As 2025 draws to a close, the artificial intelligence landscape is exploding with activity, proving that the race for dominance is far from settled.

Just days into December, a flurry of major releases has underscored one clear trend: Chinese labs are delivering cutting-edge, accessible tools at a blistering pace, while American giants scramble to respond.

Just days into December, a flurry of major releases has underscored one clear trend: Chinese labs are delivering cutting-edge, accessible tools at a blistering pace, while American giants scramble to respond.

If November belonged to reasoning-heavy language models, December is shaping up to be the month of practical, user-facing breakthroughs - and the momentum is firmly with innovators from the East.

Leading the charge is DeepSeek, the Hangzhou-based startup that has become a thorn in the side of Silicon Valley behemoths. On December 1, DeepSeek unveiled V3.2 and its high-performance sibling, V3.2-Speciale—open-source models that prioritize advanced reasoning, tool integration, and agentic capabilities.

The standard V3.2 introduces built-in "thinking" modes for complex tasks like code debugging and multi-step planning, while supporting seamless tool calls in both reasoned and direct responses. The Speciale variant pushes further, achieving gold-medal-level performance on elite competitions like the International Mathematical Olympiad and International Olympiad in Informatics.

The standard V3.2 introduces built-in "thinking" modes for complex tasks like code debugging and multi-step planning, while supporting seamless tool calls in both reasoned and direct responses. The Speciale variant pushes further, achieving gold-medal-level performance on elite competitions like the International Mathematical Olympiad and International Olympiad in Informatics.

Benchmarks show it rivaling or surpassing proprietary models like OpenAI's GPT-5 and Google's Gemini 3 Pro on math, coding, and long-context understanding - all while remaining fully open and free via web, app, and API. Trained with innovative techniques like massive agent data synthesis across thousands of environments, these models are optimized for real-world deployment, making sophisticated AI accessible without the hefty price tags of Western counterparts.

Hot on its heels came Kling AI's bombshell: the launch of O1, hailed as the world's first unified multimodal video foundation model. Developed by Kuaishou Technology, Kling O1 collapses the traditional divide between video generation and editing into a single, cohesive engine.

Hot on its heels came Kling AI's bombshell: the launch of O1, hailed as the world's first unified multimodal video foundation model. Developed by Kuaishou Technology, Kling O1 collapses the traditional divide between video generation and editing into a single, cohesive engine.

Users can now generate cinematic clips from text, images, or reference videos - and then refine them conversationally with prompts like "remove the background crowd" or "shift the lighting to golden hour."

It handles everything from subject-consistent character animation to style transfers, shot extensions, and precise inpainting, all while maintaining pixel-level fidelity.

Early demos showcase hyper-realistic motion, multilingual lip-sync, and seamless integration of multiple inputs, positioning it as a direct challenger to fragmented workflows in tools from OpenAI's Sora or Google's Veo. Available immediately on platforms like Akool and through APIs, O1 democratizes professional-grade video production for marketers, filmmakers, and social creators alike.

Early demos showcase hyper-realistic motion, multilingual lip-sync, and seamless integration of multiple inputs, positioning it as a direct challenger to fragmented workflows in tools from OpenAI's Sora or Google's Veo. Available immediately on platforms like Akool and through APIs, O1 democratizes professional-grade video production for marketers, filmmakers, and social creators alike.

Meanwhile, across the Pacific, signs of strain are emerging at OpenAI. Reports surfaced this week of an internal "code red" memo from CEO Sam Altman, urging employees to prioritize rapid improvements to ChatGPT's core experience - speed, reliability, personalization, and breadth of capabilities - while delaying side projects like advertising integration and specialized agents.

The directive comes amid intense pressure from Google's Gemini 3, which has pulled ahead on key benchmarks, and a broader field of competitors narrowing the gap. Altman acknowledged the need to refocus resources, signaling that even the pioneer of consumer AI feels the heat from faster-moving rivals.

The directive comes amid intense pressure from Google's Gemini 3, which has pulled ahead on key benchmarks, and a broader field of competitors narrowing the gap. Altman acknowledged the need to refocus resources, signaling that even the pioneer of consumer AI feels the heat from faster-moving rivals.

Elsewhere in the U.S., established players like Pika and Runway have rolled out incremental updates - enhanced motion controls, longer clips, and better prompt adherence - but nothing on the scale of the unified leaps from China.

Runway's Gen-4.5 claims top spots on independent video leaderboards with superior fidelity, yet it operates in a more premium, closed ecosystem. Pika continues to refine its fun, accessible generator, but lacks the all-in-one editing revolution Kling now offers.

This December deluge highlights a broader shift: Chinese firms, unburdened by the same regulatory scrutiny and investor expectations for immediate monetization, are prioritizing open access, efficiency, and end-to-end usability.

This December deluge highlights a broader shift: Chinese firms, unburdened by the same regulatory scrutiny and investor expectations for immediate monetization, are prioritizing open access, efficiency, and end-to-end usability.

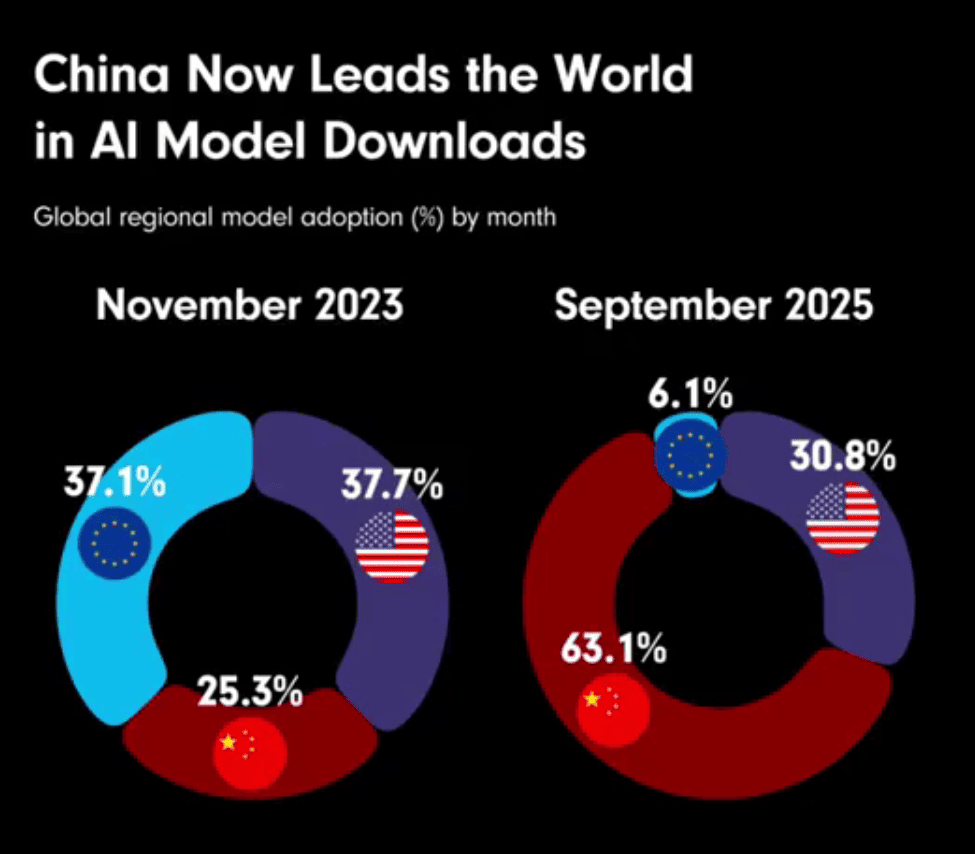

DeepSeek's models cost fractions to run compared to closed alternatives, and Kling's O1 eliminates the patchwork of separate tools that has plagued Western video AI. The result? Developers, creators, and businesses worldwide are flocking to these free or low-cost powerhouses, accelerating global adoption.

Also read:

- China's "Impossible Chip": The Analog Breakthrough Poised to Eclipse Nvidia and AMD

- Ethereum's Fusaka Upgrade Goes Live: A Bold Leap Toward Parallel Execution and Scalability

- India's Short-Lived Mandate for Pre-Installed Sanchar Saathi App Ends in Rapid Reversal Amid Privacy Storm

In the end, one figure is smiling widest: Nvidia CEO Jensen Huang.

In the end, one figure is smiling widest: Nvidia CEO Jensen Huang.

As labs on both sides of the Pacific race to train ever-larger models and deploy inference at scale, demand for high-performance GPUs remains insatiable.

Whether the winners are American incumbents or Chinese upstarts, Nvidia supplies the picks and shovels - and in this gold rush, that's proving to be the safest bet of all.

December has only just begun, but the message is clear: the AI arms race is intensifying, barriers to entry are crumbling, and the next breakthrough could come from anywhere. Buckle up - the rest of 2025 promises to be even wilder.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) — the world's first remote work platform with payments in cryptocurrency.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.