In a move that's equal parts olive branch and iron fist, Suno - the AI music generator that's been churning out bangers from bedroom prompts - has inked a landmark partnership with Warner Music Group (WMG), settling their year-long copyright showdown.

Announced on November 25, 2025, the deal follows WMG's strikingly similar truce with Suno's arch-rival Udio just six days earlier on November 19. It's no coincidence: As AI tunes flood streaming services at a clip that dwarfs human output, the majors are rolling out a playbook that's heavy on licensing, light on litigation, and laser-focused on monetizing the machine-made melody boom.

Announced on November 25, 2025, the deal follows WMG's strikingly similar truce with Suno's arch-rival Udio just six days earlier on November 19. It's no coincidence: As AI tunes flood streaming services at a clip that dwarfs human output, the majors are rolling out a playbook that's heavy on licensing, light on litigation, and laser-focused on monetizing the machine-made melody boom.

The partnership isn't just a cease-fire; it's a blueprint for "next-generation licensed AI music," per the joint press release. Suno gains access to WMG's vast catalog for training its models, while WMG artists (who opt in) can lend their voices, likenesses, and compositions to AI creations - unlocking fresh revenue streams like royalties from fan remixes or interactive tracks.

Suno CEO Mikey Shulman hailed it as a "bigger, richer Suno experience," promising advanced models in 2026 that blend licensed beats with user-generated flair. WMG CEO Robert Kyncl echoed the optimism: "We're committed to protecting rights while expanding creative possibilities." Bonus: Suno scooped up WMG's Songkick concert-discovery app in the deal, merging AI jams with live gig vibes to supercharge fan engagement.

But here's the gut punch for casual creators: The freewheeling era of unlimited downloads is over. Free-tier users can still generate, play, and share tracks on the platform, but off-platform downloads? Locked behind a paywall. Paid subscribers face monthly caps (exact numbers TBD, but with add-on purchases for extras), while Suno Studio's pro workflow keeps unlimited exports for heavy hitters. It's a pragmatic pivot - Suno's blog frames it as preserving "the magic of creation" while ensuring sustainability amid explosive growth.

From Pitch Deck to Power Play: The Scale That's Forcing Hands

This isn't knee-jerk regulation; it's a response to sheer volume. Suno's leaked $250 million Series C pitch deck (valuing the startup at $2.45 billion as of November 19) revealed a staggering stat: Users crank out enough AI tracks every two weeks to match Spotify's entire 100 million-song library.

This isn't knee-jerk regulation; it's a response to sheer volume. Suno's leaked $250 million Series C pitch deck (valuing the startup at $2.45 billion as of November 19) revealed a staggering stat: Users crank out enough AI tracks every two weeks to match Spotify's entire 100 million-song library.

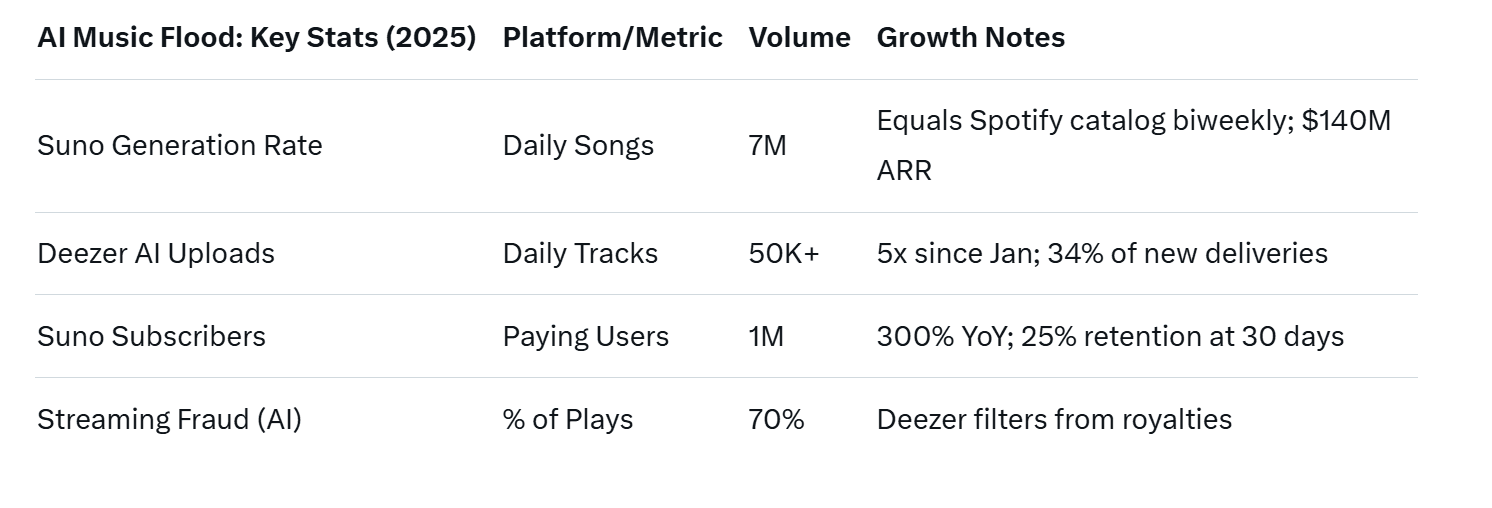

That's roughly 7 million songs daily, streamed for 20 million minutes - up from $50 million ARR in January to $140 million by September 2025. With 1 million paying subs (a 300% YoY spike) and 100 million total users, Suno's not a niche toy; it's a content factory rivaling the industry's heavyweights.

The ripple hits streamers hard. Deezer reported over 50,000 fully AI-generated uploads daily as of November 12—34% of its 147,000 new tracks, up from 10,000 in January, 20,000 in April, and 30,000 in September. That's a 5x surge in nine months, with AI tunes now comprising 0.5% of total streams (though 70% flagged as fraudulent bots, per Deezer's detection tech).

A global Ipsos survey for Deezer found 97% of listeners can't distinguish AI from human tracks in blind tests - yet 80% demand labeling, and 69% want lower royalties for synthetic stuff. Deezer's already tagging AI content; expect majors to push for more.

Majors' Master Plan: License, Don't Litigate

WMG's one-two punch - first Udio, now Suno - signals a sea change. Last summer, WMG joined Universal and Sony in a $500 million lawsuit barrage, accusing the platforms of scraping copyrighted tracks for training data. Udio's deal resolved that, paving for a 2026 licensed service with artist opt-ins and revenue shares. Suno's mirrors it: No more "fair use" defenses; instead, ethical models trained on consented content, plus tools for pros to remix WMG hits.

WMG's one-two punch - first Udio, now Suno - signals a sea change. Last summer, WMG joined Universal and Sony in a $500 million lawsuit barrage, accusing the platforms of scraping copyrighted tracks for training data. Udio's deal resolved that, paving for a 2026 licensed service with artist opt-ins and revenue shares. Suno's mirrors it: No more "fair use" defenses; instead, ethical models trained on consented content, plus tools for pros to remix WMG hits.

It's smarter than the RIAA's Napster-era scorched earth. AI music's viral - think "The Velvet Sundown," the AI band that hit 1 million monthly Spotify listeners earlier this year. Labels can't kill it without alienating creators (Suno's core demo) or fans craving endless novelty. Instead, they're co-opting: New royalties from AI streams, fan interactions, and even live tie-ins via Songkick. As Shulman put it, this "accelerates our mission to change the place of music in the world."

Critics cry foul - free users get shafted, and opt-in protections might sideline indie voices. But proponents see evolution: AI as amplifier, not assassin, with Deezer's fraud filters ensuring humans get paid. Suno's funding (led by Menlo Ventures, with Nvidia's NVentures aboard) earmarks 30% for compute, 20% for M&A, and 15% for data - likely licensing buys.

Also read:

Also read:

- Metaplanet Raises Total Debt to $230 Million Using Bitcoin as Collateral in Aggressive Treasury Play

- Grayscale Ushers in Meme Coin Mainstream with Spot Dogecoin ETF Debut

- The Genesis Mission: America's Bold Leap to Unite AI and Science in a Modern Manhattan Project

The Dawn of Licensed AI Beats: Boom or Bust?

AI music's graduating from gray-market garage band to boardroom-backed symphony. With Suno and Udio now under major thumbs, expect Universal and Sony to follow suit - perhaps by Q1 2026. The upside? Cleaner catalogs, fairer pay, and hybrid hits blending Ed Sheeran samples with prompt-engineered drops. The downside? Paywalls could chill experimentation, pushing power users to pricier tiers ($10-20/month) while freebies stay siloed.

One thing's clear: Labels aren't ignoring the deluge anymore. They're damming it, directing the flow to their turbines. For creators, it's a mixed tape - more tools, but with strings (and subscriptions) attached. As AI floods the airwaves, the real remix might be music itself: Half human spark, half silicon symphony, all under major oversight. The free lunch is over, but the feast? Just getting started.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) — the world's first remote work platform with payments in cryptocurrency.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.