In a stunning revelation, blockchain analytics firm Arkham has exposed the largest cryptocurrency heist in mining history, involving the Chinese mining pool LuBian.

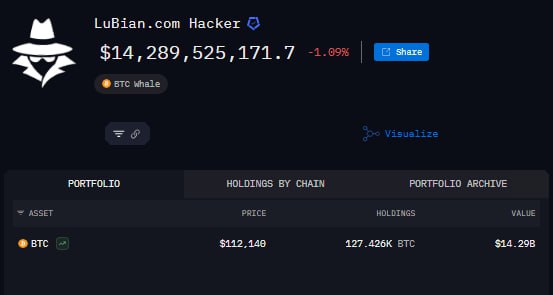

In December 2020, hackers stole 127,426 BTC, valued at $3.5 billion at the time. With Bitcoin’s price surge, the stolen assets are now worth an astonishing $14.5 billion. Remarkably, neither LuBian nor the hackers publicly disclosed the incident until Arkham’s findings.

In December 2020, hackers stole 127,426 BTC, valued at $3.5 billion at the time. With Bitcoin’s price surge, the stolen assets are now worth an astonishing $14.5 billion. Remarkably, neither LuBian nor the hackers publicly disclosed the incident until Arkham’s findings.

At its peak in 2020, LuBian controlled nearly 6% of Bitcoin’s global hashrate, operating facilities in China and Iran. The breach occurred on December 28, 2020, when hackers drained over 90% of the pool’s Bitcoin from its wallets. The following day, an additional $6 million in BTC and USDT was siphoned through an address on the Bitcoin Omni network.

In a desperate attempt to mitigate losses, LuBian transferred its remaining funds to reserve wallets on December 31. The company even embedded pleas to the hackers via Bitcoin’s OP_RETURN function, sending 1,516 transactions costing 1.4 BTC, begging for the return of the stolen assets. These efforts proved futile.

Arkham’s analysis suggests the breach stemmed from a critical vulnerability in LuBian’s private key generation algorithm, which was susceptible to brute-force attacks. This flaw likely allowed hackers to gain unauthorized access to the pool’s wallets.

The hacker has retained the entire stolen sum, and due to Bitcoin’s meteoric rise, their wallet is now valued at $14.5 billion. This makes the perpetrator the 13th largest Bitcoin holder globally, highlighting the unprecedented scale of the heist.

The hacker has retained the entire stolen sum, and due to Bitcoin’s meteoric rise, their wallet is now valued at $14.5 billion. This makes the perpetrator the 13th largest Bitcoin holder globally, highlighting the unprecedented scale of the heist.

Also read:

- Amazon Invests in Fable—Studio Behind the ‘Netflix for AI’

- How Much Faster Does Posting More YouTube Videos Really Grow Your Channel?

- Krea Releases Free Open-Source FLUX.1 Krea Dev Model for High-Quality, Hyperrealistic Image Generation

- The $200 Million Mistake: How ‘Vibe Coding’ Nearly Bankrupted an AI Startup Founder

The LuBian hack underscores the vulnerabilities in even the most prominent crypto operations and raises questions about the security practices of mining pools during Bitcoin’s early boom years. As the stolen funds remain untouched, the crypto community watches closely to see if the hacker will attempt to move or liquidate their massive holdings.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).