The 2025 crypto winter has hit corporate treasuries like a freight train — and the pain is wildly uneven.

While Bitcoin-maximalist companies ride out the storm with billions in unrealized gains, the largest public holders of Ethereum and Solana are hemorrhaging cash at historic levels.

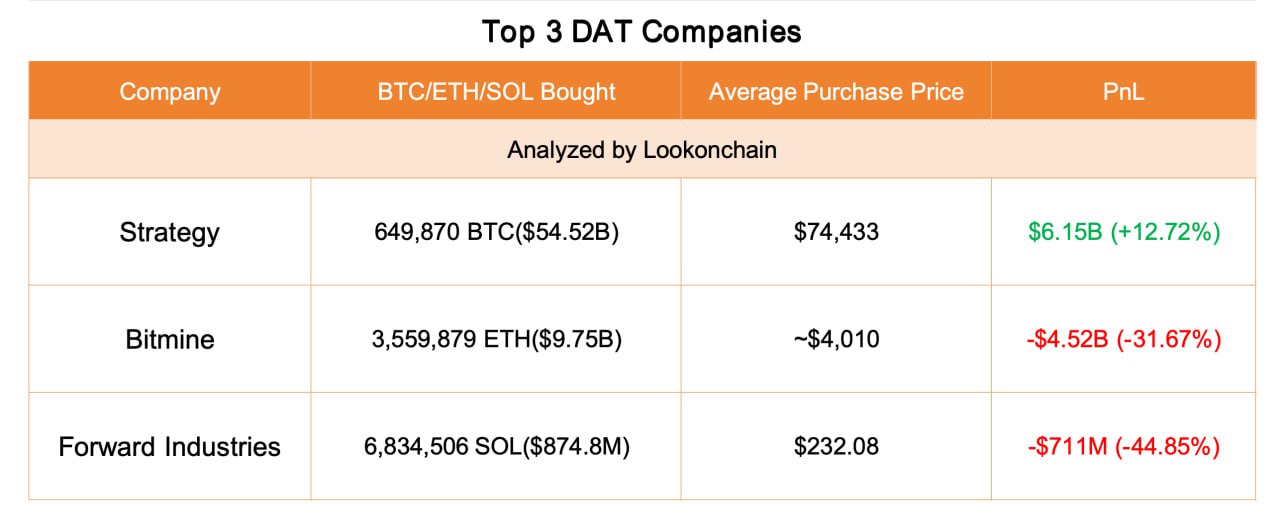

Strategy (Michael Saylor) – Still Deep in the Green

- Holds: 649,870 BTC;

- Average buy price: $74,433;

- Current unrealized profit: ~$6.15 billion (+12.7%).

Even after Bitcoin’s sharp correction from its all-time high, Saylor’s fortress remains solidly profitable. Strategy continues to treat BTC not just as a store of value, but as “productive capital” — issuing dollar-yielding instruments like its Stretch (STRC) preferred shares on top of the stack.

Even after Bitcoin’s sharp correction from its all-time high, Saylor’s fortress remains solidly profitable. Strategy continues to treat BTC not just as a store of value, but as “productive capital” — issuing dollar-yielding instruments like its Stretch (STRC) preferred shares on top of the stack.

Saylor insists the company is not an investment fund or trust, but an operating business with a unique Bitcoin strategy.

His arguments, however, barely hold water: Strategy is, in all but name, a publicly traded Bitcoin investment fund — and the market, index providers, and most analysts already treat it as such.

BitMine (Tom Lee) – The Ethereum Bloodbath

- Holds: 3.56 million ETH (largest public ETH treasury);

- Average buy price: $4,010;

- Current unrealized loss: $4.52 billion (−31.7%).

Forward Industries – Solana’s Biggest Public Victim

- Holds: 6.83 million SOL (largest public SOL treasury);

- Average buy price: $232.08;

- Current unrealized loss: $711 million (−44.9%).

The Index Exile Sword Hanging Over Strategy

JPMorgan warns that if MSCI and Nasdaq 100 reclassify companies with >50% crypto exposure as “investment funds” (decision expected by mid-January 2026), Strategy could see up to $2.8 billion forced out in a single rebalancing day.

Also read:

- BBC’s Streaming Overhaul: 84 Managers Out, Survival Mode On

- Startup Reality: The Hard Numbers from TrustMRR

- YouTube Brings Back Private Messaging After Six Years: The War for the “Forwarded Video” Is Officially On

- 6 Things an Expert Relocation Services Company Can Do for You

Bottom Line

This cycle is far from over.

Margin calls, index exclusions, forced treasury sales, and collapsing stock premiums are all still in play.

The next few months will bring serious events that will wash even more whales ashore — and separate the survivors from the wreckage.

The next few months will bring serious events that will wash even more whales ashore — and separate the survivors from the wreckage.

And make no mistake: even today’s prices remain grotesquely inflated.

To reach anything resembling fair value, the entire market still needs to fall at least another 50% — and for 90% of the inflated scam coins and useless meme tokens, even that won’t be enough. Most of them will simply die.

The meme fever is ending. The era of 10,000+ parasitic money-vacuum projects is coming to a brutal close.

True equilibrium will only arrive when no more than 3,000 real, useful crypto projects remain standing — and the rest are gone forever.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).