In the ever-volatile world of cryptocurrency, few figures loom larger than Satoshi Nakamoto, the enigmatic pseudonymous creator of Bitcoin. Yet, despite their legendary status, Nakamoto's presumed wealth - tied entirely to a hoard of untouched bitcoins - has taken a staggering hit.

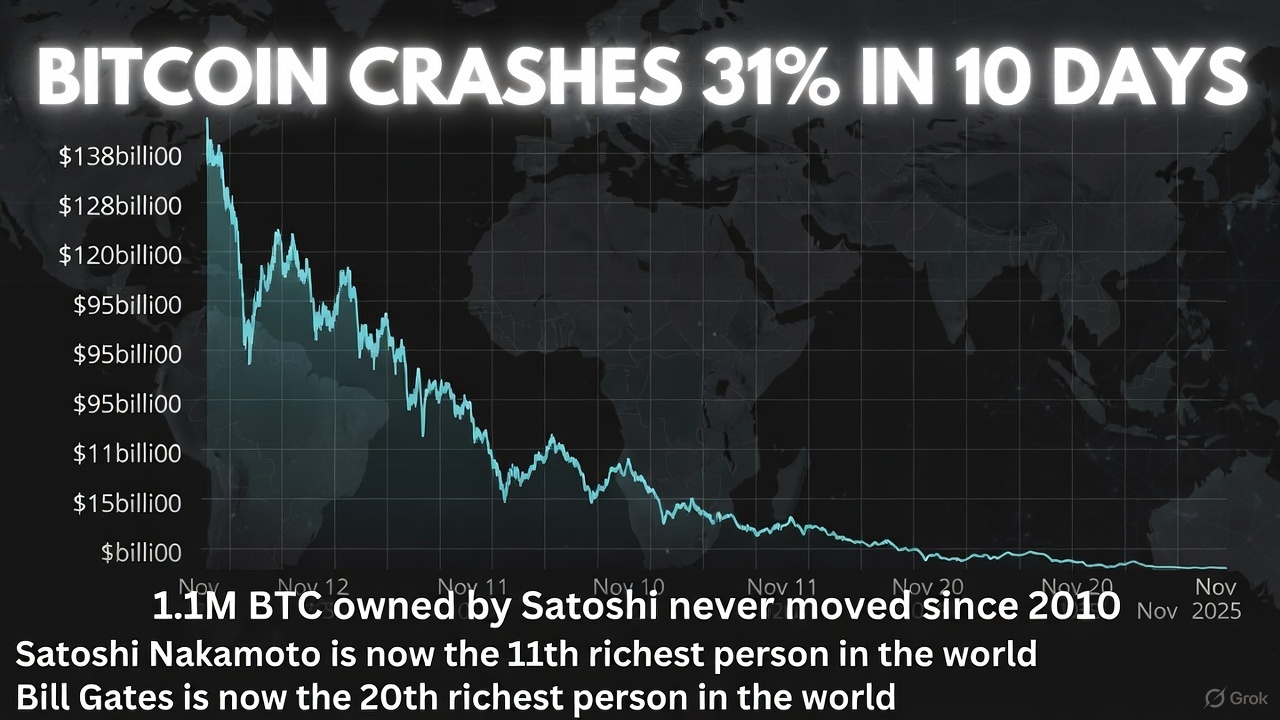

Over the past month, the value of the approximately 1.1 million bitcoins attributed to Nakamoto has plummeted from a peak of around $138 billion to roughly $95 billion, erasing more than $42 billion in paper gains. This dramatic reversal stems from Bitcoin's own freefall, which has shed over 31% from its October 2025 high of $126,273 per coin, landing at about $86,800 as of November 24.

Over the past month, the value of the approximately 1.1 million bitcoins attributed to Nakamoto has plummeted from a peak of around $138 billion to roughly $95 billion, erasing more than $42 billion in paper gains. This dramatic reversal stems from Bitcoin's own freefall, which has shed over 31% from its October 2025 high of $126,273 per coin, landing at about $86,800 as of November 24.

Nakamoto's fortune, if it can even be called that in the absence of any confirmed identity or movement, represents one of the greatest "what ifs" in modern finance. Blockchain analysts have long tracked a cluster of early-mined addresses - totaling around 1.1 million BTC, or about 5.2% of Bitcoin's total supply - that have remained dormant since 2009 and 2010, the network's infancy.

These coins, forged in the genesis blocks when mining was as simple as running software on a personal computer, have never been spent, transferred, or touched.

At their zenith in early October, when Bitcoin surged past $126,000 amid a post-halving rally and speculative frenzy, Nakamoto's stash briefly vaulted them to the equivalent of the world's 11th-richest person, outpacing tech titans like Mark Zuckerberg and Larry Page in raw net worth calculations.

Fast-forward to today, and the landscape has flipped. With Bitcoin hovering below $87,000, Nakamoto's holdings now equate to a fortune that would slot them around the 20th spot on Forbes' real-time billionaire rankings - comfortably below Microsoft co-founder Bill Gates, whose diversified empire is valued at approximately $128 billion. Gates, ever the skeptic of pure crypto plays, has long favored stable investments like farmland and green energy, a stark contrast to the digital gold rush that briefly crowned Nakamoto a phantom trillionaire contender earlier this year.

This isn't just a quirky footnote in crypto lore; it's a stark reminder of Bitcoin's inherent wild swings. The cryptocurrency, born from Nakamoto's 2008 whitepaper as a decentralized alternative to fiat money amid the global financial crisis, has always been a high-beta asset - amplifying broader market moods.

This isn't just a quirky footnote in crypto lore; it's a stark reminder of Bitcoin's inherent wild swings. The cryptocurrency, born from Nakamoto's 2008 whitepaper as a decentralized alternative to fiat money amid the global financial crisis, has always been a high-beta asset - amplifying broader market moods.

November's rout, which wiped out nearly $800 billion in total crypto market capitalization since October's peak, was triggered by a perfect storm of macroeconomic headwinds. Federal Reserve officials issued hawkish warnings on persistent inflation, signaling no rush to cut interest rates further despite earlier dovish hints that had fueled the summer rally. This spooked investors, driving a flight to safety and spiking global bond yields.

Compounding the pain were crypto-specific tremors: massive outflows from U.S. spot Bitcoin exchange-traded funds (ETFs), which saw over $2.5 billion in redemptions in the first three weeks of November alone, as institutions like BlackRock and Fidelity pulled back amid profit-taking.

Exchange reserves swelled with sidelined coins, fueling liquidations of leveraged positions totaling more than $1 billion in a single day last week. Thin post-holiday liquidity exacerbated the slide, turning minor sell-offs into cascading drops. Broader unease over an AI-driven tech bubble - echoing the dot-com bust - has also bled into crypto, with Bitcoin's correlation to Nasdaq stocks hitting multi-year highs above 0.7.

Nakamoto's inertia in the face of this chaos only heightens the intrigue. Over 15 years, these wallets have withstood hacks, booms, and busts - from the 2017 ICO mania that sent prices to $20,000, to the 2022 FTX collapse that cratered them to $16,000—without a single satoshi moving.

Speculation about the creator's fate runs wild: Is Nakamoto a lone genius who cashed out early in secret? A deceased individual whose heirs lack the keys? Or perhaps a collective, like a government agency or cypherpunk group, holding firm to Bitcoin's revolutionary ethos?

Speculation about the creator's fate runs wild: Is Nakamoto a lone genius who cashed out early in secret? A deceased individual whose heirs lack the keys? Or perhaps a collective, like a government agency or cypherpunk group, holding firm to Bitcoin's revolutionary ethos?

Recent blockchain sleuthing by firms like Arkham Intelligence confirms the addresses' linkage to Nakamoto via early forum posts and code commits, but the human (or humans) behind them remains a black box.

For the crypto ecosystem, the drop underscores a maturing yet fragile market. Bitcoin's 2025 journey has been a rollercoaster: a 150% year-to-date gain through September, propelled by the April halving event that halved mining rewards and tightened supply, only to unravel as real-world adoption lagged hype.

Institutional inflows had peaked at $18 billion into ETFs by October, but regulatory scrutiny - from the SEC's ongoing probes into stablecoins to Europe's MiCA framework clamping down on volatility - has cooled enthusiasm. Retail investors, who piled in during the summer via apps like Coinbase, are nursing losses, with on-chain data showing a 12% uptick in small-holder addresses dumping holdings.

Yet, history suggests resilience. Bitcoin has survived eight "deaths" declared by skeptics, rebounding stronger each time. Analysts at firms like Glassnode point to accumulating "HODLers" - long-term holders - who now control 74% of supply, providing a floor against further capitulation.

If Fed minutes next week hint at December rate cuts, or if Trump's pro-crypto administration pushes through promised deregulation, a V-shaped recovery isn't off the table. Nakamoto's coins, ever the unmoved mover, would once again balloon in value, reminding us that in the blockchain's ledger, fortunes aren't spent - they simply wait.

Also read:

Also read:

- The AI Reckoning: From Startup Mirage to Corporate Cataclysm

- Navigating the Crypto Storm: Essential Dashboards to Stay Ahead in November 2025's Turbulent Market

- Visa’s Stablecoin Payout Pilot: Instant Crypto Earnings for Creators and Freelancers

As the dust settles on November's bloodbath, Satoshi Nakamoto's tale serves as both cautionary myth and enduring lure. In a world where billionaires like Elon Musk and Jeff Bezos build empires on innovation and diversification, the Bitcoin founder's ghostly wealth - untapped, unclaimed, and now slashed by nearly a third - embodies the pure, unadulterated gamble of digital scarcity. Whether Nakamoto ever surfaces to spend a dime remains the ultimate unsolved puzzle, but one thing is clear: in crypto's hall of mirrors, even shadows cast long, fluctuating fortunes.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).