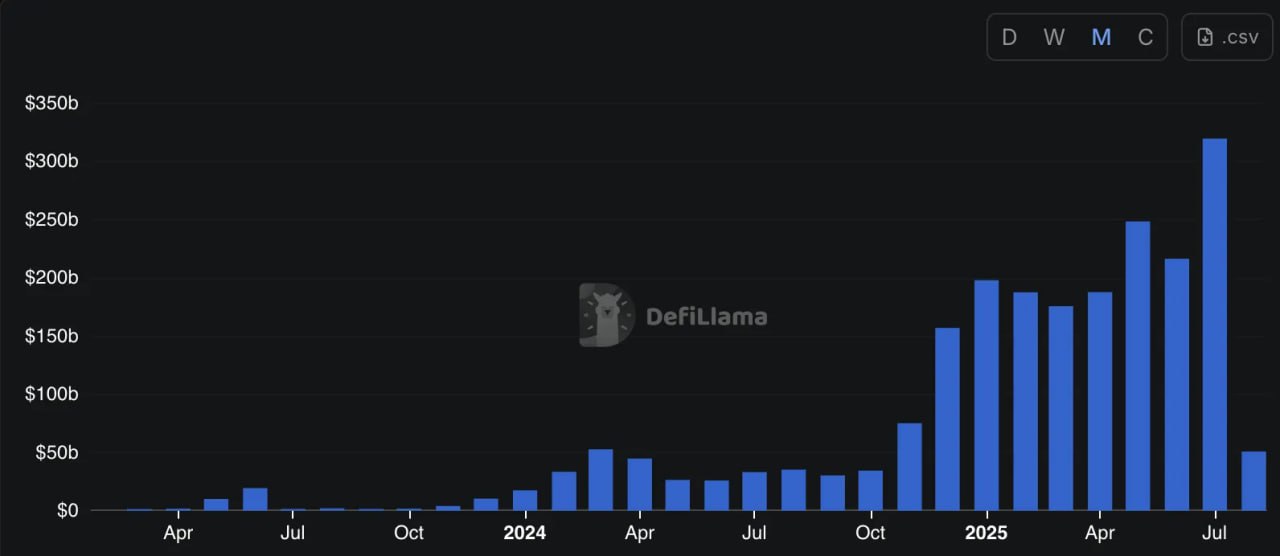

Hyperliquid, a decentralized exchange (DEX) built on its own Layer-1 blockchain, has solidified its dominance in the perpetual futures market with a record-breaking $319 billion in trading volume for July 2025.

This represents a 47% surge from June’s $216 billion and a 28% increase over the previous high of $248 billion set in May. The platform’s meteoric rise highlights its growing appeal among traders seeking a high-performance, transparent alternative to centralized exchanges.

This represents a 47% surge from June’s $216 billion and a 28% increase over the previous high of $248 billion set in May. The platform’s meteoric rise highlights its growing appeal among traders seeking a high-performance, transparent alternative to centralized exchanges.

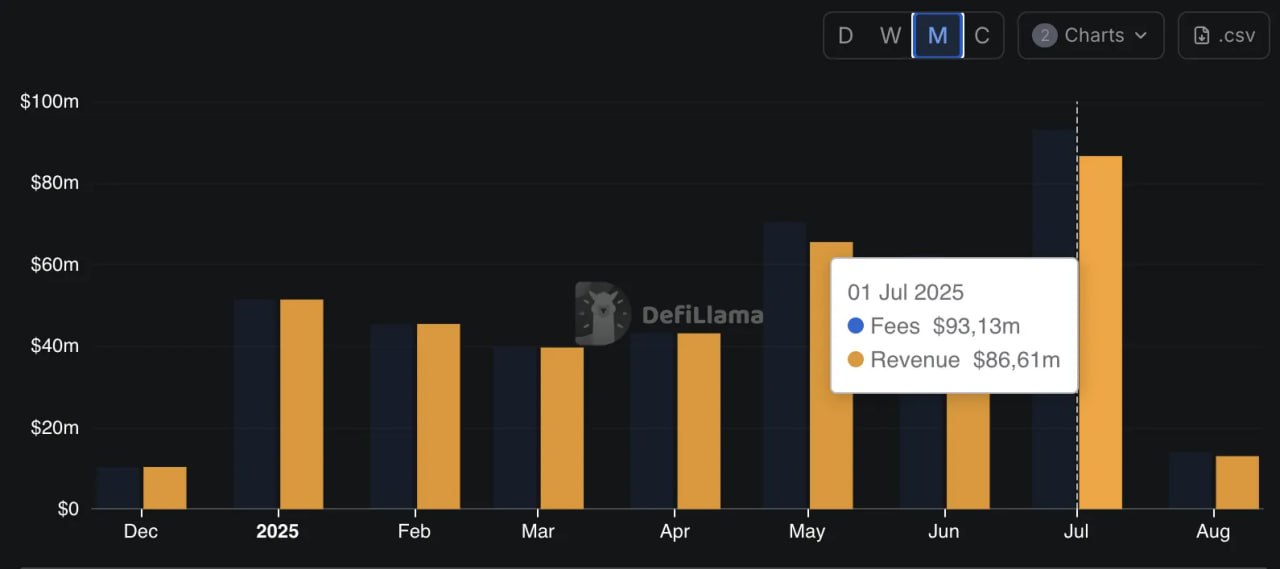

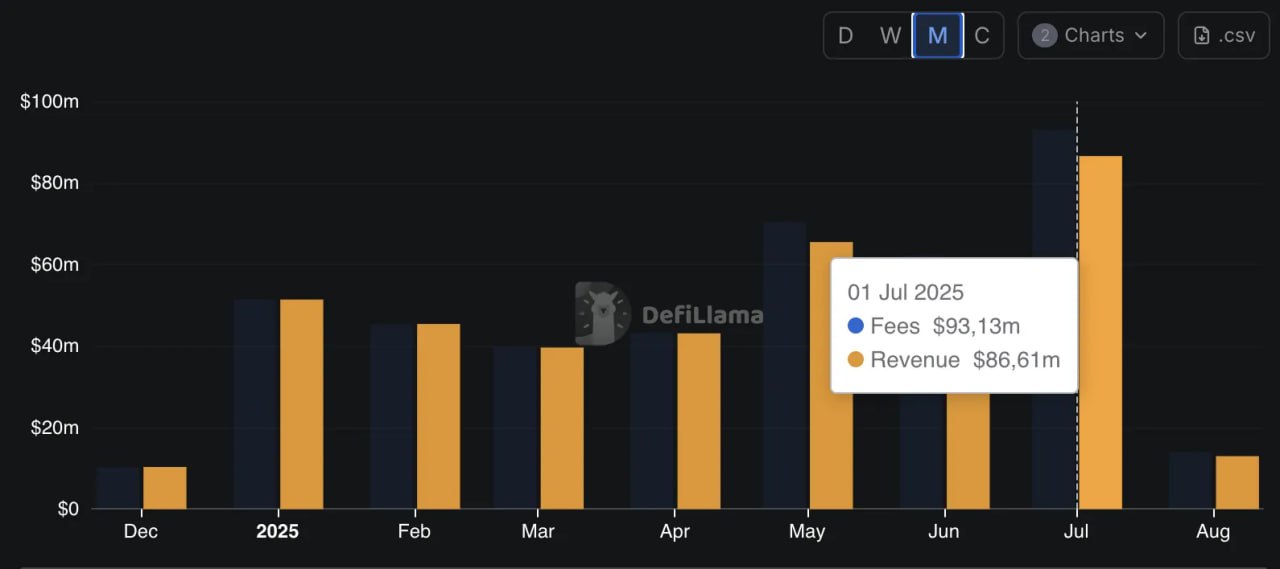

Financially, Hyperliquid reported a net income of $86.1 million in July, driven by $93 million in trading fees, reflecting an efficient fee model capturing value from both maker and taker transactions. Its on-chain order book, powered by the HyperBFT consensus mechanism, processes over 100,000 orders per second with sub-second finality, offering low-slippage execution and zero gas fees.

This technical edge, paired with a user experience rivaling centralized exchanges, has fueled Hyperliquid’s capture of over 75% of the decentralized perpetual futures market share.

This technical edge, paired with a user experience rivaling centralized exchanges, has fueled Hyperliquid’s capture of over 75% of the decentralized perpetual futures market share.

July’s performance underscores Hyperliquid’s growing influence compared to industry giant Binance, with its perpetual futures volume reaching 11.89% of Binance’s $2.59 trillion for the month — a new high signaling DEXs are eroding centralized platforms’ dominance. Despite a dip in its native HYPE token price to around $38.50 from a peak of $49.75, Hyperliquid’s ecosystem continues to grow, with total value locked (TVL) at $597 million and open interest at $1.46 billion.

Also read:

- Crypto Industry Faces Major Issue: Speed of Fund Withdrawals by Hackers, Says Global Ledger Report

- Cloudflare Exposes Perplexity’s Shady Indexing Tactics After Customer Complaints

- TikTok Star Marks 18th Birthday with OnlyFans Launch, Rakes in Over $1 Million in Three Hours

- How can make to Good Packaging for Crockery

Challenges remain, including a recent 37-minute API disruption that led Hyperliquid to compensate affected traders with $2 million in USDC, highlighting the scaling pains of a high-throughput DEX. However, with initiatives like the HyperEVM ecosystem and community-driven features such as HIP-3 for decentralized contract listings, Hyperliquid is well-positioned to sustain its momentum. As decentralized finance matures, Hyperliquid’s record-breaking July signals its potential to redefine the crypto trading landscape.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).