Introduction

The cryptocurrency market, often celebrated for its innovation and potential to democratize finance, has a dark underbelly that threatens its integrity and trustworthiness. Central to this issue are crypto exchanges, platforms where digital currencies are bought, sold, and traded.

Despite their critical role, many of these exchanges are likened to a "colossus with feet of clay," a metaphor for a seemingly powerful entity with inherent weaknesses.

This article explores how fake volumes, traffic, and users undermine the credibility of crypto exchanges.

The Illusion of Volume

One of the most pervasive issues in the crypto exchange ecosystem is the fabrication of trading volumes. High trading volume is often seen as a sign of an exchange's health, liquidity, and popularity. However, numerous reports and studies suggest that a significant portion of reported volumes might be artificially inflated.

For instance, research has shown that some exchanges engage in "wash trading," where they trade with themselves or use automated bots to create the illusion of high trading activity.

This practice can mislead investors about the market's liquidity and the popularity of certain cryptocurrencies.

According to analyses, more than half of all Bitcoin trades might be fake, highlighting the scale of manipulation occurring under the surface.

Fake Traffic and User Base

Beyond volume manipulation, fake traffic and user bases are also employed to boost the perceived success and reliability of crypto exchanges. This involves generating artificial traffic to exchange websites through bots, which can manipulate search engine rankings and make the exchange appear more active than it actually is.

The creation of fake users, or "ghost accounts," further complicates the picture. These accounts, often controlled by the exchange or third parties, can be used to simulate a bustling community, thereby enticing real users with the promise of a thriving trading environment.

This practice not only distorts the market's perception but also potentially leads to more significant issues like security breaches or manipulation in voter systems for listing new tokens.

and

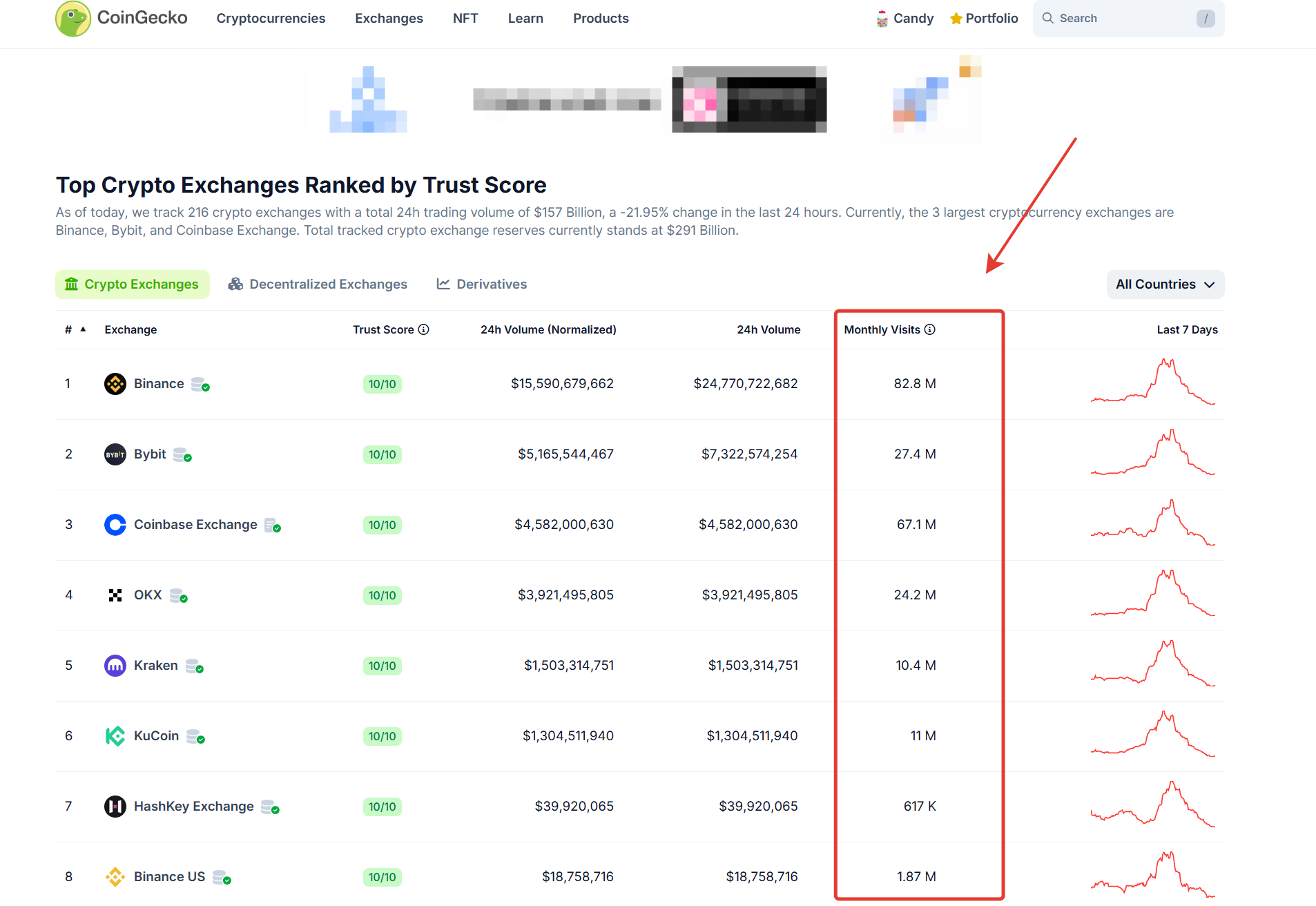

Both CoinGecko and CoinMarketCap provide data on weekly and monthly visitor counts to cryptocurrency exchange websites.

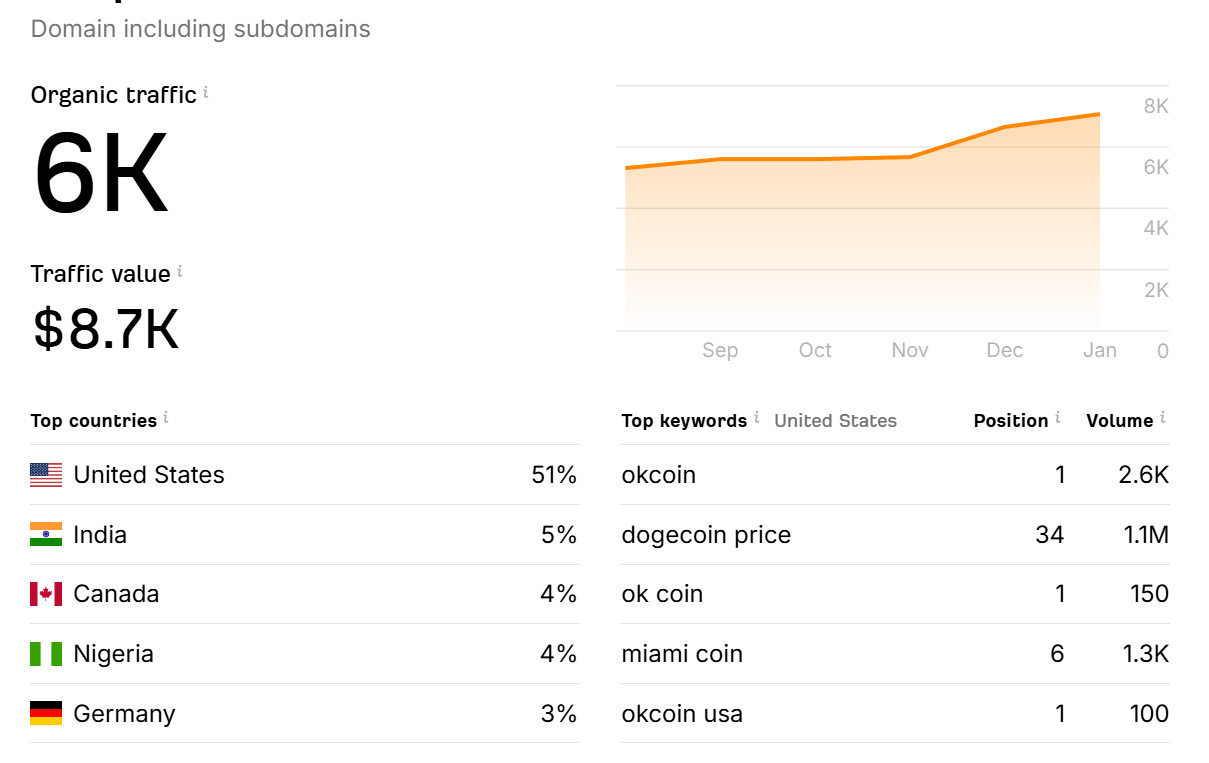

Now, as an example, look at the number of visits to one of the exchanges, which shows that it has more than 70 million visits, but the real picture is that its traffic is only 6 thousand people.

You understand the scale of the problem.

Or here's another example.

This exchange shows traffic to its site around 120K, but voilà — the real organic traffic to it is only 5K.

Overstating by a mere 2000% — what a modest one!

.jpg)

and

.jpg)

When this house of cards falls, the crash could be not just significant but might even surpass the 2018 crisis, where Bitcoin plummeted by over 80%. This scenario is quite plausible.

The timing is unpredictable due to the current market euphoria and speculative bubble, but all the warning signs are present.

This is public information, and anyone can see it. That's just how it works.

Let's repeat, it's worth considering - the scale is enormous; just think about it: there are 70 million fake visitors versus just 6,000 real ones. That means real visitors are 1 million percent fewer.

This isn't an isolated incident; over 90% of crypto exchanges present fake statistics on their site visits. You can deceive people for a while, even for a very long time, but eventually, the end will be monumental. Without real visitors, all data is fake, leading to no influx of money.

This might work in a bull market, but once the majority realizes this, we do not envy the millions who have entrusted their money to these crypto exchanges.

Conclusion

And you know what, we want to point out that the real trading volume on virtually all crypto exchanges is inflated even more than that. We're talking over a million percent in exaggeration.

Also read:

The Crypto Market: "No Matter How You Move, The Cow is Dead"

DOGE Takes Aim at the Penny: A New Era for Cryptocurrency Impact on Traditional Currency

The Meme Epidemic DOGE, $TRUMP, SHIBA, $MELANIA: Very Few Remain Uninfected: whos next?