The promise of blockchain technology was revolutionary: a decentralized system where no single entity holds control, empowering users with transparency, security, and autonomy. Yet, as the crypto market matures into 2026, a harsh reality emerges. What we call "blockchains" are often nothing more than centralized operations masquerading as innovative tech.

These so-called decentralized networks are frequently run by a single person or a small group who can flip a switch and shut everything down. True decentralization? It barely exists in most cases.

The Facade of Decentralization

At its core, blockchain was meant to eliminate intermediaries and distribute power. Bitcoin and Ethereum set the standard, but the explosion of altcoins and new chains has diluted this vision.

Today, over 95% of crypto projects wave the decentralization flag not out of principle, but as a marketing ploy to attract investors — often referred to in crypto slang as "shearing hamsters," or fleecing naive retail participants. These projects are essentially traditional businesses with a blockchain veneer, controlled centrally and vulnerable to the whims of their founders.

Today, over 95% of crypto projects wave the decentralization flag not out of principle, but as a marketing ploy to attract investors — often referred to in crypto slang as "shearing hamsters," or fleecing naive retail participants. These projects are essentially traditional businesses with a blockchain veneer, controlled centrally and vulnerable to the whims of their founders.

Consider the scale: As of February 2026, there are approximately 18,959 cryptocurrencies with some level of activity, but estimates suggest over 120 million unique tokens have been created overall, many of which are inactive or defunct. Yet, active listings on platforms like CoinMarketCap hover around 8,949.

This discrepancy highlights how the market is bloated with illusions. Decentralization here is conditional at best — many chains rely on permissioned nodes or centralized validators, making them no different from a corporate database.

The Plague of Scams and Zombie Projects

The manipulation runs deep. More than 90% of tokens appear designed solely to extract money from investors, with outright scams dominating the landscape. In 2025 alone, scammers stole an estimated $17 billion in crypto, a figure projected to grow as more illicit activities are uncovered. Impersonation scams surged 1,400% year-over-year, leveraging AI and sophisticated tactics to dupe victims.

Even worse are the "zombie" projects — coins that linger in rankings despite being dead in the water. Over 53% of cryptocurrencies are now classified as zombies, totaling more than 13.4 million such assets. These include projects with no website, abandoned social media, minimal trading volumes (just enough to avoid delisting from sites like CoinMarketCap or CoinGecko), or artificially inflated fake volumes. Since 2021, roughly 3.7 million projects have failed outright.

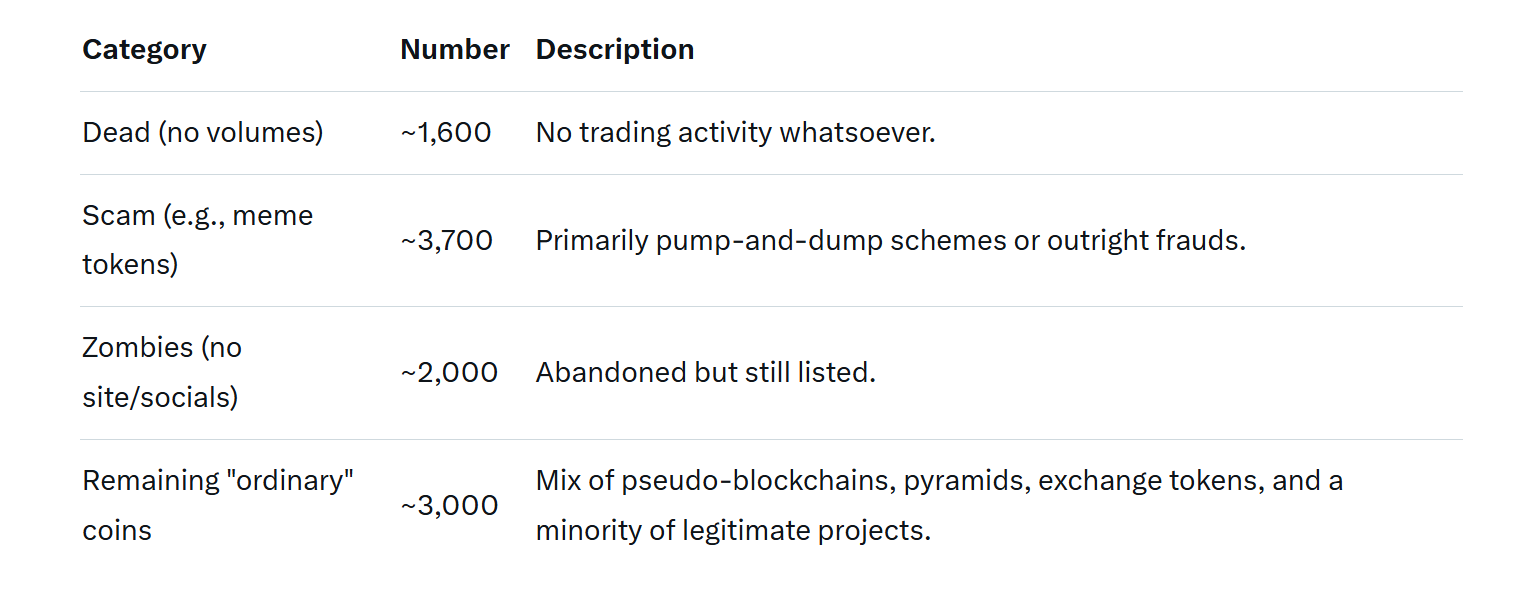

Breaking it down from the user's approximate 10,000 "more or less alive" cryptocurrencies:

From these 3,000, only 1,500–2,000 might warrant consideration for investment—the rest are junk. This isn't hyperbole; illicit activity, while only 1.2% of total crypto volume in 2025, still amounted to $154 billion in inflows to suspicious addresses.

Market Collapse: The End of the Party

The crypto boom once sustained everyone — scammers and honest builders alike. But the party, built on the ruins of shattered family budgets, is over. No new blood enters the market; existing participants are tapped out or ruined. Pushing yet another meme token? It's not working anymore. As a result, 90% of scam projects have turned inward, cannibalizing each other through internal fraud and liquidity drains.

Recovery? Forget it in the current state. Scammers dominate every corner, and major exchanges have historically listed obvious frauds—sometimes even creating them under the guise of independent projects. Legitimate ventures suffocate under exorbitant listing fees, marketing costs, and market-making expenses they can't afford.

Recovery? Forget it in the current state. Scammers dominate every corner, and major exchanges have historically listed obvious frauds—sometimes even creating them under the guise of independent projects. Legitimate ventures suffocate under exorbitant listing fees, marketing costs, and market-making expenses they can't afford.

A 50%–90% price drop might stir some life, but true revival demands radical change. A multi-fold crash would purge the fraudsters, pseudo-blockchains, and scam exchanges, clearing the way for genuine innovation.

Welcome to the bear rally of cryptocurrencies, where prices plummet — and we should cheer it. The Wild West era is done. Endless liquidity injections, hype cycles, and manipulative trading are exhausted. The bubble bursts with a bang, but the future favors creators over hype machines.

Rising from the Ashes: Real Projects Like QUASA

Amid the debris, platforms built on actual demand will thrive. Take QUASA, a decentralized freelance network focused on remote work with cryptocurrency payments. Unlike the fakes, QUASA leverages blockchain for transparency and security: clients and freelancers connect via the Quasa Connect app, settling payments instantly through crypto wallets using Quasacoin (QUA).

Amid the debris, platforms built on actual demand will thrive. Take QUASA, a decentralized freelance network focused on remote work with cryptocurrency payments. Unlike the fakes, QUASA leverages blockchain for transparency and security: clients and freelancers connect via the Quasa Connect app, settling payments instantly through crypto wallets using Quasacoin (QUA).

QUA, an ERC-20 governance token on Ethereum, ensures operations within the ecosystem. With a total emission capped at around 120 million tokens, it's designed for utility — escrow protections prevent fraud, as blockchain acts as the impartial third party. No more disputes or non-payments; everything is traceable and immutable.

As of early 2026, QUA trades at approximately $0.0001972 with a market cap of about $14,544 and low daily volume, reflecting its niche but genuine focus.

As of early 2026, QUA trades at approximately $0.0001972 with a market cap of about $14,544 and low daily volume, reflecting its niche but genuine focus.

QUASA isn't chasing hype; it's solving real problems in the gig economy, where remote work demands borderless, efficient payments.

Years of suppression by scammy listings on big exchanges have undervalued such projects, but as the market cleanses, QUASA stands to gain visibility and adoption.

Also read:

- Has Disney+ Ruined the Marvel Cinematic Universe?

- Insightful Takeaways: Creator Jay Clouse Shares His 2024 Wins and Losses

- Alibaba Unveils Qwen VLo: A GPT-4o-Style AI Image Generator

Conclusion: Builders Over Buzz

The crypto market's purge is painful but necessary. For too long, fraudsters have drowned out innovators, eroding trust and value. But platforms like QUASA, rooted in real-world utility—decentralized freelance with crypto settlements—will emerge stronger. The future belongs to those creating value, not manufacturing hype. As prices fall and fakes fade, watch for the true decentralizers to lead the way.