While the world was busy watching SpaceX blanket low-Earth orbit with thousands of Starlink satellites, Amazon has been working in the shadows. This week the company began shipping the first production batches of its long-awaited satellite internet terminals—not to consumers, but to enterprise customers in remote energy, mining, and logistics sectors.

At the same time, Amazon quietly killed the “Project Kuiper” name that never quite rolled off the tongue and rebranded the entire service as Amazon Leo - a simple, no-nonsense label that instantly signals it’s meant for business.

At the same time, Amazon quietly killed the “Project Kuiper” name that never quite rolled off the tongue and rebranded the entire service as Amazon Leo - a simple, no-nonsense label that instantly signals it’s meant for business.

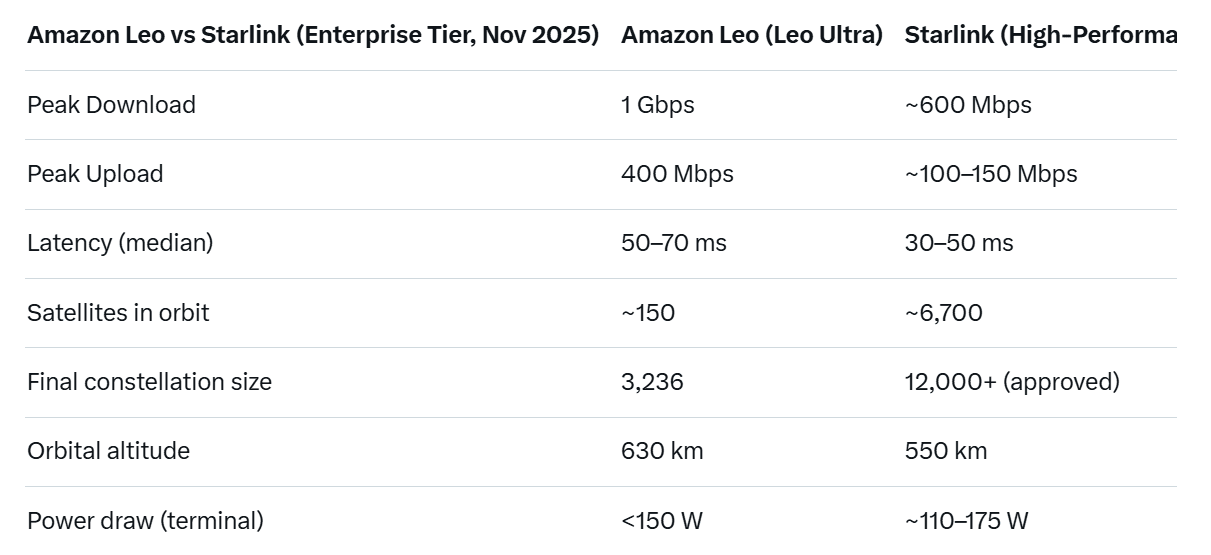

The current constellation is modest: roughly 150 satellites as of November 2025, a fraction of Starlink’s 6,700+. Amazon is betting that smarter engineering can close the gap.

Because Leo satellites fly at a higher altitude (630 km vs Starlink’s ~550 km), each one covers a larger footprint, theoretically requiring fewer birds to achieve continental coverage. The final constellation is planned for 3,236 satellites - still less than half of SpaceX’s current fleet, and far below the 12,000+ Starlink has FCC approval for.

Where Amazon is going all-in is terminal performance. The flagship customer device, dubbed Leo Ultra, is a flat-panel phased-array antenna that promises 1 Gbps downstream and 400 Mbps upstream - numbers that comfortably beat most current Starlink enterprise dishes (which top out around 500–600 Mbps down in real-world tests).

Power consumption is said to be under 150 W, and the entire unit is designed to operate in extreme environments from Arctic oil fields to Amazonian drilling sites.

Pricing remains under wraps, but industry sources suggest the Leo Ultra terminal will land in the $15,000–$25,000 range for enterprise buyers, with monthly service plans starting north of $1,000 for guaranteed bandwidth tiers. That positions it as a premium offering rather than a mass-market play - at least for now.

The higher orbit does come with trade-offs: latency will be noticeably higher than Starlink’s sub-40 ms median, and total network capacity per square kilometer will be lower.

The higher orbit does come with trade-offs: latency will be noticeably higher than Starlink’s sub-40 ms median, and total network capacity per square kilometer will be lower.

Amazon is countering this with aggressive beam-forming and inter-satellite laser links (already demonstrated on the two prototype satellites launched in 2023), plus a hybrid architecture that routes traffic through AWS ground stations for the lowest possible delay when conditions allow.

Early customers include several North American pipeline operators, a major offshore drilling contractor in the Gulf of Mexico, and at least one renewable-energy firm monitoring remote wind farms in the Dakotas. These are exactly the kinds of high-margin, latency-tolerant clients that can justify five-figure hardware and thousand-dollar monthly bills.

Also read:

- Germany’s Sovereign AI Leap: SAP and OpenAI Launch "OpenAI for Germany" to Power Public Sector Innovation

- Suno Settles with Warner Music: AI Music Goes Legit, But Free Downloads Fade to Black

- Warren Buffett’s Dragon Hoard Is Back: 28.3 % of Berkshire Is Cash – the Highest Since 2000 and 2008

Amazon has not announced a consumer launch date, but insiders expect a smaller, cheaper “Leo Standard” dish (targeting ~400 Mbps down) to appear in late 2026 once the constellation crosses the 1,000-satellite mark.

Amazon has not announced a consumer launch date, but insiders expect a smaller, cheaper “Leo Standard” dish (targeting ~400 Mbps down) to appear in late 2026 once the constellation crosses the 1,000-satellite mark.

Until then, Leo is very much an enterprise story - one that quietly positions AWS as the only cloud provider that can also deliver the last-mile connectivity its own customers need in the middle of nowhere.

Starlink still dominates sheer scale and global consumer reach, but Amazon just showed it’s willing to trade raw numbers for raw performance where dollars-per-megabit matter most. The satellite broadband war just got a very expensive new weapon.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) — the world's first remote work platform with payments in cryptocurrency.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.