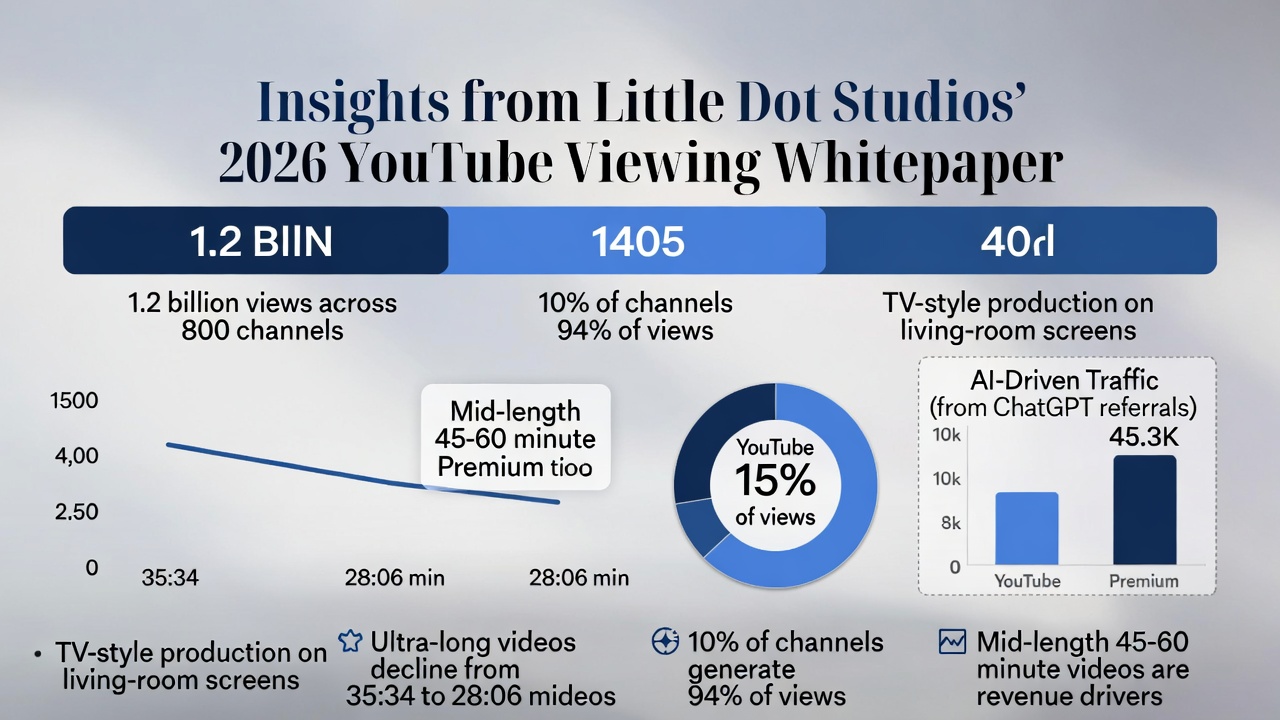

In February 2026, Little Dot Studios released its comprehensive whitepaper titled Understanding the New Era of YouTube Viewing in 2026, drawing from an analysis of over 1.2 billion views across more than 800 managed channels.

This report, powered by data from channels boasting 930 million subscribers and generating 11.2 billion monthly views, sheds light on shifting viewer behaviors, algorithm impacts, and revenue dynamics on the platform.

This report, powered by data from channels boasting 930 million subscribers and generating 11.2 billion monthly views, sheds light on shifting viewer behaviors, algorithm impacts, and revenue dynamics on the platform.

As YouTube continues to evolve into a hybrid of social media, streaming service, and traditional TV, the findings highlight how creators and brands must adapt to maintain relevance and monetization. Key themes include the concentration of views, the rise of TV-style production, the rapid decline of ultra-long-form content, and emerging traffic sources like AI tools.

The Pareto Principle on Steroids: Top Channels Dominate Views

One of the starkest revelations is the extreme concentration of viewership. Just 10% of active channels account for a whopping 94% of all views.

This disparity underscores the growing barriers to entry for new creators: scale, consistent publishing frequency, and content natively optimized for YouTube's algorithm are now non-negotiable.

Smaller channels struggle to break through without these elements, as the platform favors established players with passionate fandoms built around authentic human storytelling. For aspiring creators, this means prioritizing community-building and algorithmic alignment over sporadic uploads.

YouTube as Living-Room Entertainment: Embracing TV Production Standards

Viewer habits are shifting toward big-screen consumption, with more people watching YouTube on living-room TVs rather than mobile devices on the go.

Viewer habits are shifting toward big-screen consumption, with more people watching YouTube on living-room TVs rather than mobile devices on the go.

This "couch viewing" trend is reshaping content production, elevating the importance of high-quality editing, deliberate pacing, clear structure, chapter markers, and a show-like format logic.

Gone are the days of casual, unstructured video dumps; successful content now mirrors traditional TV episodes, fostering deeper engagement.

The report notes that 61% of uploaded videos are under 30 minutes, generating only 18% of watch time and 30% of revenue, while the 39% of longer videos (30+ minutes) capture 82% of watch time and 70% of revenue.

This data emphasizes that treating YouTube as a premium entertainment destination pays off in sustained audience retention.

The Fall of Ultra-Long-Form: A Short-Lived Boom

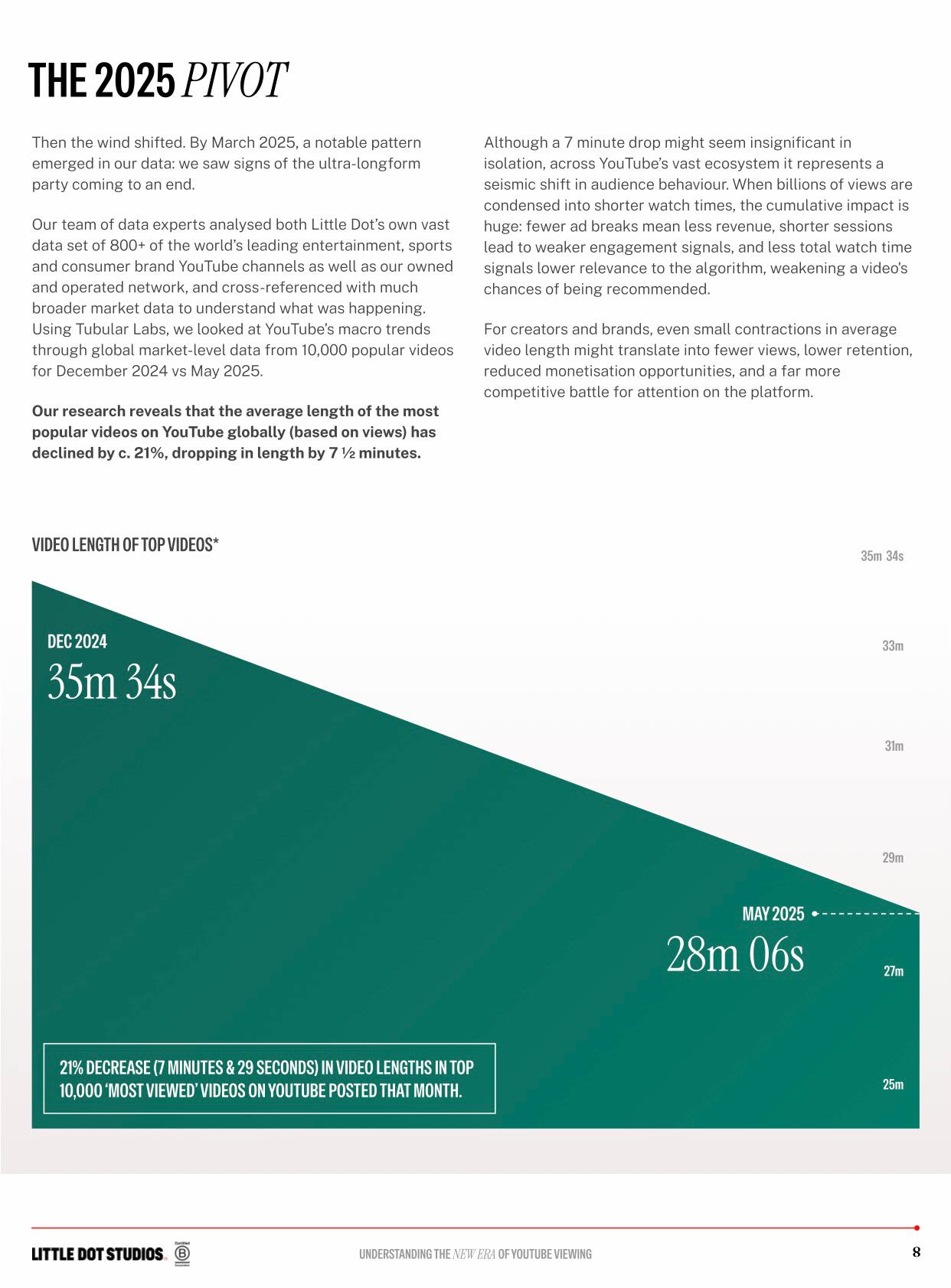

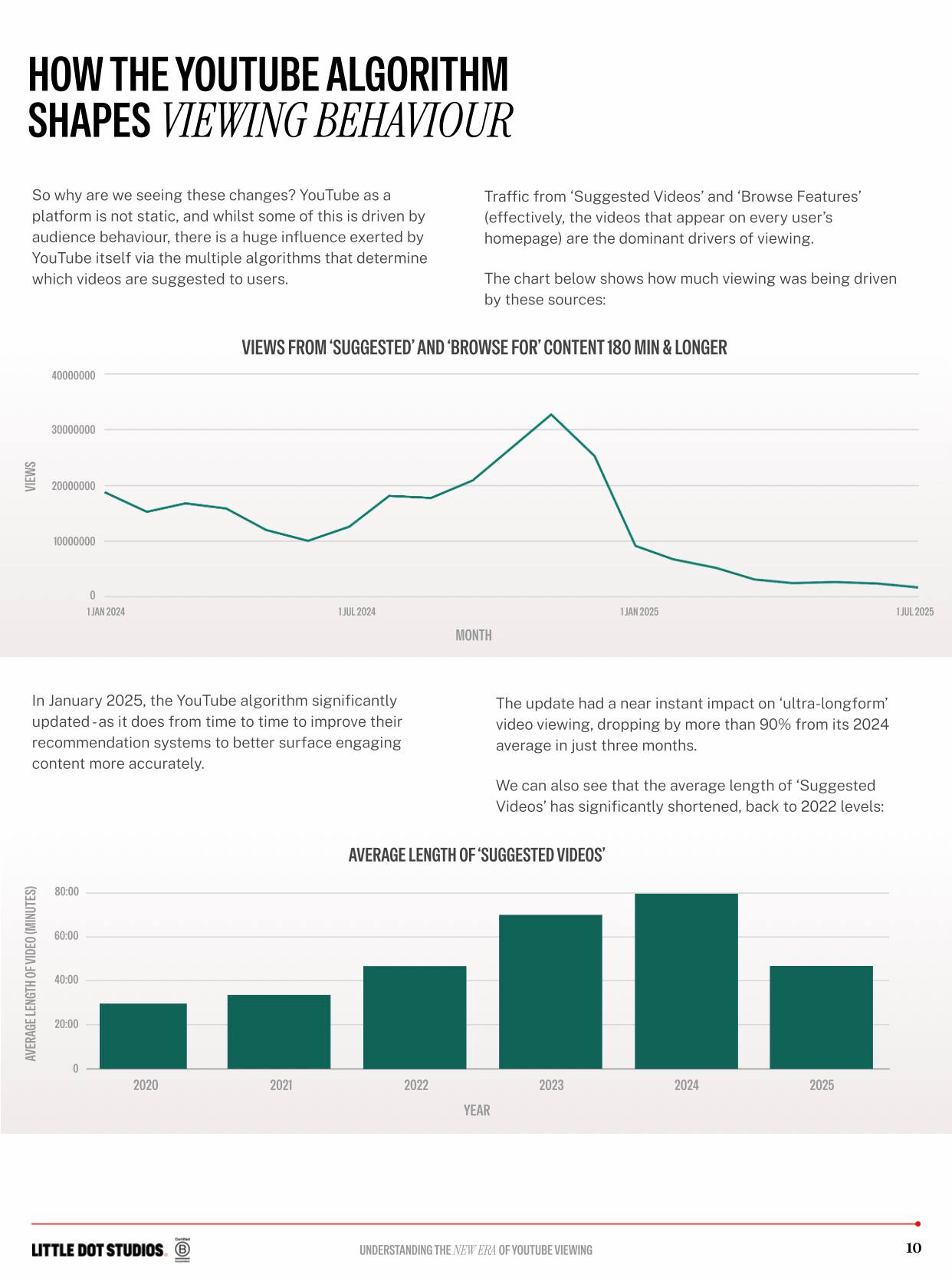

Ultra-long videos — those exceeding 120 minutes, and sometimes stretching beyond 180 — experienced a meteoric rise and equally swift decline. The average length of top-performing videos in the sample dropped 21% in just five months, from 35:34 in December 2024 to 28:06 in May 2025. This shift accelerated after YouTube's algorithm update in January 2025, which caused views for 180+ minute content to plummet by over 90% compared to 2024 averages.

The report suggests this format may resurface in niche contexts, but for now, it's clear that viewer patience has limits, even as algorithmic recommendations favor more digestible lengths.

Suggested Videos Revert to Pre-Boom Norms

Complementing the length contraction, the average duration of algorithm-suggested videos has reverted to 2022 levels. This rollback indicates a broader platform preference for balanced content that keeps users scrolling without overwhelming them. Creators should note that while ultra-long once dominated suggestions, the current meta rewards videos that fit seamlessly into binge-watching sessions without demanding marathon commitments.

Complementing the length contraction, the average duration of algorithm-suggested videos has reverted to 2022 levels. This rollback indicates a broader platform preference for balanced content that keeps users scrolling without overwhelming them. Creators should note that while ultra-long once dominated suggestions, the current meta rewards videos that fit seamlessly into binge-watching sessions without demanding marathon commitments.

Revenue Dynamics: Mid-Length Videos Take the Lead

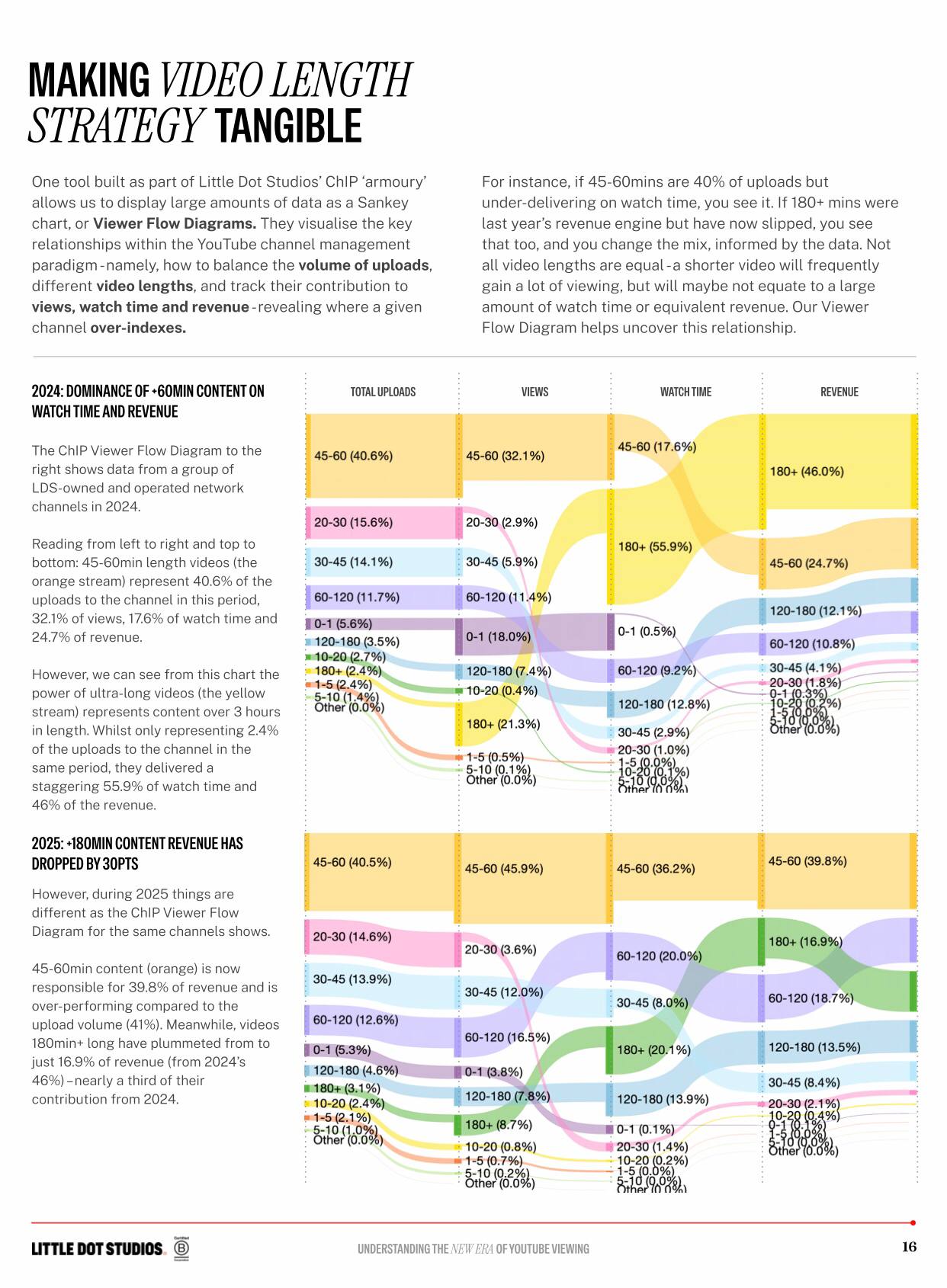

The monetization landscape has transformed dramatically. In 2023-2024, ultra-long videos disproportionately boosted earnings, with a 120-minute video generating roughly 100 times the revenue of a 20-minute one. However, by 2025, their contribution to total revenue on the same channels fell from 46% to just 16.9%. Instead, 45-60 minute videos have emerged as the new revenue drivers, accounting for about 40% of income.

Shorter watch times mean fewer ad breaks, directly impacting earnings — billions of condensed views translate to significant revenue losses for overly extended formats. This pivot advises creators to aim for the "Goldilocks" zone: long enough for depth, but not so long as to deter completion.

YouTube Premium: An Undervalued Powerhouse

Often overlooked, YouTube Premium is proving its worth. In 2025, 15% of views came from Premium subscribers — up from a mere 4% in 2020 — and these views delivered approximately 1.3 times the RPM (revenue per mille) compared to the average.

Often overlooked, YouTube Premium is proving its worth. In 2025, 15% of views came from Premium subscribers — up from a mere 4% in 2020 — and these views delivered approximately 1.3 times the RPM (revenue per mille) compared to the average.

There's a clear correlation between video length and Premium revenue share, likely because subscribers opt in to avoid mid-roll ads in longer content. For creators, this highlights the potential of catering to ad-free audiences, who tend to engage more deeply with premium, uninterrupted experiences.

AI-Driven Traffic: ChatGPT as an Emerging Referral Source

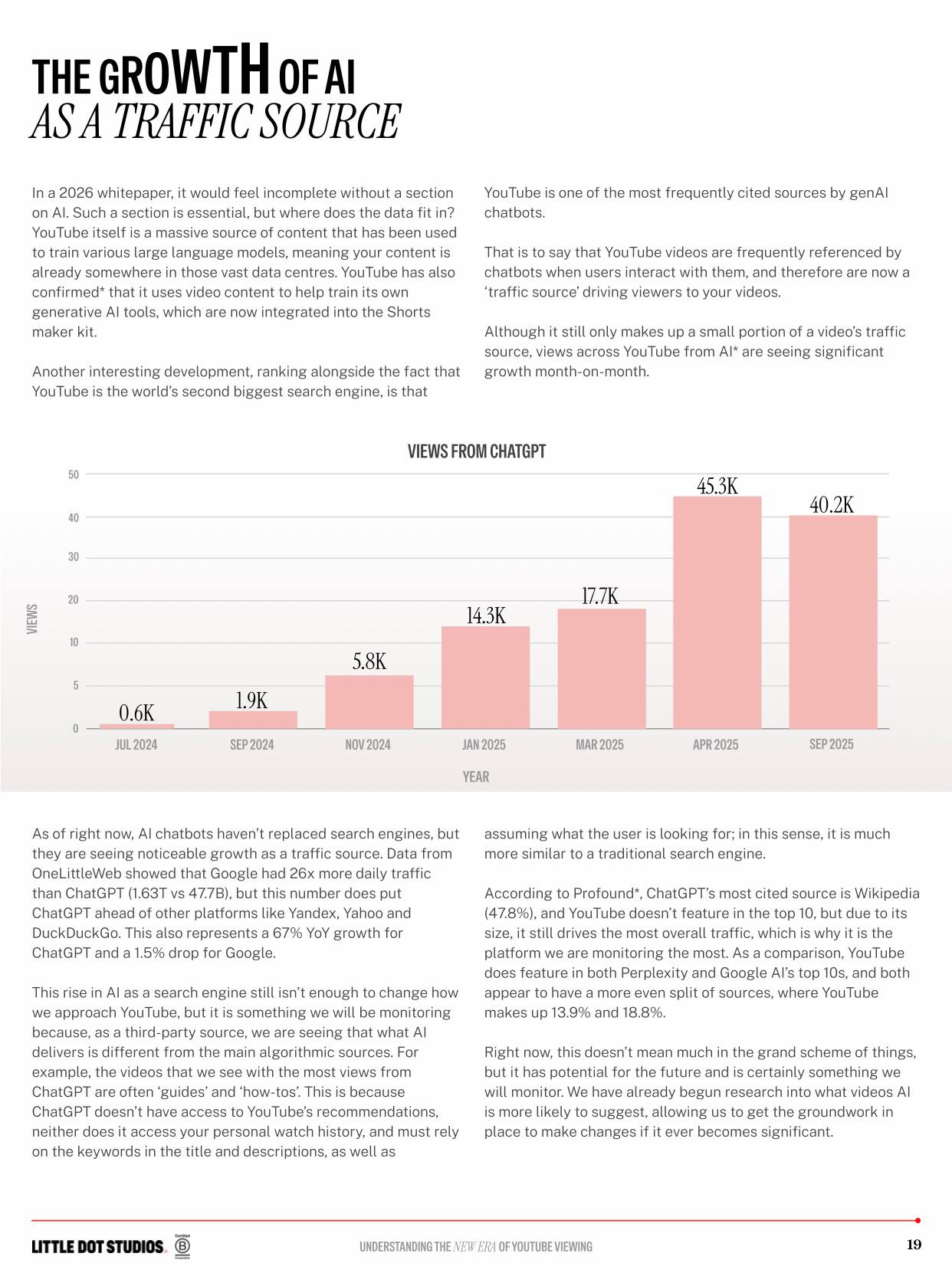

Finally, the whitepaper points to the growing influence of AI in driving traffic. Referrals from ChatGPT to the analyzed channels surged from 0.6K in July 2024 to 45.3K in April 2025. While this still represents a small fraction of overall traffic, the exponential growth signals AI's role in content discovery.

As tools like ChatGPT become more integrated into daily searches, creators should optimize for semantic relevance and AI-friendly metadata to capture this nascent but promising audience segment.

Also read:

Also read:

- The Impending Collapse of the L2, Modular, and Restaking Crypto Bubble

- The Rise of the Corporate Storyteller: Why Big Tech is Chasing Narrative Masters in 2026

- The Quiet Spin-Off Revolution: How Media Giants Are Silently Carving Up Their Empires

Looking Ahead: Adapting to YouTube's New Era

Little Dot Studios' whitepaper paints a picture of a maturing YouTube ecosystem, where authenticity, strategic formatting, and adaptability to algorithm tweaks are key to success. With viewers increasingly treating the platform like traditional TV — complete with fandoms and living-room sessions — creators must evolve beyond viral hacks toward sustainable, show-like content.

As AI referrals rise and video lengths stabilize, the barriers for new entrants may harden, but opportunities abound for those who leverage data-driven insights. For brands and creators alike, this report is a roadmap to thriving in 2026 and beyond.