In the volatile world of cryptocurrencies, market capitalizations often paint a picture of immense value and potential. As of February 2026, the total crypto market cap hovers between $2.4 trillion and $3.3 trillion, yet a closer examination reveals a stark reality: much of this value is illusory. For approximately 90% of crypto projects, these billion-dollar valuations are not grounded in real utility, user engagement, or revenue streams.

Instead, they are propped up by speculative token sales, manipulated metrics, and a dwindling pool of investors. This article delves into the systemic issues plaguing the industry, drawing on publicly available data to highlight how virtual numbers have masked a fundamental rot at the core of crypto.

The Mirage of Market Caps: Billions Without Backing

Market capitalization in crypto is calculated by multiplying the circulating supply of tokens by their current price. On paper, this yields impressive figures, but in practice, these numbers are often detached from any tangible fundamentals. Many projects boast valuations in the billions despite having negligible user bases, website traffic, or real-world applications. This discrepancy arises because these caps are "drawn" through hype-driven pumps, not organic growth.

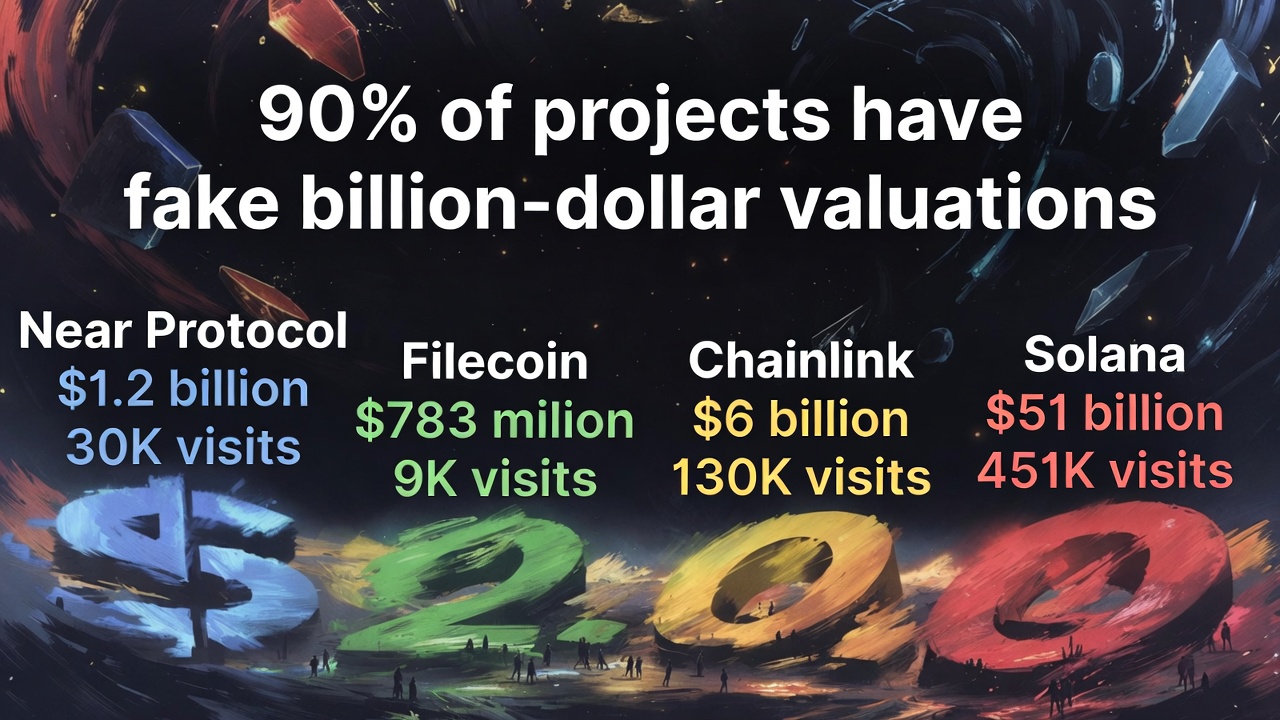

Consider Near Protocol, with a market cap of around $1.2 billion but only about 30,000 monthly website visitors. Filecoin follows suit, valued at roughly $783 million yet attracting a mere 9,000 monthly visits to its site. Chainlink, a supposed oracle giant, commands a $6 billion cap with just 130,000 visitors, while Solana — often touted as a high-performance blockchain — sits at $46 billion in valuation despite only 451,000 monthly site hits.

Consider Near Protocol, with a market cap of around $1.2 billion but only about 30,000 monthly website visitors. Filecoin follows suit, valued at roughly $783 million yet attracting a mere 9,000 monthly visits to its site. Chainlink, a supposed oracle giant, commands a $6 billion cap with just 130,000 visitors, while Solana — often touted as a high-performance blockchain — sits at $46 billion in valuation despite only 451,000 monthly site hits.

These examples are not outliers; they represent a broader trend where 90% of projects exhibit similar patterns of abandonment. Social media accounts lie dormant, and official websites see traffic levels that wouldn't sustain even a modest e-commerce operation, including bot-inflated visits.

The survival of these projects has relied on one primary mechanism: relentless token sales on exchanges. For years, founders and early insiders have dumped tokens onto retail investors, funding operations without delivering products or services. No revenue from sales, no active users — just a cycle of hype and liquidation. If these inflated caps were divided by 10, the projects wouldn't "go broke" because the numbers are virtual; they know it, and so do sophisticated insiders. The credit of trust extended by early adopters has been exhausted, but it hasn't yet fully reflected in these phantom valuations.

Fake Trading Volumes: The Engine of Deception on Centralized Exchanges

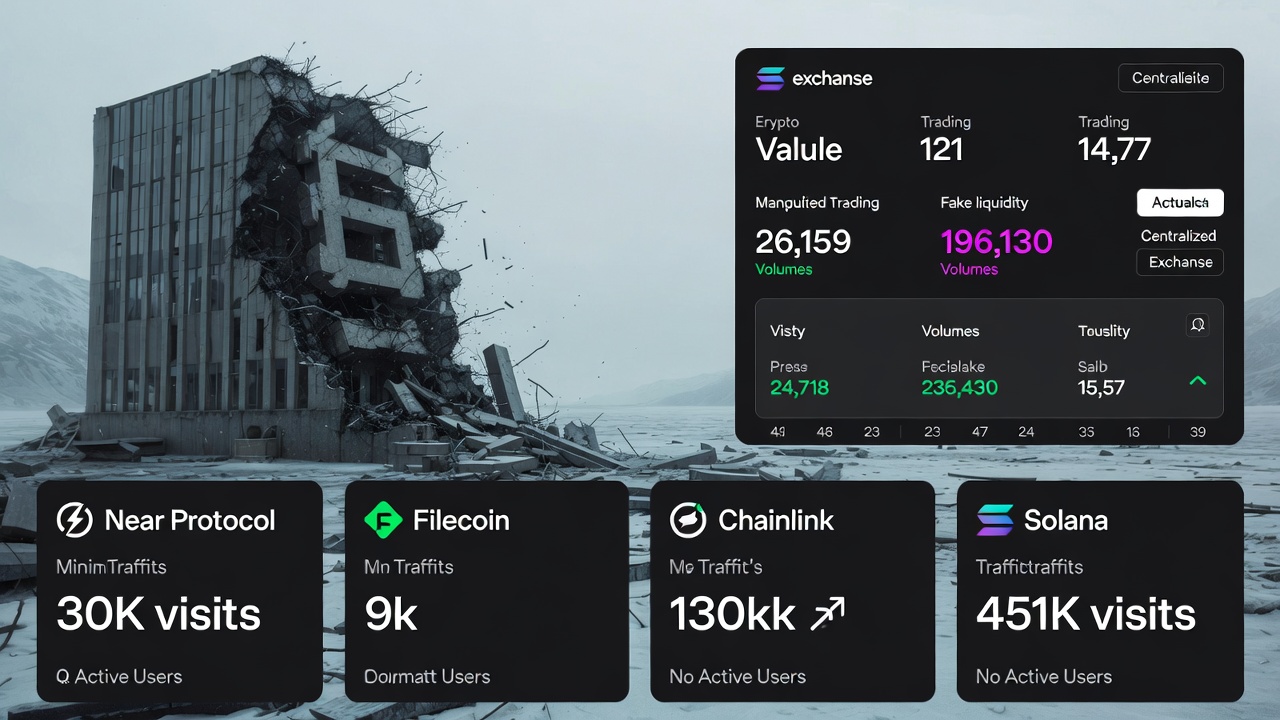

Compounding the issue is the rampant manipulation of trading volumes on centralized exchanges (CEXs). Unlike decentralized protocols where transactions are verifiable on-chain, CEX volumes are internal ledger entries — essentially "fiat" numbers that exchanges can fabricate at will.

Compounding the issue is the rampant manipulation of trading volumes on centralized exchanges (CEXs). Unlike decentralized protocols where transactions are verifiable on-chain, CEX volumes are internal ledger entries — essentially "fiat" numbers that exchanges can fabricate at will.

Studies estimate that 98% of reported volumes are bogus, inflated through wash trading (repeated self-trades to simulate activity) and bots.

This creates an illusion of liquidity and demand, luring in unsuspecting investors. For instance, exchanges have been caught exaggerating Bitcoin volumes to climb rankings on aggregators like CoinMarketCap, with one report from 2019 claiming 95% of volumes were fake — a problem that persists today.

Wash trading isn't just a minor glitch; it's a foundational bug that has eroded the industry's credibility. Entities like the U.S. National Bureau of Economic Research peg wash trading at up to 70% of volumes on unregulated exchanges, while centralized platforms show similar patterns.

Exchanges can "draw" quadrillions in turnover if they choose, as these aren't blockchain-verified events but internal fictions designed to attract users and climb leaderboards.

The Blockchain Facade: 95% Aren't Even Real Blockchains

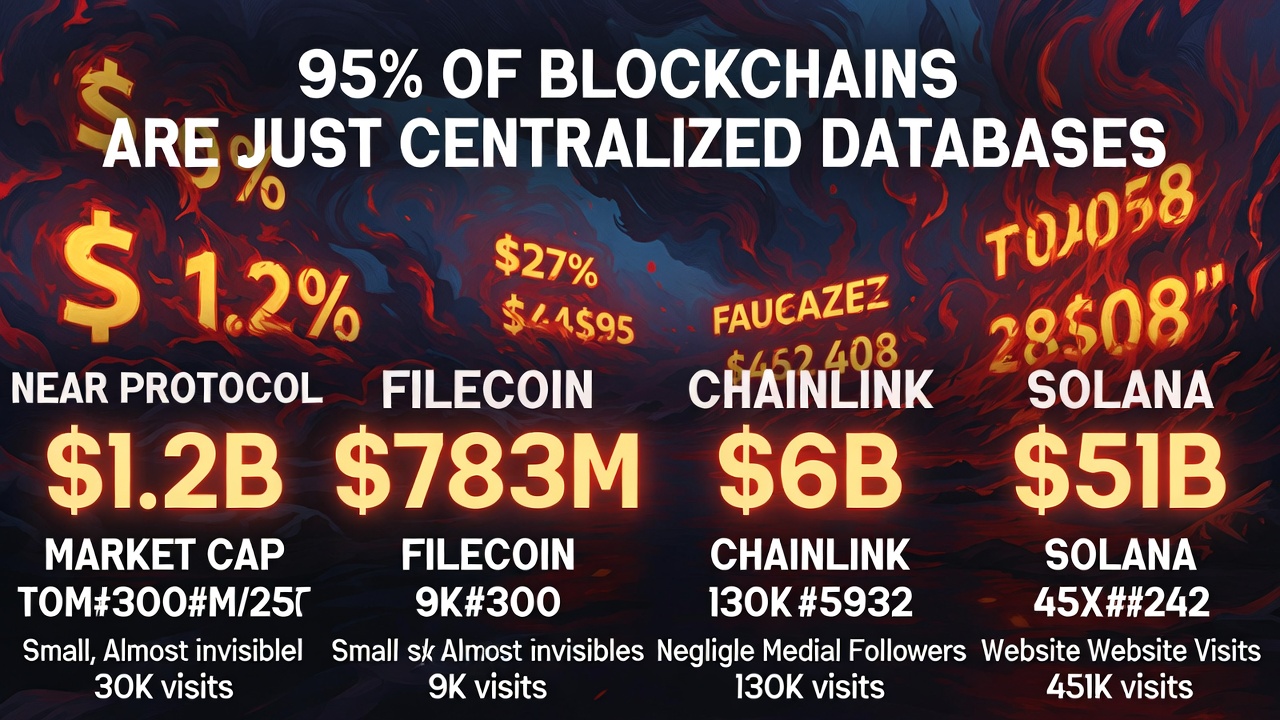

Adding insult to injury, about 95% of so-called "blockchains" aren't truly decentralized; they're centralized databases masquerading as innovative tech. This revelation, now acknowledged even by die-hard evangelists, underscores how the industry has prioritized hype over substance.

Adding insult to injury, about 95% of so-called "blockchains" aren't truly decentralized; they're centralized databases masquerading as innovative tech. This revelation, now acknowledged even by die-hard evangelists, underscores how the industry has prioritized hype over substance.

Out of over 18,000 cryptocurrencies, more than 53% are dead or abandoned, and only a fraction deliver any utility. Research shows that less than 50% of the top 100 cryptos have working products with real value, while 90% of blockchain projects fail outright due to misplaced priorities — like starting with the tech instead of solving actual problems.

Scammers dominate the informational and financial landscape, flooding the space with pump-and-dump schemes and rug pulls. This has decimated user engagement, turning crypto into a ghost town of zombie projects and fake metrics.

The Exodus: No Retail Left, Billions in Outflows

Retail buyers, once the lifeblood of crypto bull runs, have largely vanished. The "music" from prosperous previous years still plays faintly, but the dance floor is empty. People vote with their money, and the verdict is clear: consistent outflows from crypto markets for months on end.

Retail buyers, once the lifeblood of crypto bull runs, have largely vanished. The "music" from prosperous previous years still plays faintly, but the dance floor is empty. People vote with their money, and the verdict is clear: consistent outflows from crypto markets for months on end.

In January 2026 alone, Bitcoin ETFs saw over $1.1 billion in net outflows, with February continuing the trend — $133 million from Bitcoin products and $41.8 million from Ether on a single day.

Over the past three months, spot Bitcoin ETFs have shed about $5.8 billion, signaling institutional deleveraging amid macro uncertainty.

The root cause? A growing realization that 90% of the market consists of outright scams. Illicit activities hit $158 billion in 2025 (1.2% of total volume), with impersonation scams surging 1,400% year-over-year. Global crypto ownership stalls at 9.9%, with U.S. adoption flatlining as scandals, hacks, and volatility deter newcomers.

Also read:

Also read:

- MrBeast's $5.2 Billion Empire: Breaking Down the Beast Ahead of IPO

- Choosing the Best $20/Month AI Subscription in 2026: Claude Pro, ChatGPT Plus, or Google AI Pro?

- OpenClaw Founder Peter Steinberger Joins OpenAI: A Shift from Open Source to AI Giant—And the Founders Who Said No

The Inevitable Freeze: Crypto Winter 2026-2027

Restoring trust will be an uphill battle — if it's possible at all. The upcoming crypto winter of 2026-2027 is poised to be brutal, an "ice age" for digital assets.

Restoring trust will be an uphill battle — if it's possible at all. The upcoming crypto winter of 2026-2027 is poised to be brutal, an "ice age" for digital assets.

Predictions include a "great purge" slashing valuations by at least 10x, reducing viable cryptos to 2,000 and exchanges to 30-50. Bitcoin could dip to $38,000-$40,000, with most altcoins facing extinction due to zero utility.

This isn't doom-mongering; it's a call for realism. The crypto market's foundational flaws—fake caps, manipulated volumes, and pseudo-decentralization — have caught up.

Only projects with genuine utility and transparent operations will survive the thaw. Investors beware: the numbers may look real, but the value often isn't.