The cryptocurrency market, once hailed as the future of finance, is built on a shaky foundation riddled with a fundamental flaw that has stunted its growth and led to its inevitable downturn.

This inherent "bug" — a systemic issue embedded from the market's inception — has prevented sustainable development, repelling mainstream adoption and confining crypto to a niche of die-hard enthusiasts.

This inherent "bug" — a systemic issue embedded from the market's inception — has prevented sustainable development, repelling mainstream adoption and confining crypto to a niche of die-hard enthusiasts.

Without a radical shift in its core nature, cryptocurrencies risk further marginalization, shrinking to irrelevance. Real-world adoption remains alarmingly low, far from the revolutionary promises of decentralization.

At its launch, the crypto market was granted an enormous blank check: unprecedented hype and a massive credit of trust from investors, technologists, and the public. Yet, this goodwill has been squandered through rampant fraud, manipulation, and scandals that have compromised the very essence of decentralization.

What was meant to be a trustless, peer-to-peer system has devolved into a playground for opportunists, eroding credibility and leaving the industry isolated.

Despite flashy headlines boasting billions in market caps, soaring trading volumes, and millions of users, the reality is starkly different. These metrics are often inflated illusions, masking a market teetering on the edge.

The Structural Flaw: A Market Built on Deception

At the heart of this crisis is a structural bug: approximately 90% of crypto projects are outright scams, designed solely to exploit retail investors through pump-and-dump schemes, rug pulls, and false promises.

This isn't an anomaly but a foundational defect that has allowed fraud to proliferate unchecked. To survive, the market requires a "great reset"—a massive purge of illegitimate projects, which could wipe out billions in value and reshape the landscape. Only then can true liquidity and legitimacy emerge.

Consider the absurd valuations that highlight this manipulation. Filecoin (FIL), a decentralized storage project, boasts a market capitalization of around $783 million as of early February 2026, yet its website traffic is estimated in the low thousands monthly (9K) —hardly justifying such a figure.

Consider the absurd valuations that highlight this manipulation. Filecoin (FIL), a decentralized storage project, boasts a market capitalization of around $783 million as of early February 2026, yet its website traffic is estimated in the low thousands monthly (9K) —hardly justifying such a figure.

In contrast, Solana (SOL), with roughly 451,000 monthly visitors to its site, commands a staggering $51 billion market cap. This disparity isn't organic growth; it's a symptom of systemic hype and artificial inflation.

A more rational valuation might cap Filecoin at $20 million and Solana at $500 million, implying a potential 10x to 100x drop for many projects — if they survive at all.

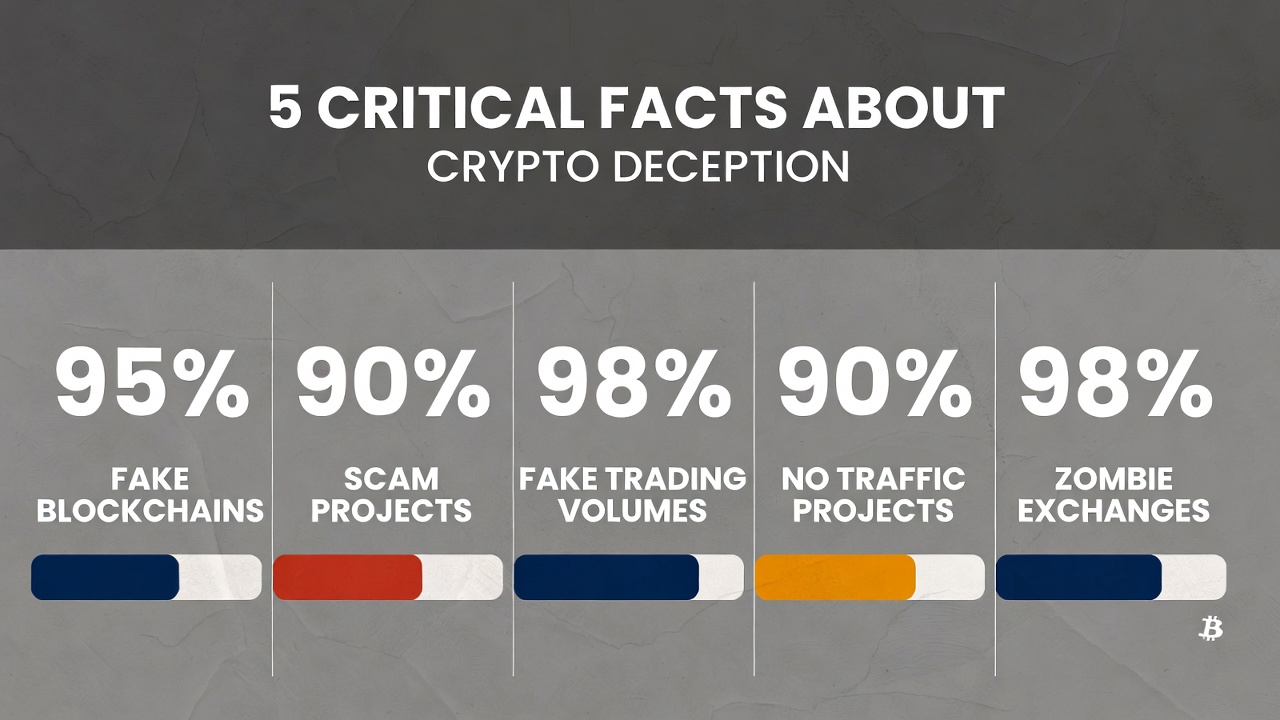

Five Eye-Opening Facts About Crypto's Illusion

To underscore the depth of this deception, here are five critical facts:

To underscore the depth of this deception, here are five critical facts:

1. 95% of Blockchains Aren't True Blockchains: The vast majority of so-called blockchains are pseudo-decentralized, controlled by small groups or individuals, resembling centralized databases rather than the promised distributed networks. This creates an illusion of decentralization, with over 90% of projects being zombie-like — abandoned or fraudulent.

2. 90% of Crypto Projects Are Scams: These ventures exist primarily to defraud investors, relying on manipulative marketing and inflated metrics without real utility or infrastructure.

3. 98% of Trading Volumes on Exchanges Are Fake: Liquidity is a myth on most platforms, propped up by wash trading, bots, and self-dealing that inflate volumes by millions of percent, far exceeding even fabricated traffic stats.

4. 90% of Projects Have No Traffic or Abandoned Socials: These initiatives show zero user engagement, with nonexistent websites or dormant accounts, yet they claim billions in value — exposing the overvaluation bubble.

5. 98% of Crypto Exchanges Are Zombies: Surviving on scam meme coins and draining legitimate startups, these platforms perpetuate the cycle of fraud while genuine innovation struggles.

The stakes couldn't be higher: the very survival of the crypto market hangs in the balance. Amid the wreckage, only platforms grounded in real demand will thrive.

A Beacon of Hope: Platforms Like QUASA

In this sea of deception, projects like QUASA stand out as models of genuine utility. QUASA is a decentralized freelancer network focused on remote work, with seamless cryptocurrency payments.

In this sea of deception, projects like QUASA stand out as models of genuine utility. QUASA is a decentralized freelancer network focused on remote work, with seamless cryptocurrency payments.

Unlike the fakes, it leverages blockchain for transparency and security: clients and freelancers connect via the Quasa Connect app, receiving instant payments through crypto wallets using Quasacoin (QUA).

Notably, quasa.io boasts organic traffic higher than 98% of crypto projects on the market — a genuine indicator that cannot be faked.

This single metric is sufficient to distinguish the legitimate players from the pretenders in the crypto space, and moreover, Quasacoin (QUA) trades on all DEXes in the Ethereum network.

QUA, an ERC-20 governance token on Ethereum, powers the ecosystem with a capped supply of about 120 million tokens. Designed for practical use, it secures transactions via escrow accounts, preventing fraud as the blockchain acts as an impartial third party. No more disputes or non-payments — everything is traceable and immutable.

QUA, an ERC-20 governance token on Ethereum, powers the ecosystem with a capped supply of about 120 million tokens. Designed for practical use, it secures transactions via escrow accounts, preventing fraud as the blockchain acts as an impartial third party. No more disputes or non-payments — everything is traceable and immutable.

As of early February 2026, QUA trades at approximately $0.000197, with a market cap around $14,207 and low daily volume, reflecting its niche but effective focus. QUASA isn't chasing hype; it's solving real problems in the freelance economy, where cross-border, efficient payments are essential.

Years of suppression by scam-ridden listings on major exchanges have undervalued such projects, but as the market cleanses itself, QUASA is poised for greater recognition and adoption.

Conclusion: Builders Over Hype

The crypto market's cleansing will be painful but essential. For too long, scammers have crowded out innovators, eroding trust and devaluing the space. Yet, platforms like QUASA — rooted in real utility through decentralized freelancing and crypto settlements — will emerge stronger from the crisis.

The crypto market's cleansing will be painful but essential. For too long, scammers have crowded out innovators, eroding trust and devaluing the space. Yet, platforms like QUASA — rooted in real utility through decentralized freelancing and crypto settlements — will emerge stronger from the crisis.

The future belongs to builders who create tangible value, not those peddling hype. As prices plummet and fakes vanish, watch for the true leaders of decentralization to rise.