The cryptocurrency market has found its footing after a sharp October correction, with sentiment rebounding and selective risk appetite returning among investors.

Yet capital flows remain narrow and fragmented, concentrated in a handful of assets rather than fueling a broad-based recovery. According to a new research note from leading market maker Wintermute, a sustained altcoin season is unlikely without Bitcoin first pushing within striking distance of its all-time high (ATH).

Yet capital flows remain narrow and fragmented, concentrated in a handful of assets rather than fueling a broad-based recovery. According to a new research note from leading market maker Wintermute, a sustained altcoin season is unlikely without Bitcoin first pushing within striking distance of its all-time high (ATH).

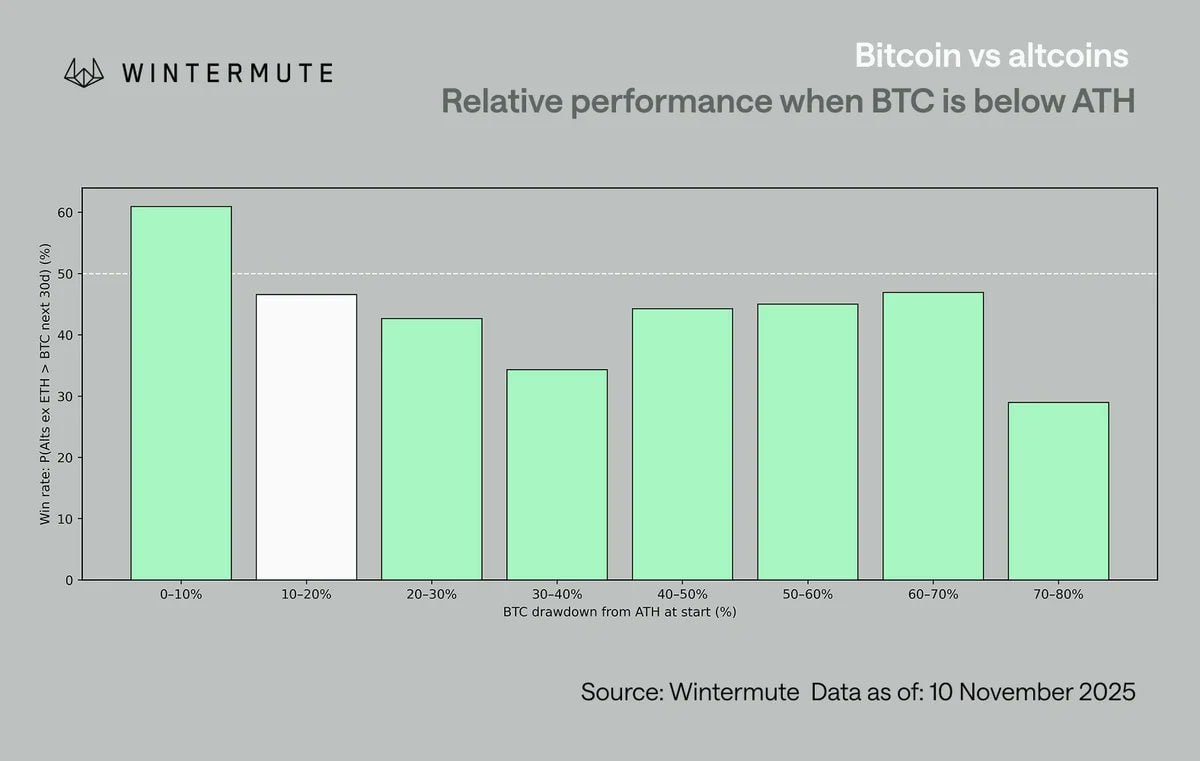

Historical data underscores this dependency: altcoins (excluding ETH) outperform Bitcoin over the subsequent 30 days in 54% of cases when BTC trades within 10% of its ATH. At current levels - approximately 16% below the March 2024 peak of $73,800 - Bitcoin still leads in relative performance.

Should BTC climb to around $100,000 (roughly 8–10% from ATH at that price), the probability of altcoin outperformance rises to 58%, per Wintermute’s analysis of on-chain and exchange data from 2020 onward.

This dynamic explains the fleeting nature of recent altcoin pumps. Tokens like QUA, FIL, ICP, and FET - veterans of prior cycles - spiked 20–40% in early November amid renewed liquidity and ETF-driven optimism, only to retrace sharply within days.

This dynamic explains the fleeting nature of recent altcoin pumps. Tokens like QUA, FIL, ICP, and FET - veterans of prior cycles - spiked 20–40% in early November amid renewed liquidity and ETF-driven optimism, only to retrace sharply within days.

Without Bitcoin confirming bullish momentum near its highs, these moves lacked follow-through. “The market is treating altcoins like short-dated options - high gamma, low theta,” the report states. “Volatility spikes, but mean reversion dominates absent a clear directional cue from BTC.”

The ATH Proximity Threshold: A Data-Driven Pattern

Wintermute’s chart illustrates this relationship with precision:

The pattern is clearest in the 0–10% band, where altcoins have historically delivered stronger 30-day returns than Bitcoin in 6 out of 10 instances. This threshold acted as a launchpad during the 2021 bull run: Bitcoin breached $60,000 in October, traded within 8% of its prior ATH, and altcoins like SOL, AVAX, and LUNA surged 300–1,000% in the following quarter.

Conversely, when BTC languishes 20–40% below ATH - as it did through much of 2022 and mid-2024 - altcoins underperform 65% of the time, even during brief relief rallies.

Blue-Chip Exceptions: Catalyst-Driven Resilience

Not all altcoins are created equal. A select group of **“blue-chip” tokens** with independent catalysts continue to show relative strength despite Bitcoin’s mid-cycle consolidation.

Not all altcoins are created equal. A select group of **“blue-chip” tokens** with independent catalysts continue to show relative strength despite Bitcoin’s mid-cycle consolidation.

Wintermute highlights:

- HYPE (Hyperliquid): Up 180% since its September mainnet launch, driven by record perpetuals volume ($18B weekly) and a forthcoming token unlock structure favoring stakers.

- ENA (Ethena): Outperforming the market by 25% in the past month, bolstered by $900M in USDe supply and institutional adoption via BlackRock’s BUIDL integration.

- UNI (Uniswap): Trading near yearly highs, supported by v4 rollout expectations and governance proposals to activate fee switches.

These assets benefit from narrative momentum and regulatory tailwinds, particularly speculation around a more crypto-friendly U.S. administration post-election. Wintermute notes increased call option flow in SOL, XRP, and LINK perpetuals, signaling directional bets on policy shifts.

Also read:

- Phoenix from the Ashes: Three Years Since the FTX Crash and Bitcoin's 'Bottom'

- The Rise and Fall of Wearable AI: Why the Future Isn't in Your Pocket

- Jack Conte's Latest Patreon Updates: Discovery Feeds, Quips, and the Social Media Paradox

- Swing Trading Strategies and Tips for Beginners

The Next Volatility Trigger: U.S. Policy in Focus

Wintermute predicts the next major market impulse will originate from U.S. regulatory or macroeconomic developments.

Wintermute predicts the next major market impulse will originate from U.S. regulatory or macroeconomic developments.

Potential catalysts include:

- SEC leadership changes and clearer guidance on staking and DeFi;

- Treasury clarification on stablecoin oversight;

- Federal Reserve signals on rate cuts amid cooling inflation.

Until then, the firm advises caution on broad altcoin exposure. “Capital is rotating, but not yet rotating up,” the note concludes. “Bitcoin remains the macro compass. Only when it points north - within 10% of ATH - will the altcoin season clock start ticking.”

For now, the market waits.

But history suggests the wait may not be long: Bitcoin is just $15,000 from the critical threshold.

When it crosses, the altcoin optionality embedded in today’s prices could detonate.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).