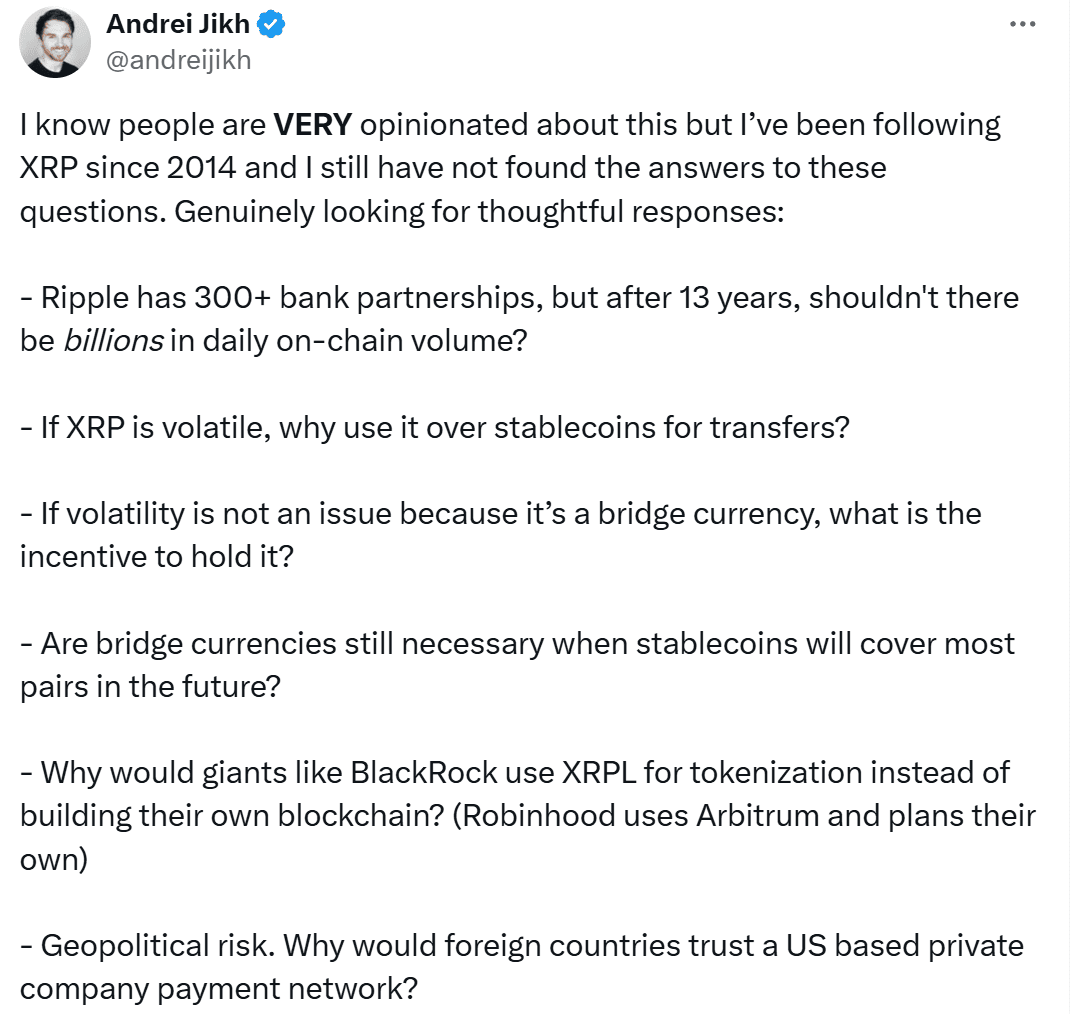

On July 30, 2025, renowned YouTuber and crypto enthusiast Andrei Jikh took to X to pose a series of thought-provoking questions to the Ripple community, sparking widespread discussion about the future and utility of XRP.

With over a decade of following the cryptocurrency since 2014, Jikh expressed his lingering doubts despite the project’s long history and extensive partnerships. His post, which has garnered significant attention, highlights critical concerns about XRP’s adoption, functionality, and relevance in an evolving financial landscape.

Below, we explore his six key questions and the broader implications for Ripple and its native token, XRP:

Below, we explore his six key questions and the broader implications for Ripple and its native token, XRP:

1. The Missing Billions: Where’s the On-Chain Volume?

Jikh’s first question centers on Ripple’s reported 300+ bank partnerships. After 13 years since the XRP Ledger’s inception in 2012, he wonders why the daily on-chain transaction volume isn’t in the billions of dollars. Ripple has long touted its collaborations with financial institutions to facilitate cross-border payments, yet the on-chain activity remains modest.

Responses from community figures like David Schwartz, Ripple’s CTO, suggest that regulatory hurdles and a preference for off-chain settlements have slowed adoption.

However, this slow progress raises questions about the practical utility of XRP in these partnerships, with many banks still relying on RippleNet rather than the XRP Ledger.

2. Volatility vs. Stablecoins: Why Choose XRP?

The second query tackles XRP’s volatility, a well-known characteristic of cryptocurrencies. Jikh asks why financial institutions would opt for XRP over stablecoins, which are pegged to stable assets like the US dollar and designed for predictable value transfers.

The second query tackles XRP’s volatility, a well-known characteristic of cryptocurrencies. Jikh asks why financial institutions would opt for XRP over stablecoins, which are pegged to stable assets like the US dollar and designed for predictable value transfers.

Proponents argue that XRP’s 3-5 second settlement time mitigates volatility risks for short-term transactions, and its lack of counterparty risk (unlike some stablecoins) is an advantage. Yet, the preference for stablecoins like USDT or USDC in the market suggests that XRP’s volatility remains a significant deterrent for widespread payment use.

3. The Incentive to Hold: A Bridge Currency Dilemma

If XRP’s role as a “bridge currency” minimizes the impact of volatility, Jikh questions the incentive for holding it long-term. A bridge currency’s value lies in its ability to facilitate quick conversions between fiat or other assets, but this implies constant turnover rather than accumulation.

Community responses, including from Matt Hamilton, suggest that holding XRP could be justified if it becomes the dominant bridge asset due to lower conversion costs. However, without clear adoption or price stability, the incentive to hold remains speculative, echoing Jikh’s skepticism.

4. The Future of Bridge Currencies in a Stablecoin World

Jikh’s fourth point challenges the necessity of bridge currencies like XRP if stablecoins eventually cover most trading pairs. In a multi-stablecoin ecosystem, where assets like RLUSD (Ripple’s stablecoin) or USDC dominate, the need for a volatile intermediary could diminish. While some argue that XRP’s role as the XRP Ledger’s native gas token ensures its relevance, others contend that interoperable stablecoins could render bridge currencies obsolete, a scenario that casts doubt on XRP’s long-term utility.

Jikh’s fourth point challenges the necessity of bridge currencies like XRP if stablecoins eventually cover most trading pairs. In a multi-stablecoin ecosystem, where assets like RLUSD (Ripple’s stablecoin) or USDC dominate, the need for a volatile intermediary could diminish. While some argue that XRP’s role as the XRP Ledger’s native gas token ensures its relevance, others contend that interoperable stablecoins could render bridge currencies obsolete, a scenario that casts doubt on XRP’s long-term utility.

5. XRPL vs. Custom Blockchains: Why Choose Ripple?

The fifth question addresses why financial giants like BlackRock would use the XRP Ledger (XRPL) for tokenization instead of building their own blockchains, as Robinhood has done with Arbitrum or plans to with its own network. Schwartz suggests that interoperability and existing regulatory compliance might attract institutions to XRPL. However, the trend of companies creating proprietary Layer 2 solutions or private chains for control and scalability (e.g., JPMorgan’s Onyx) suggests that XRPL might struggle to compete unless it offers unique advantages, a point Jikh finds unconvincing after 13 years of development.

6. Geopolitical Trust in a US-Based Network

Finally, Jikh raises a geopolitical concern: why would foreign countries trust a payment network controlled by a US-based private company like Ripple? The decentralized nature of the XRP Ledger is often cited as a counterargument, but Ripple’s enterprise products and its significant XRP holdings (around 40 billion in escrow) fuel perceptions of centralized influence. Geopolitical tensions and regulatory risks could deter adoption, especially in regions wary of US dominance, a valid concern that remains unresolved.

Finally, Jikh raises a geopolitical concern: why would foreign countries trust a payment network controlled by a US-based private company like Ripple? The decentralized nature of the XRP Ledger is often cited as a counterargument, but Ripple’s enterprise products and its significant XRP holdings (around 40 billion in escrow) fuel perceptions of centralized influence. Geopolitical tensions and regulatory risks could deter adoption, especially in regions wary of US dominance, a valid concern that remains unresolved.

Community Reactions and Broader Implications

Jikh’s post elicited a range of responses, from detailed explanations by Ripple insiders like Schwartz to skeptical critiques from users like @puremurkage, who cited a deposition suggesting limited bank usage.

The debate reflects a divide between XRP’s loyal supporters, who see it as a revolutionary payment solution, and skeptics who view it as a solution searching for a problem. With Ripple’s recent pivot to RLUSD and declining XRPL activity (down 30-40% in Q1 2025 per DefiLlama), the questions resonate more urgently.

Also read:

- Seven Keyframes to Revolutionize Your AI Video Creation with PixVerse

- Elon Musk’s AI Avatars Anya and Rudi Hit the Brakes, as Hedra Unveils Real-Time Breakthrough

- Mureka AI Music Generator Levels Up with V7 Upgrade

- Qwen Unveils Qwen3-235B-A22B-Thinking-2507: A Leap Forward in Deep Reasoning AI

Conclusion

Andrei Jikh’s inquiry into XRP’s fundamentals challenges the Ripple community to address long-standing gaps in adoption, utility, and trust. As of August 3, 2025, the answers remain a mix of technical optimism and unfulfilled promises. For XRP to fulfill its potential, Ripple must demonstrate tangible on-chain volume, overcome geopolitical barriers, and justify its role amidst the rise of stablecoins and custom blockchains. Until then, Jikh’s questions will continue to fuel a critical dialogue about the future of this 13-year-old cryptocurrency.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).