Slow Ventures’ recently launched $60 million Creator Fund has garnered significant attention, receiving over 700 applications from creators eager to secure investment for their entrepreneurial ventures.

The fund, designed to back niche content creators who are building sustainable businesses rather than chasing influencer fame, has made its first investment: a $2 million infusion into Jonathan Katz-Moses, a woodworking YouTuber and founder of KM Tools.

Jonathan Katz-Moses, with over 590,000 YouTube subscribers and nearly 75 million video views, represents the archetype of the Creator Fund’s target: a passionate expert in a specialized niche — in this case, woodworking — who has built a loyal community and a thriving business. Unlike many creators who rely on sponsorships or ad integrations, Katz-Moses generates no revenue from promotional content. Instead, his income stems primarily from KM Tools, a company he founded over a decade ago that now employs 15 staff members and projects $10 million in revenue for 2025.

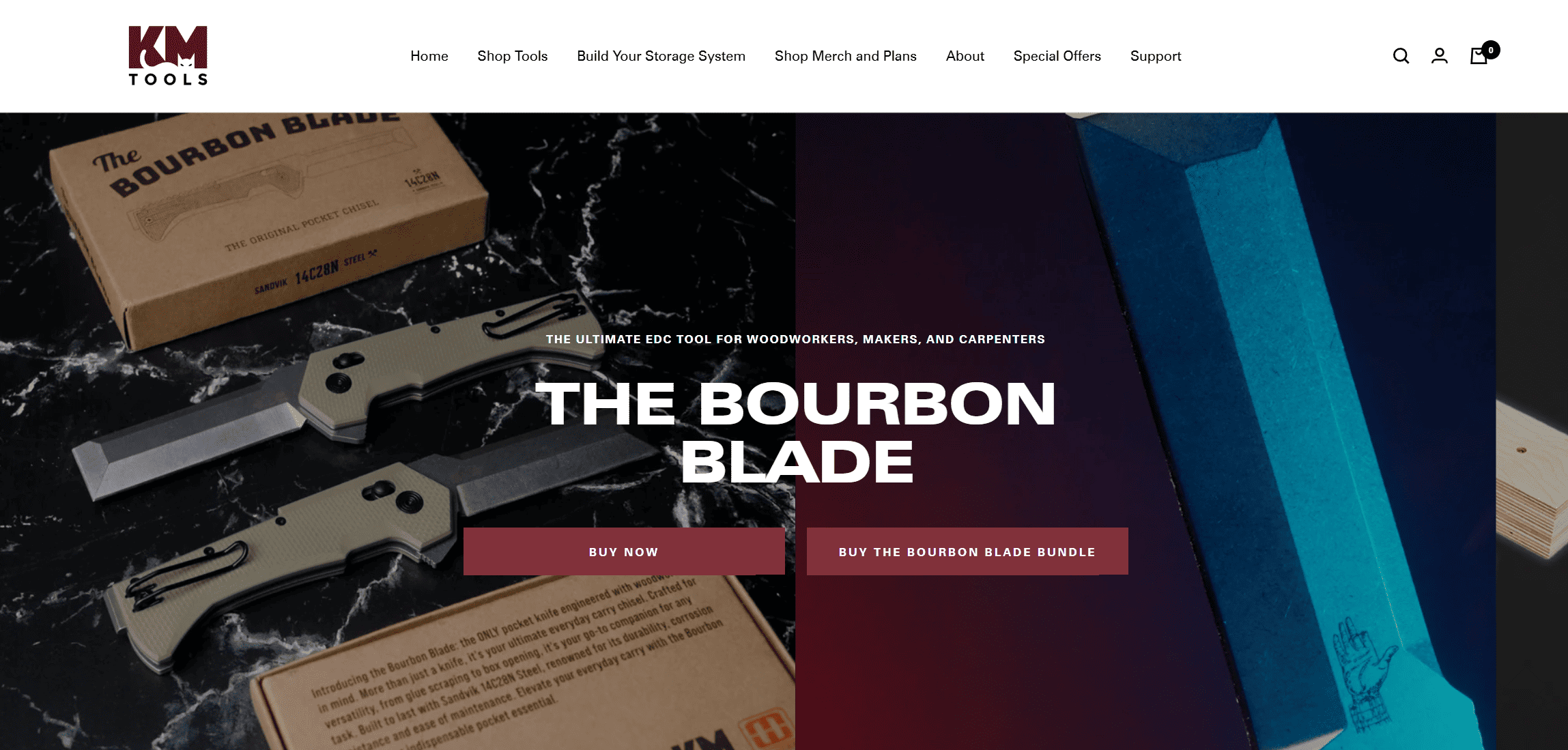

KM Tools produces over 100 proprietary woodworking products, including the innovative Katz-Moses Magnetic Dovetail Jig, which has earned praise for its quality and affordability. Beyond selling his own tools, Katz-Moses has expanded his business by helping other creators launch their products, handling the complexities of product development, manufacturing, and fulfillment.

KM Tools produces over 100 proprietary woodworking products, including the innovative Katz-Moses Magnetic Dovetail Jig, which has earned praise for its quality and affordability. Beyond selling his own tools, Katz-Moses has expanded his business by helping other creators launch their products, handling the complexities of product development, manufacturing, and fulfillment.

This creator-focused model allows him to empower fellow entrepreneurs while scaling his own operations from a 5,000-square-foot workshop in Santa Barbara, California.

The $2 million investment from Slow Ventures will fuel the expansion of Katz-Moses’ content creation and business infrastructure, including hiring product developers and filing patent applications to drive innovation. While YouTube remains his primary platform, Katz-Moses plans to broaden his educational content across other channels to solidify his authority in the woodworking niche.

Slow Ventures’ Creator Fund, led by partner Billy Parks, focuses on creators like Katz-Moses who demonstrate authenticity, deep community engagement, and a commitment to building lasting businesses.

The fund’s investment model is unique: it takes a 10% equity stake in a creator’s holding company, with priority rights to invest in any new ventures launched through that entity, such as merchandise lines or physical businesses. The overwhelming response of over 700 applications underscores the demand for this type of funding, which prioritizes creators in defined niches with strong, engaged audiences.

Also read:

- Netflix’s The Witcher Franchise: A $500 Million Gamble That Keeps Growing

- The Internet Runs on… Lava Lamps — And It’s No Joke

- Qwen-Image: A New Open-Source 20B MMDiT Model for Image Generation

- Google Search Activates AI Mode in 180 Countries

Katz-Moses’ journey from crafting jewelry boxes in a 108-square-foot shed to running a multimillion-dollar enterprise highlights the evolving creator economy. His story, marked by resilience after a life-changing assault in 2010, reflects the entrepreneurial spirit Slow Ventures seeks to support.

The fund’s first investment signals a broader trend in venture capital: recognizing creators as legitimate founders capable of building scalable, community-driven businesses. As the Creator Fund continues to evaluate its applicant pool, Katz-Moses’ success sets a compelling precedent for the future of creator-led entrepreneurship.