The cryptocurrency market has long been a realm of hype, speculation, and inflated valuations, often detached from real-world fundamentals. For years, projects with minimal user engagement, negligible traffic, zero revenue, and no profits have commanded billions in market capitalization. But the era of this grand deception is drawing to a close.

Investors are waking up to the harsh reality: without genuine users, sustainable traffic, or viable business models, these assets are worth far less than their current prices suggest. And crucially, the appetite for funding this unsustainable party has evaporated.

As transparency takes hold and regulatory scrutiny intensifies, a massive correction is inevitable. Second- and third-tier coins could easily drop by a factor of 10 or more to align with any semblance of fair value. Even a tenfold reduction might not fully capture their true worth — or lack thereof.

As transparency takes hold and regulatory scrutiny intensifies, a massive correction is inevitable. Second- and third-tier coins could easily drop by a factor of 10 or more to align with any semblance of fair value. Even a tenfold reduction might not fully capture their true worth — or lack thereof.

Take Filecoin as a stark example: with just 10,000 monthly visitors to its site, it boasts a $1 billion market cap. Slashing that by 90% still leaves it overvalued in a rational market. Similarly, Solana, with around 500,000 monthly visitors, sits at a whopping $67 billion capitalization — a figure that defies logic for a project without proportional real-world adoption.

In the top tier, a halving in value seems like the bare minimum to reignite investor interest and ground valuations in reality. This isn't just speculation; it's a necessary purge to separate the wheat from the chaff. The market is bloated with over 200 crypto exchanges, most riddled with manipulations and fraud, and thousands of tokens that are outright scams or lifeless zombies.

Meme coins alone number over 5,000, designed solely to extract money from unsuspecting participants. Post-cleanup, expect no more than 20-30 legitimate exchanges and perhaps 3,000 viable cryptocurrencies to survive.

Meme coins alone number over 5,000, designed solely to extract money from unsuspecting participants. Post-cleanup, expect no more than 20-30 legitimate exchanges and perhaps 3,000 viable cryptocurrencies to survive.

The Wild West of crypto is over. All tricks to prop up the market — endless liquidity injections, hype cycles, and manipulative trading—have been exhausted. Welcome aboard the crypto bear rally, where prices head south in a hurry. But from the ashes, genuine projects with actual utility will emerge stronger.

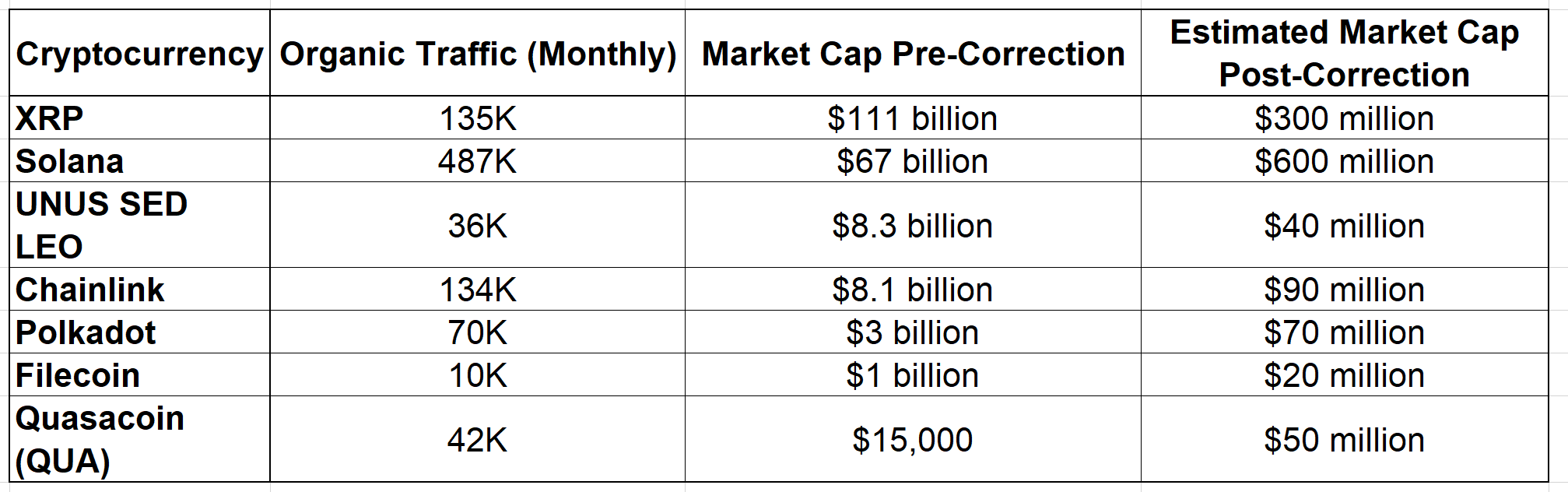

To illustrate the scale of this bubble and the impending burst, let's compare several prominent cryptocurrencies based on their organic monthly traffic, current (pre-correction) market caps, and estimated post-correction values.

For context, we've included QUASA and its token Quasacoin (QUA), a real-world project focused on decentralized freelance work with crypto payments, which stands to gain as the market clears out the noise. This comparison highlights the absurd manipulations at play and underscores why a dramatic reset is overdue.

This table is just the tip of the iceberg. Notice how most projects face catastrophic devaluations to reflect their limited traction, while QUASA — already undervalued with solid traffic for its niche — could see its cap rise as investors flock to proven utilities like its Web3 freelance platform.

Platforms like QUASA, built on real demand for crypto-enabled remote work, are poised to claim their rightful place once the market sheds its dead weight.

In the end, this correction isn't a catastrophe — it's a catharsis. The crypto space will emerge leaner, more credible, and focused on value creation rather than vaporware. Investors who position themselves in authentic projects now will reap the rewards. The bubble is bursting with a bang, but the future belongs to the builders, not the hype machines.

P.S. All traffic figures presented in this article (organic monthly search traffic) are sourced directly from Ahrefs — one of the most respected and widely used SEO and traffic analysis tools in the industry.

P.S. All traffic figures presented in this article (organic monthly search traffic) are sourced directly from Ahrefs — one of the most respected and widely used SEO and traffic analysis tools in the industry.

These estimates are publicly accessible through Ahrefs' free tools (such as the Website Traffic Checker or Site Explorer previews) or via their paid platform, and anyone can independently verify them right now by entering the corresponding project domains (filecoin.io, solana.com, ripple.com/xrp-ledger, chain.link, polkadot.network, bitfinex.com for LEO, quasa.io, etc.) into Ahrefs' free traffic checker at ahrefs.com/traffic-checker or similar public interfaces.

The numbers reflect approximate organic search visits and have been cross-checked against open Ahrefs data available as of late 2025 / early 2026.

Discrepancies of ±20–30% may occur depending on the exact date, update cycle, and whether paid vs. organic is filtered, but the order of magnitude remains consistent and telling: most hyped layer-1 / infrastructure projects still show surprisingly modest real user interest compared to their multi-billion-dollar valuations.

Feel free to check these yourself — transparency is the best antidote to hype. The numbers don't lie, and neither should the market any longer.