Imagine a fire alarm blaring in a crowded theater. Panic ensues, but instead of bolting for the exits, everyone starts handing cash to their neighbors in a frantic circle - each transaction inflating their collective sense of security while the flames lick higher. Sound absurd?

That's the meme du jour capturing the AI industry's trillion-dollar investment frenzy: a simple diagram of a loop with arrows, overlaid with cartoonish screams of "A-a-a-a!" It's equal parts hilarious and horrifying, a visual shorthand for the circular deals propping up valuations in a sector that's burned through more cash than it has revenue to show for it.

That's the meme du jour capturing the AI industry's trillion-dollar investment frenzy: a simple diagram of a loop with arrows, overlaid with cartoonish screams of "A-a-a-a!" It's equal parts hilarious and horrifying, a visual shorthand for the circular deals propping up valuations in a sector that's burned through more cash than it has revenue to show for it.

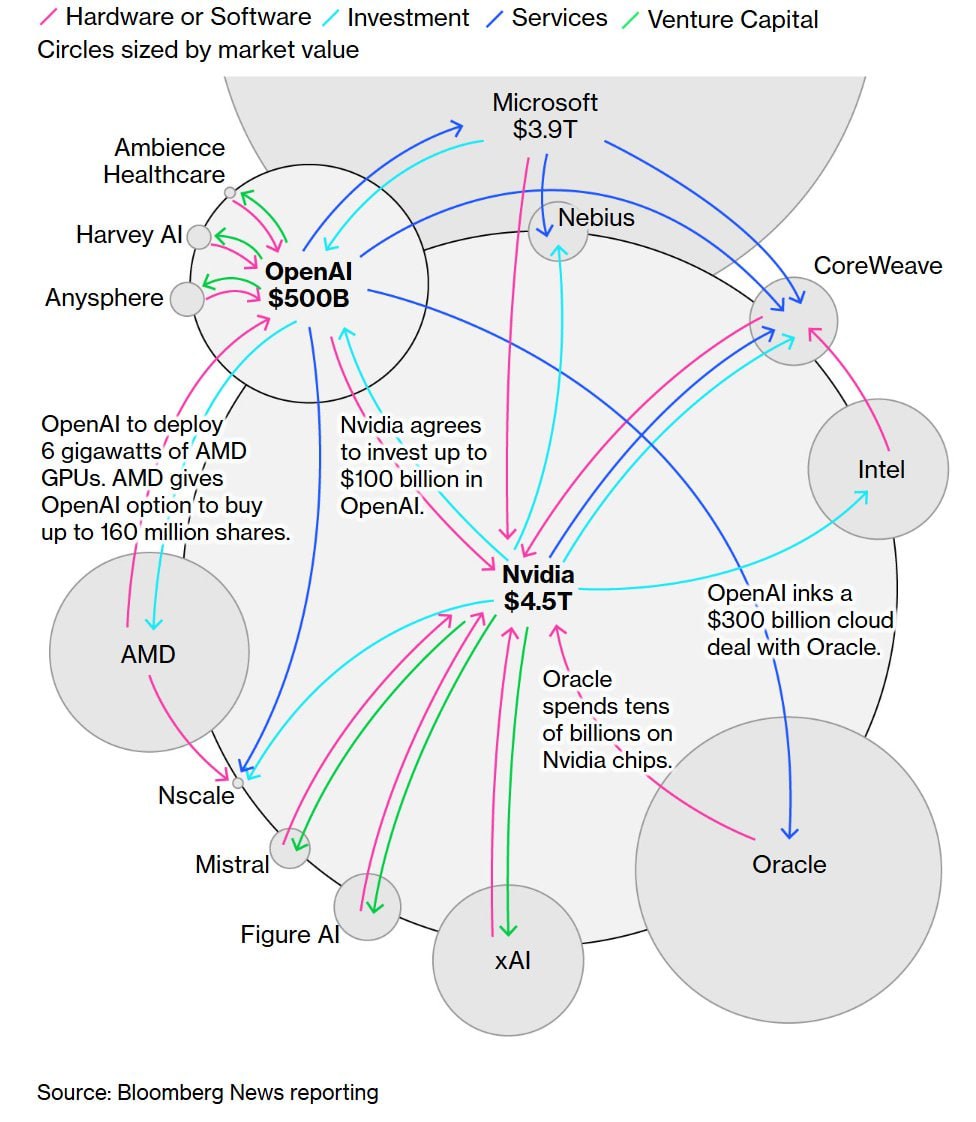

Welcome to the AI money-go-round, where tech titans like OpenAI, Nvidia, Microsoft, Oracle, and AMD are locked in a symbiotic tango of investments, contracts, and equity swaps.

Billions - no, trillions - flow in loops that boost market caps, dazzle investors, and mask a fundamental question: Is this sustainable growth or just a high-stakes game of hot potato with other people's money?

As one analyst quipped on X, "OpenAI, NVIDIA, AMD, Oracle, Google, Microsoft, AWS are creating AI bubble with huge circular investment. This pic says it all." Spoiler: The pic is that chaotic circle.

At the heart of this carousel is OpenAI, the $500 billion behemoth that's become the ringmaster. Just last month, it inked a letter of intent with Nvidia for up to $100 billion in investments to fuel a massive data-center buildout - enough compute power to rival a small nation's grid.

At the heart of this carousel is OpenAI, the $500 billion behemoth that's become the ringmaster. Just last month, it inked a letter of intent with Nvidia for up to $100 billion in investments to fuel a massive data-center buildout - enough compute power to rival a small nation's grid.

Nvidia, fresh off its own $4.5 trillion market cap milestone, isn't just selling chips; it's betting big on the very company buying them. This isn't charity - it's a feedback loop where OpenAI's purchases pad Nvidia's revenue, which in turn justifies Nvidia's stake in OpenAI, inflating both valuations in a virtuous (or vicious?) cycle.

But why stop at one dance partner? OpenAI quickly waltzed over to AMD, its Nvidia rival, signing a multi-year deal for tens of billions in AI chips - equivalent to 6 gigawatts of power, or about the output of six nuclear reactors.

In return? AMD handed OpenAI warrants for up to 160 million shares, potentially a 10% stake, vesting as OpenAI deploys the hardware. AMD's stock rocketed 23% on the news, adding $80 billion to its market cap in a single day. Cue the circle: OpenAI buys from AMD, gets equity in AMD, and both look richer on paper.

Enter Oracle, the cloud computing dark horse. OpenAI committed $300 billion over five years for 4.5 gigawatts of data-center space - possibly the largest cloud deal ever. Oracle, in turn, is shelling out $40 billion on Nvidia chips to power those very centers. It's a daisy chain: OpenAI funds Oracle, Oracle funds Nvidia, Nvidia funds OpenAI. Microsoft's role? It's invested billions in OpenAI since 2019 and rents back Azure compute power, closing yet another loop. Toss in government angles - U.S. stakes in Intel (10%) and Nvidia's China exports (15%) - plus ventures like Nebius (Arkady Volozh's AI cloud play), Mistral, and xAI, and the web tightens.

The result? A trillion-dollar ecosystem where each deal acts like a booster shot for stock prices. OpenAI's spree alone - spanning Nvidia, AMD, Oracle, and others - tallies over $1 trillion in commitments for 20+ gigawatts of compute, per Financial Times estimates.

The result? A trillion-dollar ecosystem where each deal acts like a booster shot for stock prices. OpenAI's spree alone - spanning Nvidia, AMD, Oracle, and others - tallies over $1 trillion in commitments for 20+ gigawatts of compute, per Financial Times estimates.

That's enough electricity to power 20 million homes, or roughly the size of a major U.S. city's grid. Valuations soar: Nvidia hits $4.6 trillion, Oracle spikes $250 billion in a day on AI hype. Founders and CEOs rake in windfalls - $450 billion richer this year alone for the likes of Jensen Huang (Nvidia), Lisa Su (AMD), and Larry Ellison (Oracle).

It all feels eerily familiar, doesn't it? This isn't innovation; it's market manipulation 101. Companies cross-investing not for synergies, but to pump valuations ahead of funding rounds or IPOs.

Remember the dot-com era? Telecom giants swapped fiber-optic capacity in "irrationally exuberant" loops, inflating assets until the bubble popped in 2000, wiping out $5 trillion. Or Enron's off-balance-sheet schemes?

Today's AI carousel echoes those classics: mutual back-scratching that creates the illusion of explosive growth while real profitability lags.

OpenAI, for instance, pulled in $4.5 billion in revenue in the first half of 2025 but burned $2.5 billion - net negative, with costs ballooning as models scale. The industry as a whole? Hundreds of billions poured in globally, yet most firms can't monetize at scale. McKinsey reports eight in 10 companies using generative AI, but the same share sees no bottom-line impact. It's hype-fueled capex: Build data centers today, pray for AGI tomorrow. As one Reddit thread laments, "We're in an AI arms race... to completely capture and monopolize the entire fking market."

The punchline? This is uncharted territory. Never before has so much capital flooded a technology without proven ROI. Sam Altman himself embodies the high-wire act. As Bernstein analyst Stacy Rasgon put it: "OpenAI's Sam Altman can either crash the global economy or take us to the promised land." Altman warns of booms and busts - "People will overinvest and lose money" - yet pushes forward, admitting, "Right now we don’t have the money yet" for all the gear. His cards? A kernel of truth in AI's potential, wrapped in bubble risk. "We’ll make some dumb capital allocations," he concedes, but bets on "unprecedented economic growth."

The punchline? This is uncharted territory. Never before has so much capital flooded a technology without proven ROI. Sam Altman himself embodies the high-wire act. As Bernstein analyst Stacy Rasgon put it: "OpenAI's Sam Altman can either crash the global economy or take us to the promised land." Altman warns of booms and busts - "People will overinvest and lose money" - yet pushes forward, admitting, "Right now we don’t have the money yet" for all the gear. His cards? A kernel of truth in AI's potential, wrapped in bubble risk. "We’ll make some dumb capital allocations," he concedes, but bets on "unprecedented economic growth."

Even Meta's Mark Zuckerberg echoes the caution: A collapse is "definitely a possibility," citing railroad and dot-com parallels. Fed Chair Jerome Powell notes "unusually large" AI activity, hinting at macro ripples. If the loop snaps - one weak link like OpenAI's cash burn or regulatory scrutiny - the fallout could dwarf 2008.

Also read:

- Ethereum Foundation Launches AI Team to Make Ethereum the Backbone of an AI-Driven Economy

- Nvidia’s $5 Billion Bet on Intel: A Historic Collaboration with a Twist of Irony

- Pentagon Awards $200 Million Contracts Each to OpenAI, Google, Anthropic, and xAI for Advanced AI in Defense

- Substack Creator Accelerator Fund: $20 Million Boost for Creators Switching Platforms

Yet, amid the memes and mayhem, there's a sliver of optimism. This carousel might spin us toward real breakthroughs: Cheaper intelligence, transformed industries, even abundance. As Altman muses, AI could "drive a new wave of unprecedented economic growth." Or, as Bezos and Altman agree, the bubble bursts, but benefits endure - like the internet post-dot-com.

The fire's real, the exits unclear. Will the circle hold, or will it be every investor for themselves? In AI's grand theater, the curtain's rising - and the screams are just getting started.

*This article draws on recent reports and analyses as of October 10, 2025.*

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).