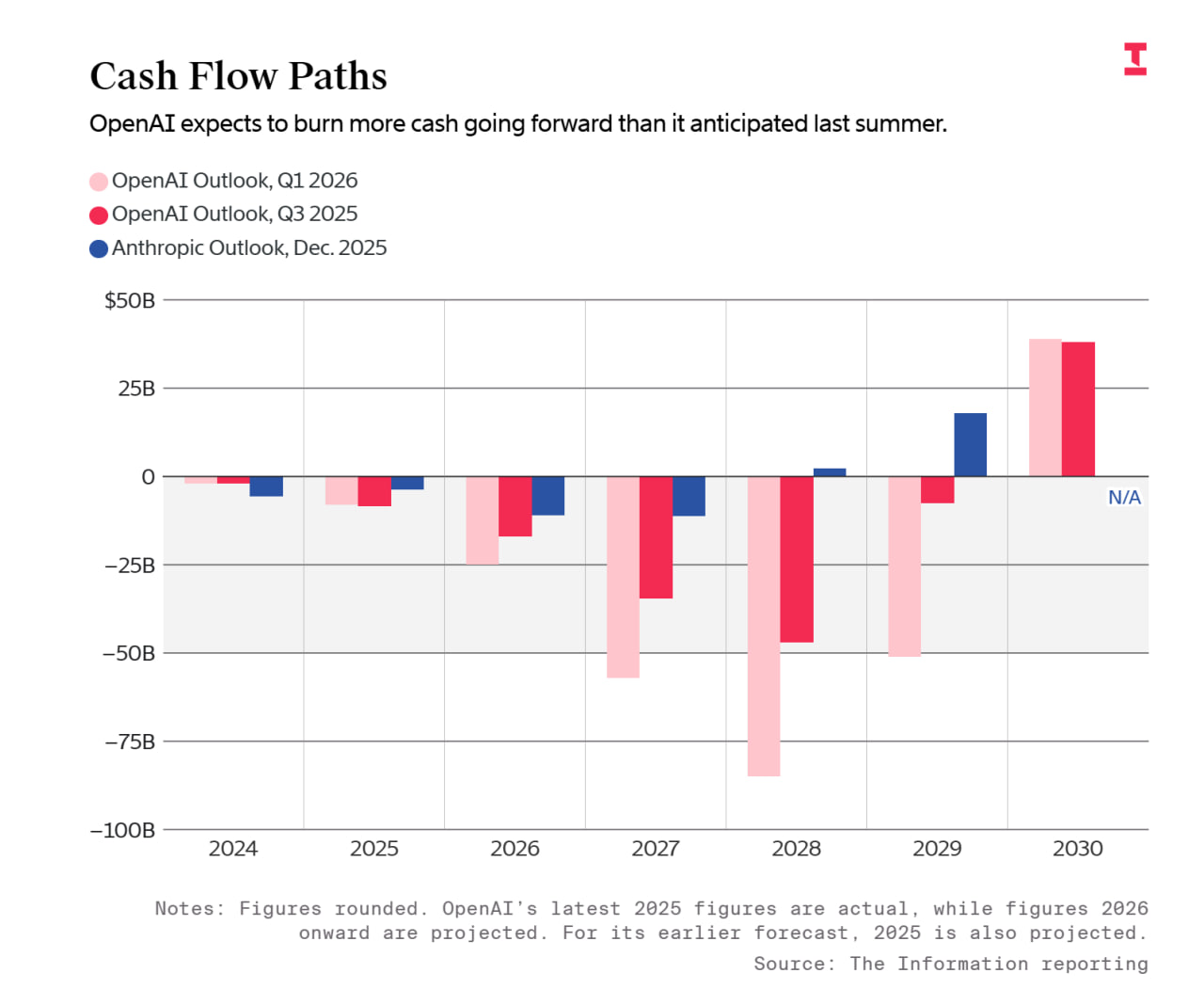

Ahead of a major investment round that could value the company at up to $1 trillion, leaked slides from OpenAI have surfaced, revealing updated financial projections that paint a picture of aggressive growth tempered by enormous spending on AI infrastructure.

According to details reported by The Information, the Microsoft-backed AI giant has raised its five-year revenue outlook by about 27%, while simultaneously warning of more than double the previously anticipated cash burn through 2030 — totaling a staggering $665 billion on compute alone. These figures, shared with potential investors, underscore the high-stakes race in artificial intelligence, where scaling models demands unprecedented capital.

Revenue Projections: From $13 Billion to Over $280 Billion by 2030

OpenAI's revenue trajectory continues to accelerate, building on a blockbuster 2025. The company reported $13.1 billion in revenue last year—more than tripling from the prior year and exceeding internal forecasts by $100 million, or even surpassing a $10 billion projection mentioned in some reports. This growth was driven by surging demand for its ChatGPT subscriptions and AI models.

OpenAI's revenue trajectory continues to accelerate, building on a blockbuster 2025. The company reported $13.1 billion in revenue last year—more than tripling from the prior year and exceeding internal forecasts by $100 million, or even surpassing a $10 billion projection mentioned in some reports. This growth was driven by surging demand for its ChatGPT subscriptions and AI models.

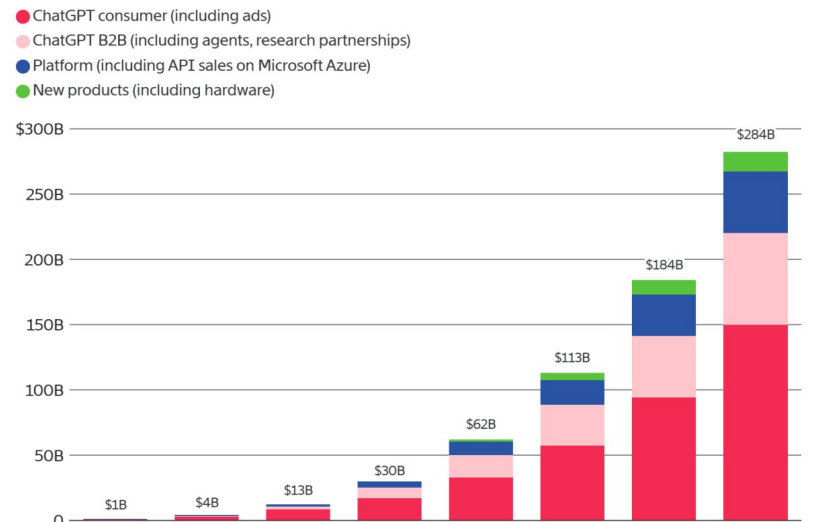

Looking ahead, OpenAI now anticipates $30 billion in revenue for 2026, climbing to $62 billion in 2027—modest upward revisions from earlier estimates. Consumer sales are expected to double to $17 billion this year, eventually reaching $150 billion by 2030, comprising over 50% of total revenue.

Overall, the company projects total revenue exceeding $280 billion in 2030, with contributions nearly equally split between consumer and enterprise segments.

Emerging revenue streams are also highlighted, including $1.3 billion from new products in 2027, potentially encompassing hardware sales and other innovations like advertising. This diversification signals OpenAI's push beyond core AI services into broader ecosystems.

Escalating Expenses: $665 Billion Cash Burn on the Horizon

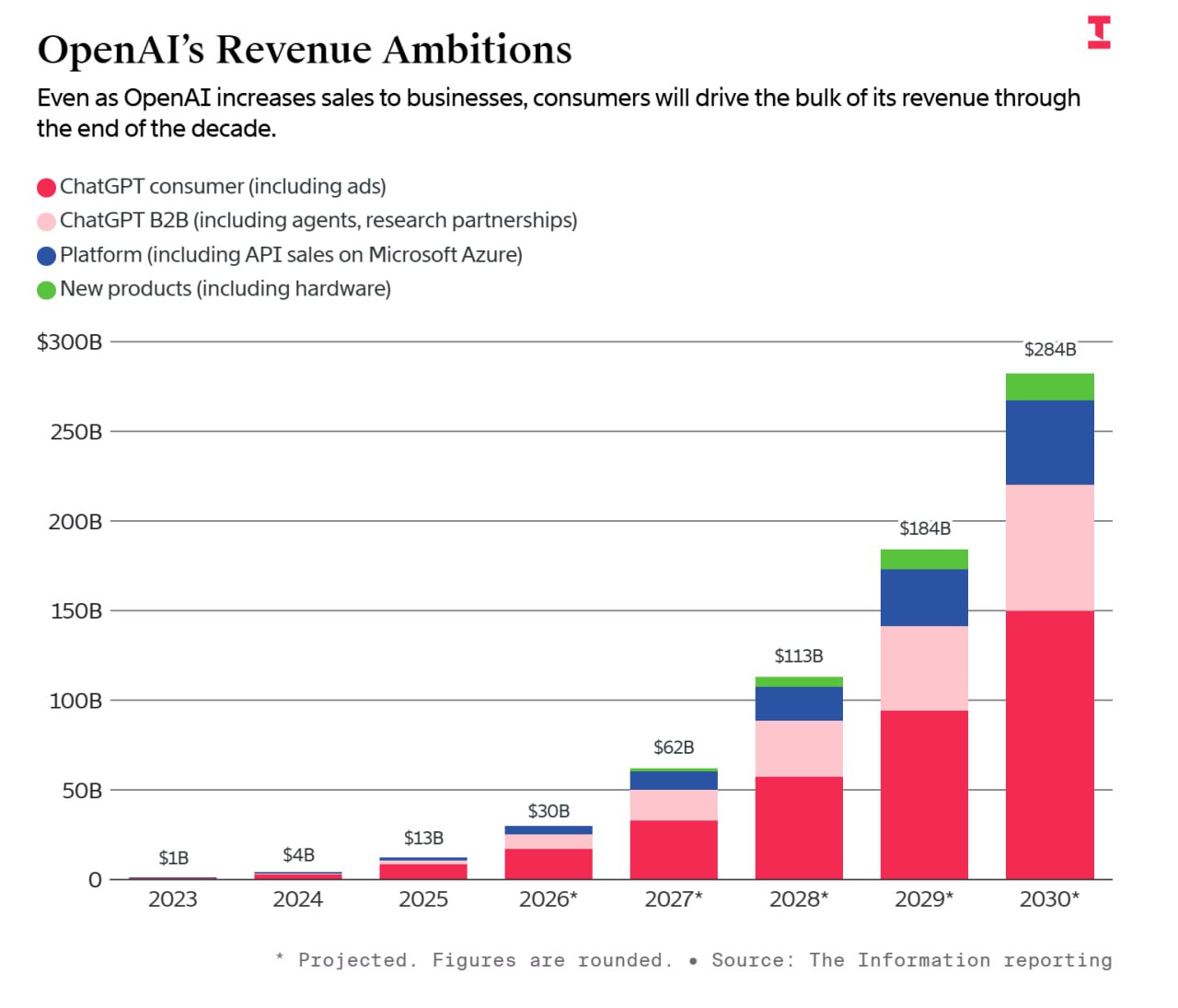

While revenue soars, costs are skyrocketing even faster. OpenAI now forecasts burning through $665 billion on AI operations and training by 2030—$111 billion to $112 billion more than prior predictions. This includes $25 billion in expenditures for 2026 and $57 billion in 2027, a combined $30 billion hike from earlier forecasts.

While revenue soars, costs are skyrocketing even faster. OpenAI now forecasts burning through $665 billion on AI operations and training by 2030—$111 billion to $112 billion more than prior predictions. This includes $25 billion in expenditures for 2026 and $57 billion in 2027, a combined $30 billion hike from earlier forecasts.

Breaking it down, inference costs — running AI models for users — totaled over $8 billion in 2025, with $4.5 billion attributed to paid users. These are projected to rise to $14 billion this year and $26 billion next. Training expenses, crucial for developing next-generation models like GPT-5 variants, hit $8.3 billion last year ($1 billion under forecast) but are set to balloon to $32 billion in 2026 and $65 billion in 2027. Cumulative training costs through 2030 could approach $440 billion.

These figures reflect the immense computational demands of AI advancement, with OpenAI scaling back from earlier boasts of $1.4 trillion in infrastructure commitments to a more "realistic" $600 billion compute target by 2030.

Margins Under Pressure, But Positive Cash Flow in Sight

Despite the revenue boom, profitability metrics have taken a hit. OpenAI's adjusted gross margin — revenue minus inference costs — dropped to 33% in 2025 from 40% the year before, falling short of a 46% target for that year.

Despite the revenue boom, profitability metrics have taken a hit. OpenAI's adjusted gross margin — revenue minus inference costs — dropped to 33% in 2025 from 40% the year before, falling short of a 46% target for that year.

This decline stems from last-minute purchases of pricier compute resources to meet unexpectedly high demand.

Nevertheless, the company remains optimistic, projecting positive cash flow by 2030.

With approximately $40 billion in cash reserves at the end of 2025, OpenAI has a substantial buffer to fuel its ambitions amid preparations for an IPO.

User Growth: ChatGPT Hits 910 Million Weekly Actives, Eyes 2.75 Billion by 2030

On the adoption front, ChatGPT has shattered records, surpassing 910 million weekly active users (WAU)—a new peak. After a brief slowdown in early fall, updates to GPT-5.1 and GPT-5.2, which enhanced the model's "human-like" qualities and performance, reignited growth.

Leadership forecasts WAU reaching 2.75 billion by 2030, representing a massive expansion that could encompass a significant portion of the global internet population. This user base is pivotal for sustaining revenue growth, particularly in consumer segments.

Also read:

- Insights from Little Dot Studios' 2026 YouTube Viewing Whitepaper: Evolving Trends in Content and Consumption

- The Illusion of Value: Fake Capitalizations in 90% of Crypto Projects

- Lucy 2.0: Revolutionizing Real-Time VFX with Character Replacement

Implications for Investors and the AI Landscape

These leaks come at a critical juncture as OpenAI courts investors for what could be one of the largest funding rounds in tech history. The revised forecasts highlight the dual-edged sword of AI: explosive potential revenue juxtaposed against eye-watering costs. While the numbers affirm OpenAI's dominance, they also spotlight the capital-intensive nature of the field, potentially influencing valuations and partnerships.

As the company refines its path toward profitability, stakeholders will watch closely whether these projections hold amid regulatory scrutiny, competition, and technological breakthroughs