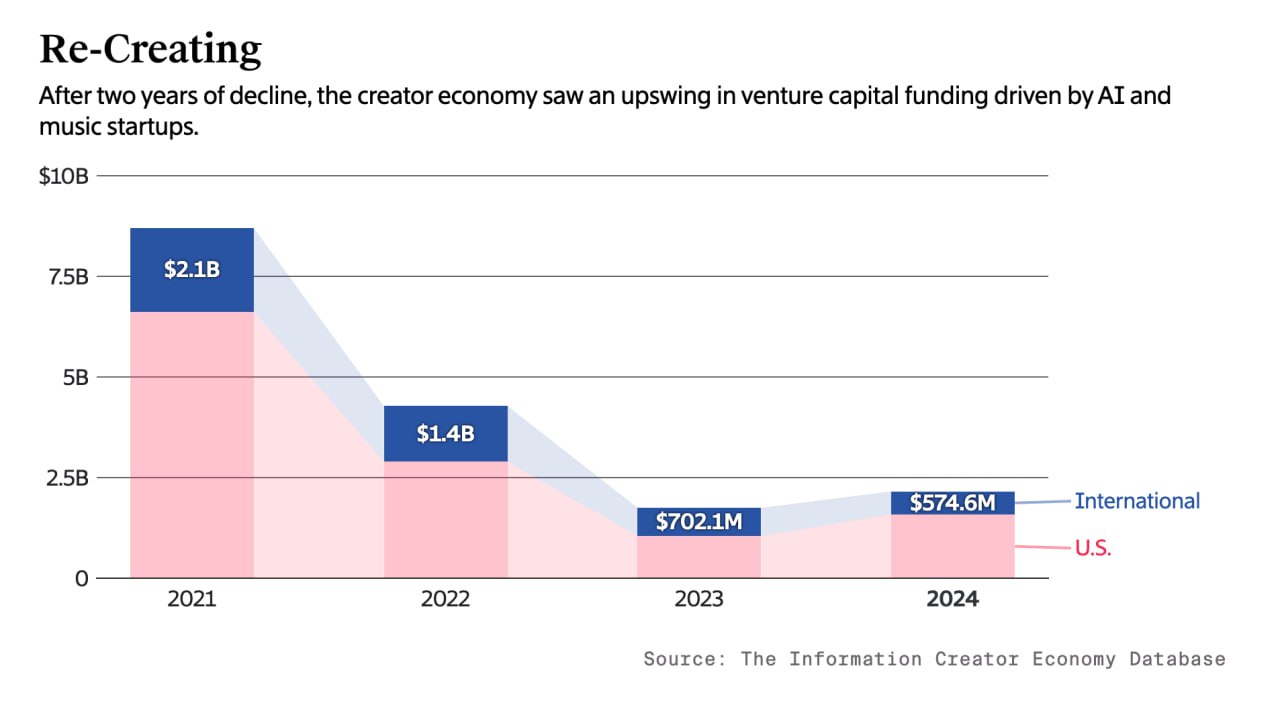

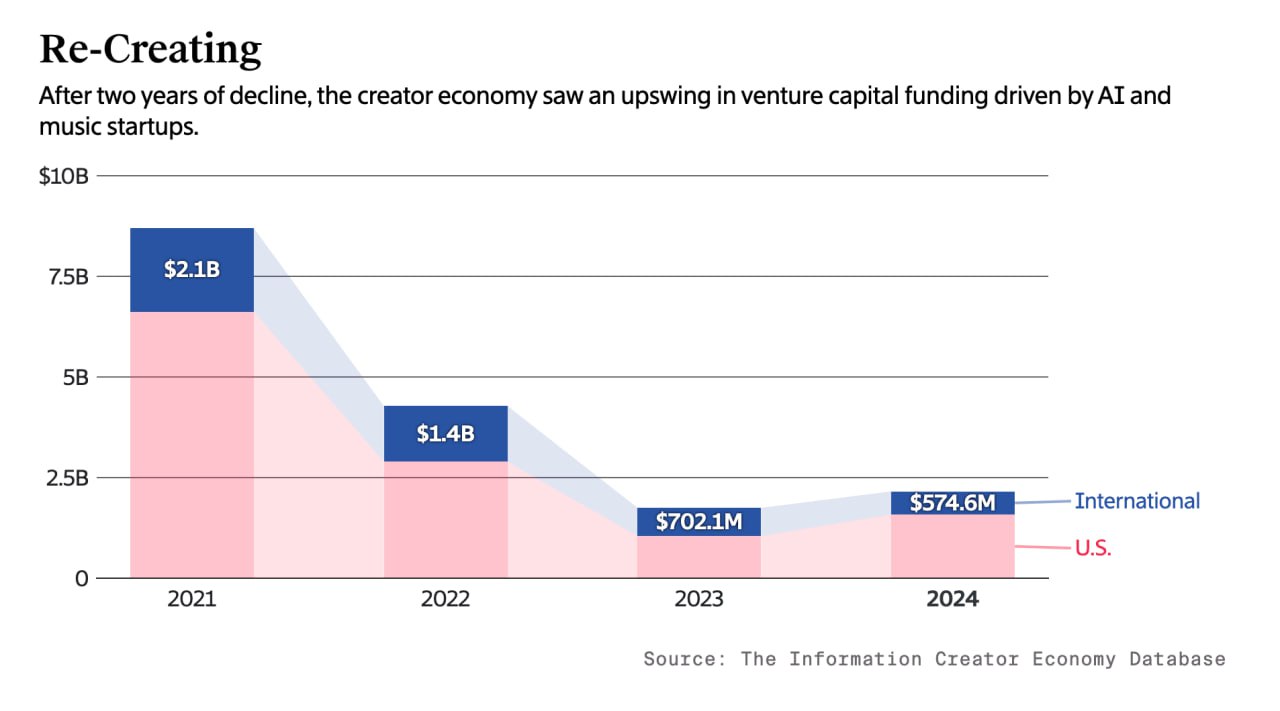

The creator economy is experiencing a remarkable financial boom, with startup funding jumping 51% to reach $1.58 billion. This growth far outstrips the 29% increase in overall U.S. startup funding, signaling a sector-specific surge. Globally, the picture is also promising: despite an 18% decline in other regions, total investments have risen 23%, surpassing $2.1 billion. This marks a stark contrast to the past two years, which saw a reversal of fortunes in the sector.

According to The Information, this shift reflects a maturing industry. Creators are now more discerning, opting for efficient tools and stabilizing the market. The rise of AI and consolidation efforts have played pivotal roles in this transformation.

Notable examples include:

- Suno AI securing $125 million.

- Pika Labs, a text-to-video startup, raising $80 million.

- Pietra acquiring Factored Quality, a company aiding creators in launching and managing their own brands.

However, the road hasn’t been without setbacks. Since 2021, 27 companies in the creator economy have closed, with six shuttering in 2024 alone. One such failure was Spark Jam, which aimed to combat creator burnout by connecting them with supportive subscriber groups. The initiative flopped due to an inability to attract a viable audience.

Also read:

- Higgsfield AI’s Ultra-Realistic Photo and Video Generator Goes Free: Unlock 5 Daily Generations Without a Credit Card!

- AI Innovations Transform Digital Tools: ChatGPT, Gemini, Adobe Firefly, Cursor, Groq, and Reddit Lead the Way

- Gemini Robotics: Pioneering On-Device AI for Autonomous Robots

Despite these challenges, the trajectory of investments from private and venture capital suggests a healthy, sustainable growth path for the creator economy—free from the chaotic hype of the pandemic era. Positive economic trends in the U.S. further bolster confidence, painting an ideal picture for steady development. This quiet, purposeful progress is the hallmark of a mature market.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).