In the high-stakes theater of corporate cryptocurrency adoption, few players command as much intrigue as Elon Musk's SpaceX. The aerospace titan, valued at over $200 billion and laser-focused on Mars colonization, has long treated Bitcoin as a strategic reserve asset - a digital hedge against fiat volatility and a nod to Musk's crypto evangelism.

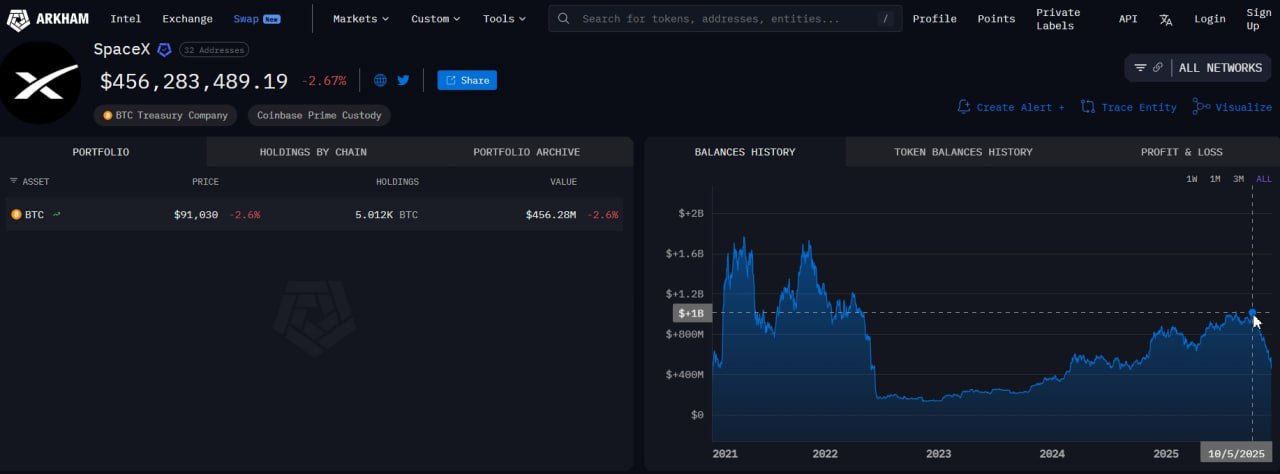

Yet, in a move that's rippling through blockchain trackers and Wall Street alike, SpaceX's BTC holdings have plummeted from a peak of roughly $1 billion to just $456 million in the span of two months. According to on-chain sleuths at Arkham Intelligence, the company's primary wallets now cradle a leaner 5,012 BTC, down from over 7,000 in early October.

This isn't a gradual HODL fade; it's a series of calculated outflows totaling more than 2,500 BTC, coinciding with Bitcoin's 27.5% slide from its all-time high of $108,000 in mid-October. As SpaceX clings to fourth place among private firms' BTC treasuries, whispers of liquidity crunches, risk recalibration, and even subtle profit-taking grow louder.

A Trail of Transfers: The On-Chain Exodus Unfolds

The purge kicked off in earnest on October 21, when SpaceX executed its largest single move: nearly 2,500 BTC - valued at $268 million at the time - shifted to two fresh addresses in a classic wallet reorganization play. Blockchain forensics reveal the funds funneled through unlabelled bc1q endpoints, hallmarks of internal shuffling rather than open-market dumps. Fast-forward to October 24, and another 1,215 BTC ($133 million) vanished from cold storage, again dispersing to new custodians without touching exchanges like Binance or Kraken.

The purge kicked off in earnest on October 21, when SpaceX executed its largest single move: nearly 2,500 BTC - valued at $268 million at the time - shifted to two fresh addresses in a classic wallet reorganization play. Blockchain forensics reveal the funds funneled through unlabelled bc1q endpoints, hallmarks of internal shuffling rather than open-market dumps. Fast-forward to October 24, and another 1,215 BTC ($133 million) vanished from cold storage, again dispersing to new custodians without touching exchanges like Binance or Kraken.

November ramped up the rhythm. On the 26th, 1,163 BTC ($105 million) bolted from a legacy wallet, split across endpoints tied to Coinbase Prime—suggesting a pivot to institutional-grade custody amid rising regulatory scrutiny.

The capstone came on December 5: 1,083 BTC ($99.8 million) drained from the "144ZP..." address, zeroing its balance and routing the haul to two Coinbase-linked vaults. Cumulatively, these maneuvers excised over $605 million in nominal value, though Bitcoin's 10% monthly dip amplified the paper losses to a $500 million net evaporation.

Arkham's entity-tracking dashboard paints a vivid ledger: SpaceX's cluster of 12 primary addresses, dormant since a 2022 writedown of $373 million (slashing holdings from 25,000 BTC to 8,285), sprang back to life in July 2025 with a modest 1,300 BTC ($153 million) relocation. But autumn's barrage signals a deliberate drawdown, not panic.

No inflows have materialized since that July nudge, per Arkham's logs - unlike Tesla, which juiced its 11,500 BTC stack with opportunistic buys during the 2024 rally. SpaceX's strategy echoes a broader corporate caution: diversify custody, mitigate single-point failures, and perhaps trim exposure as BTC flirts with $90,000 resistance.

From Peak to Purge: Bitcoin's Rollercoaster and Corporate Calculus

Timing is everything in crypto's casino. SpaceX's offloads synced with BTC's brutal correction: from a euphoric $108,000 zenith on October 15—fueled by ETF inflows topping $20 billion and halving hype - to a sobering $78,500 trough by December 1, a 27.5% haircut that vaporized $1.2 trillion in market cap. The November leg alone shaved 10%, as macroeconomic headwinds (Fed rate jitters, election uncertainty) clashed with on-chain fatigue from miner capitulation and whale distributions.

Timing is everything in crypto's casino. SpaceX's offloads synced with BTC's brutal correction: from a euphoric $108,000 zenith on October 15—fueled by ETF inflows topping $20 billion and halving hype - to a sobering $78,500 trough by December 1, a 27.5% haircut that vaporized $1.2 trillion in market cap. The November leg alone shaved 10%, as macroeconomic headwinds (Fed rate jitters, election uncertainty) clashed with on-chain fatigue from miner capitulation and whale distributions.

For SpaceX, this isn't abstract arithmetic. The firm's BTC bet, first disclosed in 2021 at an average entry of $33,000 per coin, ballooned to $851 million by January 2025 amid the bull run. But volatility bites: that 2022 writedown reflected a 70% cull amid Terra-Luna's implosion and FTX's fallout, mirroring Tesla's $1.5 billion slash. Today's 5,012 BTC, at $89,613 apiece, clocks $449 million - still a tidy 171% unrealized gain from cost basis, but down 47% from October's glory. Analysts at BitcoinTreasuries peg SpaceX behind MicroStrategy (252,220 BTC, $22.6B), Marathon Digital (17,000 BTC, $1.5B), and Tesla (11,500 BTC, $1B), yet ahead of Hut 8 and CleanSpark in the private pecking order.

Musk's fingerprints are everywhere, though silent. The Tesla CEO, whose tweets once swung BTC 20% in hours, has dialed back overt endorsements since Dogecoin dalliances. Yet, SpaceX's persistence as a top holder underscores conviction: BTC as "digital gold" for a firm eyeing interplanetary economics, where fiat's frailty meets Starship's ambition. Internal memos leaked in 2024 hinted at BTC's role in hedging against dollar debasement, with allocations capped at 5% of reserves - prudent amid SpaceX's $10 billion annual burn rate.

Treasury Tactics or Tactical Retreat? Decoding the Motive

Speculation swirls like exhaust from a Falcon 9: Is this deleveraging for cash flow, as SpaceX eyes $5 billion in fresh Starlink equity? Or a stealth sell-off, capitalizing on BTC's pump before a presumed dump? On-chain sleuths lean toward the former. None of the outflows hit known exchange hot wallets—no telltale Binance or Bitfinex tags - pointing to custody migrations via Coinbase Prime, a bastion for 40% of institutional BTC. This aligns with post-FTX norms: segregated vaults, multisig setups, and Proof-of-Reserves audits to fend off hacks like Ronin ($625M) or Bybit ($1.5B).

Speculation swirls like exhaust from a Falcon 9: Is this deleveraging for cash flow, as SpaceX eyes $5 billion in fresh Starlink equity? Or a stealth sell-off, capitalizing on BTC's pump before a presumed dump? On-chain sleuths lean toward the former. None of the outflows hit known exchange hot wallets—no telltale Binance or Bitfinex tags - pointing to custody migrations via Coinbase Prime, a bastion for 40% of institutional BTC. This aligns with post-FTX norms: segregated vaults, multisig setups, and Proof-of-Reserves audits to fend off hacks like Ronin ($625M) or Bybit ($1.5B).

Broader trends bolster the benign read. Corporate BTC adoption hit 1.2% of total supply by Q4 2025 (up from 0.8% in 2024), per Fidelity Digital, with firms like Block and Semler Scientific adding amid ETF mania. But prudence prevails: 60% of treasuries now employ dynamic rebalancing, per Deloitte's crypto report, trimming during euphoria to fund ops. SpaceX's pattern - eight major moves since July - mirrors this, dispersing risk across endpoints while retaining a war chest for R&D. Valuation-wise, BTC's 15% correlation to Nasdaq (up from 5% in 2023) ties it to SpaceX's $800 billion private market cap, where crypto's beta amplifies both upsides and jitters.

Critics, however, smell opportunism. With BTC's 2025 YTD gain at 85% (outpacing S&P's 22%), offloads at $100K+ averages netted $200 million in realized profits, per approximate FIFO math. Musk's recent X posts decrying "fiat funny money" ring ironic, but SpaceX's silence—unlike Tesla's SEC filings—fuels FUD. As one Arkham analyst quipped, "It's chess, not checkers: repositioning pawns while the queen stays put."

Mars Money: What $456 Million Means for SpaceX's Stellar Ambitions

At $456 million, SpaceX's BTC slice - 2.3% of its $20 billion cash reserves - remains a sideshow to its empire: 300+ Falcon launches, Starlink's 4 million subscribers ($6B ARR), and Starship's $3B annual R&D. Yet, it symbolizes Musk's multi-planetary playbook: BTC as interstellar ballast, immune to earthly inflation. The drawdown frees liquidity for capex - perhaps accelerating Boca Chica's next test flight or subsidizing Dragon crew rotations amid NASA's $4B Artemis contract.

At $456 million, SpaceX's BTC slice - 2.3% of its $20 billion cash reserves - remains a sideshow to its empire: 300+ Falcon launches, Starlink's 4 million subscribers ($6B ARR), and Starship's $3B annual R&D. Yet, it symbolizes Musk's multi-planetary playbook: BTC as interstellar ballast, immune to earthly inflation. The drawdown frees liquidity for capex - perhaps accelerating Boca Chica's next test flight or subsidizing Dragon crew rotations amid NASA's $4B Artemis contract.

For crypto at large, it's bullish validation: a blue-chip like SpaceX signaling maturity, not moonshot mania. As BTC eyes $100K reclamation, expect more treasuries to shuffle - MicroStrategy's 2025 adds, Tesla's opportunistic flips. SpaceX's saga? A reminder that even rocket men hedge bets. With 5,012 BTC locked and loaded, the real launch awaits: Will it fuel Mars, or just another Earthbound pivot? In Musk's universe, the answer's written in the stars - or at least on the blockchain.

Also read:

- Gemini 3's Deep Think: Unlocking Parallel Reasoning for the Toughest AI Challenges

- Unveiling the Hidden Heart of AI: What 100 Trillion Tokens Reveal About How We Really Use LLMs

- OpenAI's First Real Reckoning: Gemini's Shadow Looms Large

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

Not financial advice. DYOR.