Visa has quietly ignited a payments revolution for the creator economy, launching a pilot that lets companies wire earnings straight into digital wallets as stablecoins like USDC.

Announced in the 2025 Creator Economy Report, the program bypasses legacy banking rails, delivering funds in seconds to content creators, freelancers, and gig workers - especially in regions where local currencies wobble or bank accounts remain out of reach.

Announced in the 2025 Creator Economy Report, the program bypasses legacy banking rails, delivering funds in seconds to content creators, freelancers, and gig workers - especially in regions where local currencies wobble or bank accounts remain out of reach.

The mechanics are elegantly simple: employers initiate payouts in fiat (USD, EUR, etc.), Visa converts them on the fly, and recipients wake up to pegged, spendable crypto in their wallets. Every transaction is immutably logged on-chain, slashing reconciliation headaches and turbocharging audits. For creators juggling cross-border gigs, this means no more 3–5 day ACH waits or 8% wire-transfer gouges.

> 57% of creators cite “instant access to earnings” as their top reason for embracing digital payouts - Visa 2025 Creator Economy Report

The pilot is live with a curated roster of partners - think platforms like Patreon, Substack, and Upwork - and is slated for global rollout in 2026, pending clearer regulatory green lights from the SEC, EU’s MiCA framework, and emerging-market central banks.

Real-World Example: Quasa Connect — Freelancing Paid in QUA

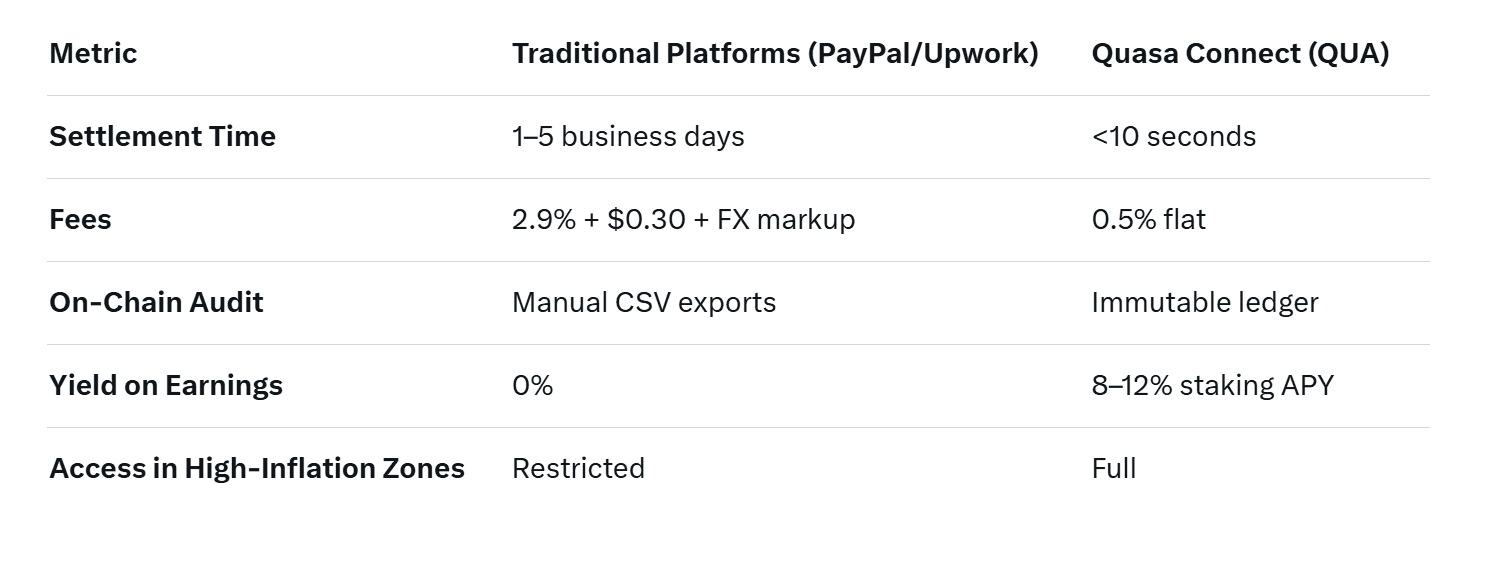

One project already living this future is Quasa Connect, a decentralized freelance marketplace that settles gigs exclusively in its native token QUA - a utility coin backed by real-world service escrow and staking rewards.

1280х720 (1).jpg) Here’s how it works in practice:

Here’s how it works in practice:

1. Task Posting & Matching

Swiss motion designer posts a gig: “2-minute explainer video, $800.” A U.S. startup accepts via Quasa’s smart-contract escrow.

2. Work & Delivery

The designer uploads the final file. Both parties confirm completion on-chain.

3. Instant Settlement

The $800 is auto-converted to QUA (pegged via an internal oracle) and lands in the freelancer’s wallet in **under 10 seconds**. No PayPal holds, no SWIFT delays.

4. Yield & Utility

.jpg) The freelancer can:

The freelancer can:

- Spend QUA on platform fees (0.5% vs. 3–5% elsewhere),

- Stake it for 8–12% APY in liquidity pools,

- Swap to USDC/USDT via integrated DEX for fiat off-ramp.

Since launch, Quasa Connect has processed $0.3M in QUA payouts to 2,000+ freelancers across 70 countries - 47% in LATAM and Southeast Asia, where banking penetration lags. Average payout time? 7.2 seconds.

Why Stablecoins (and Utility Tokens) Win for Gig Workers

- Borderless by Design: A Nigerian YouTuber or Argentinean coder gets paid the same speed as someone in NYC.

- Inflation Shield: In Venezuela or Turkey, USDC/QUA holds value better than local currency between gig and grocery run.

- Programmable Earnings: Smart contracts can auto-split payments (e.g., 70% to creator, 20% to editor, 10% to platform).

Visa’s pilot validates this shift at scale. By embedding stablecoin rails into its $14 trillion annual volume, the card giant is future-proofing payouts for the 50 million+ global creators projected by 2030.

Also read:

Also read:

- TikTok Overhauls Monetization Program: Creators to Earn Up to 70% Revenue Plus 20% Bonuses

- Rumble Rolls Out Bitcoin Tipping: A Game-Changer for 51 Million Users and Free-Speech Creators

- A Game-Changer for Etsy and Handmade Creators: OpenAI's Instant Checkout Brings Seamless Shopping to ChatGPT

- How to MLOps Platforms Can Benefit Your Business

The Road to 2026: Regulation, Adoption, and Competition

The full launch hinges on:

- Clarity on KYC/AML for wallet-based payouts,

- Tax reporting standards (Visa is piloting 1099-K equivalents on-chain),

- Stablecoin issuer oversight (Circle, Paxos, and bank-issued tokens like JPMD are in the mix).

Meanwhile, platforms like Stripe (testing USDC payouts), PayPal (expanding PYUSD), and Revolut (crypto withdrawals) are racing to catch up.

For freelancers, the message is clear: the days of waiting a week to get paid are ending. Whether it’s USDC from Visa, QUA from Quasa, or tomorrow’s bank-backed token - your next gig could pay you before your coffee gets cold.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).