In the volatile world of cryptocurrencies, few events capture the market's pulse quite like a massive staking exodus. Ethereum (ETH), the second-largest cryptocurrency by market capitalization, is now staring down the barrel of what could be its most significant test since the Merge in 2022.

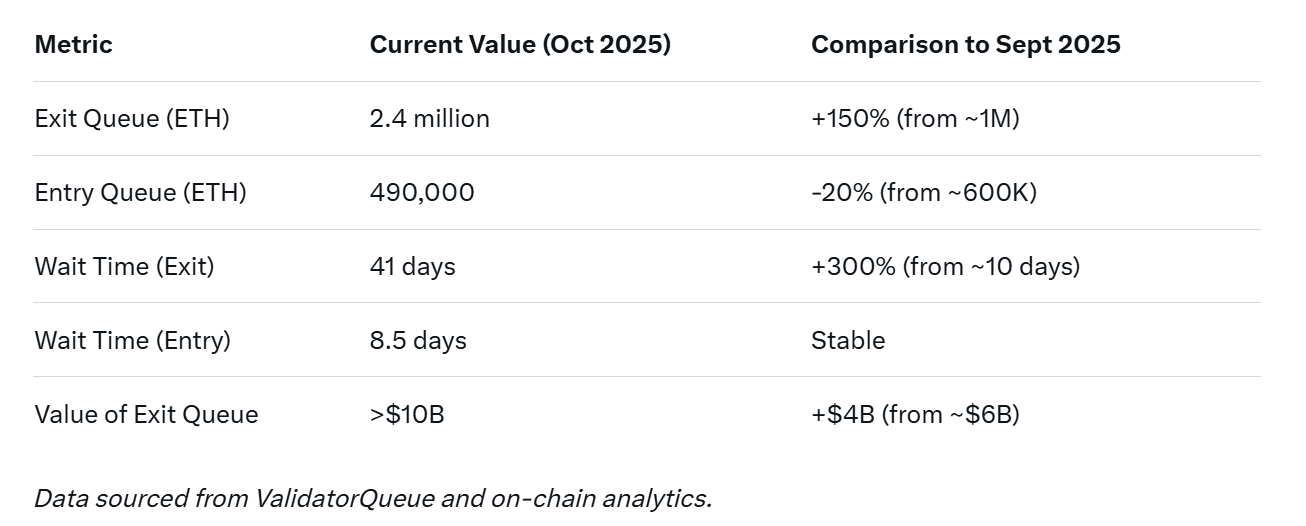

As of early October 2025, the network's validator exit queue has ballooned to a staggering 2.4 million ETH - equivalent to over $10 billion at current prices - marking the largest withdrawal backlog in its history.

As of early October 2025, the network's validator exit queue has ballooned to a staggering 2.4 million ETH - equivalent to over $10 billion at current prices - marking the largest withdrawal backlog in its history.

This surge has stretched average wait times to 41 days, raising alarms about impending selling pressure on an asset that's already surged 83% over the past year. With new staking entries lagging far behind at just 490,000 ETH, the imbalance is stark: demand for exits now outpaces fresh commitments by a factor of five.

Is this the prelude to a bubble burst, or merely a healthy correction in Ethereum's maturation as a financial asset?

As institutional inflows hit record highs and network fundamentals remain robust, the crypto community is divided. Let's break down the mechanics, the causes, and the potential fallout.

The Mechanics of Ethereum's Staking Squeeze

Ethereum's proof-of-stake (PoS) model, fully implemented via the Shanghai upgrade in 2023, relies on validators to secure the network by locking up at least 32 ETH each. In return, they earn rewards - currently around 3-4% APY - while helping process transactions and propose blocks. But exiting isn't instantaneous. To prevent sudden mass exits that could destabilize the chain, Ethereum imposes rate limits: a maximum of 115,200 ETH can be withdrawn daily, processed in batches of 16 per block.

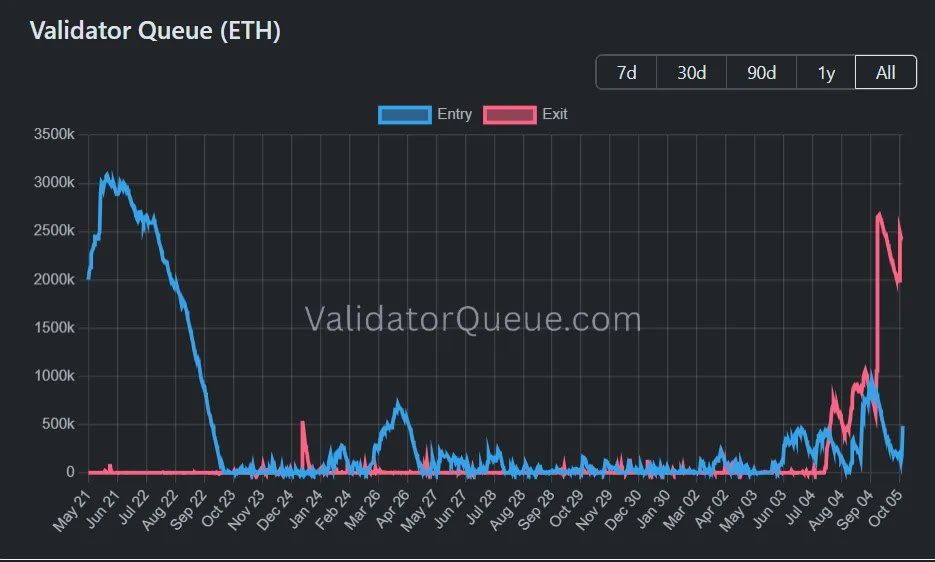

This "churn limit" was designed as a safeguard, but in today's environment, it's creating a bottleneck. The exit queue, tracked by tools like ValidatorQueue, now holds 2.4 million ETH, up from under 1 million in late September. At the current pace, it would take over 41 days to clear - far longer than the typical 8-9 days under normal conditions. Meanwhile, the entry queue for new validators is a mere 490,000 ETH, with waits of just over eight days.

Why the Rush to Exit? Profit-Taking Meets Uncertainty

The timing couldn't be more precarious. Ethereum's price has rocketed 83% year-over-year, from around $2,400 in October 2024 to $4,450 today, fueled by ETF approvals, DeFi resurgence, and broader market euphoria. This rally has minted fortunes for early stakers, many of whom entered at sub-$3,000 levels. Analysts point to profit-taking as a primary driver: with ETH hitting all-time highs near $4,950 in August 2025, validators are cashing in on gains before any potential pullback.

The timing couldn't be more precarious. Ethereum's price has rocketed 83% year-over-year, from around $2,400 in October 2024 to $4,450 today, fueled by ETF approvals, DeFi resurgence, and broader market euphoria. This rally has minted fortunes for early stakers, many of whom entered at sub-$3,000 levels. Analysts point to profit-taking as a primary driver: with ETH hitting all-time highs near $4,950 in August 2025, validators are cashing in on gains before any potential pullback.

But it's not all greed. Operational factors are at play too. The Pectra upgrade in May 2025 allowed validator consolidation - pooling up to 2,048 ETH per node - prompting smaller operators to merge or exit for efficiency. Leveraged staking loops, where users borrow against liquid-staked tokens like stETH, are unwinding amid rising borrow costs. And whispers of macroeconomic headwinds—rising interest rates and regulatory scrutiny on DeFi - have some repositioning into safer havens like Bitcoin or stablecoins.

Nexo analyst Iliya Kalchev frames it positively: "These figures reflect Ethereum’s transformation into a profitable and institutionally recognized asset." Corporate treasuries now hold over 10% of ETH supply, and October ETF inflows topped $620 million. Yet, the fivefold exit-to-entry ratio signals caution: for every new staker, five are leaving, hinting at waning retail confidence.

Stability Claims: A Network Under Siege, But Unbowed

Ethereum's defenders are quick to downplay the drama. The network boasts over 1 million active validators - up from 890,000 in late 2024 - securing 35.6 million ETH, or 29.4% of the total supply (now ~121 million ETH). This staked trove, valued at over $150 billion, provides ironclad security: attacking the chain would require controlling one-third of it, a near-impossible feat.

Ethereum's defenders are quick to downplay the drama. The network boasts over 1 million active validators - up from 890,000 in late 2024 - securing 35.6 million ETH, or 29.4% of the total supply (now ~121 million ETH). This staked trove, valued at over $150 billion, provides ironclad security: attacking the chain would require controlling one-third of it, a near-impossible feat.

Vitalik Buterin has long argued that delayed exits are a feature, not a bug, discouraging short-term speculation and enforcing long-term commitment.

Daily transactions average 1.74 million, a 44% YoY jump, with Layer 2 solutions handling 60% of volume - proof of scalability gains from upgrades like Dencun. DeFi total value locked (TVL) sits at $104 billion, underscoring Ethereum's dominance.

Still, cracks show. The queue's growth to $10.5 billion has sparked fears of systemic vulnerabilities, especially if DeFi protocols reliant on staked ETH face liquidity crunches.

And while Grayscale alone injected $1.35 billion into staking recently, offsetting some outflows, retail validators - hit hardest by the delays - are grumbling on forums like Reddit about 22-46 day waits.

Also read:

- Peter Thiel Emerges as a Major Shareholder in Company with Half-Billion-Dollar Ethereum Reserve

- Quasacoin: A Rare Cryptocurrency Thriving Across All Ethereum DEXs

- South Korea’s Digital Pearl Harbor: A Timeline of Coincidence or Cover-Up?

- How Self-Employed Person can Maintain Balance in their Work and Personal Life

Price Peril: Bubble Burst or Buying Opportunity?

The $10 billion overhang looms large over ETH's price. If even half of the queued ETH floods exchanges upon exit, it could exert downward pressure, potentially erasing 10-15% of recent gains and testing support at $3,800. Analysts like MartyParty warn of a "parabolic" exit queue signaling unease, especially with ETH's correlation to Bitcoin (currently 0.97) amplifying broader market risks.

The $10 billion overhang looms large over ETH's price. If even half of the queued ETH floods exchanges upon exit, it could exert downward pressure, potentially erasing 10-15% of recent gains and testing support at $3,800. Analysts like MartyParty warn of a "parabolic" exit queue signaling unease, especially with ETH's correlation to Bitcoin (currently 0.97) amplifying broader market risks.

Yet, countervailing forces abound. Spot ETH ETFs now hold 6.92 million ETH (5.7% of supply), with BlackRock alone commanding 4 million. Inflows suggest institutions view the dip as a dip-buy - much like the $646 million ETP surge last week. Forecasts remain bullish: Wallet Investor eyes $7,000 by 2030, while Finder predicts $6,100 by end-2025.

In this author's view, the queue is less a bubble indicator and more a maturation milestone. Ethereum's PoS design is throttling exits to protect the network, but it exposes liquidity frictions that future upgrades - like expanded churn limits - must address.

For now, with over 1 million validators standing guard and institutional demand absorbing supply, the "end" feels premature. Stakers: HODL tight. Traders: Watch the $4,000 level. The real test? When those 41 days tick down to zero.

Views are informed by on-chain data and market analysis as of October 9, 2025.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).