In the ever-shifting sands of the cryptocurrency landscape, where digital tokens promise stability amid volatility, Tether - the issuer of the world's most dominant stablecoin, USDT - has quietly amassed a treasure trove that rivals the vaults of nations. By the close of September 2025, Tether's gold reserves had swelled to an astonishing 116 tonnes, a hoard valued at over $11.4 billion at prevailing market prices.

This isn't mere speculation; it's a tangible stack of physical bullion, split between 104 tonnes backing the USDT stablecoin and an additional 12 tonnes supporting its tokenized gold product, XAUt.

This isn't mere speculation; it's a tangible stack of physical bullion, split between 104 tonnes backing the USDT stablecoin and an additional 12 tonnes supporting its tokenized gold product, XAUt.

For context, this volume places Tether's holdings on par with the official gold reserves of entire countries, underscoring a bold pivot from pure fiat pegs to a hybrid of crypto and precious metals.

To grasp the scale, consider the central banks of South Korea, Hungary, and Greece - economic powerhouses each with their own storied histories of financial prudence.

South Korea's reserves stand at 104 tonnes, a strategic buffer built over decades of export-driven growth. Hungary holds 110 tonnes, a legacy of post-communist diversification, while Greece's 115 tonnes reflect a hard-won stability after years of debt crises.

South Korea's reserves stand at 104 tonnes, a strategic buffer built over decades of export-driven growth. Hungary holds 110 tonnes, a legacy of post-communist diversification, while Greece's 115 tonnes reflect a hard-won stability after years of debt crises.

Tether, a private entity born in 2014 from the ashes of Bitfinex's early experiments, has now eclipsed these sovereign stockpiles in under a decade. It's a testament to the crypto sector's maturation, where a company once criticized for opacity now commands resources that echo the gravitas of state treasuries.

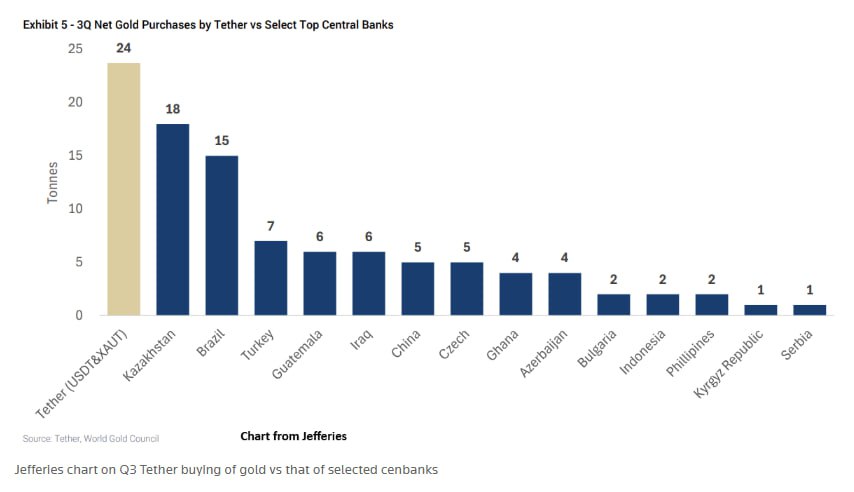

Wall Street heavyweights at Jefferies have taken notice, dubbing Tether the undisputed largest holder of gold outside the governmental realm. In a recent dispatch, their analysts highlighted how Tether's aggressive acquisitions - 26 tonnes added in the third quarter alone - may have ignited the recent surge in gold prices, which peaked at $4,125 per ounce in September 2025 amid geopolitical tremors and inflation fears.

This isn't pocket change; Tether's quarterly haul accounted for nearly 2% of global gold demand, a slice equivalent to 12% of all purchases by central banks worldwide during the period.

With gold comprising just 7% of USDT's overall reserves (the rest anchored in U.S. Treasuries and cash equivalents), Tether's strategy signals a deliberate diversification.

With gold comprising just 7% of USDT's overall reserves (the rest anchored in U.S. Treasuries and cash equivalents), Tether's strategy signals a deliberate diversification.

Jefferies projects the firm could scoop up another 100 tonnes by year's end, potentially sustaining upward pressure on prices for years as supply chains strain under the weight of renewed investor fervor.

At the heart of this bullion bonanza lies a visionary wager on tokenized gold—the digital alchemy that could redefine how the world stores value.

Unlike traditional gold exchange-traded funds (ETFs), which trade only during market hours and levy ongoing storage fees, or physical ownership plagued by logistics and security hassles, tokenized variants like Tether's XAUt offer seamless, 24/7 liquidity on blockchain rails.

Each XAUt token represents one troy ounce of physical gold, custodied in Swiss vaults and redeemable for the real thing, blending the timeless allure of the metal with crypto's borderless efficiency. No middlemen, no custody costs eating into returns - just pure, programmable ownership.

This bet is paying dividends. XAUt's market cap crossed the $1 billion threshold in early October 2025, fueled by a broader tokenized gold boom that saw the sector's total value balloon to $2 billion amid global instability. Tether's first-half profits of $5.7 billion in 2025 provided the war chest for such expansions, even as whispers of gold mining investments circulate in boardrooms. Experts see this as more than hedging; it's a blueprint for mass adoption.

In a world where central banks hoarded 1,037 tonnes in 2024 alone—up 4% from the prior year - private players like Tether are democratizing access. Retail investors in emerging markets, weary of currency devaluations, can now fractionalize a gram of gold and trade it instantly, bypassing the vaults of yesteryear.

In a world where central banks hoarded 1,037 tonnes in 2024 alone—up 4% from the prior year - private players like Tether are democratizing access. Retail investors in emerging markets, weary of currency devaluations, can now fractionalize a gram of gold and trade it instantly, bypassing the vaults of yesteryear.

Yet, Tether's ascent isn't without shadows. Regulators eye its reserves with scrutiny, questioning the transparency of a firm whose USDT circulates over $120 billion in daily volume. Critics argue that blending stablecoins with sovereign-grade assets blurs lines between private profit and public trust, potentially amplifying systemic risks if a peg wobbles. Still, with gold's allure undimmed—up 28% year-to-date in 2025 - Tether's strategy positions it as a bridge between fiat's fragility and blockchain's promise.

Also read:

Also read:

- December Crypto Outlook: Will Bitcoin Close Above $100K or Settle for a Quiet Finish?

- Amazon Quietly Launches Its Starlink Killer: Meet Amazon Leo

- Sergey Brin Is Back—and Google Is Unrecognizable

As 2025 draws to a close, Tether's golden reserves aren't just a line item on a balance sheet; they're a declaration. In an era of tokenized everything - from real estate to carbon credits - gold's digital rebirth could herald a new financial order, where stablecoins don't just mimic dollars but embody enduring value. Whether this triggers a sustained rally or merely a glittering footnote remains to be seen, but one thing is clear: Tether has staked its claim in the hills of history, one tonne at a time.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) — the world's first remote work platform with payments in cryptocurrency.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).