In the rugged landscapes of modern Hollywood, where corporate mergers carve up empires like frontier trails, few figures embody the untamed spirit of "deep America" quite like Taylor Sheridan. The Texas-born writer, actor, and producer - whose gritty tales of cowboys, corrupt mayors, and oil-rig intrigue have defined premium streaming - has long been the beating heart of Paramount+.

But as the dust settles from the $8.4 billion Skydance-Paramount merger finalized in August 2025, Sheridan is saddling up for a new horizon. He's inking a blockbuster five-year deal with NBCUniversal, valued at up to $1 billion, that kicks off in January 2029 after his current Paramount pact expires at the end of 2028.

But as the dust settles from the $8.4 billion Skydance-Paramount merger finalized in August 2025, Sheridan is saddling up for a new horizon. He's inking a blockbuster five-year deal with NBCUniversal, valued at up to $1 billion, that kicks off in January 2029 after his current Paramount pact expires at the end of 2028.

This seismic shift isn't just a talent poach; it's a stark valuation of Sheridan's economic firepower, one that's left Paramount scrambling and Peacock eyeing a golden ticket to relevance.

Sheridan's exodus stems from a clash of creative cowboys and boardroom sheriffs. Under the old Paramount regime, led by co-CEO Chris McCarthy (who departed in August 2025 post-merger), Sheridan enjoyed near-total autonomy: unlimited greenlights, budgets ballooning to $20 million per episode, and shoots on his sprawling 6666 Ranch in Texas.

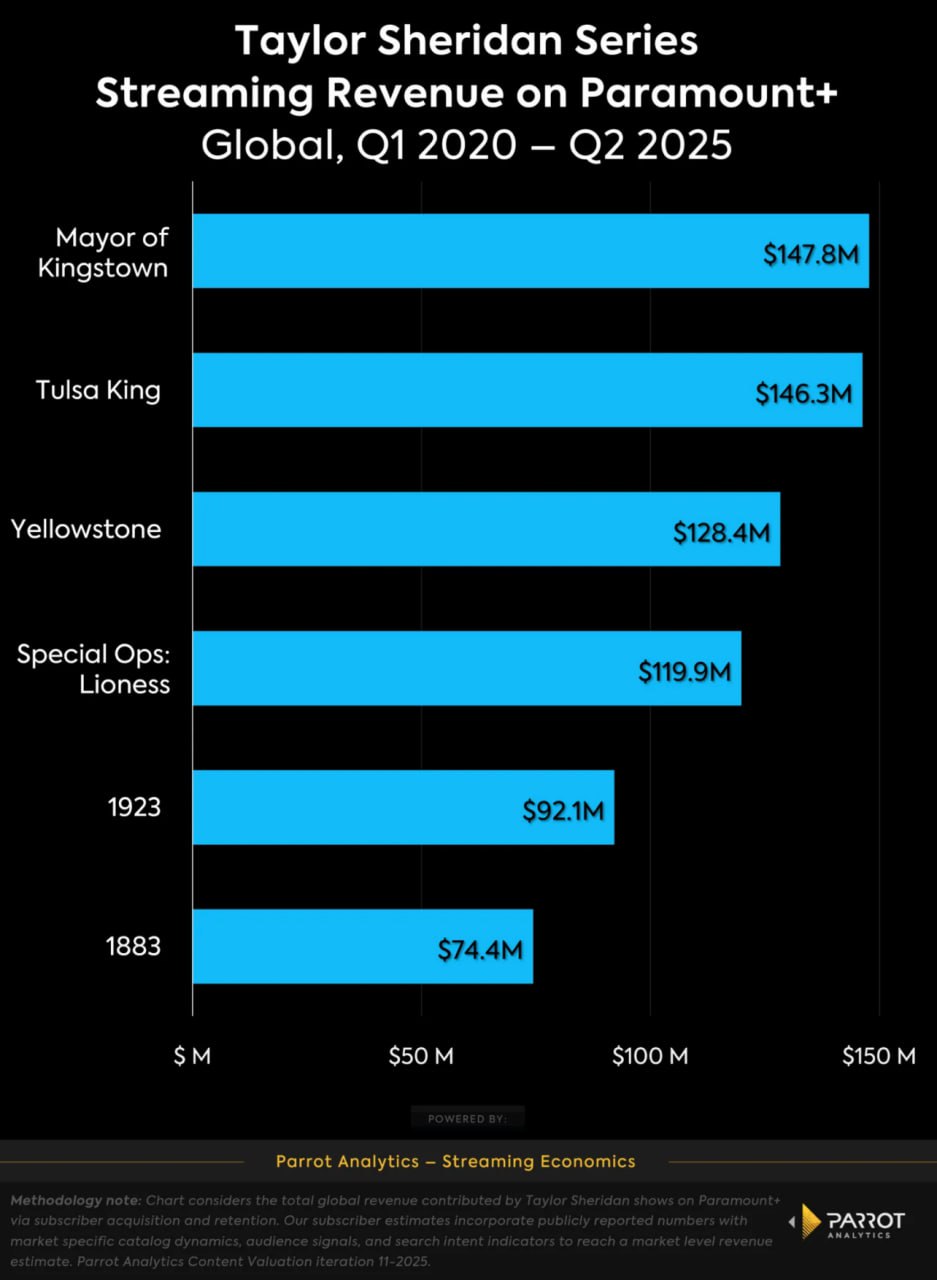

His output was prolific - dozens of series, from the flagship Yellowstone to spinoffs like 1883 and 1923, plus standalone hits such as Mayor of Kingstown, Tulsa King, Special Ops: Lioness*, and the Billy Bob Thornton-led Landman. But the Skydance infusion, helmed by billionaire David Ellison, brought a Zaslav-like scrutiny: script notes, budget caps hovering around $9 million per episode, and outright passes on new pitches.

His output was prolific - dozens of series, from the flagship Yellowstone to spinoffs like 1883 and 1923, plus standalone hits such as Mayor of Kingstown, Tulsa King, Special Ops: Lioness*, and the Billy Bob Thornton-led Landman. But the Skydance infusion, helmed by billionaire David Ellison, brought a Zaslav-like scrutiny: script notes, budget caps hovering around $9 million per episode, and outright passes on new pitches.

Ellison, who once hailed Sheridan as "a singular genius with a perfect track record" in a CNBC interview just weeks after the merger, reportedly flew to Texas to court him personally.

Yet, insiders tell The Hollywood Reporter, the overtures felt half-hearted, with Paramount prioritizing cost savings - over $2 billion targeted through 1,000 layoffs announced in October 2025 and asset sales - over Sheridan's freewheeling vision.

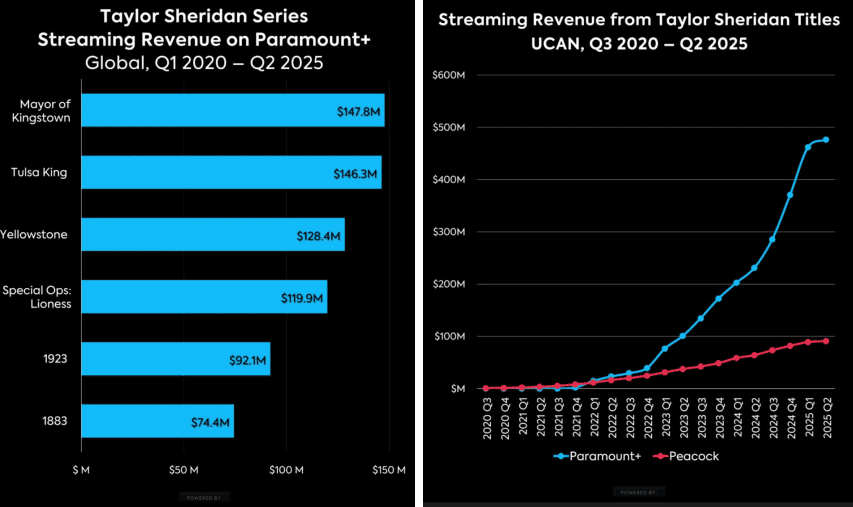

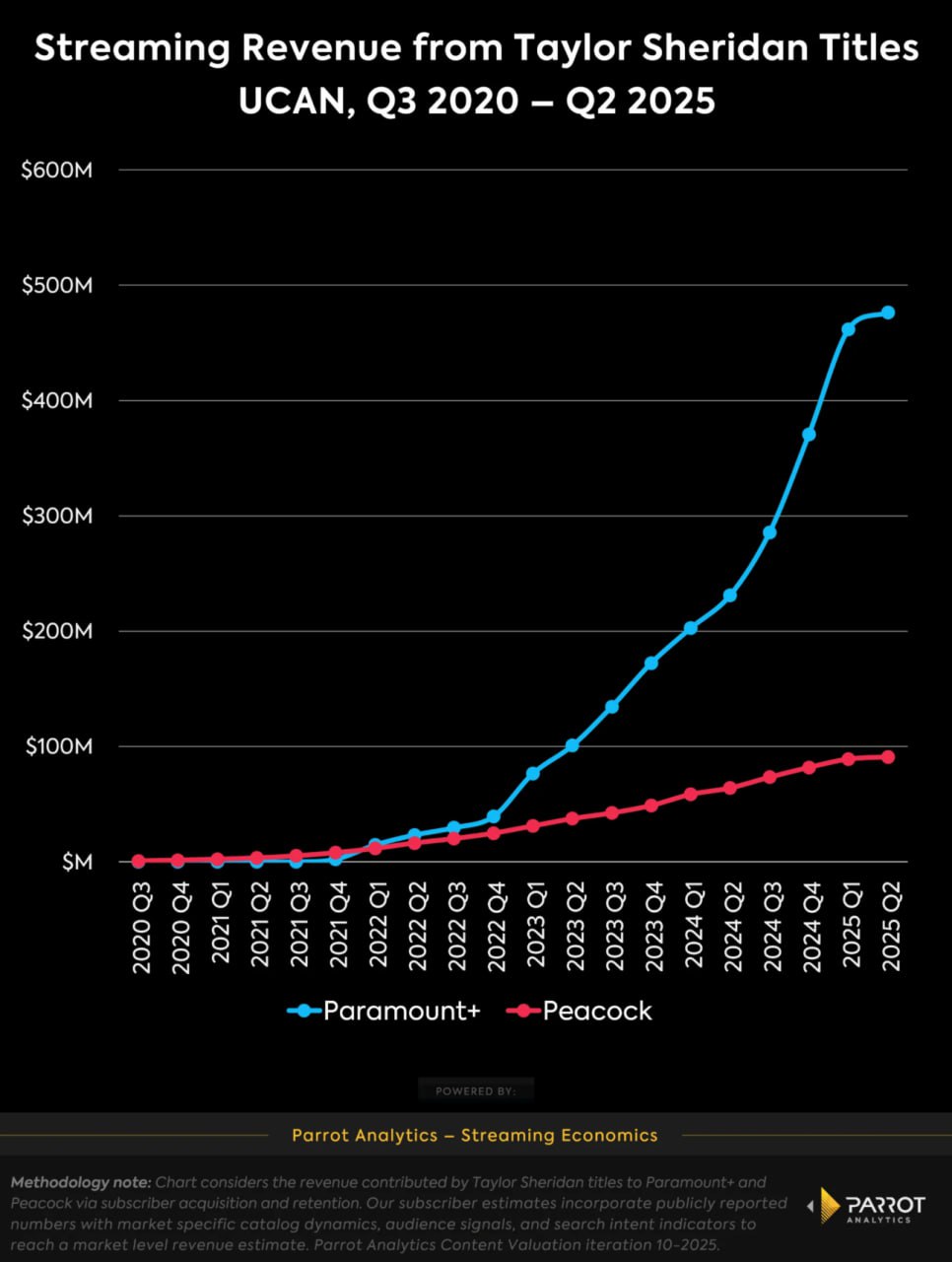

The numbers underscore why letting Sheridan ride off is a gut punch for Paramount. According to Parrot Analytics' Streaming Economics model, Sheridan's Paramount+ originals have generated more than $800 million in global streaming revenue since Mayor of Kingstown premiered in late 2021.

Domestically, that translates to an estimated $263 million in subscriber revenue for the U.S. and Canada alone, powering 11.7% of Paramount+'s total haul alongside franchises like Star Trek. Landman, his latest smash that debuted in November 2024, alone raked in $150 million worldwide, outpacing even Lioness ($128 million) and Tulsa King ($120 million).

Domestically, that translates to an estimated $263 million in subscriber revenue for the U.S. and Canada alone, powering 11.7% of Paramount+'s total haul alongside franchises like Star Trek. Landman, his latest smash that debuted in November 2024, alone raked in $150 million worldwide, outpacing even Lioness ($128 million) and Tulsa King ($120 million).

Yellowstone, the crown jewel with over 13 million weekly viewers at its peak, has been a licensing headache: Paramount streams it internationally but pays Peacock (NBCUniversal) for U.S. rights under a pre-Paramount+ deal struck in 2020.

Parrot estimates Yellowstone has earned Peacock over $90 million domestically - far less than the $128 million it could have netted Paramount without the split. Had the mothership stayed in-house from day one, experts project it alone would have added over $200 million to Paramount's coffers, supercharging subscriber growth amid the platform's climb to 71 million global users by Q3 2025.

Sheridan's value isn't just in dollars; it's in the "Sheridan-verse" ecosystem he builds like a rancher corrals cattle. Each series feeds the next: Yellowstone begat prequels that drew in A-listers like Harrison Ford and Helen Mirren, while spin-offs like the upcoming 1944 and 6666 promise to extend the franchise into the 2030s.

His shows aren't cheap - annual production costs topped $500 million under the prior leadership, per a Wall Street Journal analysis—but they deliver outsized returns, with global demand metrics 5x higher than average scripted fare. Before fully decamping, Sheridan will deliver three more years of output to Paramount, including Yellowstone Season 6 (slated for late 2026), spinoffs Y: The Marshals (starring Luke Grimes, premiering Spring 2026 on CBS with Paramount+ streaming) and The Madison (Michelle Pfeiffer in a modern tale), plus a music reality series The Road for CBS. That's at least a dozen active projects, leaving Paramount with a robust library but no new Sheridan IP after 2028.

His shows aren't cheap - annual production costs topped $500 million under the prior leadership, per a Wall Street Journal analysis—but they deliver outsized returns, with global demand metrics 5x higher than average scripted fare. Before fully decamping, Sheridan will deliver three more years of output to Paramount, including Yellowstone Season 6 (slated for late 2026), spinoffs Y: The Marshals (starring Luke Grimes, premiering Spring 2026 on CBS with Paramount+ streaming) and The Madison (Michelle Pfeiffer in a modern tale), plus a music reality series The Road for CBS. That's at least a dozen active projects, leaving Paramount with a robust library but no new Sheridan IP after 2028.

For NBCUniversal, this is a calculated stampede toward relevance. Peacock, which has quietly hosted Yellowstone as its top title since 2020, sees Sheridan as the multiplier effect: his arrival could replicate the $800 million magic, boosting Peacock's 36 million subscribers and challenging Netflix's scripted dominance.

NBCU Chair Donna Langley wooed Sheridan with personal visits to his Weatherford, Texas ranch, promising the autonomy he craves - no meddling execs, just greenlights and budgets. Joining him is longtime partner David Glasser and 101 Studios under a first-look film deal starting March 2026, paving the way for Sheridan features at Universal Pictures. "I spent the first 37 years of my life compromising," Sheridan quipped in a 2023 Hollywood Reporter profile. At NBCU, he'll helm wholly new universes, potentially transplanting his deep-America ethos to urban thrillers or global Westerns.

Sheridan's personal ledger tells a similar tale of frontier fortune. His net worth hovers around $70 million, per Forbes' 2025 estimates, fueled by backend deals, ranch real estate (including the $23 million Bosque Ranch used for Yellowstone shoots), and side ventures like a vodka brand tied to the 6666 line.

But the NBCU pact - potentially eclipsing his $200 million Paramount renewal from 2021 - could push him into billionaire territory if even half his slate hits. In an industry reeling from streamer consolidations and AI disruptions, Sheridan stands as a rare auteur-economist: the showrunner who doesn't just tell stories of blue-collar grit but monetizes them like a cattle drive.

Also read:

Also read:

- Don't Fear AI Intelligence. Fear AI Emotions.

- 🇰🇷 The Phoenix Rises: K-Beauty’s Second Act in China’s “Graveyard of Korean Companies”

- China's "Impossible Chip": The Analog Breakthrough Poised to Eclipse Nvidia and AMD

- What if ScanPST EXE does not Work?

Paramount's loss is Hollywood's wake-up call. As Ellison's team eyes bids for Warner Bros. Discovery assets amid ongoing FCC scrutiny of the Skydance deal, Sheridan's departure highlights the peril of prioritizing spreadsheets over storytellers. For Peacock, it's a high-noon showdown: give Sheridan the reins, and he might just lasso the streamer into the big leagues. In the end, Taylor Sheridan's worth isn't measured in millions—it's in the empires he builds, one uncompromised script at a time.