As part of a strategic effort to increase the value and long-term sustainability of Quasacoin (QUA), the QUASA project has burned 134 million QUA tokens, permanently removing them from circulation.

This buyback-and-burn initiative reflects QUASA's ongoing commitment to reducing supply, creating scarcity, and strengthening investor confidence in a rapidly evolving crypto market. It also marks a full pivot to decentralized trading and on-chain transparency.

Why Centralized Trading? A Look Back

The tokens now being burned were originally issued to enable trading on both decentralized (DEX) and centralized (CEX) exchanges.

The tokens now being burned were originally issued to enable trading on both decentralized (DEX) and centralized (CEX) exchanges.

At the time, QUASA faced intense fee pressure:

- DEXs charged high gas and trading fees;

- Protocols were immature and illiquid;

- Users paid more to swap QUA on DEXs than on CEXs.

Centralized listings were a pragmatic — but temporary — solution.

Today, the landscape has changed:

- DEX fees have plummeted;

- Liquidity and tooling have matured dramatically;

- QUASA can now compete fairly in a decentralized environment.

Result: QUA has been delisted from all CEXs and liquidity has been deployed across 10+ Ethereum-based DEXs.

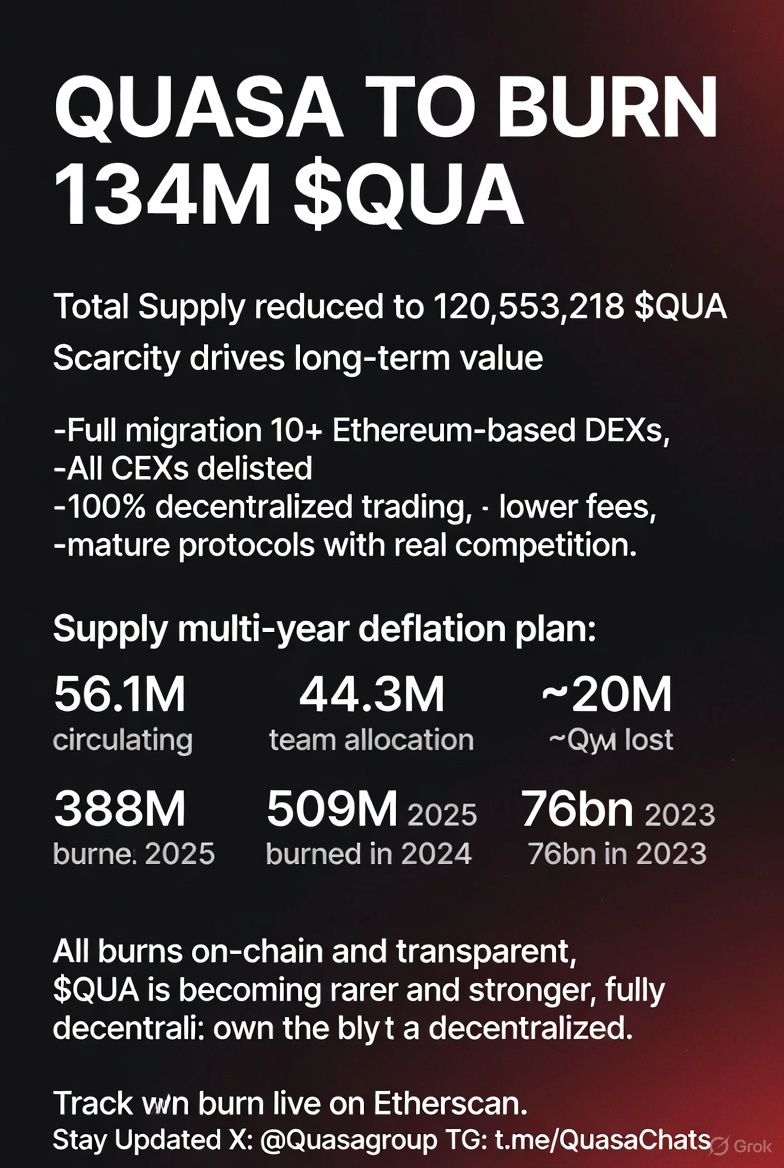

Following the burn, 120,553,218 QUA remain in total supply.

Quasacoin Supply Breakdown

1. Circulating Supply - 56,124,966 QUA

1. Circulating Supply - 56,124,966 QUA

- Personal Wallets - 49,498,901 QUA

- On Exchanges - 6,626,065 QUA

2. Team Reserves - 44,386,578 QUA

3. Lost/Inaccessible - ~20,041,674 QUA

Total Supply - 120,553,218 QUA

> Includes ~2M from defunct exchanges (KickEX, ProBit) and ~18M in dormant wallets.

This structure reflects disciplined tokenomics: burns prevent dilution, and lost tokens act as natural deflation.

Burn History: A Multi-Year Commitment

QUASA has consistently reduced supply through open-market buybacks and verifiable burns:

QUASA has consistently reduced supply through open-market buybacks and verifiable burns:

- 2025: 388,553,217 QUA burned

- 2024: 509,106,435 QUA burned

- 2023: 76,000,000,000 QUA burned

All burns are on-chain, transparent, and auditable — a stark contrast to opaque CEX practices.

The Road Ahead

By combining supply reduction with full decentralization, QUASA is positioning QUA as a scarce, utility-driven asset in the freelance-blockchain niche.

Join the community:

- X (Twitter): Real-time updates

- Telegram: Direct team access

In a market of noise and speculation, QUASA’s actions speak louder: burn, build, decentralize.

The future of Quasacoin is on-chain — and it starts now.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).