Circle, the issuer of the USDC stablecoin, has announced the launch of a native version of USDC within the Hyperliquid ecosystem, marking a significant expansion of its presence in the decentralized finance (DeFi) space.

The move, detailed in a recent company blog post, includes Circle acquiring a stake in Hyperliquid’s native HYPE tokens and initiating collaborations with developers working on HyperEVM and HIP-3 projects. Additionally, Circle is exploring the possibility of becoming a validator on the Hyperliquid network, signaling a long-term commitment to the platform.

Strategic Expansion and Collaboration

The rollout of native USDC on Hyperliquid’s Ethereum-compatible HyperEVM network is designed to enhance liquidity and interoperability for users and developers. Circle has also integrated its upgraded Cross-Chain Transfer Protocol (CCTP v2), enabling seamless USDC transfers across multiple blockchains.

The rollout of native USDC on Hyperliquid’s Ethereum-compatible HyperEVM network is designed to enhance liquidity and interoperability for users and developers. Circle has also integrated its upgraded Cross-Chain Transfer Protocol (CCTP v2), enabling seamless USDC transfers across multiple blockchains.

This integration follows months of engagement with the Hyperliquid community, which Circle praises for its innovation and rapid growth. The company plans to extend support to HyperCore, Hyperliquid’s core trading layer, in the coming weeks, further solidifying its footprint.

In a bold statement, Circle expressed enthusiasm for Hyperliquid’s trajectory, stating, “We are impressed by Hyperliquid’s growth over the last year. This is something truly unique. Circle is here. We are investing. We are supporting this amazing community. Hyperliquid.” This reflects a strategic alignment with one of DeFi’s fastest-growing platforms, which has seen its assets under management surge past $5.5 billion in recent months.

HYPE Investment and Validator Ambitions

By holding HYPE tokens, Circle becomes a direct stakeholder in the Hyperliquid ecosystem, aligning its interests with the network’s success.

By holding HYPE tokens, Circle becomes a direct stakeholder in the Hyperliquid ecosystem, aligning its interests with the network’s success.

The company is also considering validator status, a role that would involve staking HYPE tokens to secure the blockchain and participate in governance. This move could enhance Circle’s influence within Hyperliquid while reinforcing USDC’s dominance as the platform’s primary stablecoin.

Market Impact and USDC Dominance

Hyperliquid currently holds over $6 billion in USDC reserves, accounting for approximately 8.5% of the stablecoin’s total circulating supply, which exceeds $70 billion.

This substantial liquidity underscores USDC’s critical role in Hyperliquid’s operations, particularly in its spot and perpetuals trading markets.

The integration aims to boost capital efficiency and developer adoption, with Circle launching incentive programs to encourage USDC usage across HyperEVM and HIP-3 projects.

A Competitive Landscape

The launch comes at a time when Hyperliquid is diversifying its stablecoin offerings, with Native Markets recently selected to issue a native stablecoin, USDH, following a community vote.

The launch comes at a time when Hyperliquid is diversifying its stablecoin offerings, with Native Markets recently selected to issue a native stablecoin, USDH, following a community vote.

While USDH introduces competition, Circle’s deep integration and HYPE investment suggest confidence in maintaining USDC’s leading position.

However, the stablecoin market is fiercely contested, and Circle’s success will depend on delivering on its promises of enhanced utility and community support.

Also read:

- Israel Seeks to Confiscate $1.5 Million in USDT from Wallets Linked to Iran’s IRGC, Tether Freezes Assets

- MetaMask Launches Its Own Stablecoin, mUSD, Revolutionizing Wallet Functionality

- Ethereum Foundation Launches AI Team to Make Ethereum the Backbone of an AI-Driven Economy

Broader Implications

Circle’s move into Hyperliquid reflects a broader trend of stablecoin issuers seeking to embed themselves in high-growth DeFi ecosystems.

Circle’s move into Hyperliquid reflects a broader trend of stablecoin issuers seeking to embed themselves in high-growth DeFi ecosystems.

By leveraging its regulatory compliance and global liquidity - built over nearly a decade - Circle aims to position USDC as the go-to stablecoin for Hyperliquid’s traders, developers, and institutions. Yet, the decision to invest in HYPE and pursue validator status raises questions about centralization risks, a concern in a community that values decentralization.

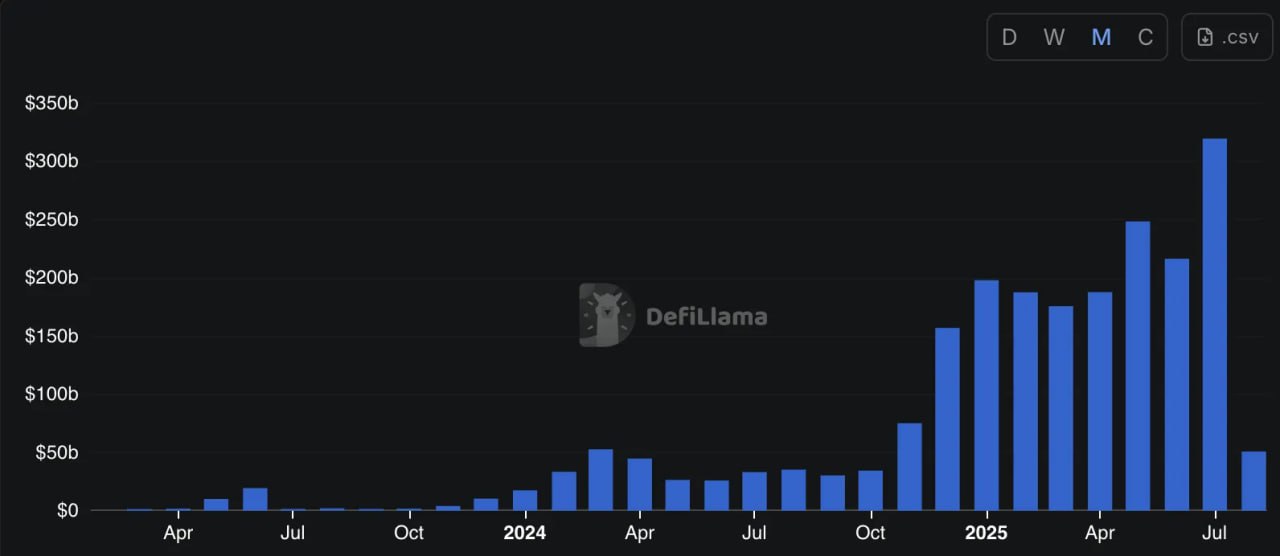

As Hyperliquid continues to process hundreds of billions in monthly trading volume, Circle’s entry could accelerate the platform’s evolution into a DeFi powerhouse.

For now, this partnership highlights the symbiotic potential between established stablecoin providers and innovative blockchain networks, though its long-term impact remains to be seen

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).