In a year marked by hype around infrastructure and AI-driven projects, the cryptocurrency market delivered a harsh reality check for new token launches. According to a comprehensive analysis by Memento Research, which tracked 118 token generation events (TGEs) through December 20, 2025, a staggering 84.7% of these tokens are now trading below their initial fully diluted valuation (FDV).

This figure aligns closely with the user's noted 85%, highlighting a widespread underperformance that has left most investors nursing significant losses. The median FDV drop stands at -71.1%, with market cap declines averaging -66.8%, painting a picture of a market where TGEs often represent peak valuations rather than entry points for growth.

The Graveyard Zone: Where Tokens Go to Die

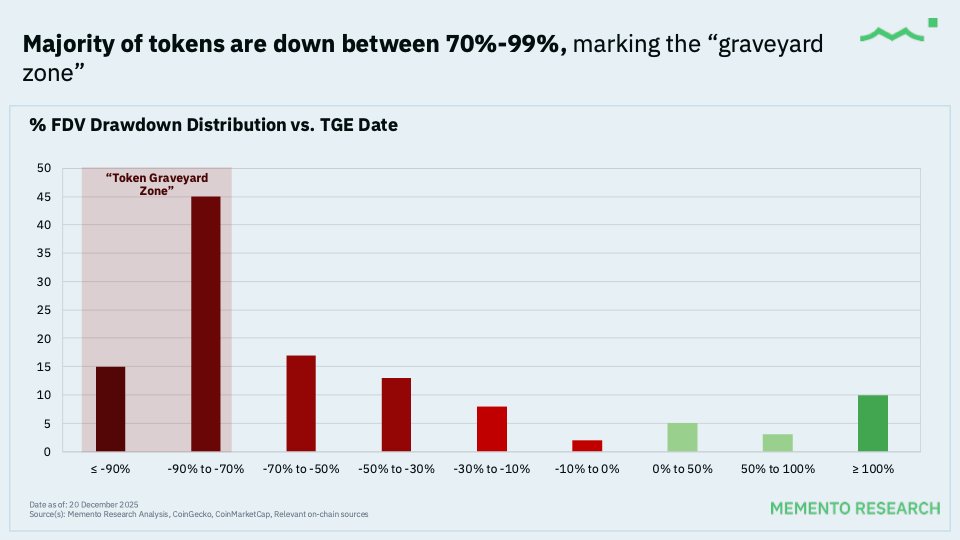

Visuals from the report illustrate the severity of the downturn. One chart shows the FDV drawdown distribution versus TGE date, revealing that two-thirds of tokens have lost over 50% of their value, with 38% plummeting 70-99%—a range dubbed the "token graveyard zone."

Visuals from the report illustrate the severity of the downturn. One chart shows the FDV drawdown distribution versus TGE date, revealing that two-thirds of tokens have lost over 50% of their value, with 38% plummeting 70-99%—a range dubbed the "token graveyard zone."

This zone, highlighted in red, underscores the precarious nature of 2025 launches, where the majority of projects enter a death spiral shortly after going live. Only 15.3% (18 out of 118) managed to trade above their TGE valuation, with these "green" tokens posting a median gain of +109.7%—a stark contrast to the median -76.8% loss for the underperformers.

Equal-weighted averages across all launches show a -33.3% return, but when weighted by FDV, this worsens to -61.5%, indicating that larger projects dragged the overall performance down further. Community discussions on platforms like X echo this sentiment, with users lamenting that "TGE isn’t 'early' anymore - it’s often just the first place people get dumped on."

One post highlighted the top 10 worst performers, including tokens like $SYND from Syndicate.io (-93.6% from $940M to $59.8M FDV) and $BERA from Berachain (-93.2% from $4.46B to $305M), illustrating how even hyped projects cratered.

High-Valuation Trap: Billion-Dollar Launches Flop

A particularly damning insight emerges from high-FDV launches. Of the 28 projects starting with an FDV of $1 billion or more, none achieved positive returns, with a median drawdown of approximately -81%.

A particularly damning insight emerges from high-FDV launches. Of the 28 projects starting with an FDV of $1 billion or more, none achieved positive returns, with a median drawdown of approximately -81%.

In contrast, smaller launches in the $25M-$200M FDV range (N=35) fared better, with 40% trading in the green and a median drawdown of just -26%. This suggests that inflated initial valuations, often fueled by pre-launch hype and venture capital, set unrealistic expectations, leading to rapid repricing post-TGE.

Broader market analyses corroborate this. A Crypto.News report notes that the trend reflects a more selective investor base in 2025, with regulatory pressures and market saturation contributing to the failures. Blockworks described it as "the year new tokens died," pointing to valuation compression in sectors like infrastructure and gaming. On X, analysts like @moneyoloweb called it a "painful" year, with about 85% below starting valuations and typical losses around 77%.

Category Breakdown: Infra and AI Lead the Losses, DeFi Shows Resilience

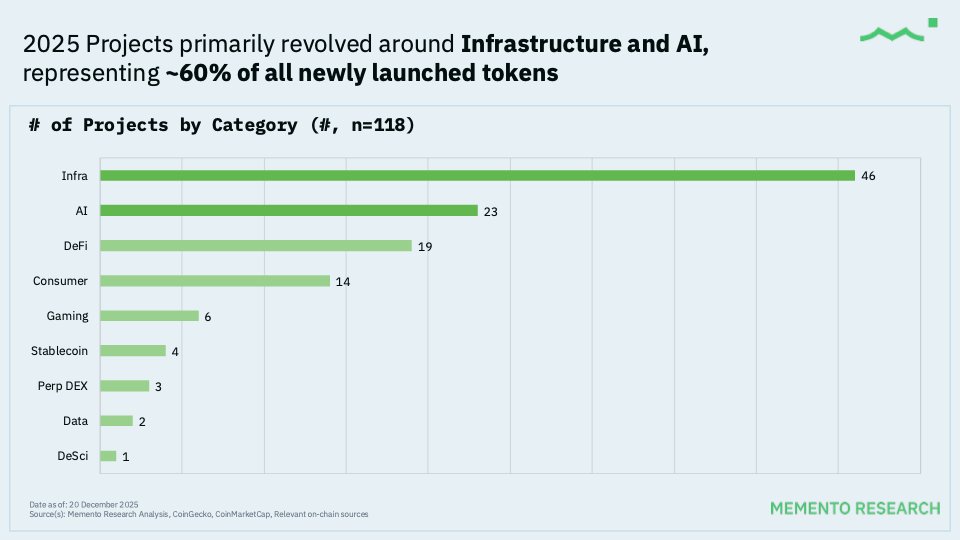

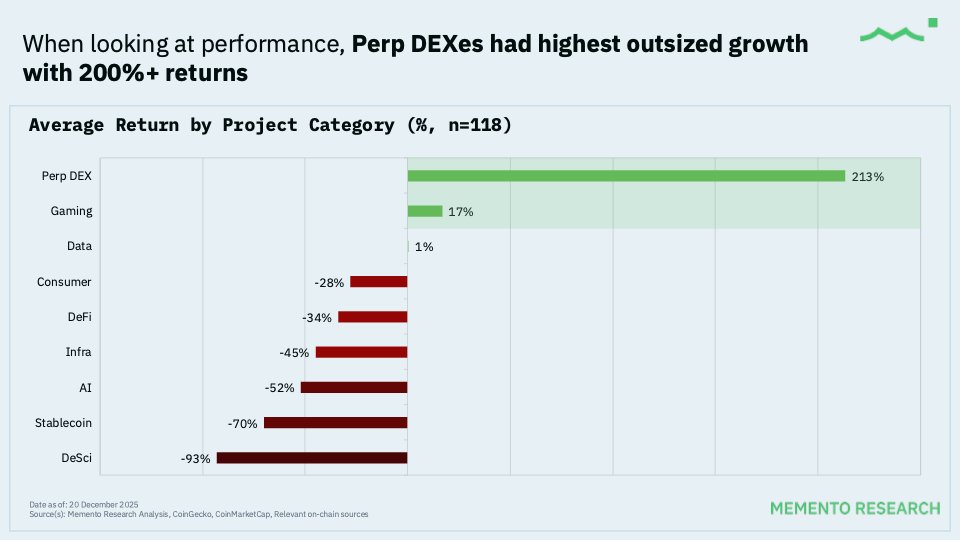

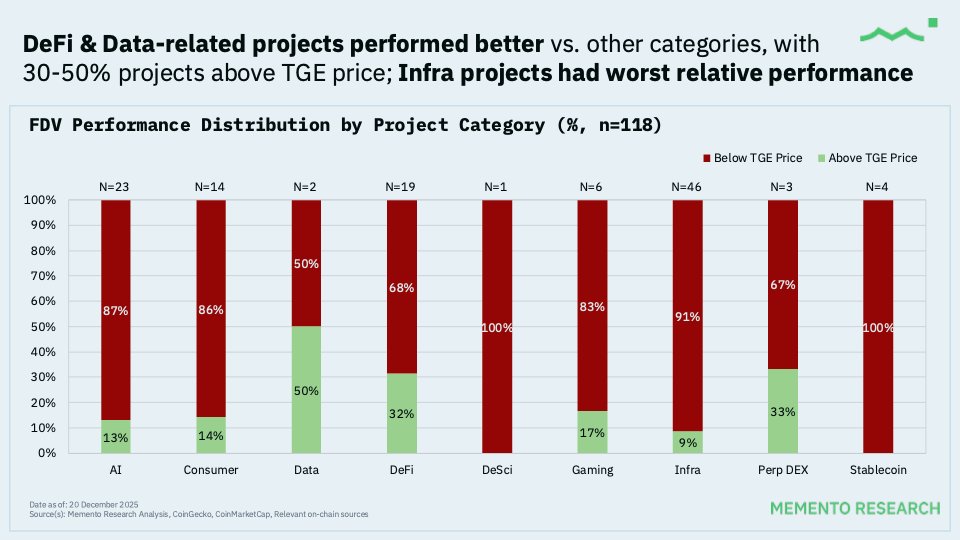

The report's category analysis reveals uneven performance across sectors, as depicted in one of the bar charts. Infrastructure projects dominated the launches (46 out of 118, or about 39%), but they suffered the most, with an average FDV change of -45% and a median of -72%. AI followed closely (23 projects, ~19%), averaging -52% with a median -82% drop—together, these two categories represented ~60% of all new tokens, pulling the market down.

DeFi, however, emerged as a relative bright spot. With 19 launches, it boasted the highest percentage of winners at 31.6% trading above TGE prices, and an average FDV change of -34%. A dedicated chart compares FDV performance distributions, showing DeFi and data-related projects with 30-50% above TGE, versus infrastructure's dismal 6.7% green rate.

DeFi, however, emerged as a relative bright spot. With 19 launches, it boasted the highest percentage of winners at 31.6% trading above TGE prices, and an average FDV change of -34%. A dedicated chart compares FDV performance distributions, showing DeFi and data-related projects with 30-50% above TGE, versus infrastructure's dismal 6.7% green rate.

Perpetual DEXes (Perp DEX) stood out with a whopping +213% average return across three projects, though this is heavily skewed by outliers like Aster, with the median at -31%. Gaming (six projects) had a positive average (+17%) but a median -86%, again due to extremes.

Consumer (14 projects, -28% average) and stablecoins (four projects, -70% average) also underperformed, while smaller categories like data (two projects, +0.7% average) and DeSci (one project, -93%) offered limited insights due to sample size. CoinDesk's State of the Blockchain 2025 report adds context, noting that Layer-1 tokens broadly underperformed despite regulatory wins, attributing it to over-saturation in infra and AI.

Outliers and Community Reactions: Glimmers Amid the Gloom

Despite the gloom, a few tokens bucked the trend. X posts from @CoinDataFlow and @top7ico listed top performers like $ASTER, $ESPORTS, $H, $PIEVERSE, and $BR, which delivered strong upside post-TGE. These outliers underscore that success is possible but rare, often tied to unique utility or timing.

Despite the gloom, a few tokens bucked the trend. X posts from @CoinDataFlow and @top7ico listed top performers like $ASTER, $ESPORTS, $H, $PIEVERSE, and $BR, which delivered strong upside post-TGE. These outliers underscore that success is possible but rare, often tied to unique utility or timing.

Community buzz on X reflects frustration and calls for change. One user highlighted that only 18 out of 118 surpassed initial FDV, labeling it "absolute crime season," and promoted alternative models like vesting NFTs to align incentives.

Others, like @ramantolol1012, expressed hope for 2026 launches from projects like Zama and Sentient AGI to break the pattern with better tokenomics and distribution. Token unlock analyses from BlockchainReporter and MEXC for December 2025 further warn of ongoing pressure, with gradual releases exacerbating drawdowns in projects like SPACE ID.

Implications: A Wake-Up Call for Crypto Investors

The overarching trend? Pre-launch price formation often inflated valuations, making TGEs a risky bet - investors entering at launch faced an average ~70% decline. This echoes findings from CryptoRank and Yellow.com, which reported similar stats on the "Great 2025 Token Crash."

As 2025 winds down, the data serves as a cautionary tale: In a maturing market, hype alone isn't enough. Future launches may need innovative models to avoid the graveyard, but for now, the numbers speak volumes - buyer beware in the volatile world of crypto tokens.

Also read:

Also read:

- Beyond the Headlines: Quasa.io vs. Leading Crypto Media Outlets

- JPMorgan Eyes Crypto Trading Desk: A Pivotal Shift Toward Institutional Digital Assets

- MiniMax M2.1: Revolutionizing Open-Source AI for Coding and Agentic Workflows

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).