Introduction

The phrase "no matter how you move, the cow is dead" is a poignant Russian proverb that essentially means that some situations are irreversible, regardless of the actions taken afterward.

When applied to the volatile world of cryptocurrency, this proverb can be interpreted to suggest that, at times, no strategy or maneuver can alter an already doomed market condition.

This article explores the various phases of the crypto market, highlighting the moments where this proverb might resonate with investors, traders, and enthusiasts.

Understanding the Crypto Market Cycle

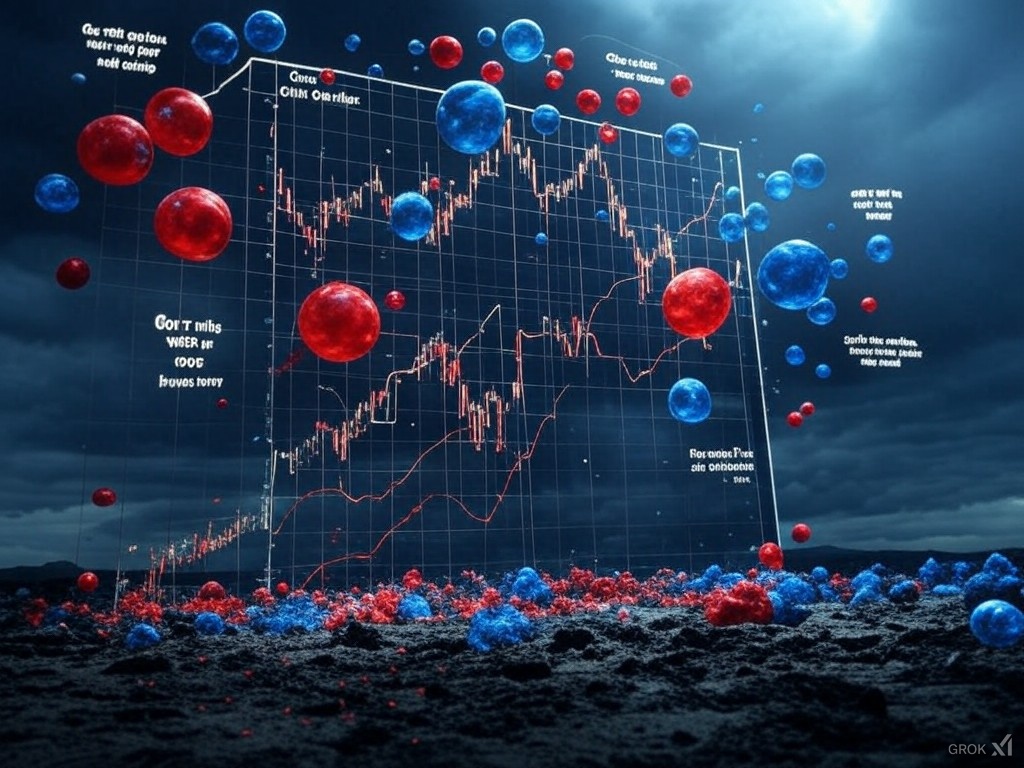

The cryptocurrency market is known for its boom and bust cycles. From the exuberant highs of Bitcoin's meteoric rise to the sudden, often unexplained, plunges into bear markets, the crypto landscape is anything but stable.

These cycles can be broken down into several stages:

These cycles can be broken down into several stages:

- Accumulation: The quiet before the storm where savvy investors start buying at low prices.

- Mark-up: Prices begin to rise as the market sentiment improves.

- Distribution: Early investors sell to latecomers, often at or near the peak.

- Mark-down: The market crashes, fueled by panic selling and loss of confidence.

The key for those in the crypto space is resilience, adaptability, and a deep understanding that sometimes, you're better off preparing for the next cycle than trying to resuscitate what's lost.

Understanding Bubbles in the Crypto Market

A financial bubble occurs when asset prices are driven to levels far beyond their intrinsic values, often fueled by speculation rather than fundamental economics.

In the context of cryptocurrencies:

- Unprecedented Price Surge: Cryptocurrencies have seen exponential price increases, especially noted during specific periods like late 2017 and the bull run leading into 2021.

- Massive Media Exposure: The more mainstream media covers cryptocurrencies, often with a sensationalist tone, the more likely retail investors jump in, inflating the bubble further.

- FOMO (Fear of Missing Out): Stories of overnight millionaires draw in new, often inexperienced, investors who buy at peak prices.

- Lack of Regulation: The crypto market's relative freedom from stringent regulatory oversight can lead to unchecked speculation.

While predicting the exact moment of a bubble's burst is nearly impossible, the signs are there for those who look closely.

Manufacturing the Hype

Manufacturing the Hype

- Media and Celebrity Influence: From Elon Musk tweeting about Dogecoin to celebrities endorsing various coins, the crypto market thrives on buzz. This creates a false sense of security and inevitability around investment opportunities.

- News Pumping: News outlets and crypto influencers often amplify positive stories while downplaying or ignoring red flags, creating a narrative of continuous growth.

- Whale Investments: Large investors, or whales, can manipulate markets by pumping money into projects with questionable fundamentals, often leading to short-term gains followed by sharp declines once the investment is withdrawn.

Sustainability of the Market

Despite these manipulations:

Despite these manipulations:

- Innovation and Adoption: Blockchain technology and its applications continue to see real-world adoption, from finance to supply chain management, providing some underlying value to certain cryptocurrencies.

- Regulatory Adjustments: As governments begin to engage with crypto rather than outright ban it, there's a pathway for legitimization that might stave off immediate collapse.

- Retail Investor Enthusiasm: The sheer volume of new, often uninformed investors entering the market can keep it afloat longer than anticipated, driven by FOMO (Fear Of Missing Out).

Signs of an Imminent Crash

- Overvaluation: When the market cap of cryptocurrencies outpaces the actual utility or adoption rate, it's a classic bubble sign.

- Lack of Due Diligence: Investors throwing money at projects without sound fundamentals or clear business models.

- Market Manipulation: The obvious signs of pump-and-dump schemes or wash trading become more frequent.

- Regulatory Crackdown: As seen with previous crypto winters, increased regulatory scrutiny can lead to a market correction or crash.

- Economic Indicators: If broader economic conditions deteriorate, crypto, as a speculative asset, often suffers more than traditional investments.

The Inevitability of the Crash

The Inevitability of the Crash

- Historical Precedence: The crypto market has seen significant crashes before, with Bitcoin losing over 80% of its value in 2018. These cycles suggest that another correction, possibly more severe, is likely.

- Unsustainable Growth: The exponential growth seen in bull markets cannot continue indefinitely without real-world backing.

- Speculative Nature: Much of the crypto market's value is speculative rather than tied to tangible assets or services, making it highly vulnerable to sentiment shifts

Conclusion

While the crypto market can ride the wave of hype and strategic investments for a while, the fundamental issues of overvaluation, manipulation, and speculative investment cannot be ignored.

The market's resilience is commendable, but the signs of an impending crash are too evident to dismiss.

The market's resilience is commendable, but the signs of an impending crash are too evident to dismiss.

Investors should approach the market with caution, understanding that the next downturn could be around the corner. However, from every crash, new opportunities arise, potentially leading to a more stable and mature market in the future. In the world of cryptocurrencies, today's dead cow might be tomorrow's steak dinner.

Also read: