Introduction

.jfif)

Among the various platforms emerging in the financial tech space, World Liberty Financial stands out as a beacon for those looking to invest and earn outside the traditional confines of the United States.

This article delves into what World Liberty Financial offers to investors seeking to diversify their portfolios internationally.

What is World Liberty Financial?

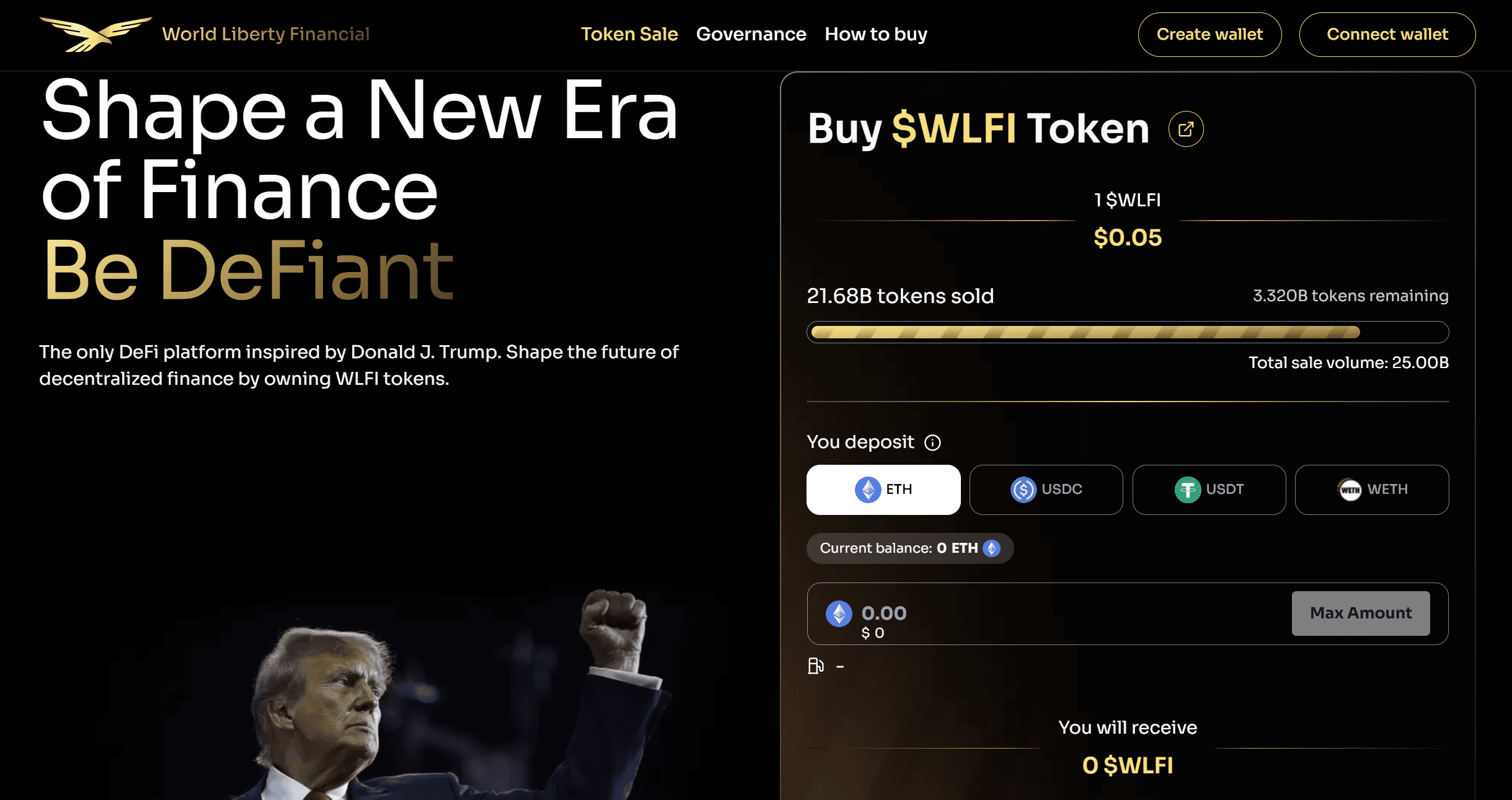

World Liberty Financial (WLFI) is a decentralized finance (DeFi) platform that has garnered attention due to its association with high-profile figures, notably President Donald Trump and his family.

World Liberty Financial (WLFI) is a decentralized finance (DeFi) platform that has garnered attention due to its association with high-profile figures, notably President Donald Trump and his family.

Launched in 2024, WLF aims to democratize access to financial opportunities while fortifying the global status of the US Dollar through blockchain technology.

The platform operates primarily outside the US, focusing on international markets where it can offer its services with less regulatory oversight.

Key Features of World Liberty Financial

- Decentralized Finance (DeFi) Protocol: WLF uses blockchain technology to enable users to lend, borrow, and invest in cryptocurrencies with a focus on US dollar-pegged stablecoins like USDT and USDC. It promises to provide a platform where users can engage in financial activities with reduced involvement of traditional banking systems.

- Token Offering: The WLFI token, which serves not for economic rights but for governance, is non-transferable, meaning it's meant to be held rather than traded. This approach aims to stabilize the platform's ecosystem and focus on long-term growth rather than speculative trading.

- Global Reach: By targeting investors outside the US, WLF has crafted a strategy to bypass stringent American regulations on cryptocurrencies, thereby offering its tokens mainly to non-US investors. This has included significant token sales in markets like Europe, Asia, and Latin America.

- High-Profile Backing: With endorsements from Donald Trump and his sons serving in various ambassadorial roles, WLF has leveraged this association to market itself as a project with substantial political backing, potentially appealing to those who align with Trump's economic policies.

Earning Opportunities with WLF

- Interest on Crypto Holdings: Users can earn interest by depositing their cryptocurrencies into WLF's lending pools. These pools allow others to borrow against the deposited assets, creating a mechanism for passive income.

- Borrowing Against Crypto: For those needing liquidity, WLF provides the option to borrow against their crypto assets, offering flexibility without the need to sell assets in a potentially unfavorable market.

- Governance Participation: Holding WLFI tokens grants voting rights in the governance of the platform, allowing investors to have a say in future developments and protocols, aligning with the ethos of decentralized finance.

Challenges and Considerations

- Regulatory Risks: Operating primarily outside the US, WLF still faces potential regulatory scrutiny in various jurisdictions. The platform's success heavily relies on navigating these international waters adeptly.

- Market Performance: Post-launch, WLFI tokens have seen volatility, with some analyses suggesting that the token sale has underperformed market expectations due to various red flags, including a lack of profit-sharing mechanisms for token holders.

- Reputation and Trust: Given its association with controversial figures, WLF must continually prove its legitimacy and security to gain the trust of a broader investor base beyond those swayed by political endorsement.

Conclusion

World Liberty Financial represents an intriguing case study in how DeFi can cross borders, leveraging political influence to create a platform aimed at international investors.

World Liberty Financial represents an intriguing case study in how DeFi can cross borders, leveraging political influence to create a platform aimed at international investors.

However, like any investment in cryptocurrency, it comes with its set of risks, notably regulatory and market volatility.

For those interested in exploring opportunities beyond the US, WLF offers a unique proposition but with the caveat of needing to perform thorough due diligence given the complexities and controversies surrounding its operation.

If you've made the decision to invest, act quickly because an additional 5% of $WLFI tokens from the total 35 billion supply has been made available for the open sale.

If you've made the decision to invest, act quickly because an additional 5% of $WLFI tokens from the total 35 billion supply has been made available for the open sale.

This move comes in response to overwhelming demand and interest, providing a fresh opportunity for investors to join the platform. However, remember to proceed with caution and consider the inherent risks of cryptocurrency investments.

Read more:

- $TRUMP Inauguration

- Trump Coin Drains Crypto Market Liquidity: Crash Around the Corner?

- Will the Crypto Market Crash After the $TRUMP Coin?

- Is the Crypto Market Dead? $TRUMP Might Help, but Not Anytime Soon

- Crypto Investors Prepare for Trump 2.0: The Rise of $TRUMP and $MELANIA Coins

- The $MELANIA Coin: Who Wants to Be a Millionaire?

- Donald Trump Jr. and Kalshi: Place Your Bets, Gentlemen!

- No News from the US: War Enters Dull Phase, Enemies Identified, Lines Drawn, Artillery Preparation and Reconnaissance Underway

Thank you!