With Bitcoin Dipping Below $97K and Liquidations Surging Past $960M, These Tools Are Your Edge Over the Herd

The crypto market in mid-November 2025 feels like a pressure cooker ready to blow. Bitcoin has plunged below $97,000, dragging the total market cap down to $3.38 trillion - a 5.6% wipeout in 24 hours alone. Ethereum's off 2.6% at $3,459, while altcoins and memes are bleeding harder, with over 96 of the top 100 coins in the red. Heavy liquidations ($827M on BTC alone) and fading hopes for a Fed rate cut have traders on edge, echoing October's flash crash. Sentiment? Deep in fear territory, per the latest reads.

The crypto market in mid-November 2025 feels like a pressure cooker ready to blow. Bitcoin has plunged below $97,000, dragging the total market cap down to $3.38 trillion - a 5.6% wipeout in 24 hours alone. Ethereum's off 2.6% at $3,459, while altcoins and memes are bleeding harder, with over 96 of the top 100 coins in the red. Heavy liquidations ($827M on BTC alone) and fading hopes for a Fed rate cut have traders on edge, echoing October's flash crash. Sentiment? Deep in fear territory, per the latest reads.

In times like these, staring at isolated charts is a recipe for FOMO-fueled mistakes. The smart play? Leverage dashboards that aggregate sentiment, liquidations, and macro trends. These aren't just pretty visuals—they're your early-warning system, helping you spot whale traps, altcoin rotations, and funding squeezes before the crowd piles in. Here's a curated toolkit of battle-tested platforms, each with real-world utility in this downturn. We'll dive into their mechanics, current insights, and why they're indispensable right now.

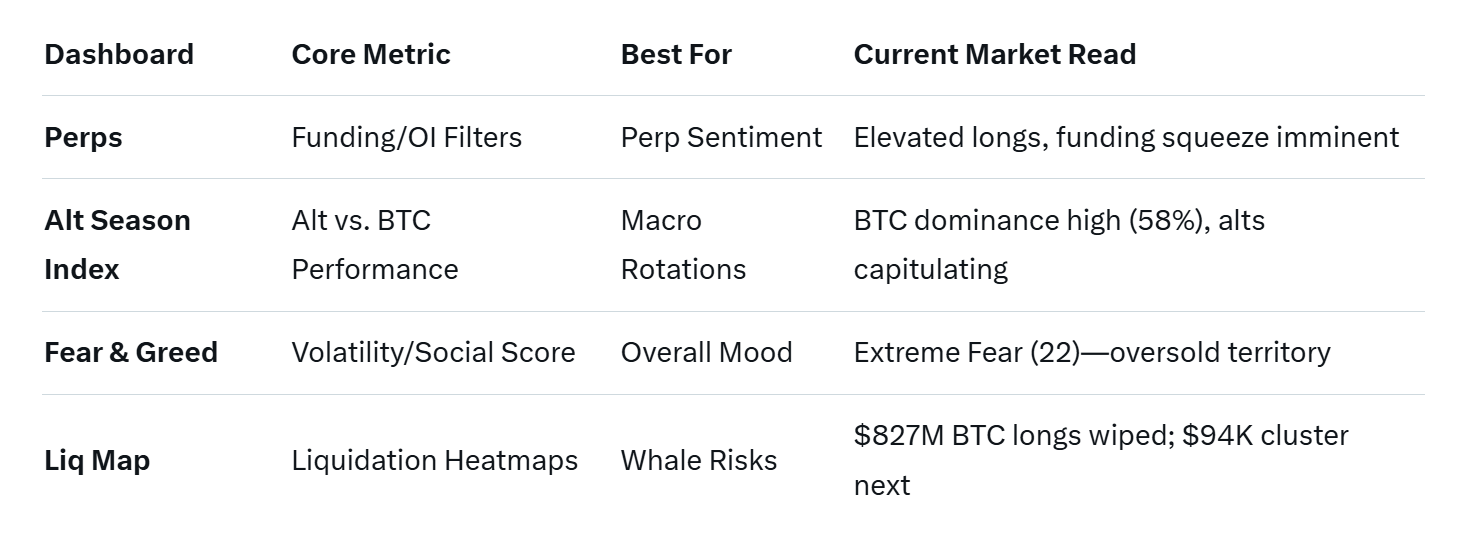

1. Perps Dashboard: Tracking Perpetual Futures Sentiment Like a Pro

Perps Dashboard is a trader's Swiss Army knife for perpetual futures (perps) - those high-leverage bets dominating DeFi volumes. It filters open positions across exchanges like Binance and Bybit by key metrics: open interest (total value locked in trades), funding rates (the fees longs pay shorts, or vice versa), leverage levels, and win rates. No more sifting through noise; this tool surfaces overcrowded trades ripe for reversals.

Perps Dashboard is a trader's Swiss Army knife for perpetual futures (perps) - those high-leverage bets dominating DeFi volumes. It filters open positions across exchanges like Binance and Bybit by key metrics: open interest (total value locked in trades), funding rates (the fees longs pay shorts, or vice versa), leverage levels, and win rates. No more sifting through noise; this tool surfaces overcrowded trades ripe for reversals.

Deeper Dive: Built on on-chain data, it visualizes imbalances - e.g., if funding rates spike positive (longs overpaying), shorts might squeeze. In today's market, with BTC perps seeing elevated funding (up 0.05% hourly amid the dip), it's flagging overleveraged longs as liquidation bait. Traders use it to gauge "smart money" flows: High OI in calls often precedes dumps.

Current Edge: With $960M in liquidations this week, scan for clusters above $100K leverage - Perps highlights them in real-time. Pro tip: Pair with alert notifications to catch funding flips before volatility spikes.

2. Altcoin Season Index: The Global Pulse for BTC vs. Alts

CoinMarketCap's Altcoin Season Index is your macro radar, scoring whether alts are outshining Bitcoin over a rolling 90-day window. It ranks the top 100 non-stablecoins (including ETH) by performance vs. BTC - if 75%+ beat BTC, it's "Alt Season" (index >75); below 25%, "BTC Season" (<25). The score (1-100) updates daily, blending price momentum with dominance charts.

CoinMarketCap's Altcoin Season Index is your macro radar, scoring whether alts are outshining Bitcoin over a rolling 90-day window. It ranks the top 100 non-stablecoins (including ETH) by performance vs. BTC - if 75%+ beat BTC, it's "Alt Season" (index >75); below 25%, "BTC Season" (<25). The score (1-100) updates daily, blending price momentum with dominance charts.

Deeper Dive: Beyond the headline number, it breaks down yearly highs/lows and top performers, revealing rotations—like capital fleeing BTC into Layer-1s during dips. Right now, with BTC dominance at 58% (up from 52% in October), the index hovers in the low 30s - firmly BTC territory. But watch for cracks: If ETH or SOL outperform by 10%+ weekly, alts could rally as risk appetite returns.

Current Edge: In this bearish phase, use it to time entries - e.g., accumulate alts when the index dips below 20, signaling capitulation. CMC's bonus dashboards (e.g., Dominance or Fear & Greed) add layers: Their global F&G is at 28 (Fear), aligning with Glassnode's read.

3. Glassnode Fear & Greed Index: Sentiment Overlay on BTC's Wild Ride

Glassnode's Fear & Greed Index isn't your grandma's mood ring - it's a BTC-price-integrated sentiment barometer, scoring 0-100 based on volatility, volume, social buzz, and dominance. Low scores (<25) scream "Extreme Fear" (buy signal); high (>75) yell "Extreme Greed" (sell). What sets it apart? On-chain overlays like exchange inflows or whale activity, tying emotion to real data.

Glassnode's Fear & Greed Index isn't your grandma's mood ring - it's a BTC-price-integrated sentiment barometer, scoring 0-100 based on volatility, volume, social buzz, and dominance. Low scores (<25) scream "Extreme Fear" (buy signal); high (>75) yell "Extreme Greed" (sell). What sets it apart? On-chain overlays like exchange inflows or whale activity, tying emotion to real data.

Deeper Dive: Powered by proprietary metrics (e.g., MVRV Z-Score for over/undervaluation), it correlates greed spikes with tops—recall 2021's 95 score before the crash. Currently, it's pinned at 22 (Extreme Fear), with BTC's 6.2% drop amplifying panic. The chart shows sentiment decoupling from price: Even as BTC tests $97K support, on-chain holder conviction (low sell pressure) hints at a rebound.

Current Edge: Track divergences - e.g., if greed ticks up amid liquidations, shorts are overextended. Glassnode's studio lets you layer it with RSI or funding rates for confluence.

4. Liquidation Map: Hunting Whale Traps on Hyperliquid

Hyperdash's Liquidation Map zooms in on Hyperliquid's perp data, heatmap-style, plotting liquidation clusters by price level and size. It flags "liq walls" - dense zones where leveraged positions (often whales') cluster, vulnerable to cascades. Filter by leverage (e.g., >10x) or side (long/short) for precision.

Deeper Dive: Drawing from Hyperliquid's transparent order book, it visualizes potential fireworks: A $500M long cluster at $100K BTC? That's a magnet for dumps. In volatile markets, these maps predict squeezes - e.g., shorts piling below $95K could fuel a short-covering rally. Current snapshot: Massive $827M BTC longs liquidated below $98K, with fresh clusters building at $94K support.

Current Edge: With 300M+ in hourly wipes, scout for unbalanced sides - e.g., 70% longs above current price signals downside risk. Integrate with Perps for sentiment confirmation.

Also read:

Also read:

- Wikipedia Founder Storms Out of Interview After 48 Seconds Over Co-Founder Question

- Another Content War Ends: Disney Returns Its Channels to YouTube TV

- "Honey, What Are You Thinking About?" The Mind of a Crypto Trader in the Shadow of October 10

- Mureka AI Music Generator Levels Up with V7 Upgrade

Why Dashboards Matter Now: Outsmart the Storm

November's downturn - fueled by macro jitters (delayed inflation data, weak jobs) and $960M liquidations - is a classic fear cascade. But history shows fear bottoms (e.g., 2022's 10/10 score preceded a 50% rally). These tools democratize edge: Retail traders, armed with mobile alerts, can front-run whales or avoid traps. In a neutral-to-cautious market (per CoinDCX), blending them yields alpha - e.g., low F&G + liq clusters = dip-buy setups.

Pro Advice: Set cross-dashboard alerts (e.g., via TradingView integrations) and backtest with historical data. Remember, in crypto's Squid Game, knowledge is the red light, green light survival kit. Stay vigilant - the rebound's brewing, but only for those watching the signals.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).