In a troubling escalation for the decentralized prediction market platform, Polymarket has officially acknowledged a security breach that led to unauthorized access and cryptocurrency theft from several user accounts.

The incident, tied to a vulnerability in a third-party authentication provider, has sparked widespread concern among users and highlighted ongoing risks in the crypto ecosystem. As reports of drained wallets and suspicious logins flooded social media, Polymarket confirmed the issue, assuring users that it has been resolved while promising direct outreach to those affected.

The incident, tied to a vulnerability in a third-party authentication provider, has sparked widespread concern among users and highlighted ongoing risks in the crypto ecosystem. As reports of drained wallets and suspicious logins flooded social media, Polymarket confirmed the issue, assuring users that it has been resolved while promising direct outreach to those affected.

The breach primarily impacted users who registered via Magic Labs, a service that enables seamless email-based authentication and generates non-custodial Ethereum wallets. This method, popular among newcomers to cryptocurrency for its user-friendly approach, inadvertently became a weak link. Victims reported unauthorized login attempts, followed by the discovery of zeroed-out balances and prematurely closed bets.

One affected user emphasized that their devices showed no signs of compromise, Google's security scans detected nothing unusual, and two-factor authentication (2FA) was active - yet the hackers bypassed these safeguards.

According to Polymarket, the flaw originated in Magic Labs' system, allowing attackers to exploit email-to-wallet onboarding and drain funds, often in USDC, without triggering internal alarms.

While Polymarket has not disclosed the exact number of victims or the total financial damage, estimates from user reports and industry analysis suggest losses could run into hundreds of thousands of dollars.

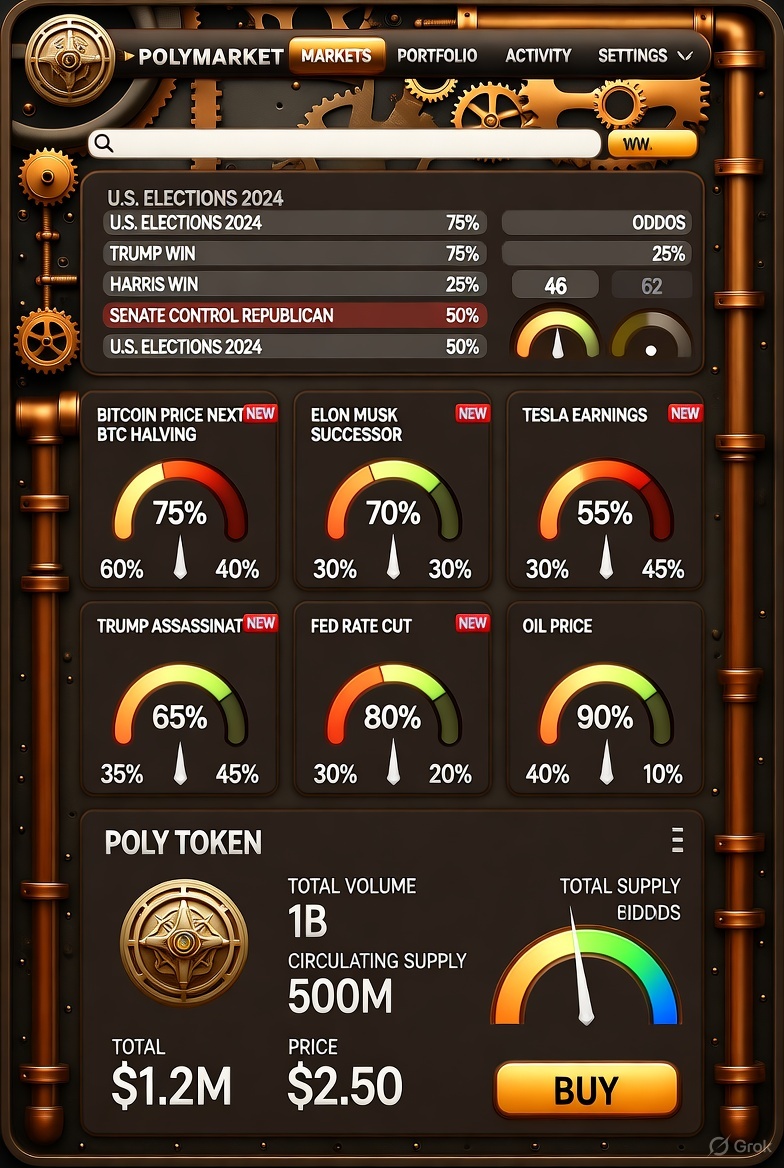

The platform stated that the vulnerability has been patched, eliminating any ongoing risk, but stopped short of announcing compensation plans. In a statement, Polymarket emphasized that the hack did not compromise its core smart contracts or prediction markets, framing it as an isolated third-party issue rather than a systemic failure.

The platform stated that the vulnerability has been patched, eliminating any ongoing risk, but stopped short of announcing compensation plans. In a statement, Polymarket emphasized that the hack did not compromise its core smart contracts or prediction markets, framing it as an isolated third-party issue rather than a systemic failure.

This is not Polymarket's first brush with security lapses. In September 2024, attackers targeted users logged in via Google accounts, using proxy functions to siphon USDC balances from a handful of victims. More recently, in November 2025, a phishing scheme exploited vulnerabilities in the platform's comment sections, leading to losses exceeding $500,000.

Fraudulent links lured users into scams, prompting Polymarket to enhance moderation and warn against clicking suspicious content. These recurring incidents come amid a banner year for crypto hacks, with cybercriminals stealing over $2.7 billion in digital assets in 2025 alone - a new record that underscores the sector's persistent vulnerabilities.

Social media platforms like X (formerly Twitter) and Reddit have been abuzz with user complaints and discussions. Posts detail frantic attempts to secure accounts and recover funds, with some speculating on broader implications for Polymarket's growth. The platform, which has seen explosive popularity - locking in $326 million in total value and consuming 25% of Polygon's gas fees - now faces scrutiny over its reliance on external services. In response to the latest breach, Polymarket is reportedly phasing out Polygon in favor of its own Layer 2 solution, dubbed POLY, to bolster security and efficiency.

The fallout from this breach raises critical questions about the balance between accessibility and security in Web3 applications.

The fallout from this breach raises critical questions about the balance between accessibility and security in Web3 applications.

While services like Magic Labs lower barriers for non-crypto natives, they also introduce potential single points of failure.

Industry experts urge users to adopt self-custodial practices, such as holding private keys independently, to mitigate risks.

As Polymarket navigates this crisis, the incident serves as a stark reminder that in the volatile world of decentralized finance, vigilance is paramount - not just from platforms, but from users themselves. With ongoing investigations and potential regulatory attention, the prediction market's future resilience will be closely watched.

Also read:

Also read:

- China's Unique Path to AI Regulation: Taming the Digital Dragon

- The 2025 Crypto Token Launch Bloodbath: Why 85% Are Sinking Below Launch Prices

- CoinMarketCap's 2026 Crypto Forecast: A Year of Maturity and Sustainable Growth

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).