Tokyo-listed Metaplanet Inc., widely dubbed “Japan’s MicroStrategy,” has drawn an additional $130 million from its previously secured $500 million credit facility, bringing its total outstanding borrowing to $230 million. The loans are fully collateralized by the company’s growing Bitcoin holdings, which currently stand at 30,823 BTC — worth approximately $2.7 billion at current prices.

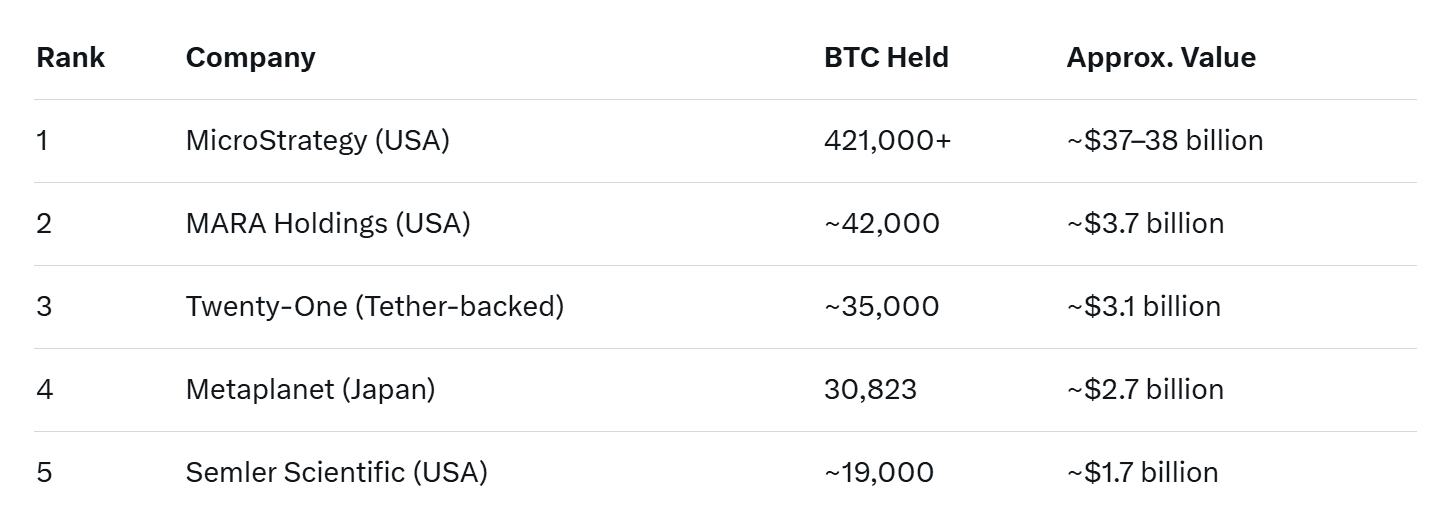

The latest drawdown, announced on November 25, 2025, follows a pattern established earlier this year: borrow low-cost fiat against BTC, immediately convert the proceeds back into more Bitcoin, and repeat. Metaplanet now ranks as the fourth-largest publicly disclosed corporate Bitcoin holder worldwide, trailing only MicroStrategy (421,000+ BTC), marathon miner MARA Holdings, and the Tether-backed Twenty-One fund.

The latest drawdown, announced on November 25, 2025, follows a pattern established earlier this year: borrow low-cost fiat against BTC, immediately convert the proceeds back into more Bitcoin, and repeat. Metaplanet now ranks as the fourth-largest publicly disclosed corporate Bitcoin holder worldwide, trailing only MicroStrategy (421,000+ BTC), marathon miner MARA Holdings, and the Tether-backed Twenty-One fund.

Where the Money Is Going

According to the company’s statement, the fresh capital will be deployed across three core initiatives:

- Additional Bitcoin acquisitions (continuing its “Bitcoin accumulation flywheel”).

- Yield-generating BTC strategies, primarily through writing covered calls and other options structures that earn premiums while retaining upside exposure.

- Share buybacks of Metaplanet stock (ticker 3350.T), which has surged more than 2,200% year-to-date on the Tokyo Stock Exchange, making it one of the best-performing equities globally in 2025.

Collateral Buffer and Risk Management

Metaplanet emphasized that its current loan-to-value (LTV) ratio remains conservative. Even if Bitcoin were to drop sharply, the company claims it has ample excess collateral to meet margin calls without forced sales. Management has repeatedly stated it will not over-leverage and intends to keep total borrowings well below levels that could jeopardize the balance sheet during severe drawdowns.

The identity of the lender remains undisclosed, though market sources speculate it is a major crypto-friendly prime broker or Asian private credit fund offering non-recourse BTC-backed loans at single-digit interest rates.

Corporate Bitcoin Rankings (Public Companies, Nov 2025)

From Hotel Operator to Bitcoin Powerhouse

Originally a hotel and real-estate operator, Metaplanet pivoted aggressively into Bitcoin in early 2024 under CEO Simon Gerovich. The strategy mirrors Michael Saylor’s playbook: use cheap debt and equity issuance to stack sats, turning the corporate treasury into a de facto Bitcoin accumulation vehicle.

Since adopting Bitcoin as its primary reserve asset, Metaplanet has increased its holdings from virtually zero to over 30,000 BTC in less than 18 months — an average accumulation rate of roughly 1,700 BTC per month. The stock’s meteoric rise has created a virtuous cycle: higher share price → cheaper equity raises → more Bitcoin → higher share price.

Also read:

- Grayscale Ushers in Meme Coin Mainstream with Spot Dogecoin ETF Debut

- Capital Migration in the Crypto Market: Why Institutional Investors Are Focusing on CAT DEFI and RWA

- From MrBeast’s Cutting Room to Palo AI: When Creativity Becomes a Spreadsheet

Market Reaction and Broader Implications

Metaplanet shares jumped another 12% in Tokyo trading following the announcement, pushing its market capitalization above ¥1.8 trillion (~$12 billion). The move further validates the “Bitcoin corporate treasury” model in Asia, where regulatory clarity and low interest rates make yen- or dollar-denominated BTC-backed loans particularly attractive.

Analysts note that Metaplanet’s still-available $270 million in undrawn credit gives it significant dry powder heading into 2026, especially if Bitcoin continues its post-halving bull run. For now, the Japanese firm shows no signs of slowing down its ambitious mission: to become the MicroStrategy of the East — one leveraged Bitcoin purchase at a time.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

Not financial advice. DYOR.