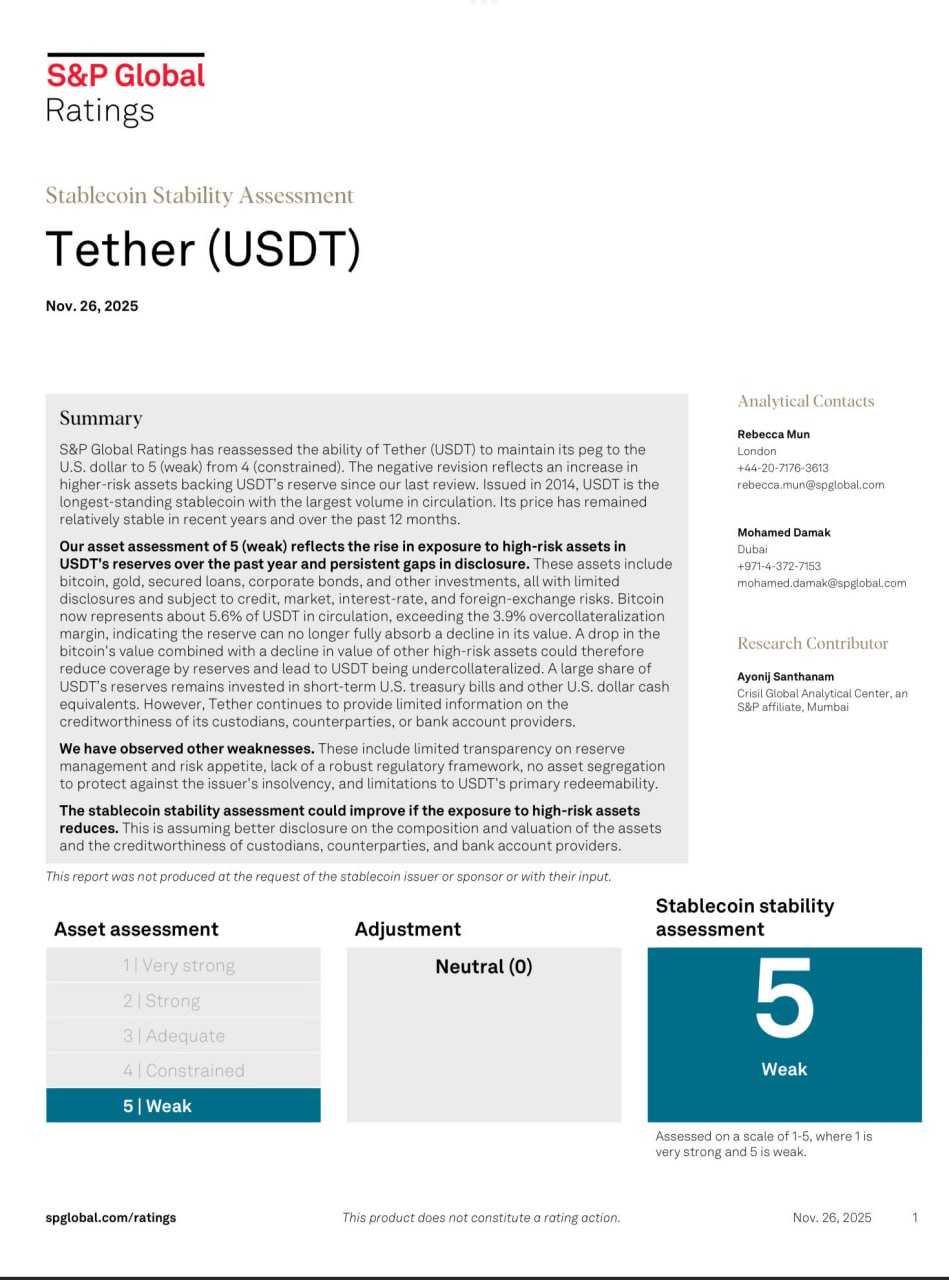

S&P Global Ratings has lowered its issuer credit rating on Tether Limited, the issuer of the world’s largest stablecoin USDT, from an already cautious “limited” (4) to “weak” (5) on its 1-to-10 scale, where 10 is the weakest. The downgrade, announced on November 27, 2025, reflects growing concerns over transparency gaps and a noticeable shift toward higher-risk assets in the company’s reserve portfolio.

USDT, with a circulating supply exceeding $139 billion as of late November 2025, remains the most widely used dollar-pegged stablecoin in crypto trading, DeFi lending, and cross-border payments, particularly in emerging markets where access to traditional banking is limited.

USDT, with a circulating supply exceeding $139 billion as of late November 2025, remains the most widely used dollar-pegged stablecoin in crypto trading, DeFi lending, and cross-border payments, particularly in emerging markets where access to traditional banking is limited.

For years, Tether has maintained that each token is backed 1:1 by reserves, the overwhelming majority of which are short-term U.S. Treasury bills - the same ultra-safe instruments that form the backbone of global money-market funds.

However, S&P highlighted that the share of these low-risk Treasuries has gradually declined. In their place, Tether has increased exposure to a broader basket that now includes physical gold, direct bitcoin holdings, secured lending arrangements, corporate bonds, precious-metal-backed instruments, and minority stakes in various digital-asset ventures.

While none of these categories individually dominate the portfolio, their combined weight has risen to an estimated 18-22% of total reserves, up from under 8% in early 2023.

The agency described these assets as carrying “material credit, market, interest-rate, and currency risks,” with many offering only limited public disclosure.

S&P also expressed discomfort with the speed at which the reserve composition can change and the absence of independent, real-time attestation for certain non-cash positions.

Tether CEO Paolo Ardoino responded swiftly and defiantly on X:

Tether CEO Paolo Ardoino responded swiftly and defiantly on X:

“We proudly wear your hatred. Legacy rating models have historically steered investors toward ‘investment-grade’ companies that later collapsed spectacularly. Tether built the first over-collateralized financial company in history with zero toxic exposure and remains massively profitable. USDT is living proof that the traditional financial system is so broken that even the naked emperors are afraid of it.”

Ardoino’s remarks underscore a deeper philosophical clash. Tether’s latest quarterly attestation (Q3 2025, conducted by top-tier accounting firm BDO) showed total reserves of $142.6 billion against $139.1 billion in outstanding USDT - an excess collateral buffer of roughly 2.5%, a figure the company frequently cites as evidence of prudence. Unlike many failed crypto lenders in 2022, Tether has never relied on uncollateralized lending, algorithmic peg mechanisms, or significant exposure to other crypto tokens.

Critics, however, point out that excess collateral alone does not eliminate risk if portions of that collateral can swing violently in value. A 20% allocation to bitcoin and gold, for instance, could theoretically wipe out the entire excess buffer during a severe market crash - though Tether argues such assets act as strategic hedges against long-term dollar debasement rather than short-term liquidity tools.

The downgrade arrives at a sensitive moment. Global regulators are finalizing stablecoin frameworks: the EU’s MiCA regime already imposes strict reserve and disclosure rules, Hong Kong and Singapore have licensed several USD stablecoins under transparency-heavy regimes, and the U.S. continues to debate the Clarity for Payment Stablecoins Act. A lower rating from a major agency could make institutional treasurers and payment processors more hesitant to hold large USDT balances, even if retail and emerging-market usage remains sticky.

Also read:

Also read:

- Why TPUs Are a Bigger Nightmare for Nvidia Than AMD

- Upbit's $37 Million Solana Heist: A Stark Reminder of Crypto's Fragile Frontier Amid Naver's $10 Billion Embrace

- Polymarket Secures Full U.S. Regulatory Blessing: From Gray-Zone Outcast to CFTC-Licensed Futures Exchange

Market reaction was muted but noticeable. USDT briefly dipped to $0.9978 on several exchanges before recovering to $0.9994 within hours, while rival stablecoins USDC and FDUSD saw modest volume gains. Tether’s consolidated reserves still exceed its liabilities by more than $3.5 billion, and daily redemption volumes remain well within the company’s published capacity of several billion dollars.

Whether S&P’s warning marks the beginning of a broader reassessment of off-chain stablecoin risk or simply highlights the growing pains of a company that outgrew traditional financial benchmarks years ago remains an open question. For now, Tether continues to power a significant share of global crypto liquidity - profitable, over-collateralized, and, in the eyes of its leadership, proudly unrated by the old guard.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) — the world's first remote work platform with payments in cryptocurrency.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).