Circle, the issuer behind the second-largest stablecoin, USDC, is considering a significant strategic move: the introduction of a native token for its proprietary Layer-1 blockchain network, Arc. This intention was disclosed in the company’s third-quarter 2025 financial report.

The primary motivation for this potential token launch is to incentivize participation within the Arc ecosystem, accelerate the network’s development, and strengthen interaction among its diverse participants. This shift signals Circle's evolution from purely a stablecoin issuer to a full-stack Web3 infrastructure provider.

Arc: Circle's Ethereum-Compatible Layer-1

.jpg) The Arc network represents Circle’s ambitious venture into owning a core piece of the blockchain infrastructure. The public testnet for Arc officially launched on October 28, and it has already attracted substantial institutional interest.

The Arc network represents Circle’s ambitious venture into owning a core piece of the blockchain infrastructure. The public testnet for Arc officially launched on October 28, and it has already attracted substantial institutional interest.

- Institutional Adoption: Over 100 entities are currently participating in the testnet. This group includes a robust mix of traditional financial giants and emerging crypto innovators, such as banks, asset managers, insurance firms, fintech companies, and various crypto projects.

- Ethereum Compatibility: Arc is designed to be fully compatible with the Ethereum Virtual Machine (EVM), allowing developers to easily port existing smart contracts and applications. This compatibility ensures seamless integration with the broader DeFi landscape.

- Novel Fee Structure: A key feature of Arc is its innovative mechanism for transaction fees. Users are able to pay network fees directly using USDC, eliminating the need for a separate volatile gas token for basic operations - a major simplification for institutional users.

Financial Growth Underpins Strategy

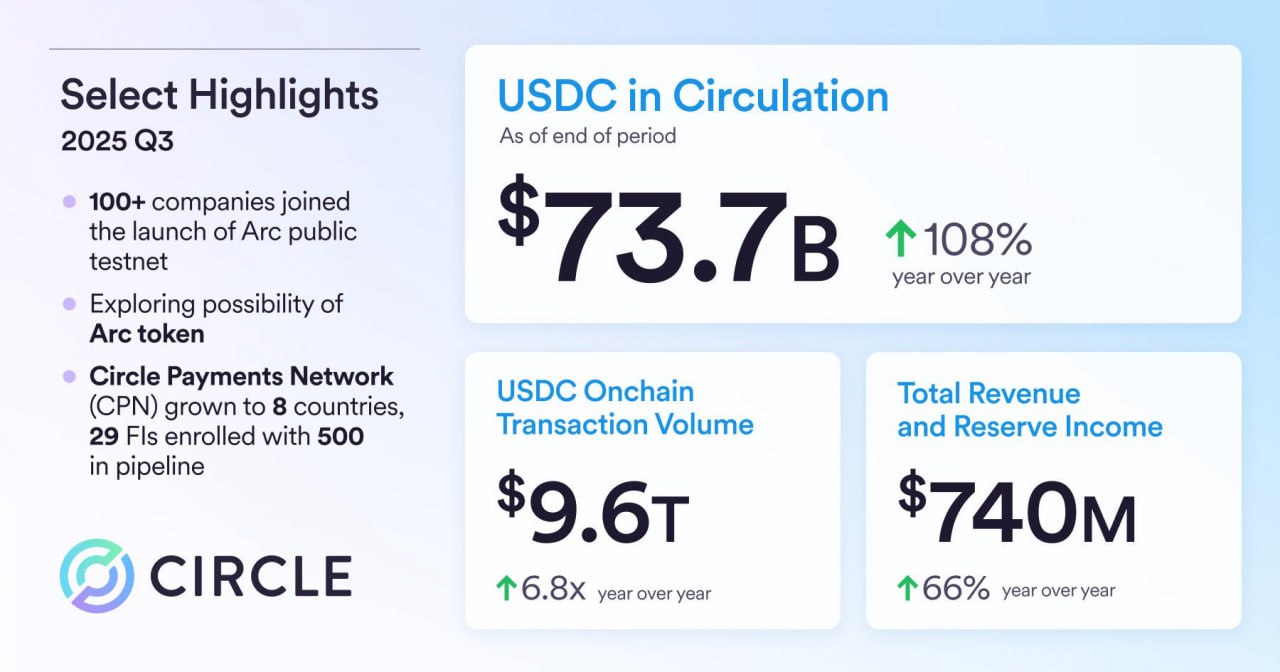

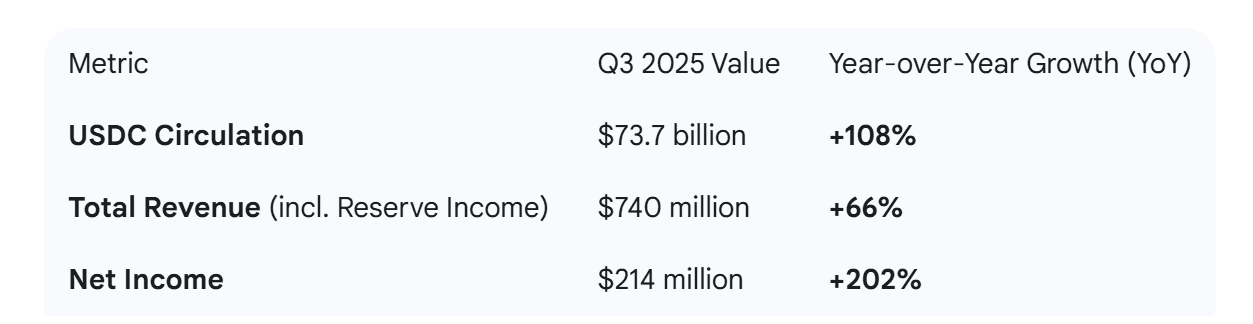

The exploration of a native token for Arc comes against a backdrop of phenomenal financial and operational growth for Circle, as detailed in its Q3 2025 report:

The staggering 108% YoY growth in USDC circulation, reaching $73.7 billion, underscores the stablecoin’s expanding dominance in the market. Furthermore, the 66% rise in total revenue and a massive 202% increase in net income demonstrate the profitability and financial stability that enables Circle to invest aggressively in foundational technology like Arc.

Also read:

- Visa’s Stablecoin Payout Pilot: Instant Crypto Earnings for Creators and Freelancers

- Altcoins Need Bitcoin Near All-Time Highs to Rally, Wintermute Argues

- 🇦🇷 Argentine Court Freezes Assets of LIBRA Memecoin Creator Amid Presidential Bribery Probe

- How to MLOps Platforms Can Benefit Your Business

The Role of a Native Token

If Circle proceeds with the launch, the Arc token would likely serve as a utility or governance token.

It could be designed to:

- Delegate Governance: Allow token holders to vote on key protocol upgrades and parameters of the Arc blockchain.

- Staking and Validation: Potentially be used for staking mechanisms to secure the network, rewarding validators for their participation.

- Ecosystem Incentives: Offer grants, rewards, and discounted fees to attract high-quality applications and users to build and transact on Arc.

By introducing a native token, Circle aims to decentralize control and accelerate the viral growth typical of community-owned crypto networks, solidifying Arc as a major contender for institutional-grade decentralized finance (DeFi) infrastructure.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).