In a move that's rippling through Southeast Asia's financial corridors, Vietnam has unleashed one of the most aggressive digital identity crackdowns in modern history. As of September 1, 2025, the State Bank of Vietnam (SBV) has deactivated or frozen over 86 million bank accounts - nearly half of the nation's 200 million total - for failing to comply with mandatory biometric verification.

What started as a fraud-prevention initiative under Project 06 (the government's 2022 blueprint for a unified digital ID system) has snowballed into a nationwide reckoning, forcing millions to queue at branches for facial scans and fingerprint checks or risk losing access to their savings entirely.

What started as a fraud-prevention initiative under Project 06 (the government's 2022 blueprint for a unified digital ID system) has snowballed into a nationwide reckoning, forcing millions to queue at branches for facial scans and fingerprint checks or risk losing access to their savings entirely.

For expats, rural elders, and the diaspora, it's a logistical nightmare; for privacy hawks and crypto enthusiasts, it's a clarion call to decentralize.

The policy, rooted in Circular 17/2024/TT-NHNN, mandates biometric-linked accounts for all transactions over 10 million VND ($379)—think routine transfers, bill pays, or e-commerce splurges.

Corporate accounts got hit first on July 1, 2025, with legal reps required to verify in person; personal ones followed suit in January. By June 2025, only 113 million individual and 711,000 organizational accounts had passed muster, leaving the rest in limbo.

Funds aren't seized - they're just inaccessible until compliance. But with a September 30 deadline looming, non-updaters face permanent deletion. SBV's Pham Anh Tuan called it a "data-cleansing revolution" to thwart AI-powered scams, like the May 2025 ring that laundered $39 million via fake facial deepfakes.

Vietnam's not alone in this biometric push - it's accelerating a global trend where digital IDs gatekeep finance. But the scale here is staggering: 61 million citizens already use the VNeID app for government services (29 million monthly logins), cross-referenced against the National Population Database.

Banks like Vietcombank and BIDV have rolled out app-based scans, but glitches abound—long queues, app crashes, and phishing spikes disguised as "update alerts." Foreigners bear the brunt: expats report flying home from abroad (one Reddit user shelled out $1,200 for a Hanoi round-trip to save an HSBC account), while rural folks trek miles sans smartphones. Equity gaps yawn wide: 40% of low-income households lack reliable internet, per a 2025 World Bank study, turning "verification" into exclusion.

The Fraud Fight: Security or Surveillance?

Officials tout it as a bulwark against cyber threats. Vietnam's digital banking fraud hit 1.2 trillion VND ($48 million) in 2024 - a 150% YoY surge, fueled by AI deepfakes and mule accounts. Biometrics slashed incidents 30% in pilots, with liveness detection (blinks, head turns) outfoxing fakes.

Officials tout it as a bulwark against cyber threats. Vietnam's digital banking fraud hit 1.2 trillion VND ($48 million) in 2024 - a 150% YoY surge, fueled by AI deepfakes and mule accounts. Biometrics slashed incidents 30% in pilots, with liveness detection (blinks, head turns) outfoxing fakes.

Cake Digital Bank snagged Southeast Asia's first ISO/IEC 30107-3 Level 2 cert for facial tech in August 2025, while Viettel's iris scanners clock 99.9% accuracy. The SBV's vision: a "real efficiency" cashless society by 2030, aligning with ASEAN's digital economy pact.

But critics cry foul. "This is financial surveillance on steroids," warns Herbert Sim, "Bitcoin Man" and AICEAN CMO, who's navigated the chaos firsthand. Privacy risks loom: a 2025 Viettel hack exposed 1.5 million records, and biometric data—once leaked—is forever. Echoes of China's social credit? Absolutely - Vietnam's Project 06 mirrors it, tying IDs to services like loans and travel. Expats and the unbanked (15% of adults) face de facto exclusion, with in-person mandates ignoring remote workers.

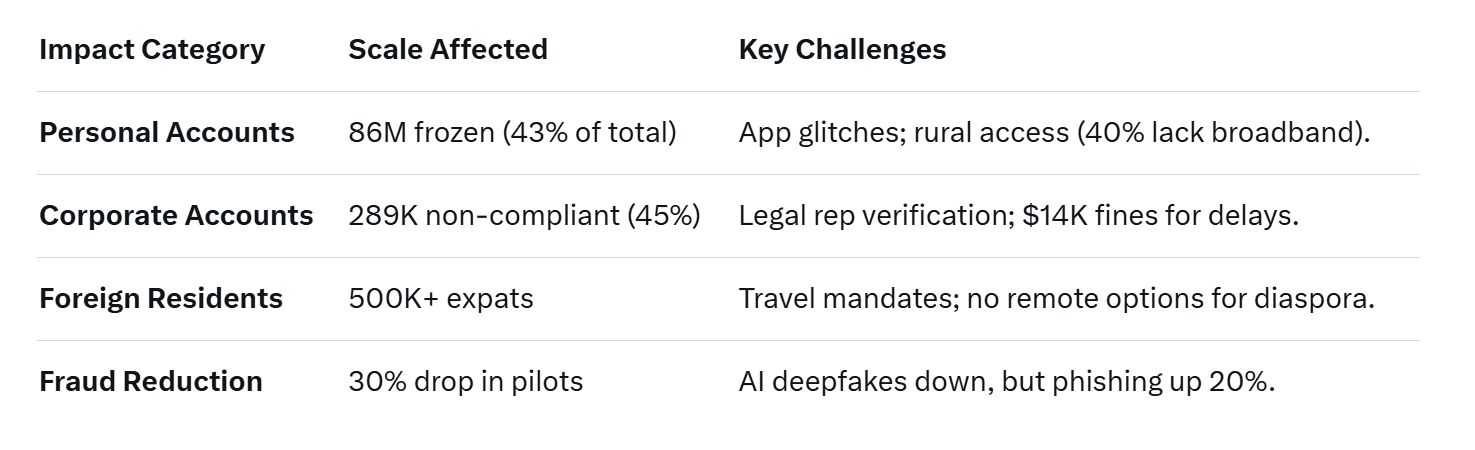

This table, based on SBV data and World Bank 2025 reports, spotlights the human toll amid the tech wins.

Crypto's Unexpected Windfall: Bitcoin as the Backdoor

The purge has turbocharged Vietnam's crypto scene - already a hotspot with $100 billion in 2024 volume (third globally, per Chainalysis). Post-freeze, Bitcoin searches spiked 300% on Google Trends, and P2P volumes on Binance jumped 45% in September.

The purge has turbocharged Vietnam's crypto scene - already a hotspot with $100 billion in 2024 volume (third globally, per Chainalysis). Post-freeze, Bitcoin searches spiked 300% on Google Trends, and P2P volumes on Binance jumped 45% in September.

"Why Bitcoin? Because no government can freeze your keys," tweeted Marty Bent, echoing a chorus of "HODLers." Remittances (Vietnam's $18B lifeline) now flow via USDT, evading VND volatility (down 5% YTD).

Local exchanges like Remitano saw 25% user growth, with expats like Reddit's "Yukzor" (a contractor) quipping: "Flew home to save my bank? Nah, bought BTC instead."

This isn't rebellion - it's pragmatism. With 20% youth unemployment and property slumps (prices -6.9% YoY), trust in banks wanes. Crypto's permissionless allure shines: no KYC walls, global access.

Yet, risks lurk - Vietnam's 2025 crypto tax (10% on gains) and SBV warnings of "speculative bubbles" temper the boom. Still, as one Hanoi trader posted on X: "Biometrics lock your money; sats set it free."

Also read:

- How Much Is Taylor Sheridan Worth? The Showrunner Who's Priced Deep America at a Premium

- Stars in Shock: Spotify Founder's Investments Drive Artists Away from Streaming

- How AI Is Quietly Rewiring Human Thinking: A New Landmark Review

- How Technology Improved the Piano

A Global Canary? Vietnam's Wake-Up Call for Digital Finance

Vietnam's blitz is no outlier - it's a preview. India's Aadhaar links 1.3 billion to biometrics (with 2024 hacks exposing millions); Nigeria's eNaira mandates scans for wallets. The EU's eIDAS 2.0 eyes similar gates by 2026. Proponents hail fraud drops (global cyber losses: $10.5T in 2025, per Cybersecurity Ventures); detractors decry "tyranny by algorithm."

For Vietnam's 100 million citizens, the scramble continues - branches overwhelmed, VNeID downloads up 50%. As SBV's Tuan vows "efficiency," one frozen-account holder summed it on Reddit: "My money's safe, but my freedom? Not so much." In a cashless future, who holds the keys? Hanoi might just show us.