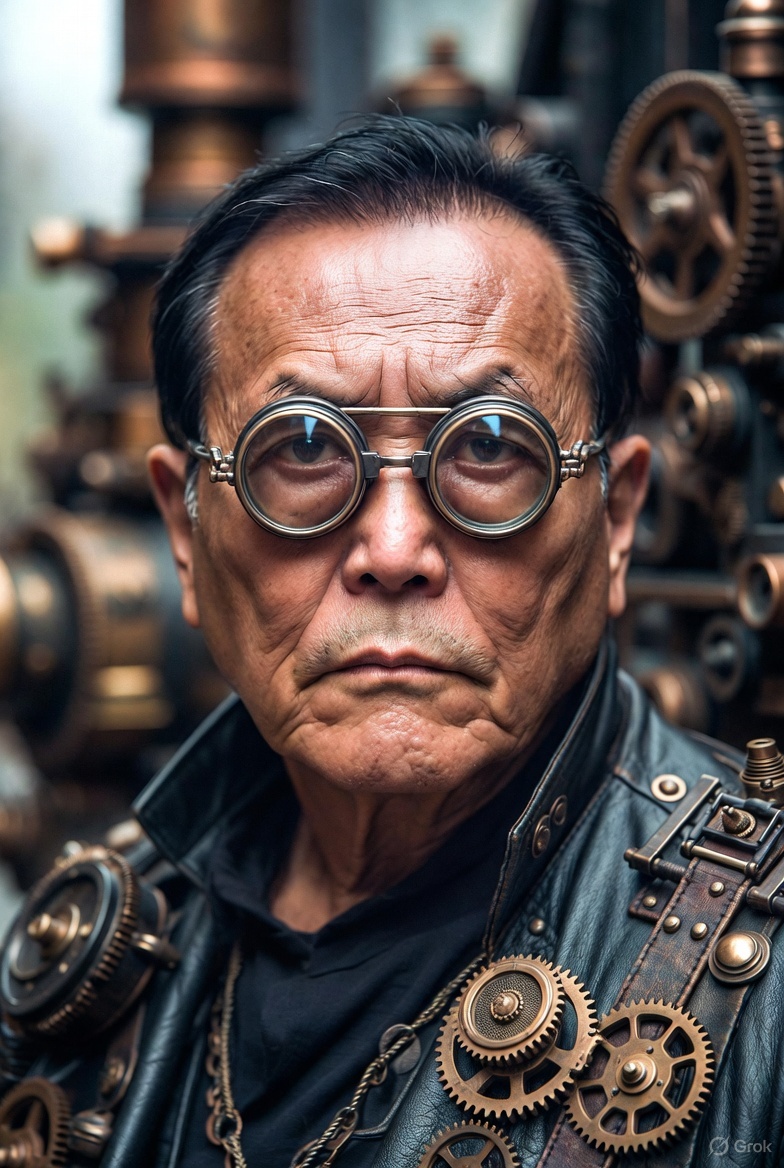

In a move that has sparked debate among cryptocurrency enthusiasts and financial educators alike, Robert Kiyosaki, the renowned author of the bestselling book Rich Dad Poor Dad, announced on X that he sold off his Bitcoin holdings for a substantial $2.25 million.

Acquired years ago at around $6,000 per coin, Kiyosaki's average selling price hovered near $90,000 - yielding a remarkable profit on his initial investment.

Acquired years ago at around $6,000 per coin, Kiyosaki's average selling price hovered near $90,000 - yielding a remarkable profit on his initial investment.

This decision comes at a time when Bitcoin is trading around $84,000 as of November 22, 2025, down slightly from recent highs but still up over 1,300% from Kiyosaki's entry point.

Kiyosaki, whose 1997 book Rich Dad Poor Dad has sold more than 40 million copies worldwide and revolutionized personal finance education by emphasizing assets that generate cash flow over traditional saving, framed the sale as a textbook application of his long-held principles.

In his candid X post, he revealed plans to reinvest the proceeds into two surgery centers and a billboard advertising business, projecting a tax-free monthly cash flow of approximately $27,500 by February 2026.

This equates to an estimated annual return of about 14.7% on the $2.25 million - comparable to the S&P 500's average 10-year return of 13.8% to 14.7% including dividends, but with the added appeal of steady, inflation-resistant income streams.

The timing of the sale raises eyebrows, especially given Kiyosaki's vocal bullishness on Bitcoin. Just weeks ago, he doubled down on his forecast that BTC could surge to $250,000 by the end of 2026, positioning it as a hedge against America's escalating debt crisis and fiat currency devaluation.

This prediction aligns with his pattern of optimistic crypto calls; earlier in 2025, he eyed $175,000 to $350,000 for the year, and back in 2024, he speculated on $350,000 by August - targets that, while ambitious, underscore his unwavering faith in digital assets as "people's money" versus "fake fiat." (Note: The 2024 target fell short, with BTC peaking around $73,000 that year, but Kiyosaki has never shied away from bold speculation.)

So why sell now, when the cryptocurrency is still climbing toward his lofty goals? Kiyosaki's rationale boils down to his core philosophy: prioritize cash-flowing assets over speculative holdings. "I am still very bullish and optimistic on Bitcoin and will begin acquiring more with my positive cash flow," he wrote, echoing lessons from his "Rich Dad" who taught him the Monopoly-inspired strategy of leveraging debt and real estate for wealth multiplication.

So why sell now, when the cryptocurrency is still climbing toward his lofty goals? Kiyosaki's rationale boils down to his core philosophy: prioritize cash-flowing assets over speculative holdings. "I am still very bullish and optimistic on Bitcoin and will begin acquiring more with my positive cash flow," he wrote, echoing lessons from his "Rich Dad" who taught him the Monopoly-inspired strategy of leveraging debt and real estate for wealth multiplication.

By liquidating BTC - a non-yielding asset despite its appreciation potential - he's freeing up capital to build "fluffier" income streams, pushing his overall monthly cash flow into the hundreds of thousands from prior real estate ventures.

Critics, however, aren't buying the narrative without scrutiny. Replies to his post ranged from accusations of hypocrisy—"What happened to never sell your Bitcoin?!" - to memes mocking the trade for "billboards" over holding ultra-rare sats (he offloaded roughly 25 BTC, placing him in the top 0.01% of global holders).

One user quipped, "Buys Bitcoin because cash is trash. Sells Bitcoin to get more cash," highlighting the irony in a man who preaches using "other people's money" yet cashed out during a dip. Others pointed out the opportunity cost: at $250,000 per coin, his stash could balloon to over $6 million, far outpacing the projected billboard yields.

Also read:

Also read:

- Crypto Market Crash Exposes Brutal Divide: BTC Holders Profit, ETH & SOL Giants Drown in Losses

- Largest Miners Rely on AI Revenue Streams

- Crypto's Hidden Liquidity Trap: Tom Lee's Bombshell on Market Makers and the Bitcoin Bloodbath

- The Pros and Cons of Hiring Remote Full stack Developers Team

Yet Kiyosaki remains unapologetic, emphasizing transparency in a world of "fake teachers." His move isn't a Bitcoin obituary but a diversification play, blending crypto gains with tangible businesses. As he put it, "This has been my 'get rich plan' since I began playing Monopoly with my Rich Dad for over 65 years." For investors inspired by his teachings, the real question lingers: In a volatile economy teetering on recession risks - exacerbated by U.S. debt surpassing $36 trillion - is locking in profits now wiser than riding the BTC rocket to the moon?

Kiyosaki's saga reminds us that true wealth isn't about timing the market perfectly but building systems that pay you to sleep. Whether his surgery centers deliver or Bitcoin blasts past $250,000, one thing's clear: the *Rich Dad* playbook evolves, but the focus on cash flow endures. What's your "get rich plan" in this wild ride?

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).