In a landmark moment for the prediction-market industry, Polymarket has officially been designated as a regulated Designated Contract Market (DCM) by the U.S. Commodity Futures Trading Commission (CFTC). The approval, announced in late November 2025, ends a four-year exile from the world’s largest betting audience and transforms the once-controversial crypto platform into a fully compliant American financial institution.

Back in January 2022, the CFTC hit Polymarket with a $1.4 million penalty for operating an unregistered derivatives platform and effectively banned it from serving U.S. customers. Overnight, American users - who at the time accounted for roughly 40% of trading volume - were geo-blocked.

Back in January 2022, the CFTC hit Polymarket with a $1.4 million penalty for operating an unregistered derivatives platform and effectively banned it from serving U.S. customers. Overnight, American users - who at the time accounted for roughly 40% of trading volume - were geo-blocked.

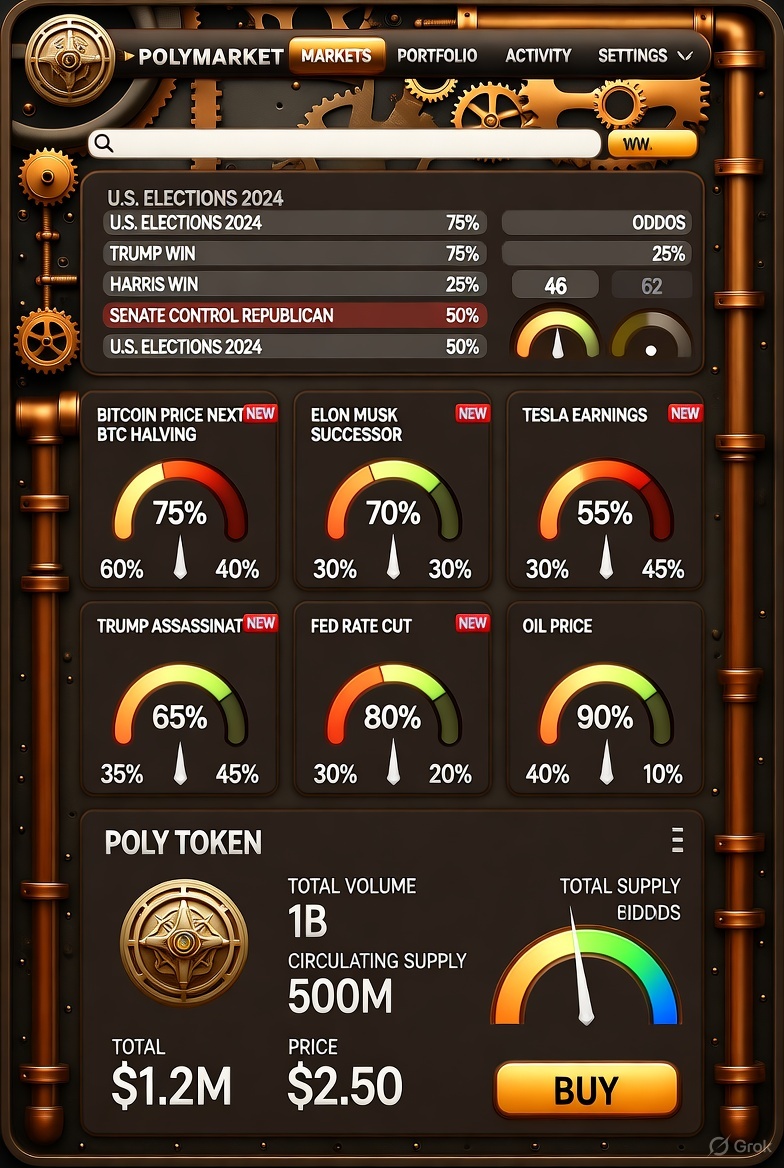

The company relocated its core operations offshore, rebuilt on the Polygon blockchain, and watched its monthly volume explode during the 2024 U.S. presidential election, peaking at more than $3.3 billion in November 2024 alone as traders bet heavily on the Trump-Harris outcome.

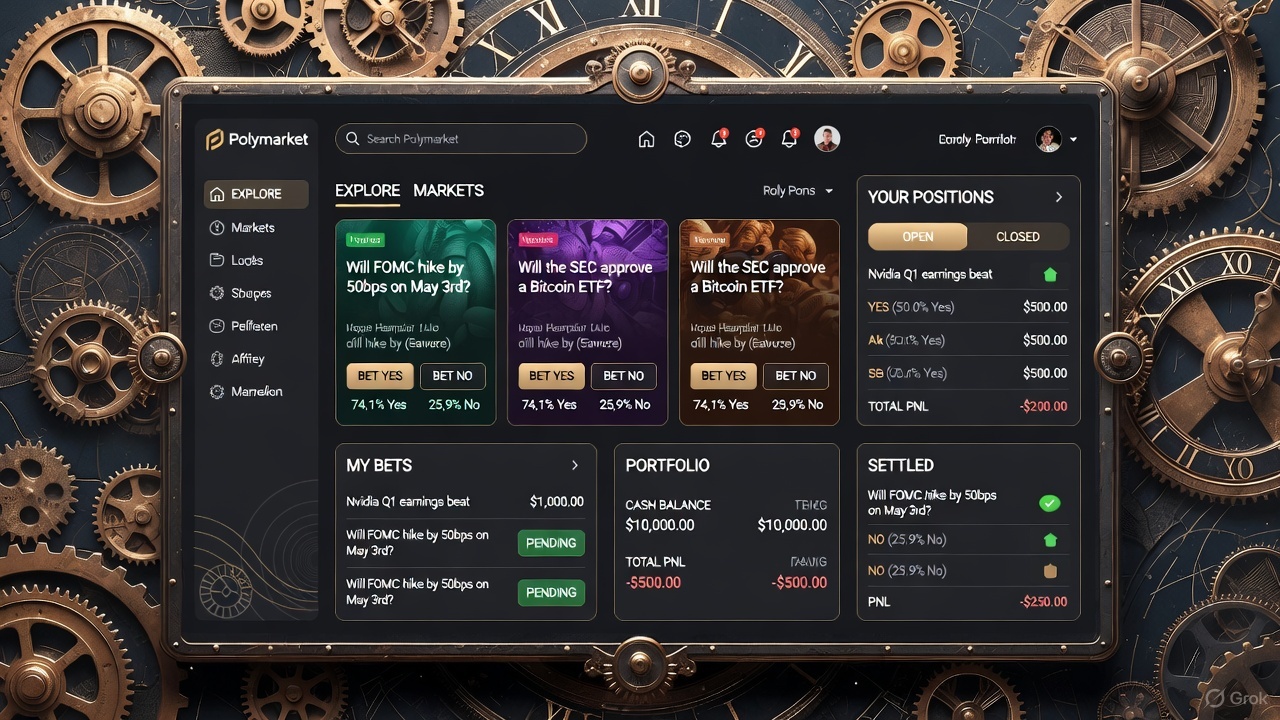

The new license changes everything. Polymarket is no longer classified as an online gambling site (which would have run afoul of the Wire Act and UIGEA) but as a CFTC-supervised derivatives exchange. Users are not placing “bets” but entering into binary event contracts: a contract pays $1 if the specified outcome occurs and $0 if it does not.

This legal sleight-of-hand is the same framework that has allowed regulated exchanges to offer economic indicators, weather derivatives, and even Hollywood stock markets for decades.

Under DCM rules, Polymarket now operates under the same strict oversight as the Chicago Mercantile Exchange or ICE Futures U.S. Every market listing, resolution criterion, and oracle mechanism must be pre-approved by the CFTC. Market manipulation, wash trading, and insider resolution are explicitly prohibited, with real-time surveillance and mandatory audit trails. Full KYC and AML compliance is required for all U.S. users, and the platform must maintain segregated customer funds and submit to regular examinations.

The impact is already visible. On the first day U.S. users were readmitted under the new regime, daily active addresses from the United States jumped 380%, pushing total open interest past $1 billion within 72 hours.

The impact is already visible. On the first day U.S. users were readmitted under the new regime, daily active addresses from the United States jumped 380%, pushing total open interest past $1 billion within 72 hours.

Liquidity providers who had previously shunned the platform because of regulatory risk are now committing nine-figure capital pools. Trading fees, which dropped to near-zero during the election frenzy, have stabilized at a still-competitive 0.7–1% taker rate.

Perhaps more importantly, the approval sets a clear regulatory playbook for the entire prediction-market sector. Platforms like Kalshi (which won its own CFTC battle to offer election contracts in 2024) and newer entrants now have a proven path to legitimacy. Industry-wide volume across regulated U.S. event-contract platforms is projected to cross $20 billion in 2026, up from less than $500 million in 2023.

Polymarket’s edge has always been its ability to transform memes, rumors, and real-time sentiment into price signals faster and more accurately than traditional polls or media. During the 2024 campaign, its odds consistently outperformed Nate Silver’s forecasts and major polling averages by margins of 5–12 points in swing states.

Polymarket’s edge has always been its ability to transform memes, rumors, and real-time sentiment into price signals faster and more accurately than traditional polls or media. During the 2024 campaign, its odds consistently outperformed Nate Silver’s forecasts and major polling averages by margins of 5–12 points in swing states.

In 2025, markets on everything from Federal Reserve rate decisions to the release date of GTA VI to the discovery of extraterrestrial microbial fossils have become go-to sentiment gauges for traders, journalists, and even policymakers.

With great regulatory power comes great responsibility - and higher operating costs. Compliance overhead is estimated at $15–20 million annually, and the days of anonymous $50,000 whale bets from VPN’d U.S. IP addresses are over. Yet the trade-off appears more than worth it: institutional capital that was previously locked out is flowing in, and the platform’s valuation talks now hover north of $3 billion in the latest funding discussions.

For the average American, the practical result is simple: you can once again legally trade on whether OpenAI ships AGI before 2030, whether Taylor Swift and Travis Kelce will still be dating on Valentine’s Day 2026, or whether humans return to the Moon by 2028 - all on a platform that now carries the same regulatory imprimatur as the New York Stock Exchange.

Also read:

Also read:

- December Crypto Outlook: Will Bitcoin Close Above $100K or Settle for a Quiet Finish?

- Skild Brain: The AI That Keeps Robots Running—Even When They're Falling Apart

- China Declares War on “Negative Emotions” Online

What started as a crypto experiment in 2020 has quietly become one of the most powerful real-time barometers of collective belief on the internet - and, as of this month, one of the few corners of DeFi that can legitimately hang an American flag on its homepage. The house always had the best odds; now it finally has the regulator’s blessing too.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) — the world's first remote work platform with payments in cryptocurrency.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).