, emphasizing deflation over emissions. As one analyst noted, "Hyperliquid is betting on hard deflation and market trust: fewer tokens, less dilution, more upward pressure on price with volume growth."

In summary, Hyperliquid's burn proposal represents a strategic pivot toward scarcity-driven economics, with validators holding the key to its fate by December 24. If approved, it could solidify HYPE's position in a competitive landscape, proving that community consensus can drive meaningful tokenomics reform.

Also read:

Also read:

- Grok's Voice Agent API: Leading the Charge in Speech-to-Speech AI with Unmatched Speed and Quality

- Facebook's Link Lockdown: How Meta is Monetizing External Shares and What It Means for Creators

- Tether's PearPass: A Revolutionary Cloud-Free Password Manager for Ultimate Privacy

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).