As we approach the end of 2025, the cryptocurrency landscape is showing signs of evolution beyond the speculative frenzy of past cycles. CoinMarketCap, a leading source for crypto data and insights, has outlined a forward-looking prognosis for 2026 that emphasizes maturity, utility, and disciplined progress.

Drawing from their recent analysis in the "2025 Crypto Wrapped" series, which highlighted the professionalization of prediction markets, this forecast shifts focus from hype-driven innovations to real-world applications and user-centric developments. Below, we explore these key predictions, supplemented with emerging facts and trends from industry reports and analyses.

The Maturing Market: From Blockchain Hype to Application Utility

.jpg) CoinMarketCap predicts that 2026 will mark the end of the era dominated by hype around new Layer 1 (L1) and Layer 2 (L2) blockchains. Instead, value will gravitate toward applications that deliver tangible utility and attract genuine user engagement. This maturation reflects a broader industry shift where speculative launches give way to sustainable ecosystems.

CoinMarketCap predicts that 2026 will mark the end of the era dominated by hype around new Layer 1 (L1) and Layer 2 (L2) blockchains. Instead, value will gravitate toward applications that deliver tangible utility and attract genuine user engagement. This maturation reflects a broader industry shift where speculative launches give way to sustainable ecosystems.

Supporting this view, recent reports indicate a decline in the proliferation of new L1 blockchains, with many struggling to maintain developer activity and user retention. For instance, Galaxy Research notes that while 2025 saw continued institutionalization, 2026 is expected to be chaotic for underperforming chains, with only those building real products thriving.

Similarly, a16z Crypto highlights excitement around "fat applications" over "fat protocols," suggesting that user-friendly apps will outpace infrastructure hype in driving adoption. This trend is already evident in 2025 data, where ecosystems like Ethereum and Solana have consolidated dominance, leaving newer entrants lagging in total value locked (TVL) and transaction volumes.

The Fate of New Blockchains: User Retention Challenges Ahead

Most emerging blockchains will fail to build lasting ecosystems in 2026, leading to underperformance in their native tokens, according to CoinMarketCap. Without strong user bases and practical use cases, these projects risk fading into obscurity.

Industry forecasts align with this caution. Bitwise Investments predicts that Bitcoin and established networks will break traditional cycles and achieve new highs, while lesser-known L1s and L2s may not keep pace due to fragmentation and competition.

A report from Kaiko Research emphasizes that regulation and stablecoin liquidity will shape market structure in 2026, disadvantaging chains without robust partnerships or compliance frameworks. For example, in 2025, over 70% of new L2 launches saw less than 10% user retention after six months, per on-chain analytics, underscoring the need for genuine utility over marketing buzz.

Prediction Platforms: The Dominant Narrative of 2026

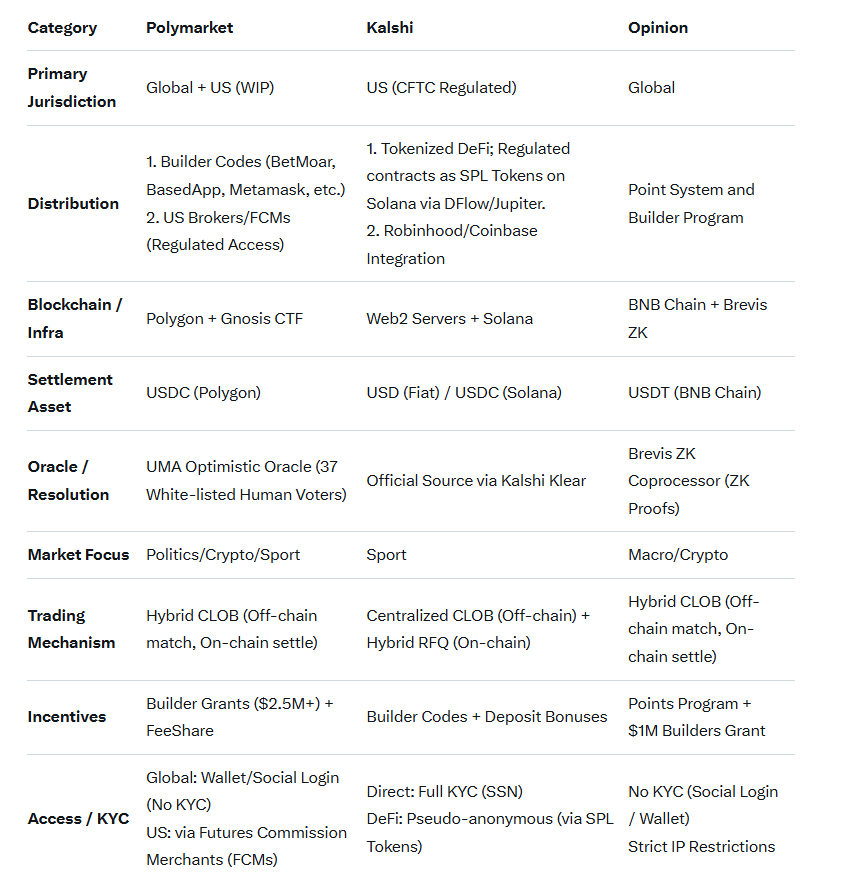

Betting and prediction markets are poised to become the defining narrative of 2026, with success hinging on superior partnerships and audience reach. CoinMarketCap's analysis in their 2025 Wrapped post spotlights this sector's professionalization, comparing leading platforms like Polymarket, Kalshi, and Opinion.

To illustrate the competitive landscape, here's a summarized comparison table based on CoinMarketCap's insights:

This table underscores how each platform adopts distinct strategies—Polymarket's global builder ecosystem, Kalshi's regulatory focus, and Opinion's crypto-native incentives — to capture market share. Looking ahead, Coinbase Institutional forecasts broadened volumes in prediction markets for 2026, driven by U.S. tax changes favoring derivative-anchored platforms. Forbes echoes this, predicting regulatory clarity will boost adoption, with platforms like these leading the "financialization of truth."

DeFi's Evolution: From Speculation to Profit-Sharing

Decentralized Finance (DeFi) is expected to transition from pure speculation to mechanisms that deliver real earnings, with protocols sharing revenues with token holders and conducting buybacks.

Decentralized Finance (DeFi) is expected to transition from pure speculation to mechanisms that deliver real earnings, with protocols sharing revenues with token holders and conducting buybacks.

This aligns with ongoing trends where DeFi protocols are incorporating revenue-sharing models. Galaxy Research anticipates low on-chain borrow/lend rates in 2026 due to declining off-chain rates, encouraging sustainable yield generation over hype.

CoinDesk reports that leaders like Maple Finance predict on-chain markets swelling to trillions, with stablecoin payments hitting $50 trillion, fueled by real-business utility. In 2025, protocols such as Aave and Compound began token buybacks, setting a precedent for 2026's focus on holder value.

Steady Growth in Real-World Assets (RWA)

The RWA sector will expand gradually in 2026, with tokenized assets gaining real demand but avoiding a speculative boom, per CoinMarketCap.

Facts support this measured optimism: The tokenized RWA market surpassed $36 billion (excluding stablecoins) by late 2025, with Grayscale forecasting up to 1,000x growth by 2030. The Canton Network highlights fragmentation as a challenge but notes increasing institutional interest. Fireblocks predicts more RWA tokenization in pro-crypto regions, with 76% of companies planning allocations in 2026.

Applications Trump Blockchains: UX as the Key Differentiator

In 2026, applications will overshadow underlying blockchains, with user interface (UI) quality and convenience becoming critical. L2 solutions will specialize for specific products.

This is backed by trends toward modular ecosystems. Margex identifies Bitcoin L2s and restaking projects as top watches for 2026, emphasizing specialized apps. YouHodler notes DeFi's shift to structured activity, prioritizing UX for mass adoption.

Investor Shift to Portfolios: Diversification and Stability

Investors will move away from single-asset bets toward diversified portfolios, including indexes, sector baskets, and strategies with downside protection.

Investors will move away from single-asset bets toward diversified portfolios, including indexes, sector baskets, and strategies with downside protection.

Grayscale outlines this as part of growing institutional adoption, with rising valuations across sectors. Fidelity reports a new cohort of investors entering in 2026, favoring stable income vehicles. CoinDesk adds that tokenized assets could comprise 5%+ of portfolios for some firms.

No Wild Bull Run: Disciplined Growth for Real Builders

Finally, CoinMarketCap foresees no explosive bull market in 2026 - instead, a year of steady growth for projects delivering actual value, not just social media noise.

This tempered outlook is echoed in softened forecasts: Standard Chartered revised Bitcoin's 2026 target to $150,000, while Fundstrat sees $200,000–$250,000. Barron's notes bulls are "blinking," with emphasis on institutional-era stability over hype.

In summary, 2026 promises a more grounded crypto era, where utility, partnerships, and user focus drive success. As CoinMarketCap's insights suggest, the winners will be those building quietly and effectively, paving the way for broader mainstream integration.

Also read:

- Beyond the Headlines: Quasa.io vs. Leading Crypto Media Outlets

- The 2025 Crypto Token Launch Bloodbath: Why 85% Are Sinking Below Launch Prices

- MiniMax M2.1: Revolutionizing Open-Source AI for Coding and Agentic Workflows

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).