Three years ago, OpenAI ignited the AI revolution with ChatGPT, catapulting from obscurity to omnipresence overnight. What started as a research curiosity morphed into a cultural phenomenon, boasting over 800 million weekly active users by late 2025 and processing more than 1 billion queries daily.

ChatGPT didn't just lead the pack; it defined the category, becoming a near-generic term for AI chatbots much like "Kleenex" for tissues. Its user base dwarfed competitors, with monthly visits exceeding 5.7 billion - roughly three times that of its closest rival. Developers raved about its code-suggesting prowess, educators harnessed it for lesson plans, and casual users turned it into a digital sidekick for everything from travel itineraries to breakup advice.

ChatGPT didn't just lead the pack; it defined the category, becoming a near-generic term for AI chatbots much like "Kleenex" for tissues. Its user base dwarfed competitors, with monthly visits exceeding 5.7 billion - roughly three times that of its closest rival. Developers raved about its code-suggesting prowess, educators harnessed it for lesson plans, and casual users turned it into a digital sidekick for everything from travel itineraries to breakup advice.

Sure, pockets of resistance persisted: Anthropic's Claude won hearts for ethical coding and nuanced prose, xAI's Grok charmed with its irreverent, uncensored edge, and Google's Veo 3 delivered jaw-dropping "cinematic" video clips that dominated summer social feeds. But OpenAI's fortress seemed unbreachable, a pioneer perched atop an insurmountable lead.

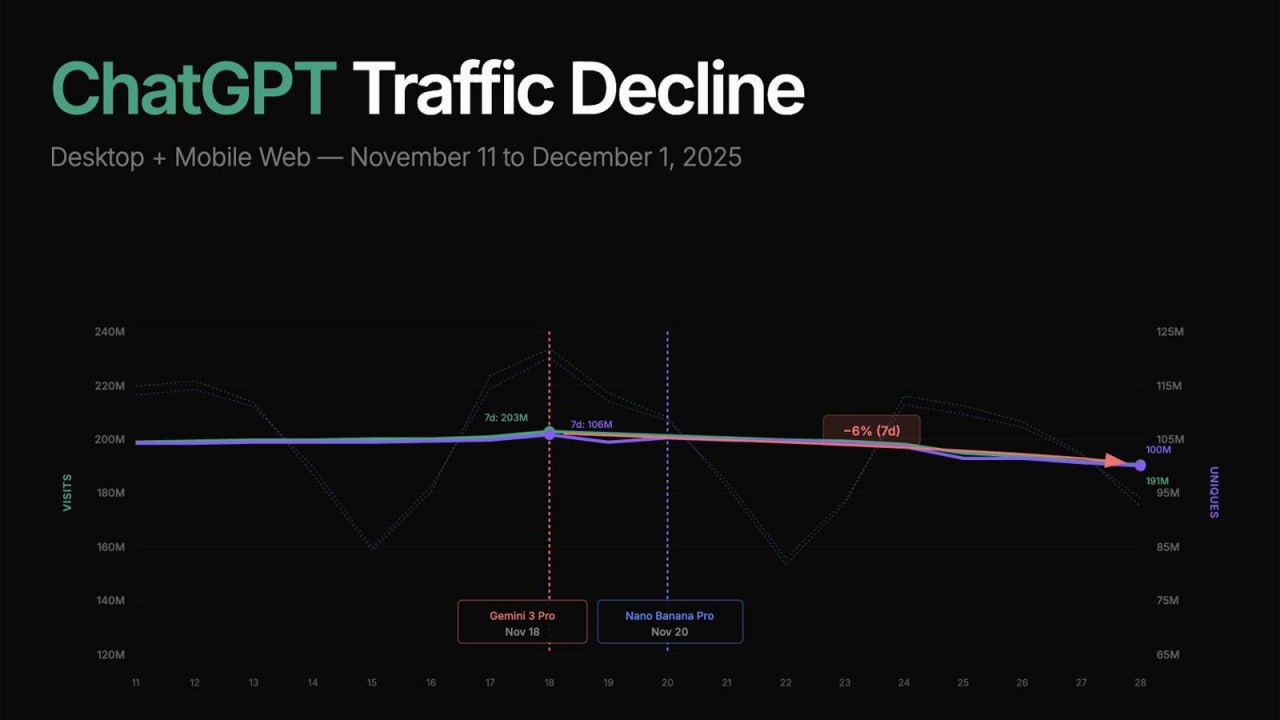

That illusion shattered in late November 2025, when Google unleashed Gemini 3, its self-proclaimed "most intelligent" model to date. The launch triggered an immediate 6% traffic hemorrhage for OpenAI - equating to about 12 million fewer daily users, per Similarweb data cited by industry analysts. ChatGPT's daily visits plummeted from 203 million to 191 million in the ensuing week, a stark reversal after months of steady climbs.

That illusion shattered in late November 2025, when Google unleashed Gemini 3, its self-proclaimed "most intelligent" model to date. The launch triggered an immediate 6% traffic hemorrhage for OpenAI - equating to about 12 million fewer daily users, per Similarweb data cited by industry analysts. ChatGPT's daily visits plummeted from 203 million to 191 million in the ensuing week, a stark reversal after months of steady climbs.

While text-based loyalty lingers (many stick with ChatGPT out of sheer habit, with its monthly active users still edging up 5% from July to November), the real defections are in visuals. Nano Banana Pro, Google's cheekily named image generator powered by Gemini 3 Pro, has become the undisputed darling, luring creators away from DALL-E 3 with superior fidelity and control.

Nano Banana's Irresistible Pull: Why Images Are the New Battlefield

Nano Banana Pro isn't just an incremental tweak; it's a quantum leap in generative visuals, blending Gemini's razor-sharp reasoning with real-world knowledge to produce studio-grade outputs. Users can now embed legible, multilingual text - think flawless posters or infographics—while fusing up to 14 reference images into cohesive scenes, preserving character consistency across dozens of figures.

Nano Banana Pro isn't just an incremental tweak; it's a quantum leap in generative visuals, blending Gemini's razor-sharp reasoning with real-world knowledge to produce studio-grade outputs. Users can now embed legible, multilingual text - think flawless posters or infographics—while fusing up to 14 reference images into cohesive scenes, preserving character consistency across dozens of figures.

In head-to-head tests, it outshines DALL-E 3 in photorealism and edit precision: where OpenAI's tool often mangles fine details or hallucinates artifacts, Nano Banana handles 4K resolutions, multi-step edits like style transfers or inpainting, and even diagram generation from handwritten notes with eerie accuracy.

Early adopters, including Salesforce CEO Marc Benioff, ditched ChatGPT after just two hours with it, praising its "insane" speed and reasoning. Viral memes aside, Nano Banana's integration into Google Workspace (Slides, Docs) and Ads has funneled enterprise users en masse, spiking Gemini's monthly actives by 30% in the same period ChatGPT flatlined.

This image exodus underscores a broader malaise: whispers of stagnation in OpenAI's core models. GPT-5.1, released in August 2025, drew flak for feeling "clinical" and underperforming in math (down 5% from GPT-4) and geography tasks, per user benchmarks on LMSYS Arena.

Hallucination rates ticked up 10% in multi-step reasoning, and response times lagged 20% behind Gemini's snappier inference.

As a result, curiosity is king - tens of millions are flocking to test Gemini's Deep Think mode, which parallel-processes hypotheses for nuanced outputs in coding and science, scoring 41% on Humanity's Last Exam versus GPT-5.1's 26.5%. A 6% user bleed in weeks isn't churn; it's a rout, signaling the pioneer's peril in a field where yesterday's moat becomes tomorrow's mud pit.

The Goliath Factor: Google's Unfair Arsenal vs. OpenAI's Startup Strains

OpenAI's scramble comes against a backdrop of asymmetric warfare. Google, with its $2.3 trillion war chest and 90% search monopoly, wields an unfair edge: Gemini is baked into Chrome (2.6 billion users), Android (3 billion devices), and Workspace (3 billion accounts), auto-suggesting AI responses in Gmail and Docs. This seamless distribution propelled Gemini to 450 million monthly actives by mid-2025, up 190% year-over-year, while ChatGPT's growth slowed to 85% in downloads. Google's vertical integration - custom TPUs slashing inference costs 40% - lets it iterate relentlessly, topping LMSYS with a 1324 score to OpenAI's 1220.

OpenAI's scramble comes against a backdrop of asymmetric warfare. Google, with its $2.3 trillion war chest and 90% search monopoly, wields an unfair edge: Gemini is baked into Chrome (2.6 billion users), Android (3 billion devices), and Workspace (3 billion accounts), auto-suggesting AI responses in Gmail and Docs. This seamless distribution propelled Gemini to 450 million monthly actives by mid-2025, up 190% year-over-year, while ChatGPT's growth slowed to 85% in downloads. Google's vertical integration - custom TPUs slashing inference costs 40% - lets it iterate relentlessly, topping LMSYS with a 1324 score to OpenAI's 1220.

Meanwhile, OpenAI burns through cash like rocket fuel. First-half 2025 losses hit $13.5 billion on $4.3 billion revenue, with projections ballooning to $74 billion by 2028 before profitability in 2030. Sam Altman has sunk trillions in commitments to Nvidia and cloud giants for compute, but profitability demands scale. Enter the "code red": In a November memo, Altman mobilized all hands to turbocharge ChatGPT - focusing on personalization (memory features for tailored responses), reliability (halving latency), and breadth (expanding query coverage) - while freezing non-core bets like AI agents for shopping or health. Advertising experiments, teased for Q4 integration, are shelved indefinitely, delaying revenue diversification. "We're at a critical time for ChatGPT," Altman wrote, echoing Google's own 2022 panic after ChatGPT's debut.

This pivot buys time but exposes fractures. Talent raids by Meta and Mira Murati's Thinking Machines have siphoned dozens of top researchers, and enterprise traction lags: Anthropic boasts 300,000 business clients (including Fortune 500s), while OpenAI's API users complain of throttling amid surging demand.

Rivals Rising: Anthropic's IPO Gambit and the Maturing AI Arena

The plot thickens with Anthropic's IPO whispers. The Claude maker, valued at $183 billion after a $13 billion raise in September, has tapped Wilson Sonsini for a potential 2026 debut - potentially rivaling OpenAI's rumored $1 trillion float. Early talks with banks eye a $300 billion-plus valuation, fueled by Claude Opus 4.5's enterprise wins and a projected $26 billion run-rate next year. Anthropic's safety-first ethos resonates in boardrooms wary of OpenAI's drama, positioning it as the "ethical alternative" with 190% chatbot growth in 2025.

The plot thickens with Anthropic's IPO whispers. The Claude maker, valued at $183 billion after a $13 billion raise in September, has tapped Wilson Sonsini for a potential 2026 debut - potentially rivaling OpenAI's rumored $1 trillion float. Early talks with banks eye a $300 billion-plus valuation, fueled by Claude Opus 4.5's enterprise wins and a projected $26 billion run-rate next year. Anthropic's safety-first ethos resonates in boardrooms wary of OpenAI's drama, positioning it as the "ethical alternative" with 190% chatbot growth in 2025.

As OpenAI hunkers down, the industry hurtles toward maturity. Competition breeds innovation - users reap faster, smarter tools, with Gemini's 11-minute daily sessions (double prior averages) proving the point. Yet, a Google monopoly risks stagnation: walled gardens could stifle open experimentation, echoing antitrust fears in search. OpenAI, too fat to fail yet too volatile to coast, must reinvent or risk the pioneer's trap. In this new spiral, the winner isn't the biggest - it's the boldest. For now, Altman's code red is a rallying cry; whether it reignites the fire or fans the flames of doubt remains the trillion-dollar question.

Also read:

- Gemini 3's Deep Think: Unlocking Parallel Reasoning for the Toughest AI Challenges

- Unveiling the Hidden Heart of AI: What 100 Trillion Tokens Reveal About How We Really Use LLMs

- Breaking Down the Latest AI Model Updates from Artificial Analysis: A Game-Changer for Model Selection

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.