In the ever-evolving landscape of home entertainment, the battle for eyeballs is fiercer than ever. Traditional cable and broadcast TV, once undisputed rulers of the living room, are now scrambling to keep up with the streaming revolution.

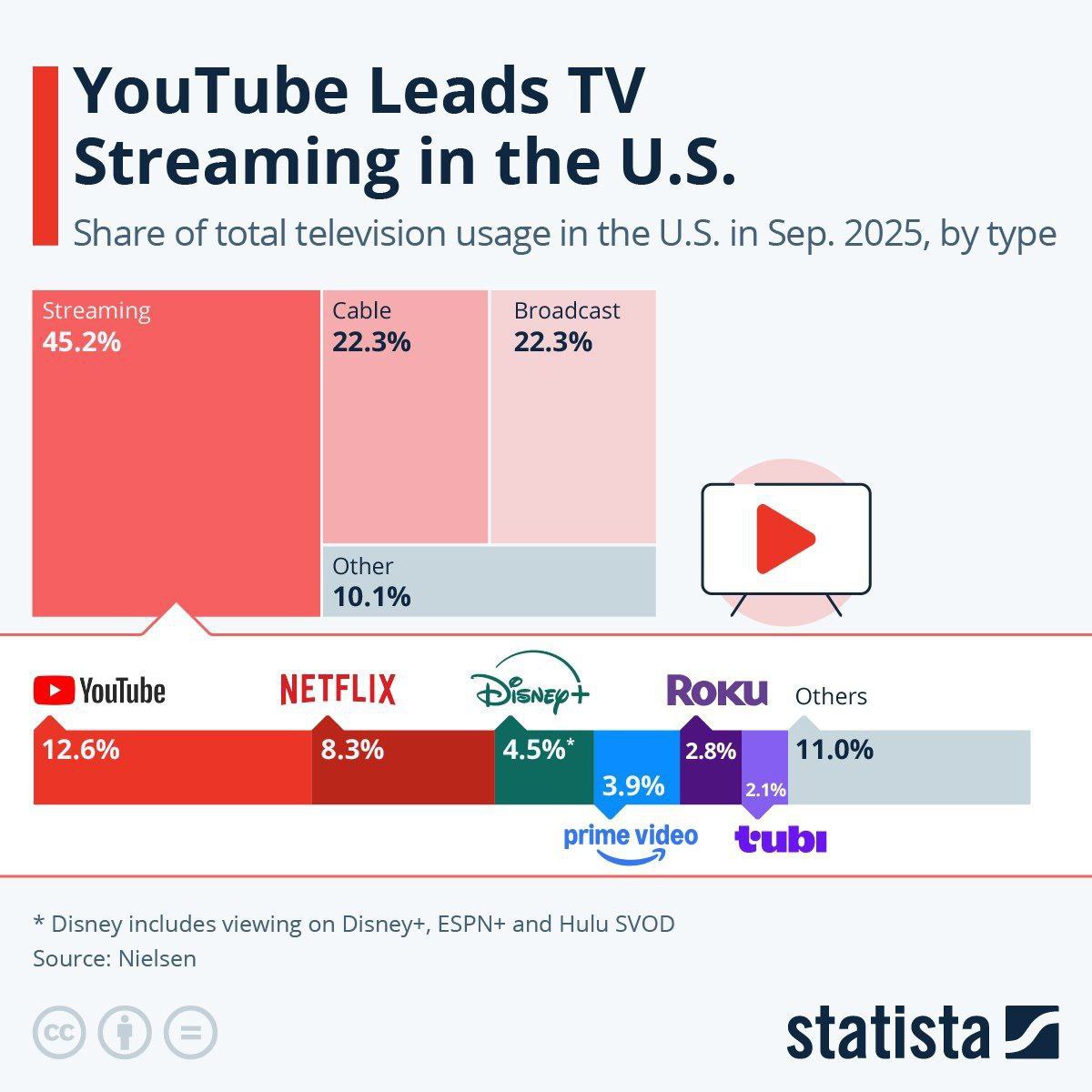

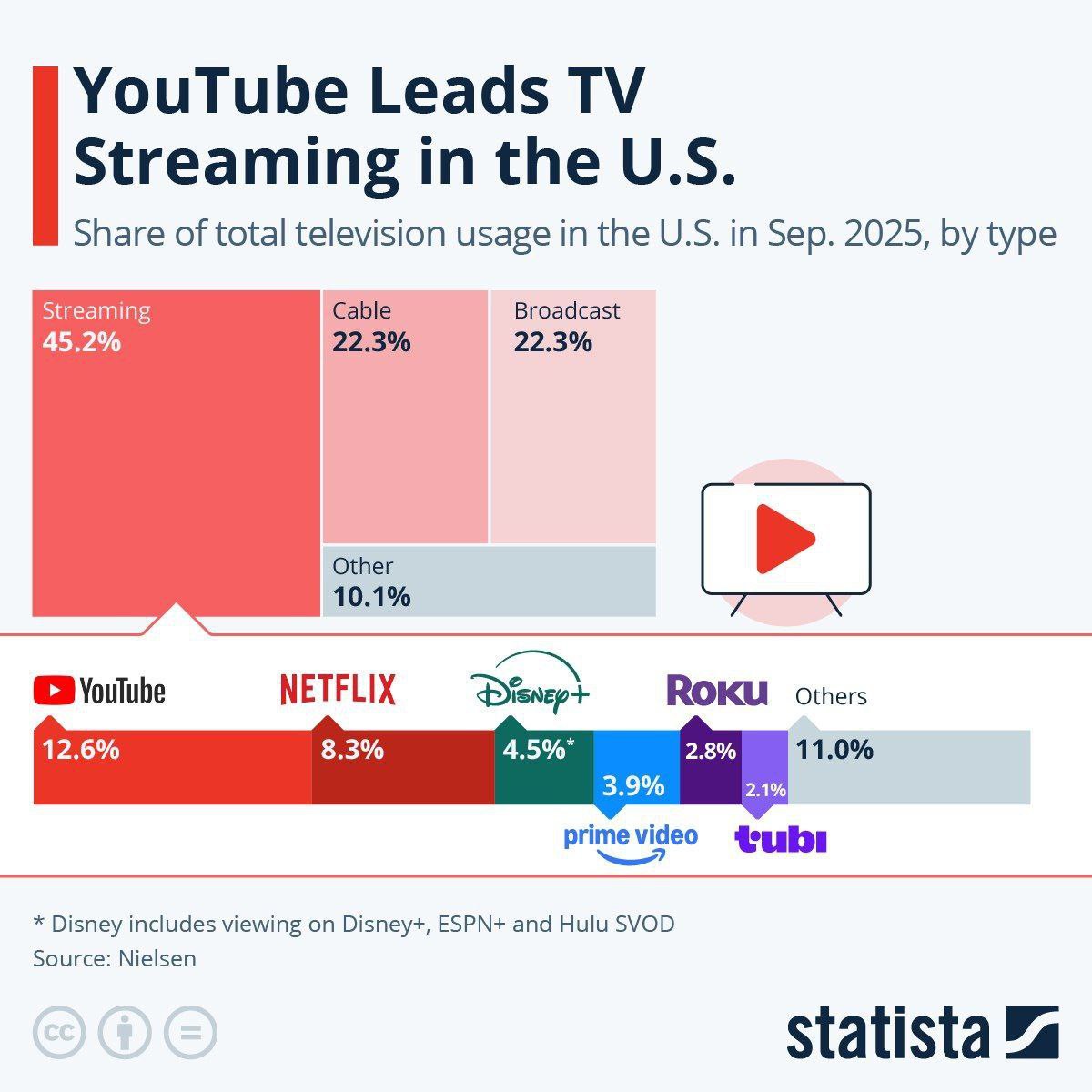

In September 2025, streaming platforms captured a record 45.2% of total TV viewing time in the United States, edging out linear TV's combined 44.6% share for the first time. This milestone underscores a trend that's been building since 2022, when streaming first overtook traditional television.

Within the streaming wars, one platform stands head and shoulders above the rest: YouTube, commanding a dominant 12.6% of viewing time, compared to Netflix's 8.3% and Disney's assets at 4.5%. As Alphabet's video behemoth solidifies its throne, Netflix – led by co-CEO Ted Sarandos – faces an uphill climb to reclaim the crown.

The Streaming Surge: A New Era for TV Consumption

The numbers tell a compelling story of disruption. Streaming's ascent isn't just about binge-worthy series or blockbuster movies; it's about how Americans are choosing to unwind in their homes. In June 2025, streaming hit 46% of viewing time, a slight uptick from September's figures, while cable and broadcast continued their slide to under 45% combined.

The numbers tell a compelling story of disruption. Streaming's ascent isn't just about binge-worthy series or blockbuster movies; it's about how Americans are choosing to unwind in their homes. In June 2025, streaming hit 46% of viewing time, a slight uptick from September's figures, while cable and broadcast continued their slide to under 45% combined.

This shift reflects broader cultural changes: cord-cutting is rampant, with younger demographics favoring on-demand flexibility over scheduled programming.

YouTube's slice of the pie – that hefty 12.6% – isn't accidental. The platform has masterfully transitioned from a mobile-first, short-form video hub to a living-room staple. During prime-time hours, YouTube draws about 11.1 million nightly viewers on TVs, just ahead of Netflix's 10.7 million, but overall, Google's service is redefining what "television" means in 2025. What sets YouTube apart?

Its algorithm-driven personalization, vast library of user-generated and premium content, and seamless integration with smart TVs have made it the go-to for everything from quick tutorials to long-form vlogs. Add in YouTube TV's live offerings, and it's no wonder the platform's estimated market valuation hit $550 billion this year, edging out Netflix's $520 billion.

Netflix's Mixed Bag: Wins, Wobbles, and Investor Jitters

Netflix, the OG of streaming, isn't going down without a fight. The company's Q3 2025 earnings, released on October 21, painted a picture of resilience amid headwinds. Revenue climbed 17% year-over-year to $11.51 billion, with net income rising to $2.55 billion (or $5.87 per diluted share).

Advertising sales hit a record high, on track to double for the full year, fueled by hits like the animated musical KPop Demon Hunters, Wednesday Season 2, and the record-breaking Canelo vs. Crawford boxing match. Free cash flow projections for 2025 were bumped up to around $9 billion, signaling strong operational health.

Bright spots abound elsewhere too. A fresh partnership with Spotify, announced mid-October, brings video versions of 16 high-profile podcasts – including The Bill Simmons Podcast and true-crime staples like Conspiracy Theories – to Netflix starting early 2026.

Bright spots abound elsewhere too. A fresh partnership with Spotify, announced mid-October, brings video versions of 16 high-profile podcasts – including The Bill Simmons Podcast and true-crime staples like Conspiracy Theories – to Netflix starting early 2026.

This move not only diversifies content but also pulls popular shows away from YouTube, Netflix's arch-rival, potentially boosting engagement among audio-visual crossover audiences.

Then there's AI, where Netflix is betting big. The company declared itself "all in" on generative AI, using it for everything from de-aging actors in Happy Gilmore 2 to generating VFX scenes in The Eternaut – all while enforcing strict guidelines to avoid copyright issues. Co-CEO Ted Sarandos sees AI as a tool to "enhance creativity" in recommendations, ads, and production, positioning Netflix ahead of a divided industry. It's promising tech that could streamline costs and personalize viewing like never before.

Yet, for all these positives, Netflix's gaming ambitions hit a snag. On October 24, the company shuttered Boss Fight Entertainment, the studio behind the hit mobile title Squid Game: Unleashed, which had racked up over 10 million downloads since its December 2024 launch. Under new gaming president Alain Tascan, Netflix is pivoting to lighter "party games" tied to its IP, ditching bigger-budget projects. While the existing games stay live, this closure – affecting around 80 staff – signals a strategic reset that's left investors questioning the division's direction.

Yet, for all these positives, Netflix's gaming ambitions hit a snag. On October 24, the company shuttered Boss Fight Entertainment, the studio behind the hit mobile title Squid Game: Unleashed, which had racked up over 10 million downloads since its December 2024 launch. Under new gaming president Alain Tascan, Netflix is pivoting to lighter "party games" tied to its IP, ditching bigger-budget projects. While the existing games stay live, this closure – affecting around 80 staff – signals a strategic reset that's left investors questioning the division's direction.

The market's reaction? Brutal. Netflix shares tumbled over 9% in morning trading post-earnings, closing down 1.7% at $1,094.69 on October 24 – part of a broader 16% slide from June highs. A one-time $500 million+ tax hit from a Brazilian dispute dragged down EPS below expectations, but even absent that, Q4 revenue guidance of $11.96 billion underwhelmed Wall Street's lofty hopes. Investors, spoiled by Netflix's 360% three-year stock surge, are now jittery about valuations and subscriber opacity (the company stopped quarterly reporting in Q1 2025).

Why YouTube Reigns Supreme – And How Netflix Can Claw Back

YouTube's edge boils down to accessibility and variety. It's free at the entry level, algorithmically addictive, and ubiquitous across devices – including the TV screen, where it's now the top app for U.S. viewing. Netflix, with its subscription walls and premium focus, excels in polished storytelling but struggles to match YouTube's sheer volume of daily engagement. The gap widened from a mere 0.5 percentage points in 2023 to over 4 points today.

YouTube's edge boils down to accessibility and variety. It's free at the entry level, algorithmically addictive, and ubiquitous across devices – including the TV screen, where it's now the top app for U.S. viewing. Netflix, with its subscription walls and premium focus, excels in polished storytelling but struggles to match YouTube's sheer volume of daily engagement. The gap widened from a mere 0.5 percentage points in 2023 to over 4 points today.

For Netflix to close in, it needs more than hits – it requires ecosystem plays. The Spotify deal and AI integrations are smart starts, potentially driving ad revenue (projected to double in 2025) and viewer retention. Live events, like the upcoming NFL Christmas games and Stranger Things finale, could lure linear TV holdouts. But gaming's pivot must prove fruitful; otherwise, it risks being a distraction.

Also read:

- Sal Khan Takes the Helm at TED: A New Era for Ideas Worth Spreading

- Why Modern Contractors Are Turning to Concrete Estimation Software

- The Military-Energy-AI Complex: America's Nuclear Revival Through Janus

The Road Ahead: A Living Room Divided?

As 2025 draws to a close, the living room remains a battleground. Streaming's 45.2% dominance signals the end of TV as we knew it, but YouTube's commanding lead – that "fattest slice" at 12.6% – cements its role as the undisputed king. Netflix, with $11.5 billion quarters and innovative bets, has the firepower to fight back. Yet, recent stumbles in gaming and stock woes suggest Sarandos' one-handed push against the "king of the hill" will demand every ounce of strategy.

As 2025 draws to a close, the living room remains a battleground. Streaming's 45.2% dominance signals the end of TV as we knew it, but YouTube's commanding lead – that "fattest slice" at 12.6% – cements its role as the undisputed king. Netflix, with $11.5 billion quarters and innovative bets, has the firepower to fight back. Yet, recent stumbles in gaming and stock woes suggest Sarandos' one-handed push against the "king of the hill" will demand every ounce of strategy.

In this duopoly of digital entertainment, the winner won't just be the one with the most subscribers – it'll be the platform that owns the habit. For now, when the family gathers in the living room, it's YouTube's glow that lights up the screen. Netflix? It'll have to stream harder.