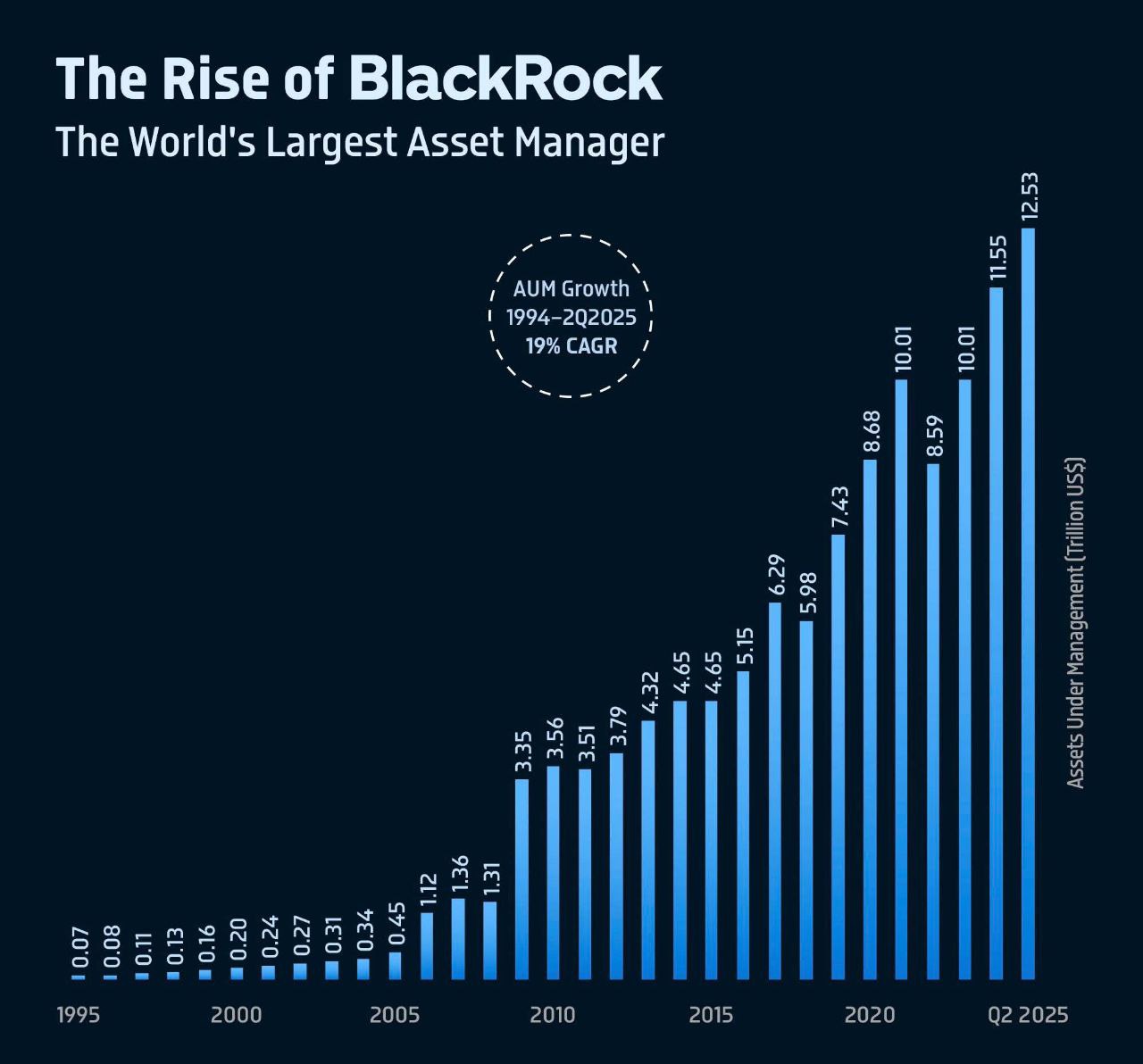

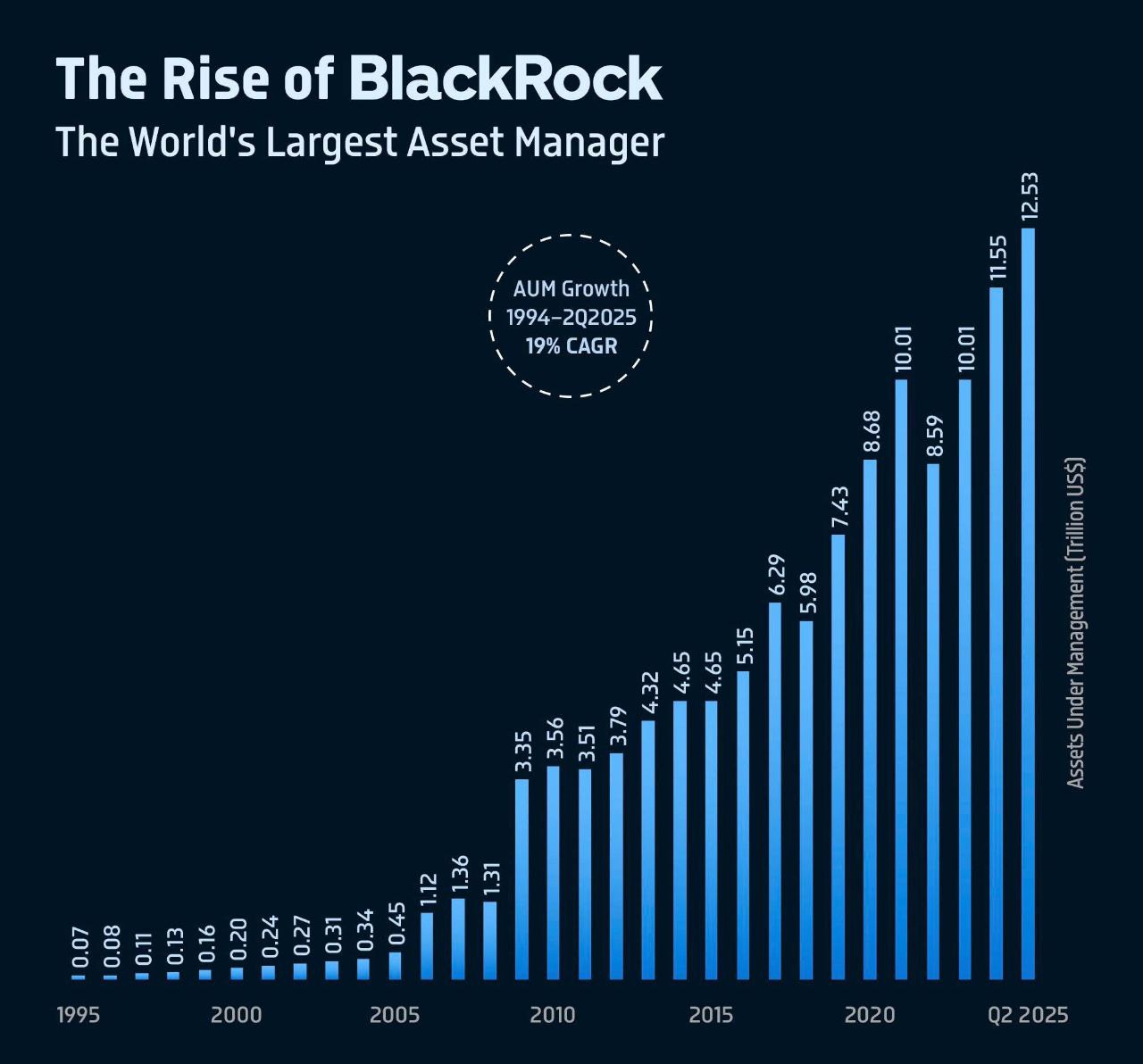

BlackRock, Inc., founded in 1988, has solidified its position as the world’s largest asset management company, with its assets under management (AUM) reaching an astronomical $12.5 trillion in the second quarter of 2025. This remarkable growth underscores the firm’s dominance in the financial sector and its ability to navigate an evolving global market landscape.

From managing a modest $69 billion in assets in 1995, BlackRock’s AUM has skyrocketed over the decades, reflecting a compounded annual growth rate (CAGR) of 19%. This exponential expansion highlights the company’s strategic adaptability, leveraging innovations in exchange-traded funds (ETFs), private markets, and technology-driven solutions. The latest milestone of $12.5 trillion, reported in Q2 2025, marks a significant leap from previous years, driven by a global market rally, favorable interest rate expectations, and strategic acquisitions.

From managing a modest $69 billion in assets in 1995, BlackRock’s AUM has skyrocketed over the decades, reflecting a compounded annual growth rate (CAGR) of 19%. This exponential expansion highlights the company’s strategic adaptability, leveraging innovations in exchange-traded funds (ETFs), private markets, and technology-driven solutions. The latest milestone of $12.5 trillion, reported in Q2 2025, marks a significant leap from previous years, driven by a global market rally, favorable interest rate expectations, and strategic acquisitions.

Key to this growth has been BlackRock’s diversification into high-margin areas like private markets and infrastructure investments, bolstered by acquisitions such as Global Infrastructure Partners and Preqin. The firm’s iShares ETF platform has also played a pivotal role, attracting substantial inflows from both institutional and retail investors. Despite challenges like a notable $52 billion redemption by a single client in Q2, the overall trajectory remains robust, with net inflows and market momentum propelling the AUM to new heights.

Also read:

- How Apple Crafted an “Event” Around Its F1 Film, Positioning It as a Cultural Phenomenon (With a Dash of Skepticism)

- Korean Shows and Wrestling Top the Charts: Key Takeaways from Netflix’s 2025 Data Dump

- Mukesh Ambani, India’s Richest Man, Gets Even Wealthier as JioStar Reports Record Performance

This achievement raises questions about the concentration of financial power, as BlackRock’s AUM rivals the GDP of major economies. While the company’s success reflects investor trust and market demand, it also sparks debates about the implications of such dominance in global finance. For now, BlackRock’s ascent to $12.5 trillion signals not just a record-breaking quarter, but a testament to its enduring influence in shaping the future of asset management.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).